What is the Accounting Profit Formula?

Accounting profit is the net earnings that are left after subtracting the total revenue from the total payable or explicit costs. For example, Anna owns a cloth business with an annual revenue of $50,000, and the explicit cost involved is $ 15,000. Thus, the accounting profit of her company will be total revenue ($50,000) – explicit costs ($15,000) = $35,000.

In other words, accounting profit is similar to net profit, which is the difference between the revenue and all the other dollar costs identified according to Generally Accepted Accounting Principles (GAAP).

Key Highlights

- Accounting profit or financial profit is a company’s net income that they compute by subtracting explicit costs from the year’s revenue.

- It is a very useful metric for analyzing and keeping track of a company’s profitability.

- The explicit costs include every type of expense that a company is liable to pay. Some examples are wages, inventory costs, sales and production costs, taxes, etc.

- Accounting profit is distinct from economic profit in that it solely accounts for the money that a company spends and the money it brings in.

Accounting Profit Formula

The accounting profit formula is:

Here,

- Total Revenue is the total income generated by a company from the sales of goods & services.

- Explicit costs are the total expenses incurred in a company, including operating expenses, depreciation & amortization, interest, etc.

Explanation

The formula for accounting profit can be derived by using the following steps:

#Step 1:

- First, determine the total revenue of the company, which is usually easily available as the first line item of the income statement.

- On the other hand, one can calculate the total revenue by multiplying the average price per unit by the number of units sold during a year.

#Step 2:

- Next, determine all the explicit costs that are incurred during the course of the business.

- It includes the cost of raw materials, wages & salaries, rental expenses, electricity bills, telephone bills, selling & administrative expenses, depreciation, interest, taxes, etc.

#Step 3:

- Finally, the formula for accounting profit can be derived by subtracting the explicit costs (step 2) of doing business from the total revenue (step 1) generated from the business as shown below.

How to calculate accounting profit? Excel examples

Example #1

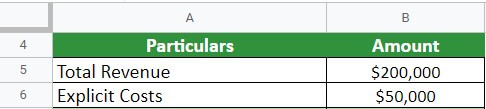

Let us take the example of a cafe, Mugs & Sips, that reported total revenue of $200,000 and explicit costs of $50,000 during FY 2023. Calculate the accounting profit of the company.

Given,

Solution:

From the above calculation, we can conclude that cafe, Mugs & Sips generated an accounting profit of $150,000 during FY 2023.

Example #2

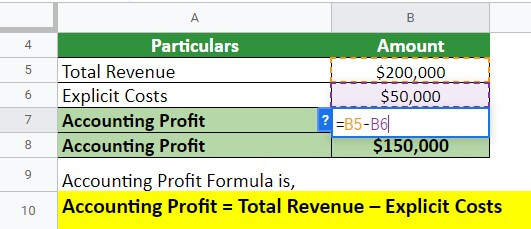

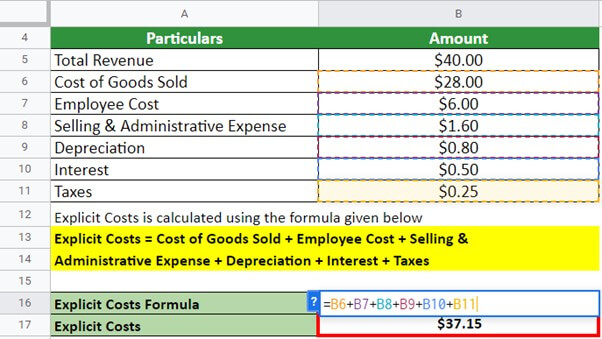

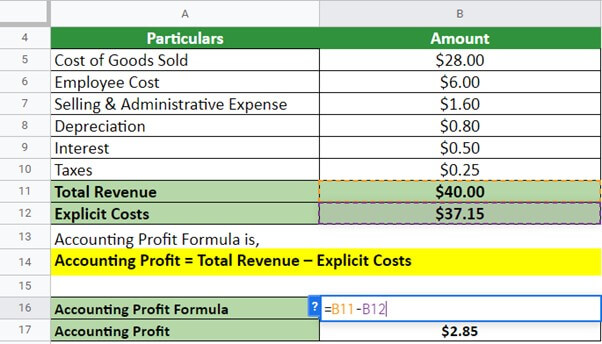

Let us take the example of a company, Foodland Stores Ltd., which is a grocery retail chain company operating in the province of Alberta, Canada. During FY 2023, the company booked the following:

- Total revenue of $40.00 million

- Cost of goods sold of $28.00 million

- Employee cost of $6.00 million

- Depreciation expense of $0.80 million

- Selling & administrative expense of $1.60 million

- Interest charge of $0.50 million

- Taxes of $0.25 million.

Calculate the company’s accounting profit for the year 2023 based on the given information.

Given,

Solution:

Let’s first calculate the explicit costs. Explicit Costs are calculated using the formula given below

Explicit Costs = Cost of Goods Sold + Employee Cost + Selling & Administrative Expense + Depreciation + Interest + Taxes

Thus, the explicit cost for the company is $37.15. Now let’s find out the accounting profit:

Therefore, Foodland Stores Ltd. generated an accounting profit of $2.85 million during the year 2023.

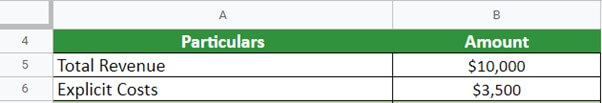

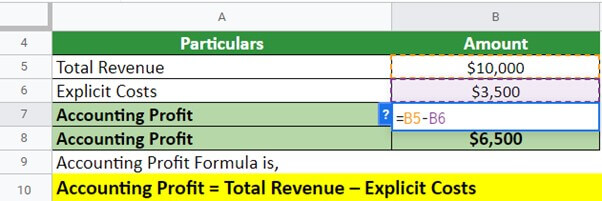

Example #3

John owns a boutique, and while analyzing the financial statements, he discovered that the company generated a revenue of $10,000 in January. Also, he discovers that explicit cost for the same accounts for $3500. Let’s find out the accounting profit for John’s boutique.

Given,

Solution:

From the above calculation, we can conclude that John’s boutique generated an accounting profit of $6,500 in the month of January.

Real-world examples

#1 Walmart

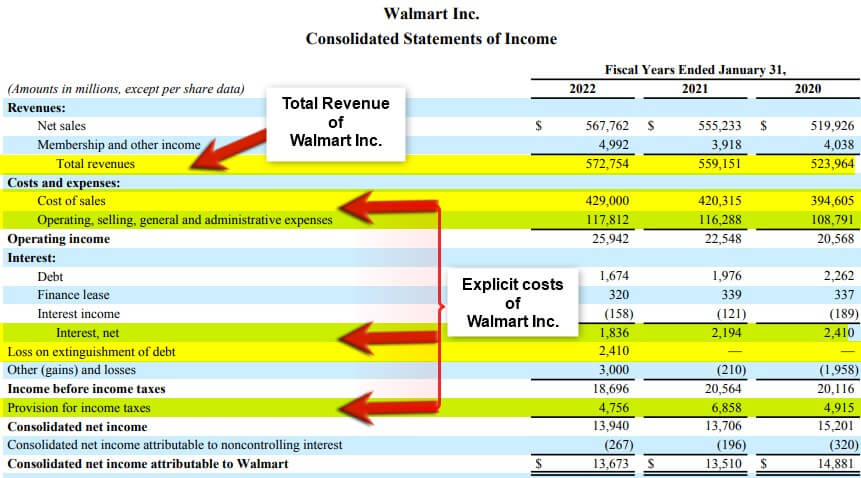

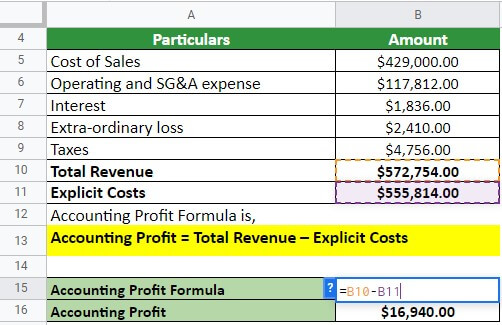

Let us take the example of Walmart Inc. to illustrate the concept of accounting profit for a real supermarket chain.

(Image Source: Walmart’s Annual Report, 2022)

As per the latest annual report, Walmart reported the following:

- Total revenue of $572,754

- Cost of sales of $429,000

- Operating and SG&A expense of $117,812

- Interest of $1,836

- Extra-ordinary loss of $2,410

- Taxes $4,756

Calculate the accounting profit generated by Walmart Inc. during FY22.

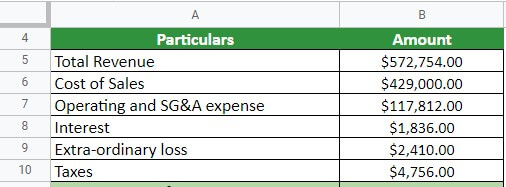

Given,

Solution:

Let’s first find the explicit cost of Walmart:

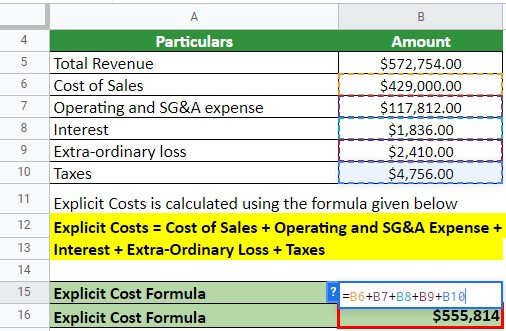

Thus, the explicit cost for the company is $555,814. Now let’s find out the accounting profit:

Therefore, Walmart Inc. earned an accounting profit of $16,940 during FY22.

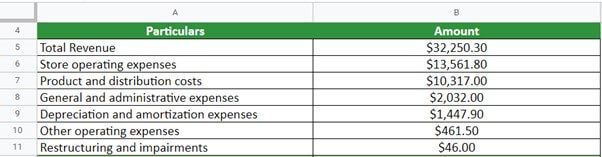

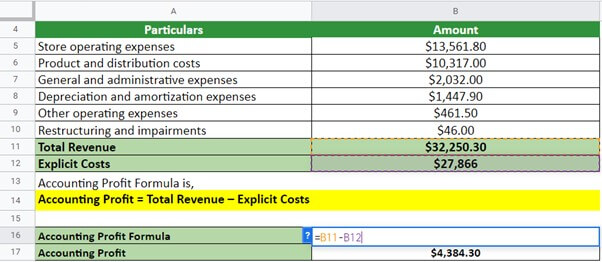

#2 Starbucks

Let us take the example of Starbucks to illustrate the concept of accounting profit for a real coffee-selling chain.

(Image Source: Starbucks Annual Report, 2022)

As per the latest annual report, Starbucks reported the following:

- Product and distribution costs of $10,317

- Store operating expenses of $13,561.8

- Other operating expenses of $461.5

- Depreciation and amortization expenses of $1,447.9

- General and administrative expenses of $2,032.0

- Restructuring and impairments of $46.0

Calculate the accounting profit generated by Starbucks during FY22.

Given,

Solution:

Let’s first find the explicit cost of Starbucks:

Thus, the explicit cost for the company is $27,866. Now let’s find out the accounting profit:

Therefore, Starbucks earned an accounting profit of $4,384 during FY22.

Relevance and Use of Accounting Profit Formula

- It becomes easier to plan for your company’s financial future if you know its accounting profit.

- Understanding your accounting profit helps you compare the success of your business to that of your rivals so you can get a sense of where you stand in your industry.

- It can help you control expenditures more efficiently by comparing the revenue generated.

- Additionally, it incorporates some techniques that help improve efficiency in resource utilization.

- Also, a company’s accounting profit helps investors know if the company is prospering or declining.

Accounting Profit vs Economic Profit

| Accounting Profit |

Economic Profit |

| It is a company’s net earnings after deducting explicit costs. | It is a company’s net earnings after deducting the explicit and opportunity costs. |

| The accounting profit formula is calculated by subtracting total revenue from explicit costs. | The economic profit formula is calculated by subtracting total revenue from explicit costs and opportunity costs. |

| It is based on actual facts and recorded financial data. | It is based on estimates and assumptions. |

| Its calculation is based on generally accepted accounting principles or GAAP. | Its calculation is based on general economic principles and market values. |

| It needs to be submitted to the IRS. | It needs not be submitted to the IRS. |

Accounting Profit Formula Calculator

Use the following calculator for Accounting Profit formula calculations.

| Total Revenue | |

| Explicit Costs | |

| Accounting Profit = | |

| Accounting Profit = | (Total Revenue - Explicit Costs) |

| = | (0 - 0 ) = 0 |

Final Thoughts

Accounting profit can be a very useful financial metric if a business wants to know and analyze its current financial position in the market. A company’s net income, or accounting profit, significantly impacts its stock price. This figure is obtained by deducting the payable costs from revenue, and investors pay the most attention to it.

Frequently Asked Questions (FAQs)

Q.1. Does accounting profit include opportunity cost?

Answer: No. Accounting profit includes both explicit and implicit costs, encompassing the opportunity cost. However, economic profit considers the opportunity cost and explicit costs by subtracting the alternative returns that could have been earned from the best-foregone opportunity.

Q.2. Which is ignored when calculating accounting profit?

Answer: While calculating the accounting profit, implicit costs are ignored, and only the explicit costs are considered. We always include explicit costs during the calculation of economic profit.

Q.3. Can accounting profit be positive while economic profits are negative?

Answer: Total revenue includes explicit costs but excludes opportunity costs, resulting in a positive accounting profit and a negative economic profit. Opportunity costs, which are the implicit costs, are not covered by accounting costs.

Q.4. What is accounting profit in economics?

Answer: Accounting profit, also known as economic profit, is a company’s net earnings after subtracting the total revenue from the explicit costs. The formula for the same is; Accounting Profit = Total Revenue – Explicit Cost.

Q.5. Can accounting profit be positive or economic profits are negative?

Answer: A company can report a positive accounting profit but negative economic profits if it earns a higher return in a different line of business. This is known as negative economic profits.

Recommended Articles

This is a guide to Accounting Profit Formula. Here we discuss how to calculate Accounting Profit along with practical examples. We also provide an Accounting Profit calculator with a downloadable excel template. You may also look at the following articles to learn more –