Definition of Accounts Payable Turnover Ratio

The term “accounts payable turnover ratio” refers to the liquidity ratio that measures the rate at which a company is able to pay off its suppliers during a certain period of time.

In other words, it indicates how many times a company is able to pay off its payables during a period. Usually, creditors use this ratio to assess a company’s liquidity position by evaluating how quickly a company can pay off its suppliers and vendors.

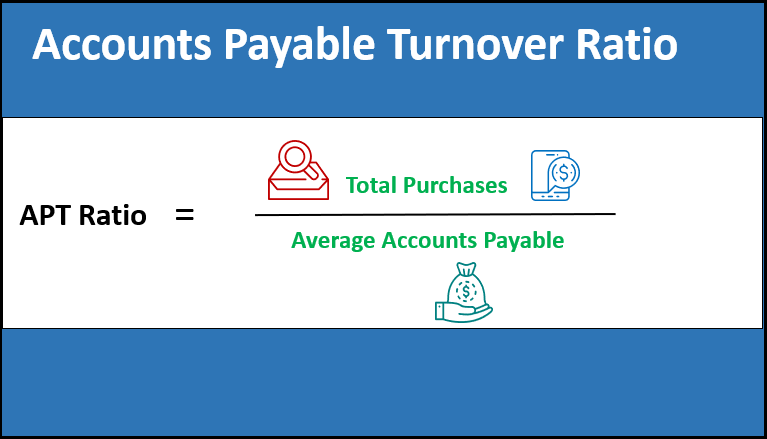

Formula

The accounts payable turnover ratio formula can be derived by dividing the total purchases during a period by the average accounts payable. Mathematically, it is represented as,

The total purchases can be computed by adding closing inventory to the cost of goods sold and subtracting the opening inventory from the result. The average accounts payable is the average of the accounts payable at the start and end of the year.

Examples of Accounts Receivable Turnover Ratio (With Excel Template)

Let’s take an example to understand the calculation of the ART Ratio formula in a better manner.

Example #1

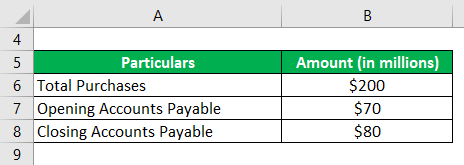

Let us take the example of a company with total purchases of $200 million and accounts payable at the start and at the end of the year of $70 million and $80 million respectively. Calculate the accounts payable turnover ratio of the company.

Solution:

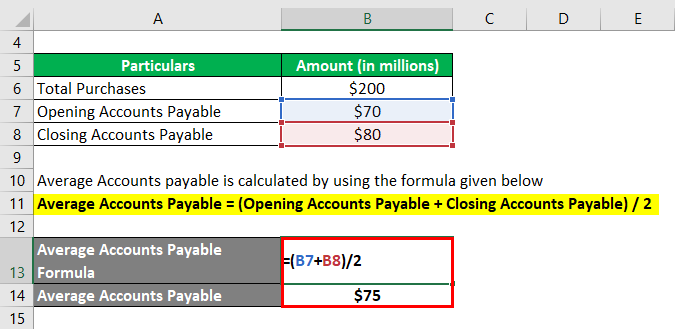

The formula used to calculate the average account payable is as follows:

Average Accounts Payable = (Opening Accounts Payable + Closing Accounts Payable) / 2

- Average Accounts payable = ($70 million + $80 million) / 2

- Average Accounts payable = $75 million

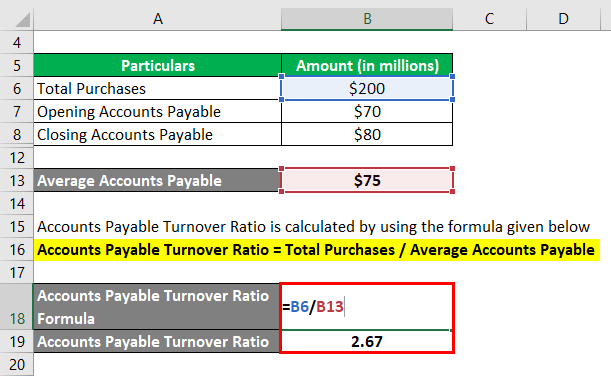

Accounts Payable Turnover Ratio is calculated by using the formula given below

Accounts Payable Turnover Ratio = Total Purchases / Average Accounts Payable

- APT Ratio = $200 million / $75 million

- APT Ratio = 2.67

Therefore, the company managed to pay off its trade payable 2.67 times during the year.

Example #2

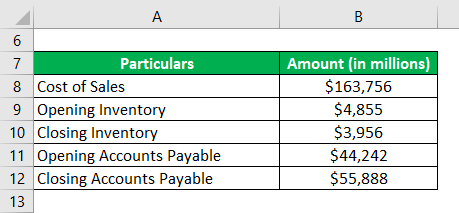

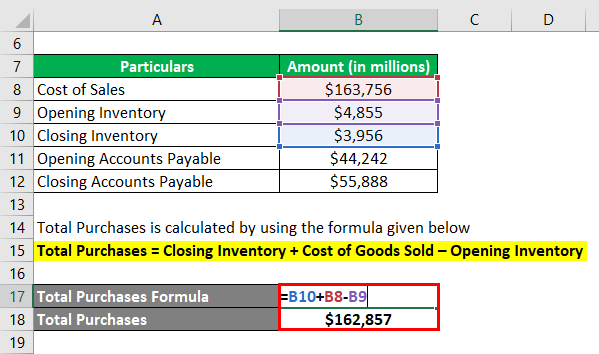

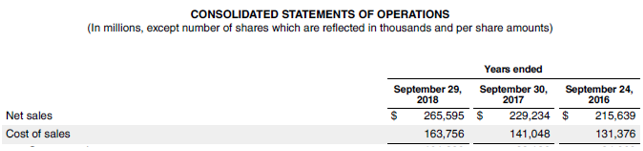

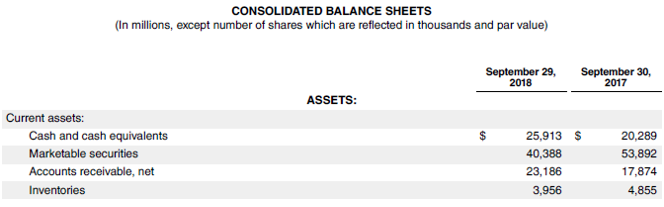

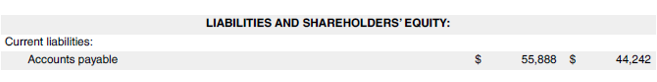

Now, let us take the example of Apple Inc. in order to compute the accounts payable turnover ratio for the year 2018. According to the latest annual report, the cost of sales was $163,756 million, opening inventory and closing inventory stood at $4,855 million and $3,956 million respectively and opening accounts payable and closing accounts payable stood at $44,242 million and $55,888 million respectively. Calculate Apple Inc.’s APT Ratio for the year 2018.

Solution:

Total Purchases is calculated by using the formula given below

Total Purchases = Closing Inventory + Cost of Goods Sold – Opening Inventory

- Total Purchases = $3,956 million + $163,756 million – $4,855 million

- Total Purchases = $162,857 million

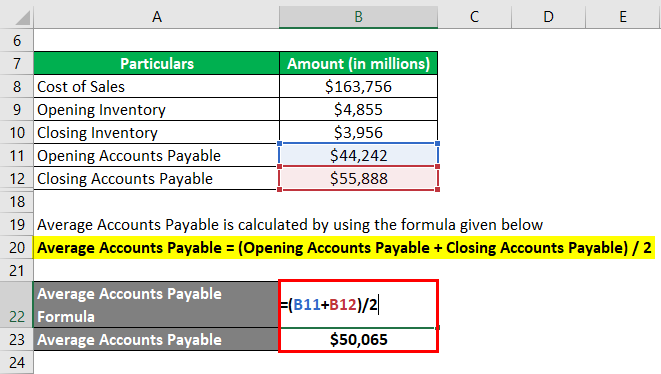

Average Accounts Payable is calculated by using the formula given below

Average Accounts Payable = (Opening Accounts Payable + Closing Accounts Payable) / 2

- Average Accounts Payable = ($44,242 million + $55,888 million) / 2

- Average Accounts Payable = $50,065 million

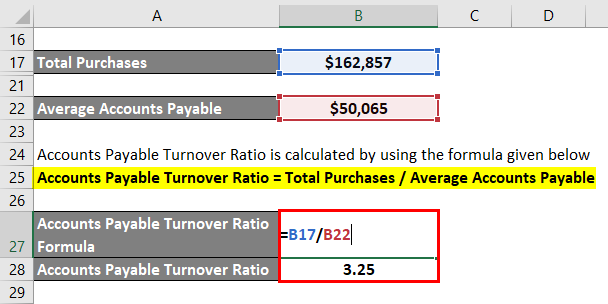

The formula used to calculate the ratio is as follows:

Accounts Payable Turnover Ratio = Total Purchases / Average Accounts Payable

- APT Ratio = $162,857 million / $50,065 million

- APT Ratio = 3.25

Therefore, Apple Inc. paid off it’s payable 3.25 times during the year 2018.

Source: Apple’s Annual Report

Example #3

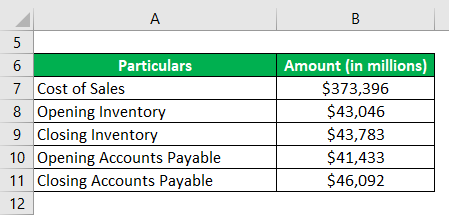

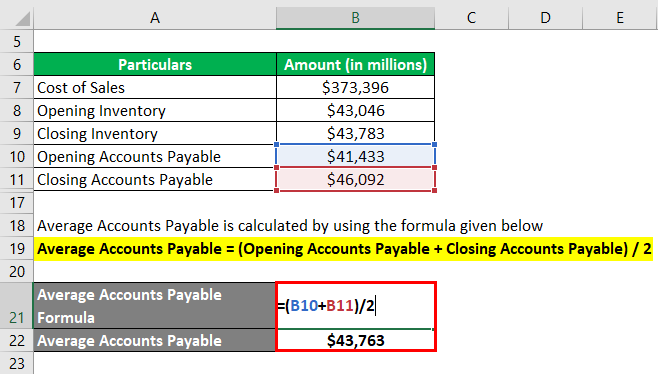

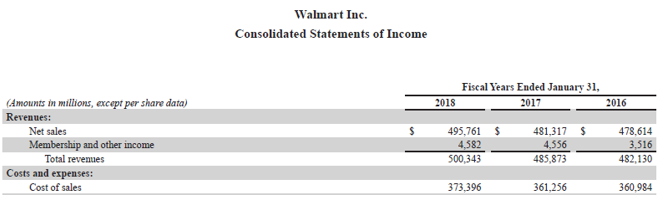

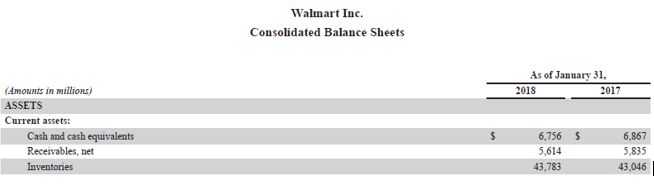

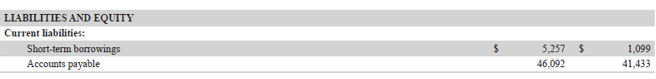

Let us take the example of Walmart Inc.’s annual report for the year 2018. According to the annual report, the cost of sales was $373,396 million, opening and closing inventory stood at $43,046 million and $43,783 million respectively and opening accounts payable and closing accounts payable stood at $41,433 million and $46,092 million respectively. Calculate the accounts payable turnover ratio for Walmart Inc. for 2018.

Solution:

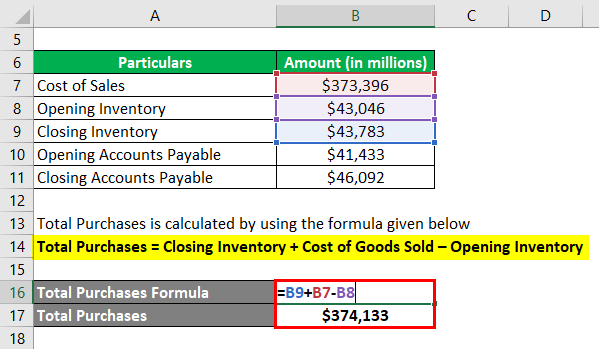

The formula used to calculate the total purchase is as follows:

Total Purchases = Closing Inventory + Cost of Goods Sold – Opening Inventory

- Total Purchases = $43,783 million + $373,396 million – $43,046 million

- Total Purchases = $374,133 million

Average Accounts Payable = (Opening Accounts Payable + Closing Accounts Payable) / 2

- Average Accounts Payable = ($41,433 million + $46,092 million) / 2

- Average Accounts Payable = $43,763 million

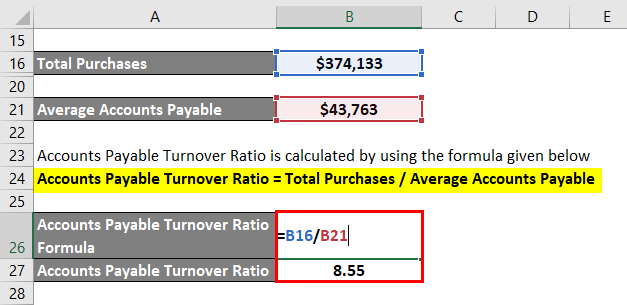

The formula used to calculate the ratio is as follows:

Accounts Payable Turnover Ratio = Total Purchases / Average Accounts Payable

- APT Ratio = $374,133 million / $43,76 million

- APT Ratio = 8.55

Therefore, Walmart Inc. paid off its payables 8.55 times during 2018.

Source: Walmart Annual Reports (Investor Relations)

Advantages

The ratio can be used to assess a company’s credit policy and its suppliers’ negotiating power.

Disadvantages

In the absence of credit purchases, total purchases are used, which can result in misrepresentation of a company’s credit policy.

Conclusion

So, accounts payable measures the liquidity position of a company. Typically, a higher value indicates that the company pays off its creditors more frequently, reflecting better working capital management. On the other hand, a lower accounts receivable turnover ratio means that the company takes longer to pay off its creditors, which can indicate a weak liquidity position.

Recommended Articles

This is a guide to the Accounts Payable Turnover Ratio. Here we discuss the introduction, examples, advantages, and disadvantages of the APT Ratio along with a downloadable Excel template. You can also go through our other suggested articles to learn more –