Guide To Overcome Seasonal Business Challenges

Many entrepreneurs in New Zealand face seasonal fluctuations in demand and expenses, whether in retail, farming, or tourism. Managing these changes can be challenging, but hiring a trusted accountant is one of the best ways to ensure financial stability year-round. If your business is in the Otago region, accountants Dunedin are familiar with local economic conditions and tax rules, making them the ideal choice. With expert advice, they can offer reliable accounting services for seasonal business owners, helping you navigate seasonal challenges effectively.

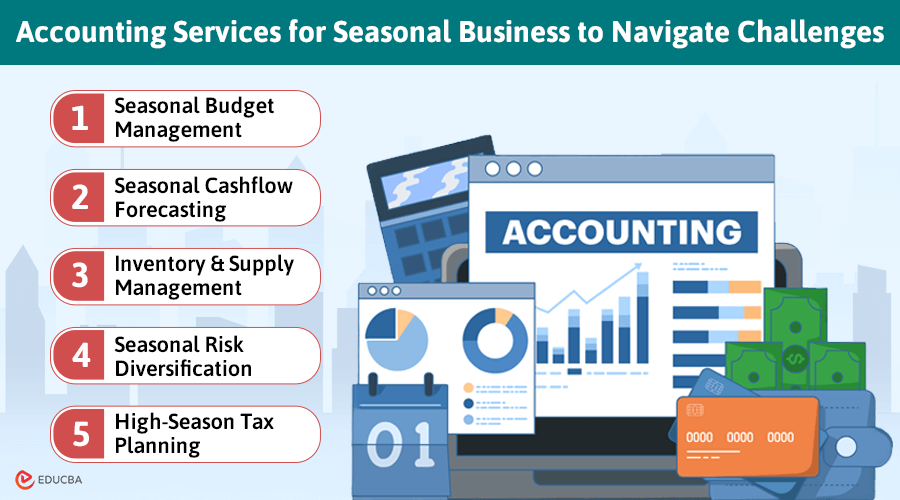

Accounting Services for Seasonal Business to Navigate Challenges

Here are the top five accounting services for business owners to navigate seasonal business challenges:

#1. Seasonal Budget Management

Seasonal fluctuations in revenue can significantly impact businesses, especially those in retail and agriculture. Here is how accounting services can help manage these challenges:

- Seasonal Revenue Variability: Businesses often experience higher sales during peak seasons (e.g., holidays and harvest) but a decline during off-peak months. If you do not manage this properly, it can lead to cash flow matters.

- Flexible Budgeting: Your accountant can help you develop a flexible budget that adjusts for seasonal changes in revenue. This guarantees your company’s year-round financial stability.

- Historical Data Analysis: By reviewing past sales data, accountants can help predict future trends, allowing for more accurate revenue and expense forecasting during peak and off-peak periods.

- Expense Control: With expert advice, you can avoid overspending during busy months and better manage costs during slower periods, ensuring you stay within your budget.

- Financial Planning: Accounting services ensure you plan for any financial challenges, providing a roadmap to navigate fluctuating revenues and maintain profitability.

#2. Seasonal Cashflow Forecasting

Cashflow forecasting is an essential tool for all types of businesses that experience seasonal fluctuations in sales.

- Seasonal Variability: Seasonal businesses often face fluctuating cash flow, with high sales during peak seasons and low or negative cash flow during off-peak periods.

- Focus on Predicting Trends: By analyzing historical sales data and industry-specific patterns, cash flow forecasting helps predict future cash flow trends, allowing businesses to plan.

- Prepare for Lean Months: Forecasting enables business owners to set aside enough funds during peak months, ensuring adequate money to pay for costs during sluggish times.

- Avoid Liquidity Issues: Effective forecasting helps prevent liquidity problems or cash shortages that can arise when sales dip, ensuring the business remains financially stable.

- Benefit of Accounting Services: An accountant can provide valuable seasonal services for business owners, helping to create accurate cash flow forecasts and ensuring financial stability year-round.

#3. Inventory & Supply Management

Businesses must have efficient supply chain and inventory management, particularly during seasonal variations.

- Demand Forecasting: By using accountants to estimate future demand by examining past sales data and trends, businesses can decrease the risk of stockouts or overstocking.

- Cash Flow Management: By avoiding excess inventory, businesses can free up cash that might be tied up in unsold stock, improving overall financial health.

- Optimized Inventory Purchases: Accounting services help business owners more strategically plan inventory purchases, ensuring sufficient stock during peak seasons without overstocking during low-demand periods.

- Minimized Sales Loss: Accurate forecasting prevents stockouts, allowing businesses to meet customer demand during peak times and avoid missed sales opportunities.

#4. Seasonal Risk Diversification

Businesses that depend on seasonal demand are vulnerable to market conditions or consumer preference changes.

- Seasonal Vulnerability: Businesses relying on a single season or product, such as Christmas retail sales or summer vineyards, may need help during off-peak periods.

- Risk of Economic Downturns: Economic downturns or shifts in industry trends can heavily impact businesses that only perform well during specific seasons.

- Diversification Strategy: Working with an accountant can help identify opportunities to diversify your business. This could involve expanding into new products, services, or markets that generate consistent revenue year-round.

- Examples of Diversification: Introducing off-season packages or events for a seasonal tourism business can create a steady income. In agriculture, diversifying crop production or branching into other areas of agribusiness can reduce reliance on seasonal income.

#5. High-Season Tax Planning

During peak seasons, higher profits can increase tax liabilities; accountants, like Reed & Co, help plan strategies to minimize taxes and avoid cash flow issues.

- Higher Tax Liabilities: Increased sales during peak seasons, like summer or holidays, often lead to higher profits, resulting in higher tax obligations at year-end.

- Potential Cash Flow Issues: Higher profits may lead to unexpected tax payments without proper tax planning, causing financial strain or cash flow problems for your business.

- Role of an Accountant: An accountant can assist in strategic tax planning, help manage seasonal profits, and reduce the impact of higher taxes.

- Tax Minimization Strategies: Accountants may recommend deferring income or accelerating deductible expenses to lower taxable profits for the current year, ultimately reducing tax liabilities.

- Financial Structure Optimization: Proper financial structuring during high-profit periods ensures your business remains financially stable while minimizing tax stress.

Final Thoughts

Accounting services for seasonal business owners are essential for managing challenges effectively. From budgeting and cash flow forecasting to inventory management and tax planning, accountants provide valuable expertise to navigate fluctuations in demand and expenses. By leveraging these services, businesses can maintain financial stability, optimize profits, and reduce risks associated with seasonal variability. With professional accounting support, business owners can ensure long-term success, even during unpredictable times.

Recommended Articles

This article on accounting services for seasonal businesses was helpful to you. Check out our other recommended articles for more insights on accounting services for businesses.