Updated July 25, 2023

Definition of Accounting Method

It is a method, rules, guidelines suggested by the Company Act, how an organization will record their business transactions in the books of accounts, in other words, how a company will record their income or expense in their books of accounts which are either in cash method or accrual method.

Types of Accounting Method

Accounting methods generally are of two types

- Cash Method

- Accrual Method

1. Cash Method

Under this method, each transaction is recorded on a cash basis. Under this method, income or expense will be recorded in the books only it is actually received or paid. It is one of the parts of the accounting method which generally followed by a small organization. It helps in measuring the actual cash flow of the organization. However, it does not play an important role in the decision-making process for long-term projection.

2. Accrual Method

Under this method, each transaction is recorded on an accrual basis. Under this method, income or expense will record when it is accrued or incurred. It is accounting principles suggested by the Company Act and which is generally followed by the large organization. It helps an organization in the decision-making process. It is an implied rule followed by a big organization. It is a very simple method to follow by an organization.

Example of Accounting Method

We will take a few examples to understand it.

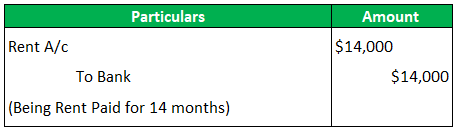

Cash Method: An organization having $1000 P. M rent, and it is paid rent for 14 months which includes 2 months’ rent of the next financial year. Under this method, an organization will record 14 months’ rent as an expense in the current financial year, and it includes 2 months’ rent of the next financial year also because it is followed a cash basis and records the transaction on a paid basis. The journal entry will be

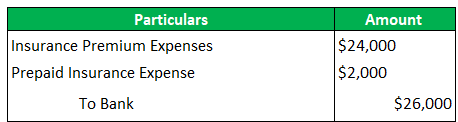

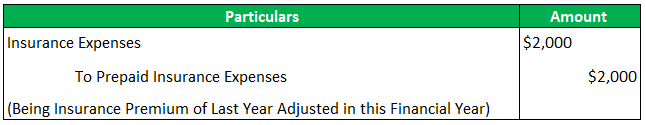

Accrual Method: An organization having an insurance premium of $ 2000 P. M, and it is paid 13 months insurance premium, which includes a 1-month premium for the next financial year also. Under this method, it will include only 12-month insurance premiums, i.e. $24000, and the remaining one-month insurance premium will be treated as prepaid expenses in the current year, which will be adjusted in next year’s insurance premium expenses.

The journal entry in the 1st year will be

The journal entry in the next financial year will be

Advantages of Accounting Method

We will discuss the advantages of both methods in an organization

Cash Method: It provides more accurate cash flow on an organization because it records the transaction only when there is a flow of cash.

- The cash method helps to identify the cash liquidity position of an organization.

- Cash Method provides information about the working capital requirements.

- Cash Method also measures the ability of an organization to pay its liability.

- Cash Method also measures the performance of debtor credibility, which debtor paying regularly and which is riskier for a credit sale.

Accrual Method: It is more useful in providing information regarding the future projection of an organization.

- Most of the decision of management is based on the accrual method.

- It is very simple to follow because it records the transaction when it is incurred or accrued, and no need to wait for the future realization of payment.

- An auditor is to verify the books of accounts whether the organization is following the Accrual method or not; otherwise, they will qualify the Audit Report.

- Under this method, we can make provisions for upcoming expenses so that we avoid a shortage of funds.

- Under this method, the organization need not report to notes to the accounts.

- All the investors and stakeholders look for an accrual method of accounting for their decision-making process.

Disadvantages of Accounting Method

We will discuss the disadvantages of both methods:

Cash Method: It doesn’t provide the necessary information for future projection.

- Cash Method is very difficult to record the transaction.

- It doesn’t play an important role in the management decision-making process.

- If an organization follows the Cash Method has to disclose to notes to the accounts.

- It is not useful for the big organization because it doesn’t have any Comparative information statements of the organization.

Accrual Method: Under this method, transactions are recorded in the books of an account without actual cash received.

- It doesn’t provide information regarding working capital requirements

- Under this method, books can show a profit, but actually, there is a shortage of cash to operate the business.

- For example, X sold goods to Y worth $ 10000 on credit. Under the accrual method, X will record the sale, and books will show the sale of $ 10000, but in reality, the transactions are on credit, and money is yet to receive from Y.

- It refers to books’ profit which does not provide information regarding the liquidity position of an organization.

Limitations

- The cash method is useful only to small businesses.

- Accrual Method can not determine the flow of cash.

- Cash Method can not measure the viability of a project

- The cash method is very complex in nature which can not measure the performance of an organization.

Important Points to Note About Change in Accounting Method

- As per the Company Act change in Accounting Method is a change in Accounting Principles, and necessary disclosure is required to notes to the accounts.

- Accrual Method has generally accepted accounting principles followed by all the company. If the company is following the accrual method, then it need not disclose to notes to the accounts.

- If the company is following the Cash method, then it has to disclose to notes to the accounts.

Conclusion

Accounting Method is followed by double accounting principles and important for all organizations to maintain books of accounts for better recording of transactions and for going concern assumption. Proper and necessary training is also required to know how it is useful for an organization.

Recommended Articles

This is a guide to Accounting methods. Here we discuss types and examples of accounting methods along with advantages, disadvantages, and limitations. You may also look at the following articles to learn more –