What are Accounting Scandals?

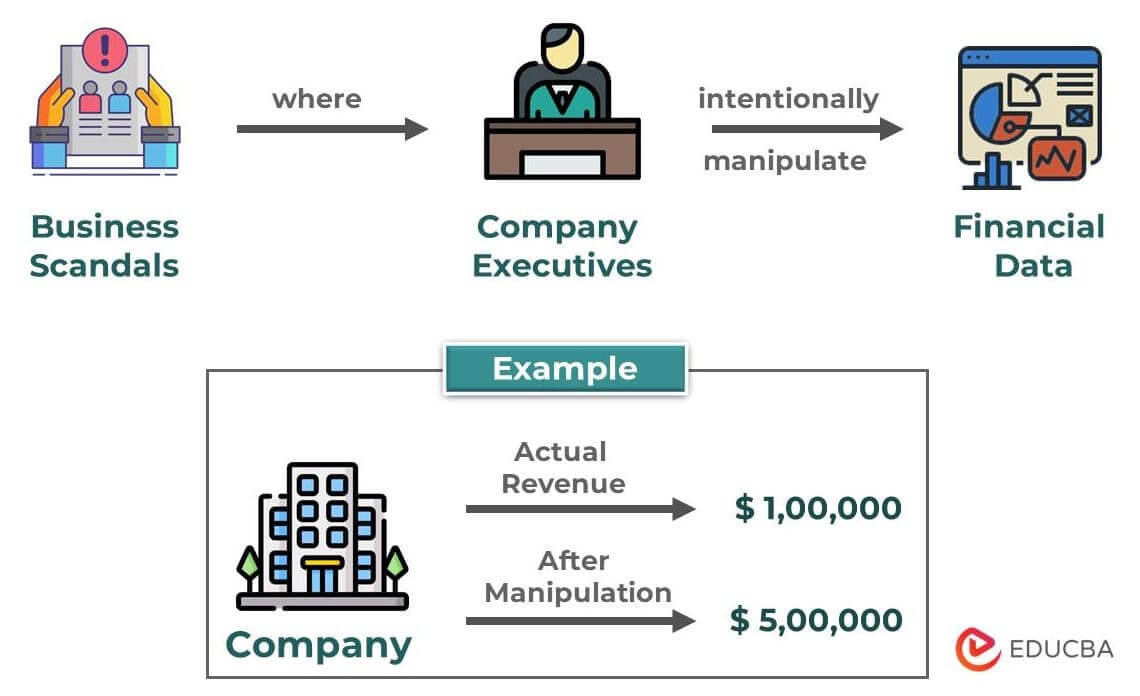

Accounting scandals happen when company executives intentionally manipulate financial or accounting records for personal gains or to hide the company’s true financial status.

For example, an executive may misuse company funds for personal investments or deceive by creating false sales or inflating asset values like inventory or property. They might also commit fraud through insider trading, bribery, or embezzlement.

Such accounting scandals are often exposed when auditors find inconsistencies in a company’s records or when a person from inside the company, called a whistleblower, reveals such misconduct. Additionally, investigations play a crucial role in discovering the truth behind the scandals.

To shed light on the repercussions of these events, we will briefly discuss 11 major accounting scandals that surfaced in the recent past. We have also added a snapshot of each accounting scandal for your reference.

- Enron Corporation

- Worldcom

- Bernie Madoff

- Tyco International Ltd.

- Healthsouth

- Lehman Brothers

- American International Group (AIG)

- The Waste Management Company

- Freddie Mac

- Satyam Computers

- General Electric

List of 11 Biggest Accounting Scandals

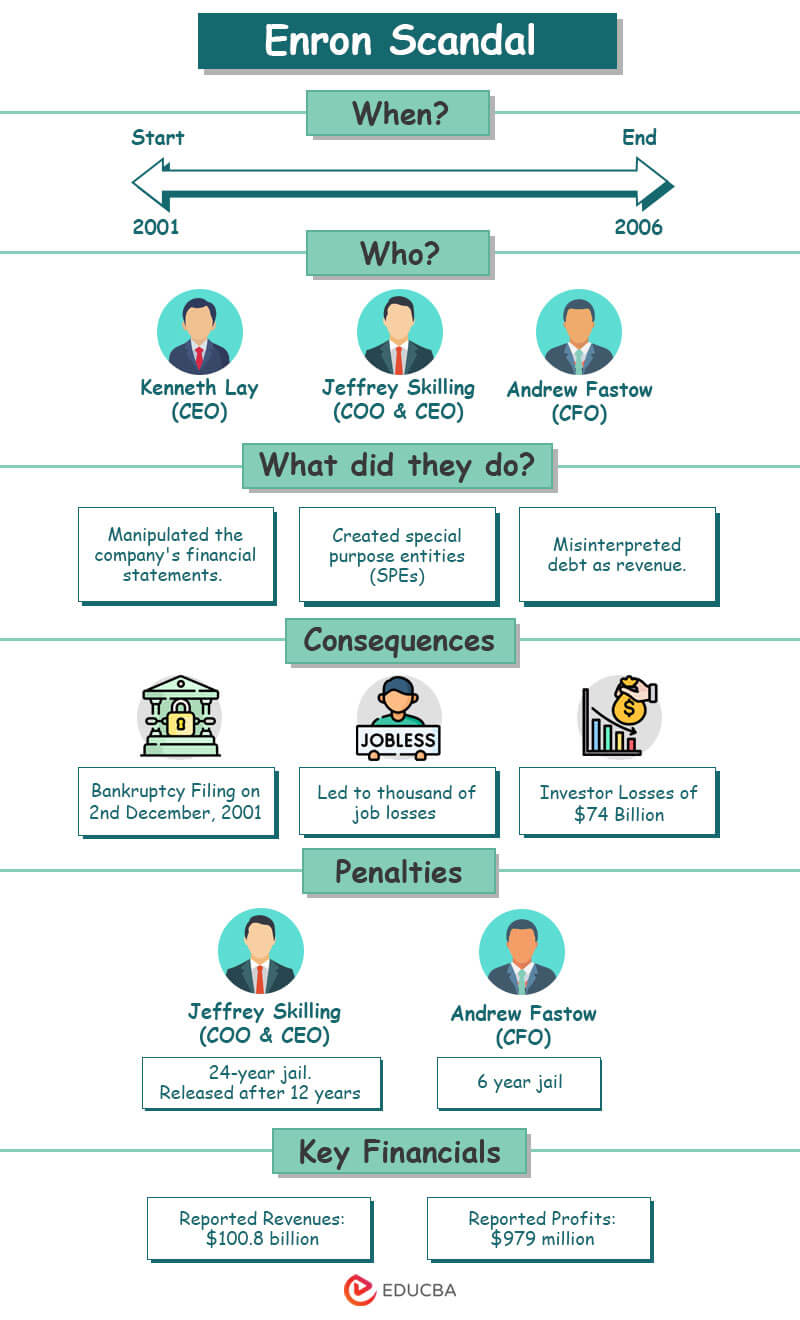

1. Enron Corporation

Enron Corporation, a company based in Houston that provided energy and utility services, got involved in a big problem in 2001. Sherron Watkins, who worked there, noticed something strange when she saw the company’s stock price increase significantly.

Later, auditors discovered that Enron was hiding a huge debt. They didn’t include it in their financial statements, so nobody knew. They wanted to keep it a secret from investors and the public.

The consequences of this accounting scandal were really bad. Shareholders lost a lot of money, around $74 billion. Many people who had invested in the company and employees saving for retirement lost all their money. The main people responsible for the problem were the CEO, Jeff Skilling, the former CEO, Kenneth Lay, and the CFO, Andrew Fastow. They were found guilty and sent to prison.

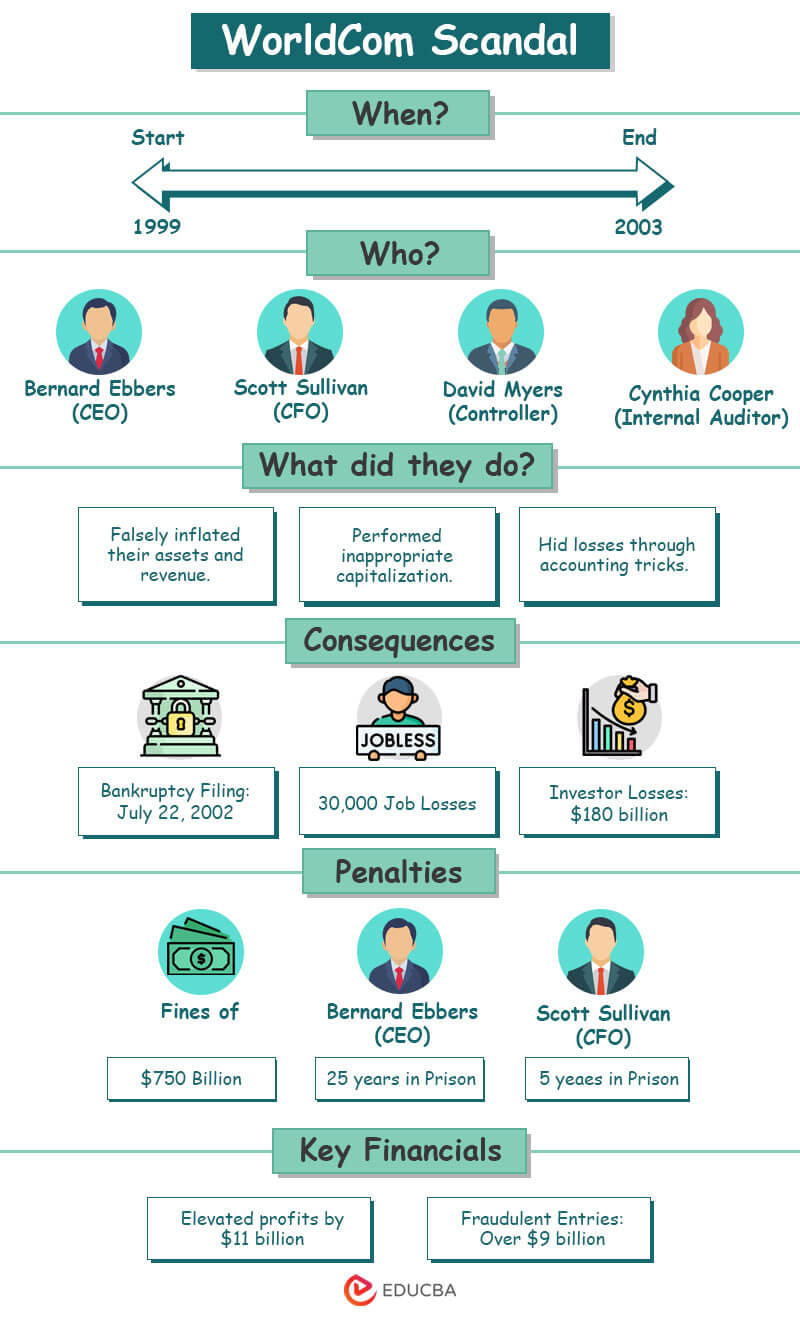

2. WorldCom

WorldCom, a telecommunications company, committed a massive accounting scandal of about $11 billion in 2002. The CEO, Bernard Ebbers, and the CFO, Scott Sullivan, were the main faces in this scam which made it seem like the company was financially stronger than it was.

They used dishonest accounting methods, such as categorizing regular expenses as long-term assets, to make it appear that the company was making bigger profits. They also falsely recorded revenue from future periods to inflate their current earnings. These tricks helped WorldCom show higher revenue and maintain a positive public image.

Unfortunately, the consequences of this accounting scandal were severe. The company lost $180 billion of investors’ money, and around 30,000 employees lost their jobs. The CEO, Bernard Ebbers, received a 25-year sentence for his fraud involvement.

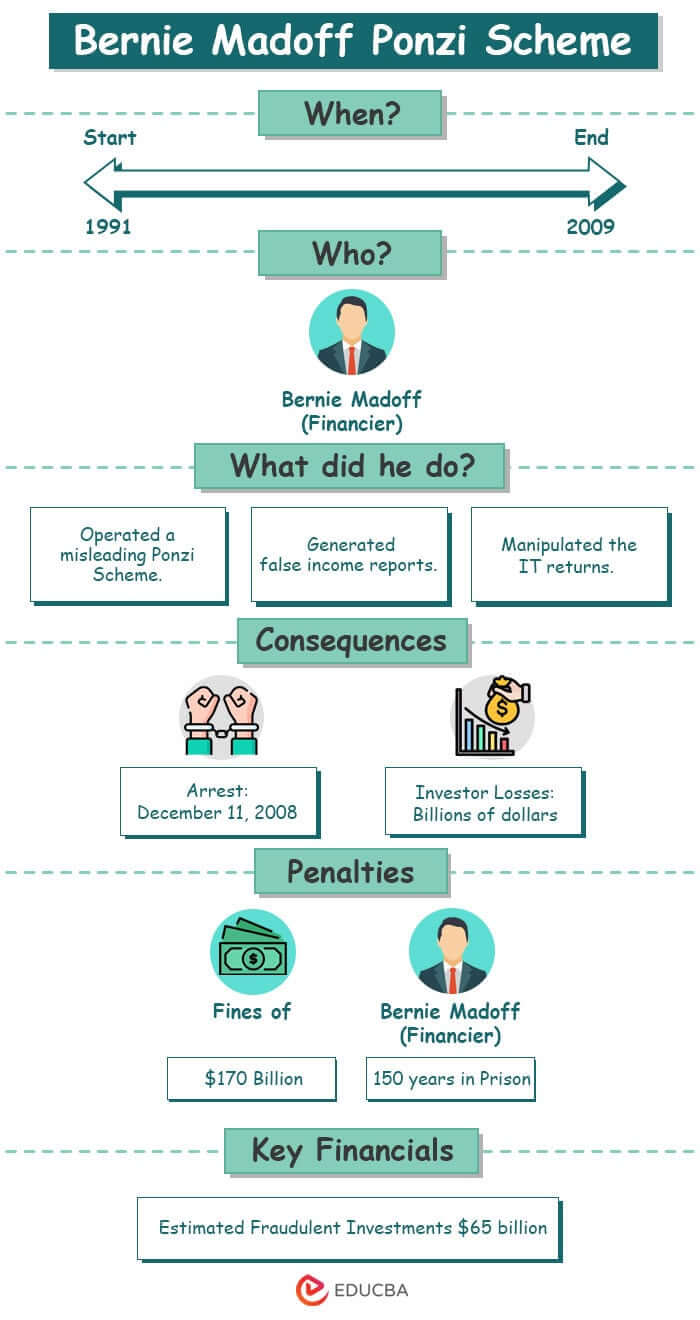

3. Bernie Madoff

In 2008, a company cheated investors, which became one of the biggest accounting scandals ever, worth a shocking $65 billion. People called it the Ponzi scheme, where the scammer uses money from one investor and pays it to another investor while stating that it’s the profit.

Interestingly, the Securities and Exchange Commission (SEC), responsible for protecting investors, started looking into Bernard Madoff’s activities in 1999. However, even though a financial analyst named Harry Markopolos filed a complaint in 2000, the SEC initially didn’t pay much attention to the case. It wasn’t until 2005 that Markopolos convinced the SEC that Madoff was running a fraudulent scheme.

In 2009, the court punished Madoff for his crimes. The court ordered a sentence of 150 years in prison and he had to give up $170 billion. By December 2008, around $2.48 billion, the company returned to the victims of Madoff’s scam. Eventually, Madoff passed away in prison on April 14, 2021.

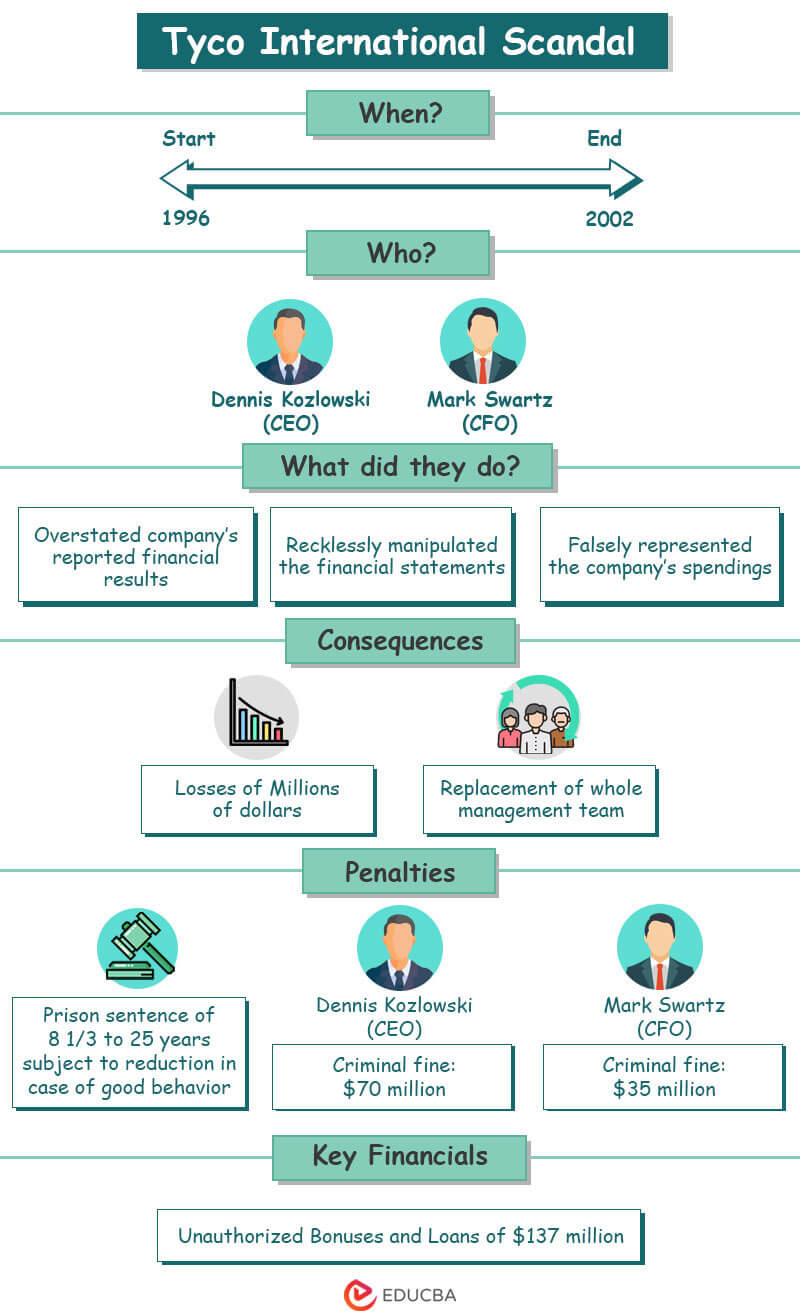

4. Tyco International Ltd.

The Tyco accounting scandal of 2002 involved a high-profile case of corporate fraud and mismanagement. CEO Dennis Kozlowski and CFO Mark Swartz were the main culprits behind the scandal that accounted for a loss of $600 billion. The scam started when Kozlowski and Swartz started awarding themselves unauthorized and excessive bonuses, including lavish compensation packages and personal loans from the company.

They embezzled around $150 million and inflated the company’s income by $500 million. Eventually, all these came to the notice of the SEC and Manhattan D.A., who uncovered this accounting scandal. Kozlowski and Swartz were sent to jail and had to pay $70 and $25 million, respectively.

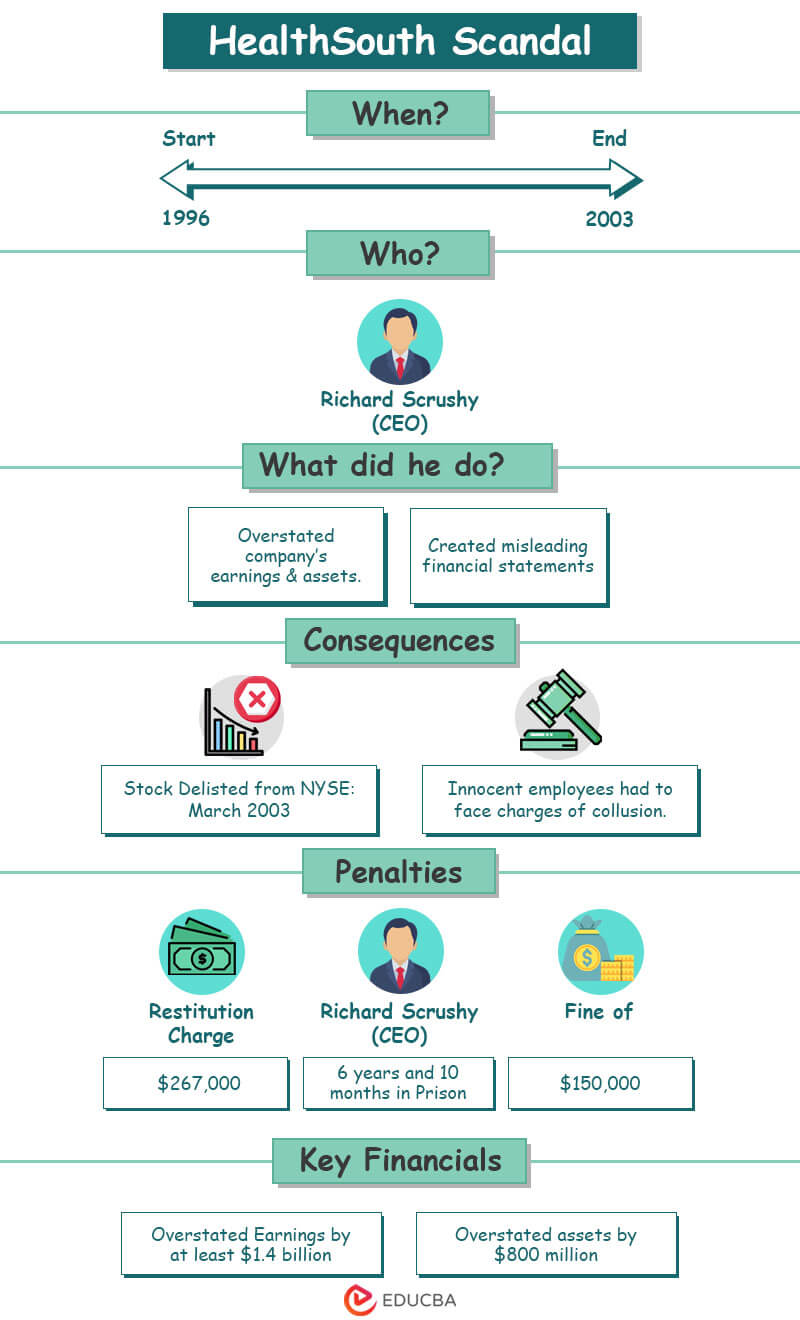

5. HealthSouth

This company had been manipulating its financial numbers by creating fake transactions since 1996, but it wasn’t until 2003 that its misleading practices came to light. The Securities and Exchange Commission (SEC) became suspicious when the company’s CEO, Richard Scrushy, sold $75 million worth of stock just one day before announcing significant losses.

While courts ultimately cleared Scrushy of the charges of accounting fraud, he was found guilty of bribing the governor of Alabama and received a 6 years and 10 months jail sentence. Interestingly, the external auditors of HealthSouth, including Ernst & Young, failed to detect the fraud. It raised concerns about their ability and independence to properly examine the company’s financial records.

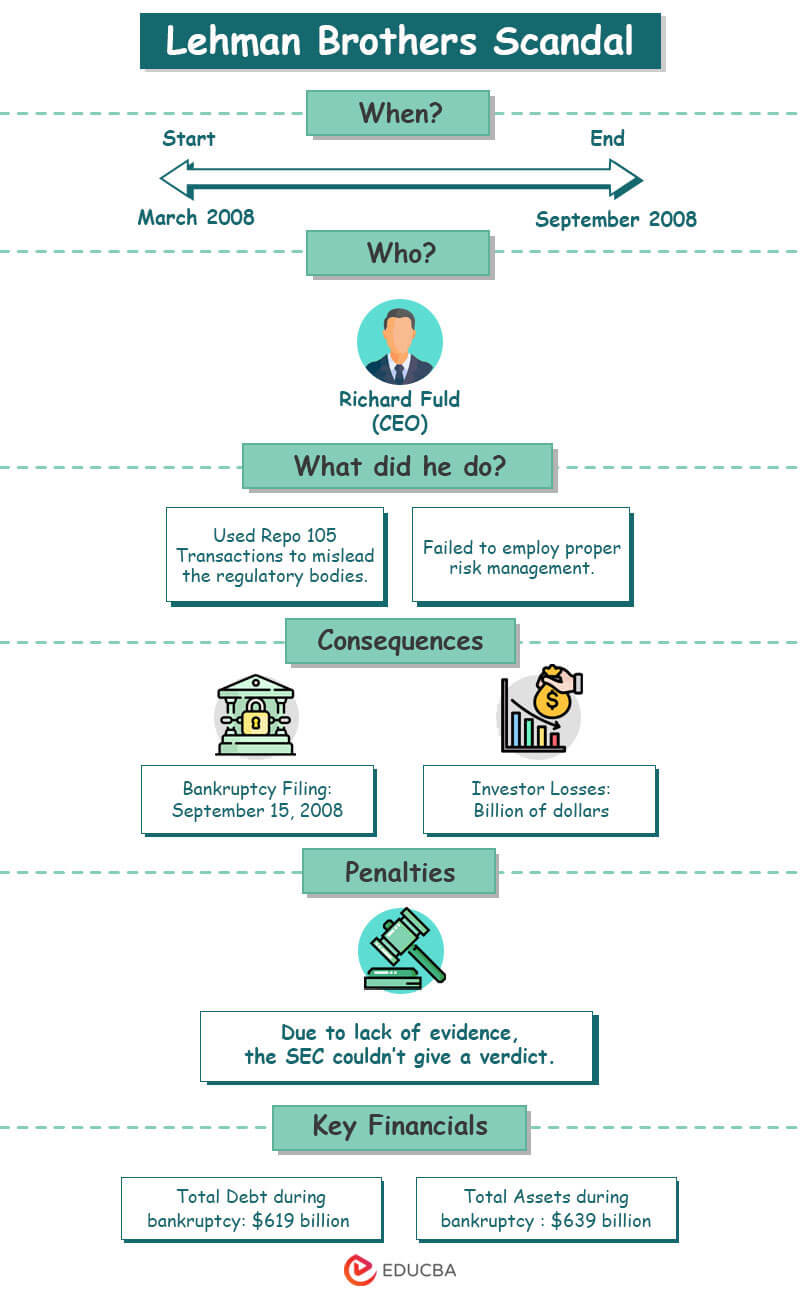

6. Lehman Brothers

Lehman Brothers, a major investment bank in the United States, engaged in fraudulent activities. They created a false appearance of having enough money by selling risky assets to banks in the Cayman Islands. They did this, understanding that they would repurchase those assets later. This accounting fraud involved loan assets worth $50 billion. The court discovered the fraud when Lehman Brothers filed for bankruptcy in 2008.

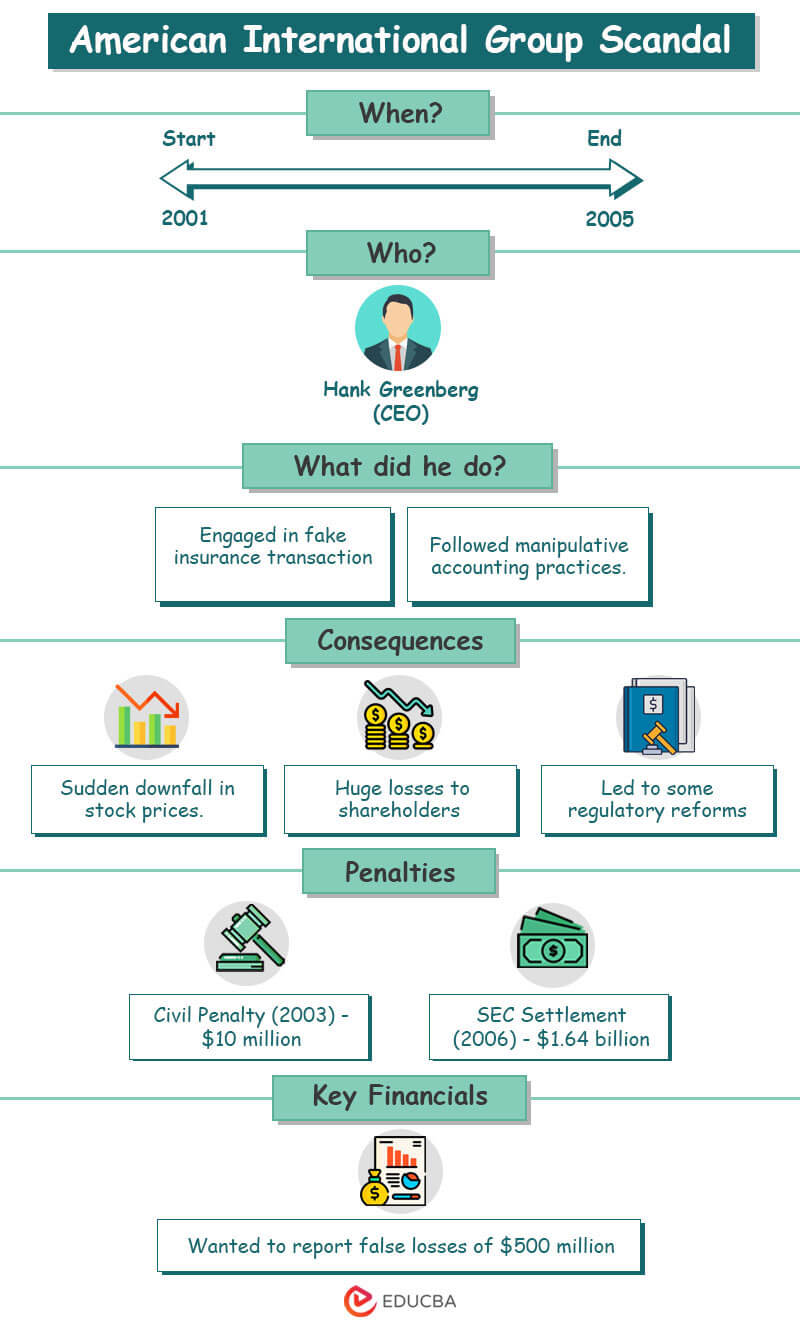

7. American International Group (AIG)

This multinational insurance company committed fraud by improperly categorizing loans as revenue and working with dishonest traders to manipulate stock prices. Eventually, the Securities and Exchange Commission (SEC) uncovered this accounting fraud in 2005, revealing approximately $3.9 billion in fraudulent activity.

The CEO at the time, Hank Greenberg, was primarily responsible. As a result, the company had to pay settlements of $10 million in 2003 and $1.64 billion in 2006 as penalties for their actions. While the company fired Greenberg from his position, he was later found not guilty of criminal charges.

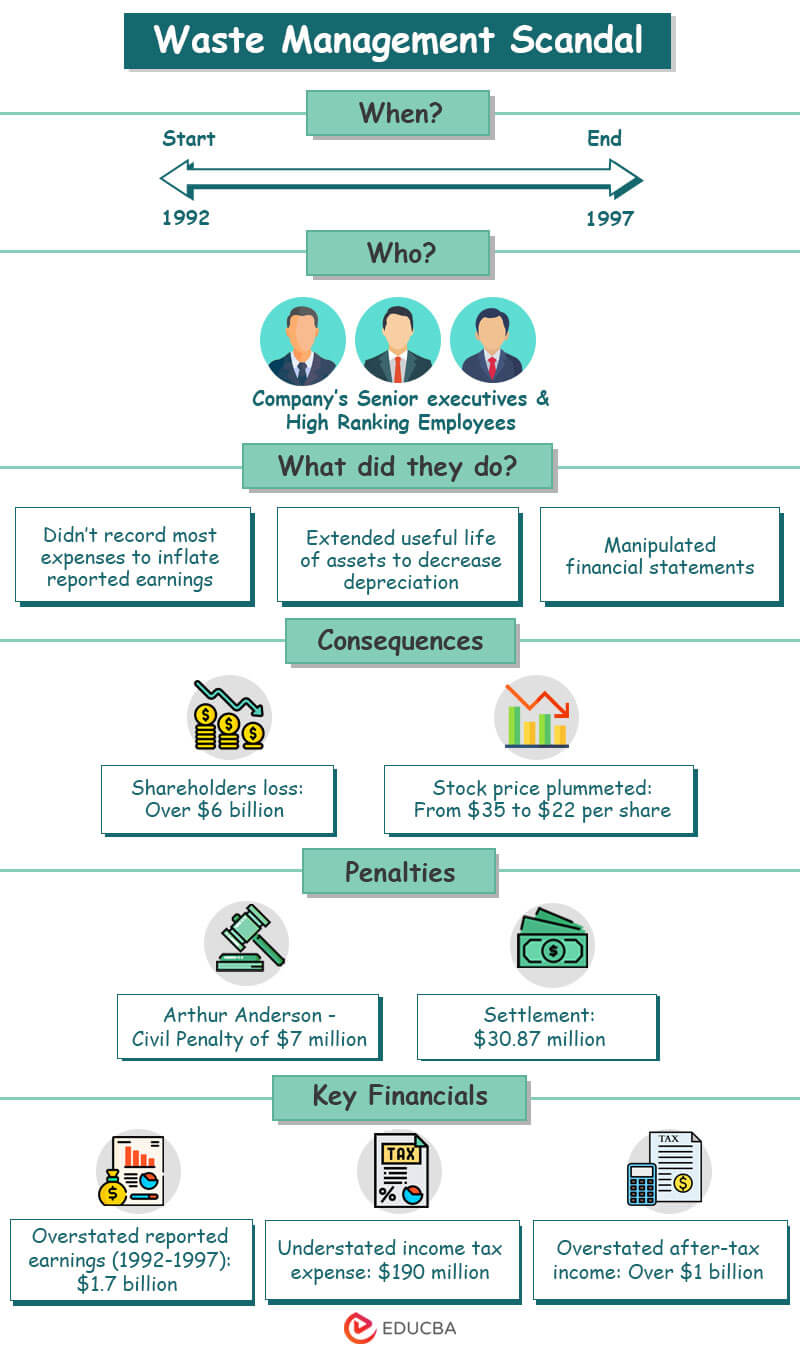

8. The Waste Management Company

Waste Management was one of the largest waste management companies in the United States in the 1990s. The company reported fake earnings of a whopping $1.7 billion, and several senior executives at Waste Management were involved in the accounting scandal.

The management used improper accounting practices to overstate their earnings and understate their expenses to show higher income. As a consequence, in 1998, Waste Management company was forced to restate its financial statements for several prior years, reducing reported earnings by around $1.7 billion.

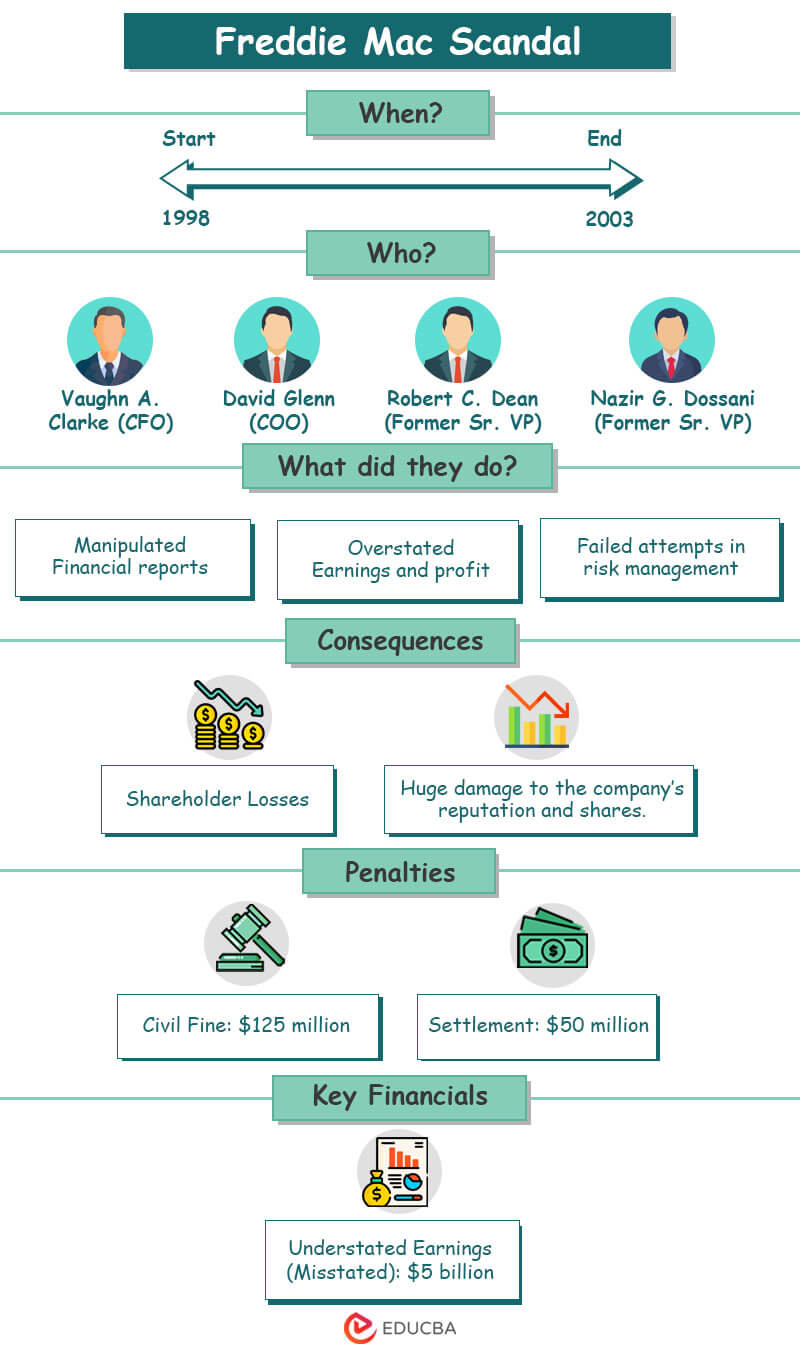

9. Freddie Mac

In 2003, Freddie Mac, a mortgage-financing giant, was involved in an accounting scandal. They were found guilty of understating their book earnings by $5 billion.

The court implicated the entire senior management team, resulting in fines of $125 million and the termination of the CEO, COO, and CFO. Freddie Mac used improper accounting practices to manipulate their earnings and portray false stability and profitability.

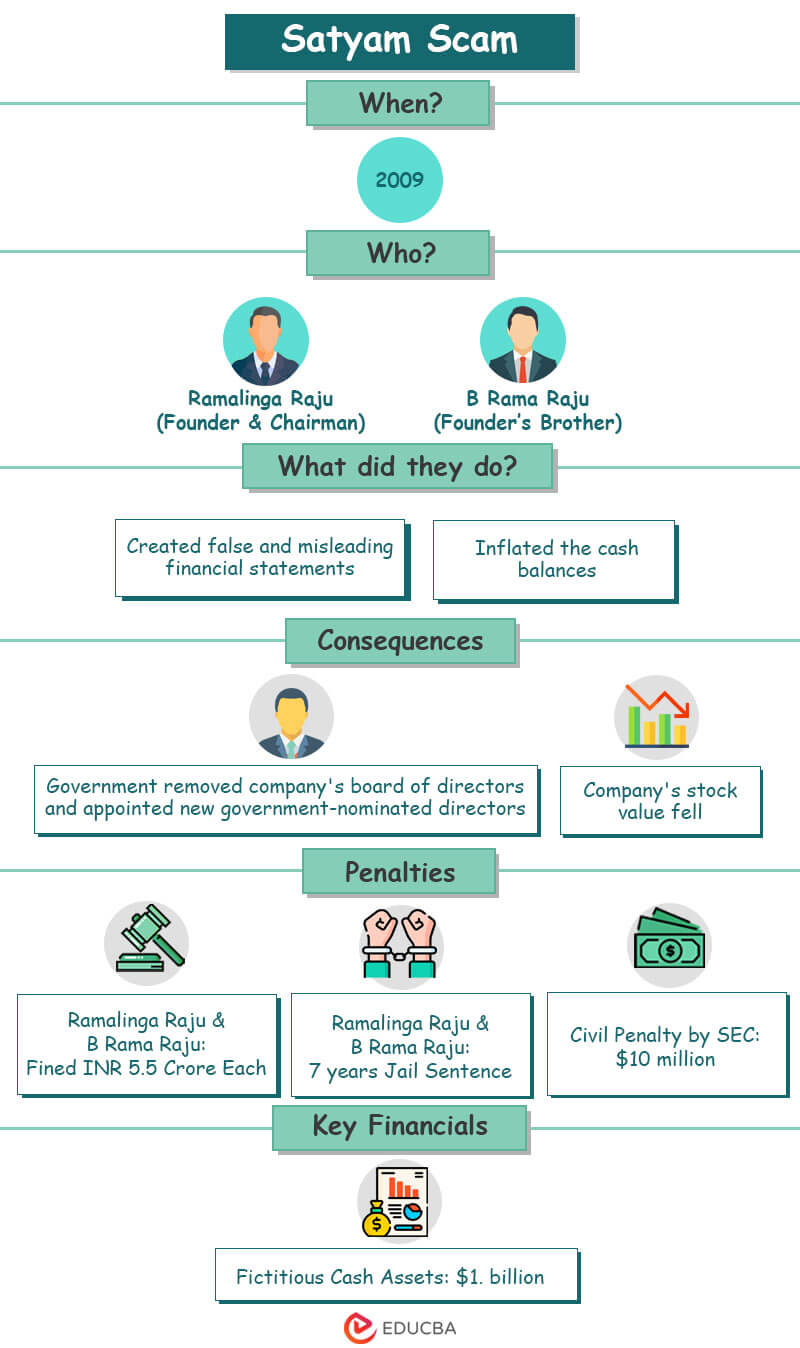

10. Satyam Computers

Satyam Computers was an IT and back office accounting firm based in Hyderabad. In 2009, the auditors discovered that the company created false transactions to boost revenue, margin, and liquidity that inflated the revenue per se by $1.5 billion.

After an investigation by India’s Central Bureau of Investigation, the guilty Ramalinga Raju (Chairman) confessed the accounting scandal fraud to the company’s board of directors in a letter. Although CBI failed to file any charges against him initially, they were fined INR 5.5 crore each and sentenced to 7 years in prison.

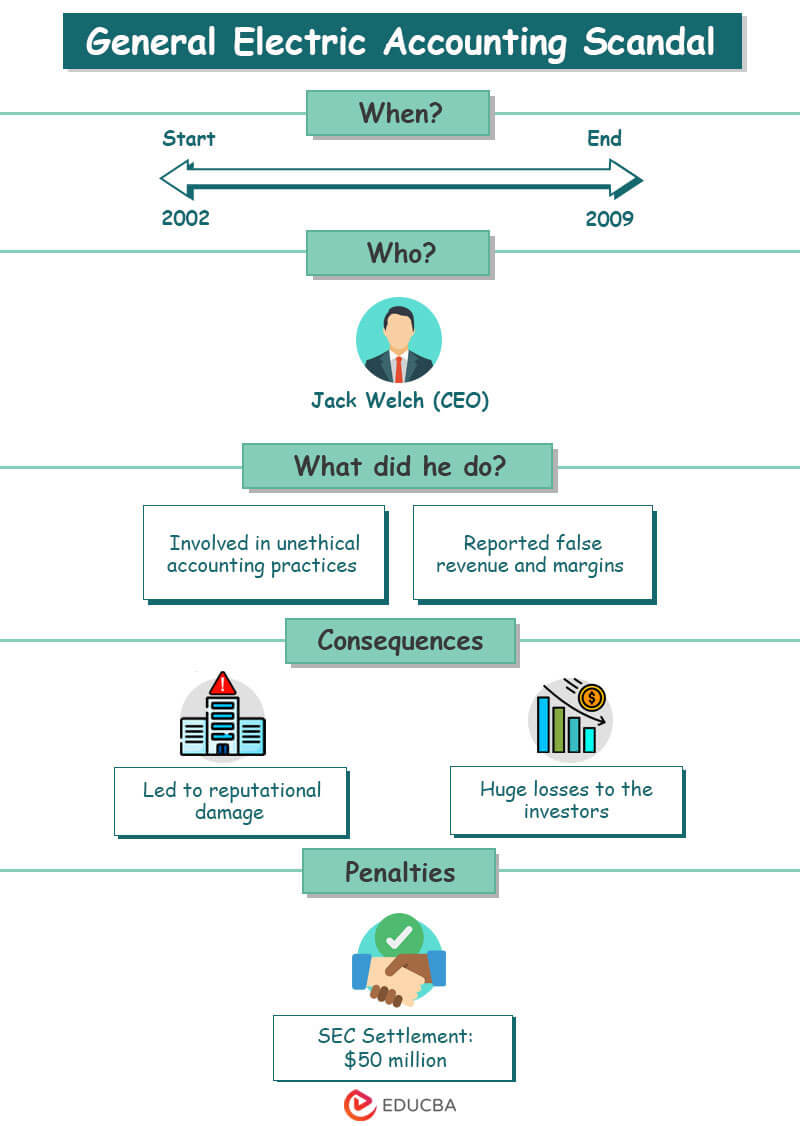

11. General Electric (GE)

During 2002 and 2009, Jack Welch, the CEO of General Electric, used unethical accounting practices to carry this accounting scandal. He reported false revenue and margins that led to huge financial losses for the investors and damaged the company’s reputation. As a result, the Securities and Exchange Commission (SEC) fined Jack with a hefty fine of $50 million.

After the scandal, rather than dissolving the company, other General Electric executives worked harder to restore their reputation and rebuild their investor’s trust.

Causes of Accounting Scandals

Now that we know about the top accounting scandals of the world, let us see some of the common causes behind most accounting scandals:

- Excessive greed for generating quick money

- Lack of transparency in financial reporting

- Poor information quality (such as inaccurate and irrelevant information)

- The internal audit team has no control

- Senior management with corrupt behavior and low moral values

- The extremely complicated structure of the organization

- Lack of proper control on financial reporting/accounting.

Recommended Articles

We created this guide on accounting scandals to educate you about the top 11 scandals to date. We covered every essential point along with their causes. Also, you may learn from similar articles below: