Updated July 20, 2023

Introduction to Accrual Accounting

Accrual Accounting refers to the concept in the accounting where there is the practice of recording expenses in the books of accounts of the business at the time when they are incurred regardless of the time when they are paid off as well as an income is recognized in the books of accounts of the business whenever they are earned and not at the time when the payment against such income is received.

Explanation

In Accrual Accounting the revenue and expenses of a business enterprise are recorded in the books of accounts in the period when they occur irrespective of the time when the payment against such revenue or expenses is received or paid respectively. For example, the sale is done by a business firm on credit basis then the sale is recorded in accounts books when the ownership of goods is transferred not when the payment against such sale is received and in the case of the expense we can take the example of electricity bill which gets due at the end of each month but is generally paid in the following month but following the accrual concept the electricity expense is recorded in the month to which it relates to.

Examples of Accrual Accounting

Following are the examples of accrual accounting are given below:

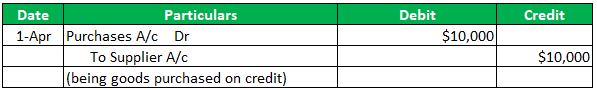

Example #1

When a business purchases the raw materials on a credit basis from the supplier then the entry in the books of accounts will be made on the invoice issue date or at the date of the receipt of the raw materials as the case may be and not at the time when the owner pay the amount to the supplier. Suppose X ltd. purchased raw material worth $10,000 from its supplier on 01.05.2020 but the payment for the same is made on 15.05.2020. In this case, entry will be made on 01.05.2020 and not on 15.05.2020 as below:

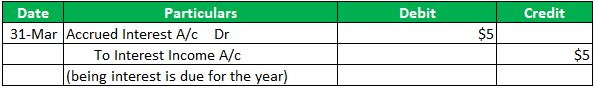

Example #2

Amery the business owner of Amery mobile has made an investment of $100 in fixed deposit for the term of 5 years with the bank that will give him the Simple interest @ 5% p.a. on the same. Mr. Amery will receive the full amount including interest after the tenure of 5 years but as per the accrual basis of accounting, Mr. Amery has to recognize the interest as income each year in the books of accounts regardless of the scheme that the whole amount is receivable at the end of five-year term. So the entry for the interest each year will be:

Here the Interest Amount is Calculated as Below:

Interest Amount = Investment Amount * Yearly Interest Rate

- Interest Amount = 100 * 5%

- Interest Amount = $5

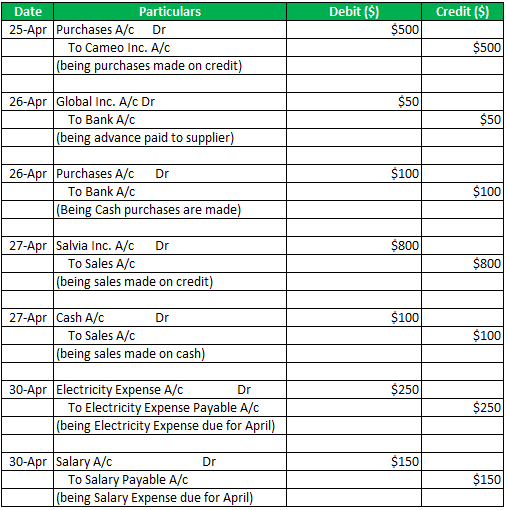

Example #3

A company named Webcam Incorporation is a manufacturer of digital cameras. Some transactions related to the month of April 2020 are given. The company purchased the raw material from Cameo Inc. on April 25thworth $500 and agreed to pay the supplier the amount in the following month. It also paid an advance worth $50 on April 26th to Global Inc. for the goods receivable in May. Also on the same day, some cash purchases were made amounting to $100.At the end of the month, the company’s electricity bill amounted to $250. During the month of April, the company sold cameras worth $900. Sales amounting to $800 were made on April 27th on a credit basis to Salvia Inc. whereas the remaining sales amounting to $100 were made on April 29th on a cash basis. The salary to be payable to employees for the month of April was $150. Now we need to record the same in the books of accounts. The journal entry book of the webcam incorporation for the month of April 2020 will be as follows:

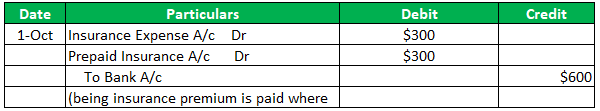

Example #4

Company ABC Inc. has taken an insurance policy to insure the plant & Machinery of the business. Where the insurance premium of $600 is paid on October 1, 2019 for the financial year 2019-20. Now in the books of accounts, only 50% of payment will be recognized as an expense of insurance premium whereas the 50% amount will be regarded as the prepaid insurance premium. Therefore, entry for the same transaction will be:

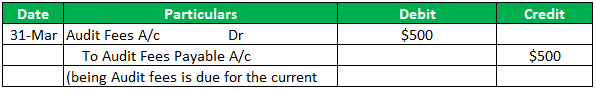

Example #5

In the companies, even the audit fees are paid to the concerned person who is conducting the audit of the company. Continuing the above example the company pays audit fees amounting to $500 to the auditor for the FY 2019-20 in April 2020. So at the end of the FY 2019-20, the provision for audit fees is to be made when an accrual basis is followed. The entry on March 31, 2020, will be:

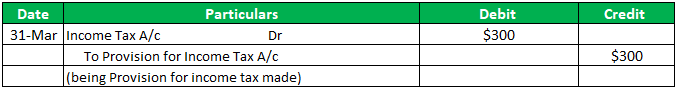

Example #6

Continuing example 5, if ABC Inc.’s tax liability pertaining to FY 2019-20 Is estimated to be $300. Then the provision for the income tax has to be made at the end of the financial year regardless of the fact that the payment is made in advance or some amount is to be paid after the end of the financial year. Therefore, the entry for the same will be

Conclusion

Thus Accrual Accounting concept provides a true and fair image of the business’s financial performance as the revenues & Expenses related to each year is booked in the financial year only irrespective of the fact that the same has been paid or not. Generally Large and Medium size industries use the accrual method only for accounting and small enterprises may prefer using a cash basis because it is easy as compared to an accrual basis.

Recommended Articles

This is a guide to Accrual Accounting Examples. Here we discuss the introduction and how to calculate accrual accounting along with practical examples. You may also look at the following articles to learn more –