Updated July 24, 2023

Definition of Accounting Ratios

Accounting Ratio is used to describe the relationship between amounts or figures shown in either balance sheet, profit, and loss statement, or any other financial statement document which is part of an accounting organization, thereby aiding financial analysis of the company and depicting its performance level.

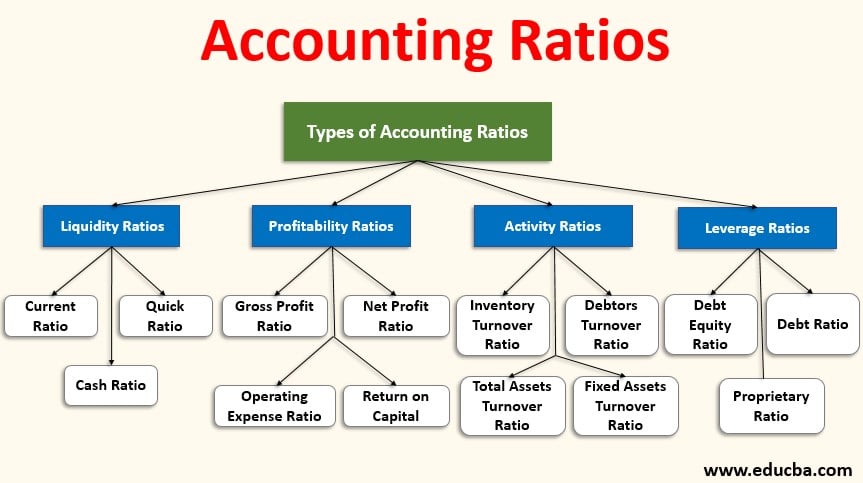

Types of Accounting Ratios

Various interested stakeholders use various types of accounting ratios to analyze the company’s financial statements. All the accounting ratios can be aptly bifurcated into four categories, as stated below.

- Liquidity Ratios

- Profitability Ratios

- Activity Ratios

- Leverage Ratios

Example of Accounting Ratios (With Excel Template)

Let’s take an example to understand the calculation of Accounting Ratios in a better manner.

Example #1 – Liquidity Ratios

Also referred to as Balance Sheet ratios, liquidity ratios are further branched out into the Current Ratio, Quick Ratio, and Cash Ratio. The main objective of any liquidity ratio is to measure the company’s short term solvency status of the company. It states the company’s efficiency and capability in paying off its current liabilities and debts by utilizing its current assets.

The formula to derive the aforementioned ratios are given below:

To Elaborate Further,

- Current Assets are assets that are going to be converted into cash in the current financial year or at latest in the next financial year while continuing with the routine business of the company.

- Similarly, current liabilities are the payment obligations which the company needs to fulfill in the current financial year or the latest in the next financial year during the course of regular business.

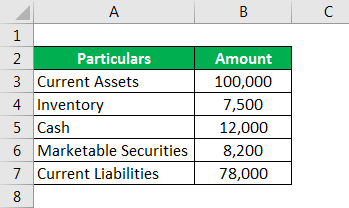

The below example will help in understanding how the ratios are calculated:

Solution:

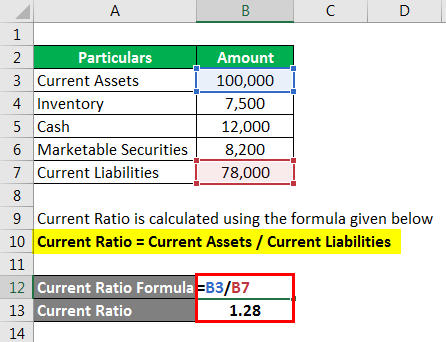

Current Ratio is calculated using the formula given below

Current Ratio = Current Assets / Current Liabilities

- Current Ratio = 1,00,000 / 78,000

- Current Ratio = 1.28

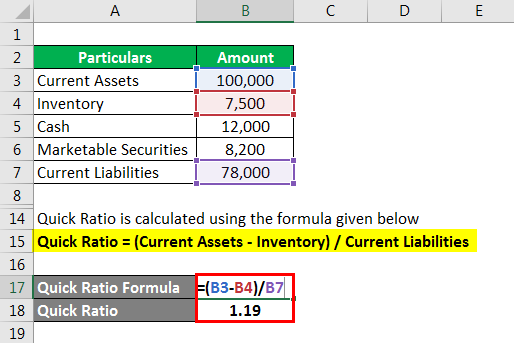

Quick Ratio is calculated using the formula given below

Quick Ratio = (Current Assets – Inventory) / Current Liabilities

- Quick Ratio = (1,00,000 – 7,500) / 78,000

- Quick Ratio = 1.19

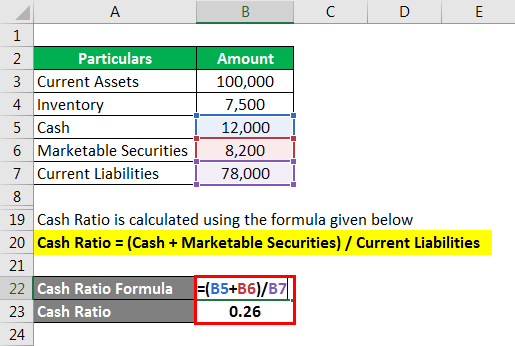

Cash Ratio is calculated using the formula given below

Cash Ratio = (Cash + Marketable Securities) / Current Liabilities

- Cash Ratio = (12,000 + 8,200) / 78000

- Cash Ratio = 0.26

Example #2 – Profitability Ratios

Profitability Ratios measure the company’s capability and efficiency in utilizing its capital in order to generate revenue and ultimately profits. Generally represented in % terms, it represents the relation of the unit in terms of % of sales.

The formula to derive the aforementioned ratios are given below:

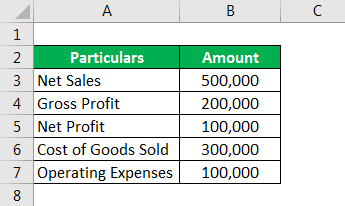

The below example will help in understanding how the ratios are calculated:

Solution:

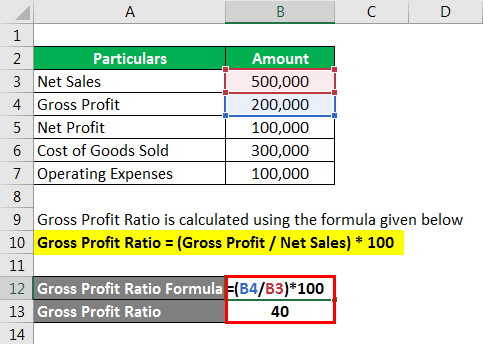

Gross Profit Ratio is calculated using the formula given below

Gross Profit Ratio = (Gross Profit / Net Sales) * 100

- Gross Profit Ratio = (2,00,000 / 5,00,000)*100

- Gross Profit Ratio = 40

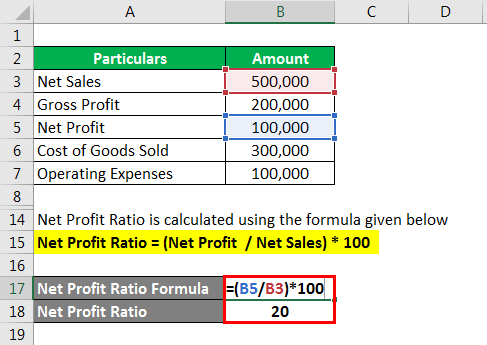

Net Profit Ratio is calculated using the formula given below

Net Profit Ratio = (Net Profit / Net Sales) * 100

- Net Profit Ratio = (1,00,000/5,00,000) * 100

- Net Profit Ratio = 20

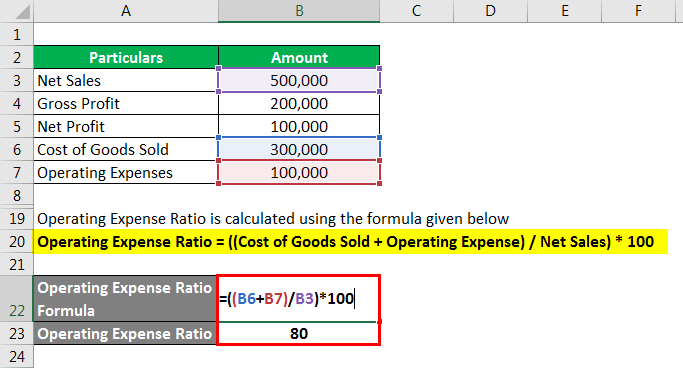

Operating Expense Ratio is calculated using the formula given below

Operating Expense Ratio = ((Cost of Goods Sold + Operating Expense) / Net Sales) * 100

- Operating Expense Ratio = ((3,00,000+100,000) / 5,00,000) * 100

- Operating Expense Ratio = 80

Example #3 – Activity Ratios

Activity Ratios measure the company’s capability of managing and converting its assets into revenue and cash. It shows the company’s efficiency in utilizing its assets in order to generate revenue.

- Inventory Turnover Ratio: This ratio measures the times taken to convert inventory in sales.

- Debtors Turnover Ratio: This ratio indicates how efficiently or what is the time taken for credit debtors to get converted into cash

- Total Assets Turnover Ratio: This ratio measures the efficiency with which the assets are managed by the company to generate revenue.

- Fixed Assets Turnover Ratio: This ratio measures the efficiency with which the fixed assets are managed by the company to generate revenue.

The formula to derive the aforementioned ratios are given below:

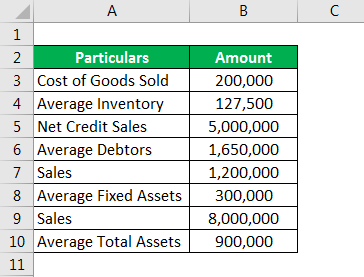

The below example will help in understanding how the ratios are calculated:

Solution:

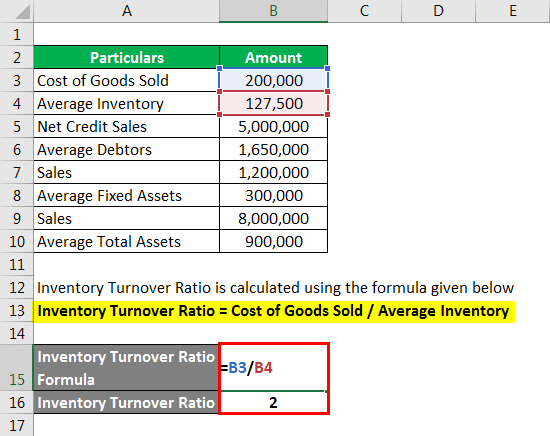

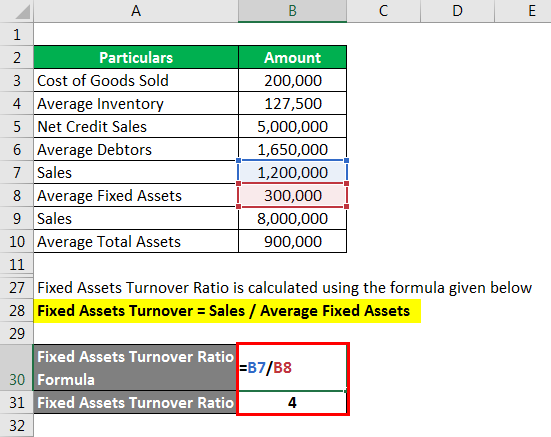

Inventory Turnover Ratio is calculated using the formula given below

Inventory Turnover Ratio = Cost of Goods Sold / Average Inventory

- Inventory Turnover Ratio = 2,00,000 / 1,27,500

- Inventory Turnover Ratio = 2

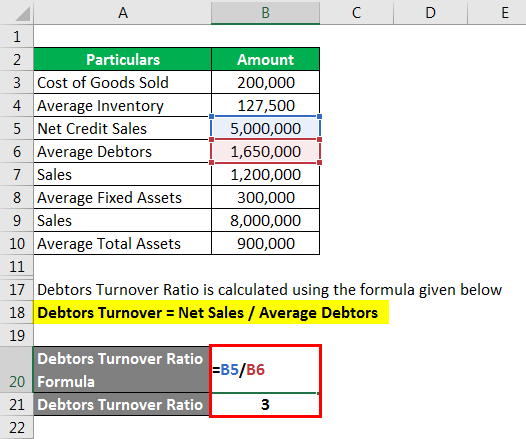

Debtors Turnover Ratio is calculated using the formula given below

Debtors Turnover = Net Sales / Average Debtors

- Debtors Turnover Ratio = 5,00,000/1,650,000

- Debtors Turnover Ratio = 3

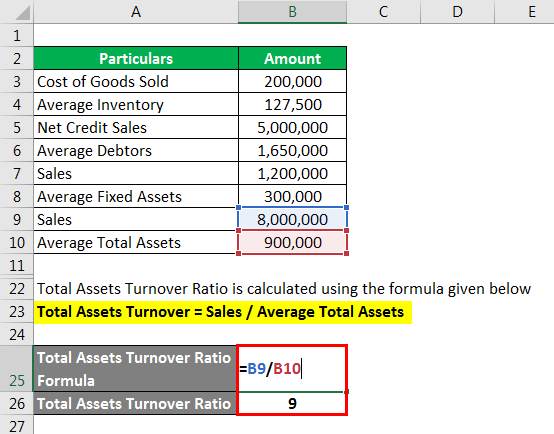

Total Assets Turnover Ratio is calculated using the formula given below

Total Assets Turnover = Sales / Average Total Assets

- Total Assets Turnover Ratio = 8,000,000 / 9,00,000

- Total Assets Turnover Ratio = 9

Fixed Assets Turnover Ratio is calculated using the formula given below

Fixed Assets Turnover = Sales / Average Fixed Assets

- Fixed Assets Turnover Ratio = 1,200,000

- Fixed Assets Turnover Ratio = 4

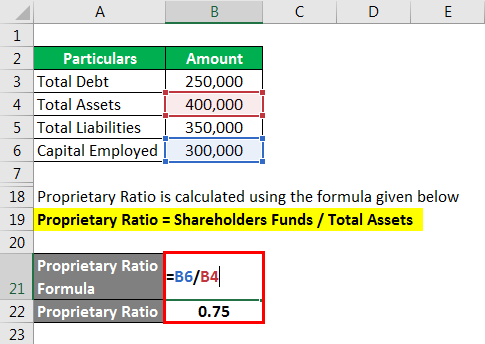

Example #4 – Leverage Ratios

Like liquidity ratios are used to understand the company’s short term solvency aspect, leverage ratio help in determining the long term solvency aspects of the company. Further bifurcated into the following ratios:

- Debt to Equity Ratio: It is the relationship between the total debts taken by the company viz a viz the total equity employed by the company. Used to measure the company’s leverage capacity, usually, a low debt to equity ratio would indicate good financial security held by the company.

- Debt Ratio: This ratio explains the relationship between the total liabilities of the company in comparison to the total assets held by the company.

- Proprietary Ratio: This ratio explains the relationship between the total shareholder funds of the company being invested in total assets held by the company.

The formula to derive the aforementioned ratios are given below:

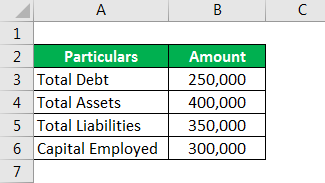

The below example will help in understanding how the ratios are calculated:

Solution:

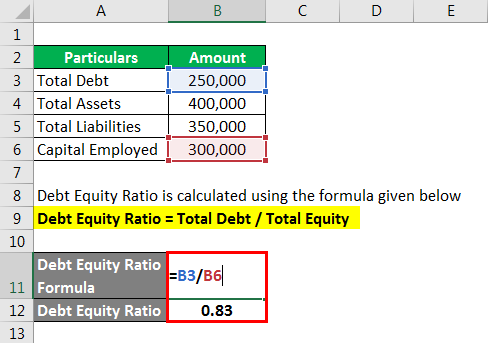

Debt Equity Ratio is calculated using the formula given below

Debt Equity Ratio = Total Debt / Total Equity

- Debt Equity Ratio = 2,50,000 / 3,00,000

- Debt Equity Ratio = 0.83

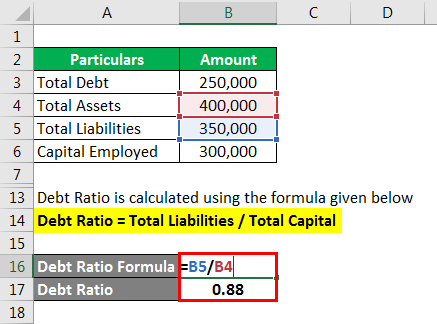

Debt Ratio is calculated using the formula given below

Debt Ratio = Total Liabilities / Total Capital

- Debt Ratio = 3,50,000 / 4,00,000

- Debt Ratio = 0.88

Proprietary Ratio is calculated using the formula given below

Proprietary Ratio = Shareholders Funds / Total Assets

- Proprietary Ratio = 3,00,00 / 4,00,000

- Proprietary Ratio = 0.75

Explanation

The formula for Accounting Ratios can be calculated by using the following points:

- In general terms, a ratio is defined to be the relationship existing between any two variables. The ratio can be represented in 4 different ways, such as pure ratio, in percentage terms, no. of times or as a fraction.

- Accordingly, accounting ratio is defined as the relationship existing between any two accounting variables expressed as number, percentage, or fraction. Note that these accounting variables can be part of any financial document such as a balance sheet or profit and loss statement.

- The accounting ratio helps you understand the profitability and stability of the company. Which ultimately assists the management in taking decisions in the best interest of the company.

Importance of Accounting Ratios

A financial number on its own has no significance in analyzing a company unless reading it in comparison with other numbers. A ratio is thus important as it provides the information in a comparative form aiding in carrying out a quantitative analysis of financial statements.

Accounting ratios are important from various perspectives and also based on the reader of financial statements. Please note that below is not an exhaustive list and there may be many more ways in which accounting ratios are important:

- Aids in analyzing the company’s performance;

- Aids in analyzing the company’s stability;

- Aids in analyzing the company’s solvency status;

- Aids in analyzing the company’s ability to utilize the assets efficiently;

- Aids the management in decision making;

- Aids the investors in analyzing the company’s growth prospects;

- Aids the company is preparing a better forecast and accordingly a better financial plan for the future;

- Aids in analyzing the company’s performance viz a viz other companies and industry;

- Aids the company in finding out about the weak areas of the business/company;

- Aids the company is working on areas which need improvement and thereby bringing in higher efficiency levels;

- Aids in capturing information regarding business from one period to another and thereby communicating the information to interested stakeholders.

Conclusion

- Accounting ratios are of utmost importance for carrying out a company’s financial analysis. Not only accounting ratios are used to compare the company performance internally but also for comparing the company’s performance viz a viz that of other companies and similar industries.

- Although represented as numbers, ratios are more than just numbers. They assess the soundness and financial standing of the company. It also provides a picture of the stability that the company has.

- However, it may be noted that accounting ratios as standalone in itself are not enough to carry out a complete analysis of the company. The Management, stakeholders, and any concerned party need to have a deep understanding of the business in order to arrive at a conclusion analysis and take decisions accordingly.

Recommended Articles

This is a guide to the Accounting Ratios. Here we discuss how to calculate Accounting Ratios along with practical examples. We also provide a downloadable excel template. You may also look at the following articles to learn more –