Difference Between Accrual vs Deferral

Certain accounting concepts are used in any company’s revenue and expense recognition policy. These are adjusting entries known as accrual accounting and deferral accounting, which businesses often use to adjust their books of accounts to reflect the true picture of the company. Accrual occurs before a payment or a receipt, and deferral occur after a payment or a receipt. These are generally related to revenue and expenditure largely. Deferral of an expense refers to the payment of an expense made in one period, but the reporting of that expense is made in another period. Deferred revenue is sometimes also known as unearned revenue that the company has not yet earned. The company owes goods or services to the customer, but the cash has been received in advance.

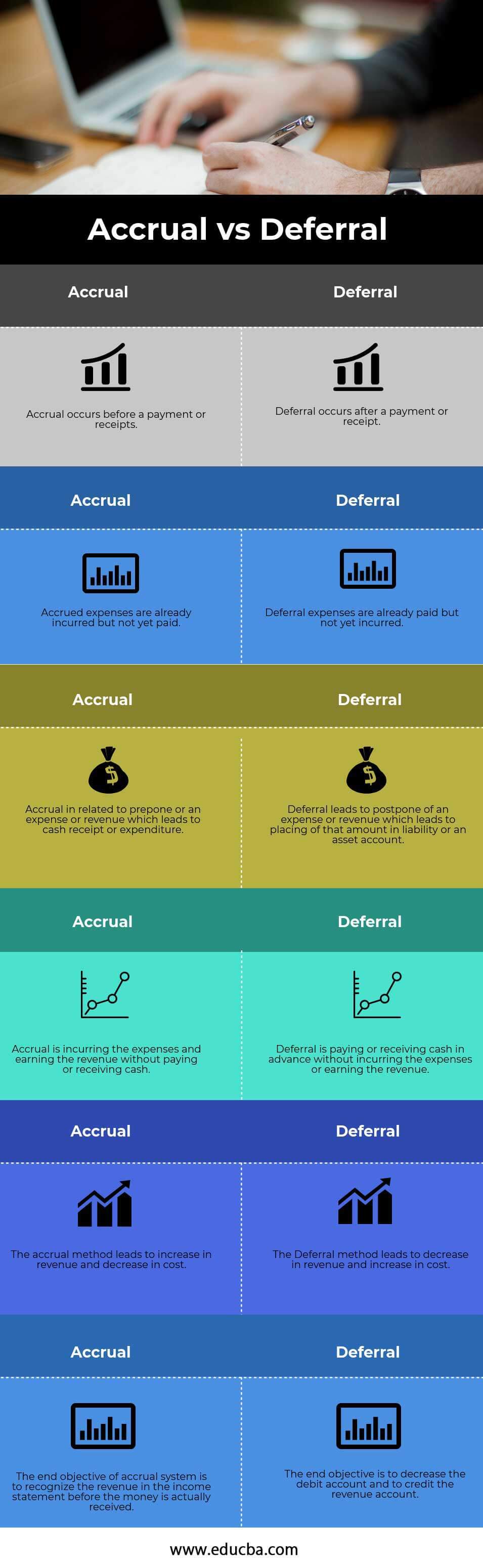

Head To Head Comparison Between Accrual Vs Deferral(Infographics)

Below is the top 6 difference between Accrual Vs Deferral

Key Differences Between Accrual vs Deferral

Both Accruals vs Deferral are popular choices in the market; let us discuss some of the major Difference Between Accrual vs Deferral

- The accrual of revenue entry is passed by the business to book all the revenue at once. Deferral of revenue generally refers to the spread of revenue over time. The same is the case with expenses as well

- When a business pass adjusting entry of accrual, it leads to cash receipt and expenditure. Deferral is the recognition of receipts and payments after an actual cash transaction has occurred

- Deferral of revenue leads to the creation of a liability as it is, in most cases, treated as unearned revenue. On the other hand, accrual of revenue leads to the creation of assets, mostly in the form of accounts receivables

- An example of deferred revenue is the insurance industry, where customers pay upfront. Whereas accrued revenue is common in the service industry

Accrual Vs Deferral Comparison Table

Below is the 6 topmost comparison between Accrual Vs Deferral

|

Accrual |

Deferral |

| Accrual occurs before a payment or receipts | Deferral occurs after a payment or receipt |

| Accrued expenses are already incurred but not yet paid | Deferral expenses are already paid but not yet incurred |

| Accrual is related to prepone or an expense or revenue which leads to cash receipt or expenditure | Deferral leads to postponing of an expense or revenue, which leads to placing that amount in liability or an asset account |

| Accrual is incurring the expenses and earning the revenue without paying or receiving cash | Deferral is paying or receiving cash in advance without incurring expenses or earning the revenue |

| The accrual method leads to an increase in revenue and a decrease in cost | The Deferral method leads to a decrease in revenue and an increase in cost |

| The end objective of the accrual system is to recognize the revenue in the income statement before the money is received | The end objective is to decrease the debit account and credit the revenue account

|

Why do we Need These Adjusting Entries?

According to the matching principle of bookkeeping accounting, these adjusting entries are used in every business to reflect the true state of accounts. The matching principle says directly is a set of guidelines that directs the company to report each expense related to that reporting period’s income. These adjusting entries occur before the financial statements of the reporting period are released. The reason to pass these adjusting entries is only that of the timing differences, which is simply when a company incurs an expense or earns revenue and when they receive cash or make payment for it.

Types of Accruals

- Interest expense and interest revenue

- When a firm delivers a good or service before receiving cash

- When a firm generates a salary expense before paying the employee in cash

Types of Expenses That are Deferred in Nature

- Insurance

- Rent

- Supplies

- Equipment

The cash basis of accounting only applies to that kind of business where sales are not exceeding more than $5 million annually. The cash basis is very easy to use, and generally, there is not much complexity involved in it as simply a record of the transaction only when the cash is received in the business. Due to the simple nature of accounting, small businesses often use cash basis to prepare their books of accounts.

On the contrary, the Accrual basis of accounting is used by larger companies for several purposes. First, it is helpful for tax reporting when sales exceed $5 million. Also, the accrual basis of accounting is necessary for audit purposes as books worldwide are prepared on an accrual basis.

Accrual is a very important method to reflect the company’s true position. However, the cash statement also has its importance as it tells about the ability of the company to generate cash in the business. Hence both are an integral part of the accounting concepts.

Accrual of an expense refers to reporting that expense and the related liability in the period they occur. For example, a water expense is due in December, but the payment of that expense will not be made until January. Similarly, accrual of revenue refers to reporting that receipt and the related receivables in the period they are earned. That period is before the cash receipt of that revenue. For example, interest earned on the investment of bonds in December, but the cash will not come until March of next year.

For example, Company XYZ receives $10,000 for a service it will provide over 10 months from January to December. But the cash has been received in advance by the company. In that scenario, the accountant should defer $9,000 from the books of account to a liability account known as “Unearned Revenue” and only record $1,000 as revenue for that period. The remaining amount should be adjusted month-on-month and deducted from the Unearned Revenue monthly as the firm will render the services to its customers.

Recommended Articles

This has been a guide to the top difference between Accrual vs Deferral. We also discuss the Accrual vs Deferral key differences with infographics and comparison tables. You may also have a look at the following articles to learn more –