Updated October 27, 2023

Definition of Accounts Receivable Factoring

Accounts receivable factoring (also known as invoice factoring, debtor financing, or accounts receivable financing) is asset-based lending wherein the organization gives away (i.e., sells) its right of realizing cash from the accounts receivables to a third party (known as a factor who is expert in managing the receivables) at a discounted value so as to obtain immediate cash from the factor.

Explanation

- Accounts receivable factoring is a financial term in which the business sells the accounts receivable to a third party (known as a factor). Sounds a little weird, right? What sense would it make for a company to sell its account receivables! Well, there is a catch! Let’s discuss it further. The story starts when a business sells goods/supply services on a “credit basis.

- Suppose an entity has $ 200,000 in accounts receivables. In that case, it will hire a person who will make daily follow-up calls with customers, prepare reconciliation of amounts received & yet to be received, balance confirmation issues, collection of cheques, submit the cheque to the bank; if it bounces, then recheck with the customer & follow-up again, and “n” number of administrative things. Say the administration cost (i.e., salary & other employee-related costs) goes around $ 45000. The entity may receive only $ 195000, and the balance will be written off (i.e., bad debts of $ 5000).

- This is where factoring comes to help. What if another organization handles the said task at $ 15000 and received yet $ 197000 today? Sounds attractive!

- So, here the organization sells the AR at a discount. Now the responsibility of “managing the account receivables” is with an organization that is an expert in this field.

- So, the agreements are entered with the factoring entity in multiple ways, either through the sale of an asset (i.e., accounts receivable factory) or through the actual receipt of a loan (with interest payable to a third party).

How Does It Work?

- After the entity has sold the goods on credit to a customer, the factor finances the company with the said amount. In turn, the factor collects the payments on account of receivables from the said customers on those specific due dates as agreed in the sale invoice.

- This helps the entity to receive cash on an immediate basis rather than waiting for the due date. With the money in hand, the entity can use it for business purposes (i.e., buying raw materials, paying for existing outstanding obligations, salary to workmen, etc.). Thus, blocked cash flow due to credit customers is released with the help of factors. The good thing about factoring is that the default risk (if any) is not to be borne by the company but by the factory.

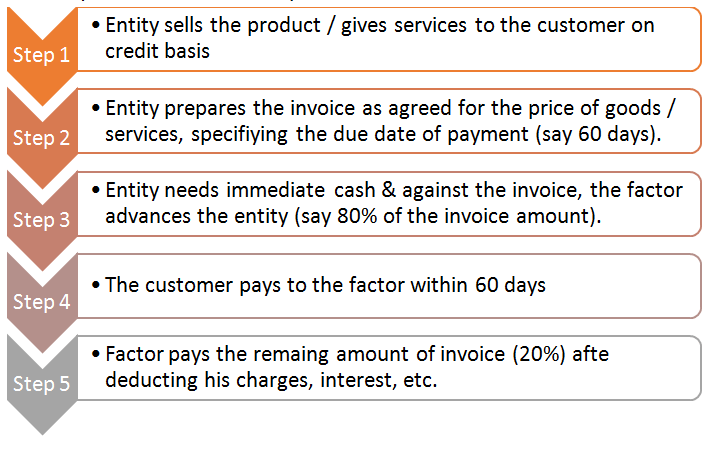

- Let’s have a quick go-through of how it work using the following image:

Image source: https://www.bluevine.com/accounts-receivable-factoring-guide-factoring-invoices/

Many of the factoring arrangements are executed in two tranches. The first tranche being advance payment by the factor to the entity, and the second tranche being paying the balance amount after adjustments. Below is the summary of events that takes place:

Example of Accounts Receivable Factoring

For a comprehensive understanding of accounts receivable factoring, let’s have a covered example of whether the company manages the receivables in-house or is recourse factoring or non-recourse factoring.

The data is as follows:

| Turnover of the company | $ 4,13,00,000 |

| Accounts receivables | $ 35,00,000 |

| Administration costs | $50,000 |

| Current overdraft rate | 7% |

| Current Bad debts to turnover ratio | 0.90% |

| Current Bad debts to turnover ratio under factoring | 0.60% |

| Credit period under factoring (days) | 35 |

| Advance payment by a factor (% of turnover) | 80% |

| The interest rate charged by the factor on the advance amount | 9% |

| Factoring Fees (recourse) | 0.75% |

| Factoring Fees (non-recourse) | 1.25% |

Solution:

| Particulars | Inhouse Management ($) | Recourse Factoring ($) | Non-Recourse Factoring ($) |

| Bad Debts | |||

| ($ 413,00,000 * 1.5%) | 6,19,500 | ||

| ($ 413,00,000 * 0.6%) | 2,47,800 | 0 | |

| Administrative Costs | 50,000 | 0 | 0 |

| Factoring Fees | |||

| ($ 413,00,000 * 0.75%) | 0 | 3,09,750 | |

| ($ 413,00,000 * 1.25%) | 5,16,250 | ||

| Interest Cost | |||

| Bank Overdraft = ($ 3500,000 * 7%) | 2,45,000 | ||

| As per factor terms (*Note 1 below) | $3,40,584 | $3,40,584 | |

| Total Cost | 9,14,500 | 8,98,134 | 8,56,834 |

Note 1 for Calculations:

The factor will ensure that customers pay within 35 days & thus, it will charge interest only on the amount lent for 35 days. The factor will advance only the 80% portion. But what if the company needs funds for that 20% as well? It can get an overdraft for the same as per the old rate.

Value of accounts receivables for 35 days = ($ 41300000 * 35 days / 365 days) = $39,60,274

Rate of Interest

| 80% advance by factor = 80% * 9% | 7.20% |

| 20% amount = overdraft from bank = 20% * 7% | 1.40% |

| Average Rate of interest applicable | 8.60% |

Interest cost under factoring arrangement = $ 39,60,274 * 8.6% = $3,40,584

Since the cost of managing the AR is least under “Non-recourse factoring”, the company should choose the same. The company will bear only $ 856,834, which is lower than inhouse management of AR.

Explanation

- You can see that the bad-debts percentage is fallen as soon as a factor is appointed. Even the bad debts are zero in the case of non-recourse factoring.

- The non-recourse factor charges higher fees than the recourse factor.

- The administration cost is saved & thus entity can focus on its business.

- Net savings due to a factoring arrangement

= $ 914,500 – $ 856,834 = $ 57,666

Recourse Factoring vs Non-Recourse Factoring

| Recourse Factoring | Non-Recourse Factoring |

| The factor advances (say 80% of the accounts receivables). The factor may pay you the balance of 20% (after adjustment for his fees & interest) depending upon whether the customer pays the factor full amount or discounted amount. | The factor advances (say 80% of the accounts receivables). The factor may pay you the balance of 20% (after adjustment for his fees & interest) irrespective of whether the customer pays the factor full amount or discounted amount. |

| The factor does not assume the default risk of the customer. Thus, default risk is borne by the entity itself. | The factor assumes the default risk of the customer. Thus, default risk is borne by the factor. |

| If the customer does not pay any amount to the factor, the entity can repay that 80% amount with interest & charges. | Here, the entity is not liable to repay back any amount to the factor. The factor bears the loss. |

| Factor charges lower fees because of the lower risk to the factor. | Factor charges higher fees because of the higher risk to the factor. |

| It does not protect the company from bankruptcy | It protects the company from bankruptcy |

Uses of Accounts Receivable Factoring

- Liquidity is made available in no time.

- It is mostly useful for companies dealing with huge invoices, and managing the accounts receivables is tough.

- Entity saves on the loss of opportunity during the credit period.

- The short-term financial needs of the business are satisfied & thus, sufficient inventory is available for near term sales.

- Guaranteed funds are received with a lower rate of interest and lower compliance than banks.

Accounts Receivable Factoring vs Accounts Receivable Bank Financing

Accounts receivable factoring vs accounts receivable bank financing is given below:

Accounts Receivable Factoring

- This is the typical method of factoring wherein the factor (i.e., financial institution) buys the invoices from the entity at a discounted price.

- The ownership of invoices is transferred from the entity to the factor. If we assume the non-recourse factoring, the factor bears even the default risk.

- The factor makes adjustments for default risk (recourse factoring), interest on advances & factoring charges before paying the balance amount.

- The factor handles the hustle & bustle of managing the AR.

Accounts Receivable Bank Financing

- This is a case of asset-based lending wherein the invoices become collateral security to the loan offered by the financing institution (i.e., the lender)

- The ownership of invoices is not transferred to the lender. Thus, the company has to bear the default risk, if any & has to manage the accounts receivables anyway.

- The lender is at no risk since it has the invoices as collateral, and it can recover the amount directly from the customer if the owner-entity does not repay the loan amount.

- However, the loan-to-asset ratio (i.e., the amount of loan to be received against the value of accounts receivables) varies from lender to lender.

- This method is still attractive since it provides immediate cash flow &, again, lower compliance than banks.

Benefits of Accounts Receivable Factoring

Some of the benefits are given below:

- An easier method of financing & can be used as a short-term financing option.

- Help grow the business during the credit period as well.

- It is not a loan & hence, the debt-to-equity ratios are not disturbed.

- The company can focus on expanding its business rather than engaging in managing the accounts receivables.

- Even in the case of non-recourse factoring, the company does not bear the default risk.

- The factor is not concerned with the company’s credit history since it relies only on the invoice.

- An ample amount of administration cost is saved.

Conclusion

In a nutshell, accounts receivable factoring involves outsourcing the management of accounts receivables to a third party in exchange for an immediate discounted cash flow. This process allows the organization to realize cash from debtors quickly. However, it’s important to note that factoring comes with its own set of business risks, including counterparty’s credit risk, contractual disputes, and compliance issues. Compared to traditional banks, factoring offers more flexibility due to fewer restrictions, contributing to its growing popularity in the market, which is estimated to be around $3 trillion globally. ABCFinance provides valuable insights into the intricacies of accounts receivable factoring and its potential advantages for your business. By understanding this financing option comprehensively, you can make an informed decision about leveraging its benefits. However, it’s crucial to maintain a delicate balance, as excessive pressure on customers by the factor could adversely affect the company’s reputation and future dealings with those customers.

Recommended Articles

This is a guide to Accounts Receivable Factoring. Here we also discuss the definition and how does accounts receivable factoring works? Along with uses and benefits. You may also have a look at the following articles to learn more –