What is an Accrued Expense?

Accrued Expense is a company’s pending expenses that it has incurred during business but is yet to pay. For example, as per the Walmart Annual Report 2022, their accrued liabilities are $26,060 million. It includes accrued wages & benefits, non-income taxes, etc., and indicates that the pending payment from 2021 will add to 2022’s expenses.

It is accounting terminology under the accrual concept, which states that expenses need to be recognized and recorded in an entity’s books of account during the accounting period in which they incurred. Regardless of whether they have been paid or not, leading to simultaneous recognition of liability, they must be paid within the current 12-month period.

Key highlights

- Accrued expense is expenses that have been incurred but not yet paid. This could be for services rendered or goods received, but an invoice has not yet been received or processed.

- These are recorded in the accruals journal and reported as current liabilities on the balance sheet.

- They often relate to interest expense, salaries, wages, and taxes. They need to be estimated when there is no invoice available.

- For businesses, it ensures that all expenses are properly accounted for and reported. For individuals, it can help with budgeting and cash flow planning.

How Does Accrued Expense Work?

It is the result of the accrual method of accounting under which the company records the expenses in the same accounting period they incur, unlike in cash accounting, where expenses are recorded only at the time of payment.

These are presented in the current liabilities section of the balance sheet as it is the current obligation of the business which needs to be settled in the future. These are also known as accrued liabilities. These are only the estimate of the expenses, and the real expense may vary from the accrued ones, which will arrive on a future date.

Examples of Accrued Expenses

Some examples of accrued expenses are as follows –

- Unpaid rent

- Unsettled commission

- Interest due on a loan payment for the month

- Unclaimed bill on the received service

- Pending payment for wages and salaries

- Accountable taxes

Excel Examples

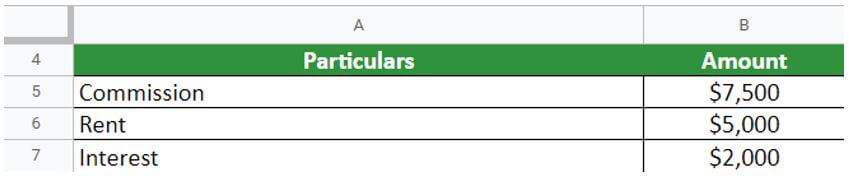

Example #1:

Let’s assume that an organization XYZ Ltd has the following transaction in their accounts for the year ending 31st December 2021:

- Rent amounting to $5000 incurred but not paid.

- Commission amounting to $7500 incurred but not paid.

- The interest of $2000 on loan incurred during the month, but the installment has not fallen due.

Calculate accrued expense for XYZ Ltd.

Given,

Solution:

Let us calculate the accrued liability for XYZ Ltd,

In this scenario, there would be an accrued expenditure of $14,500 for the year ending 2021. This is because the company has three expenses i.e., rent, commission, and interest, that have not been paid until the date of the balance sheet. For example, the commission was required to be paid by the company as this expense was due, but it was not paid. Therefore it is recorded as an accrued expenditure.

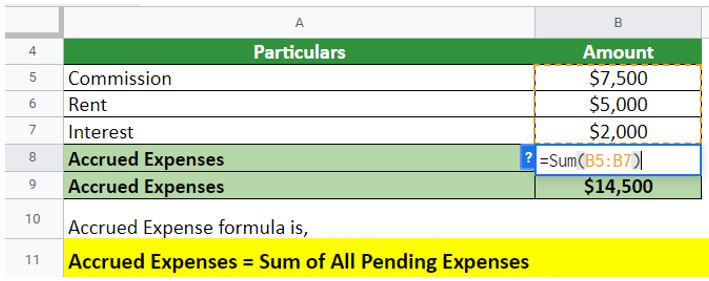

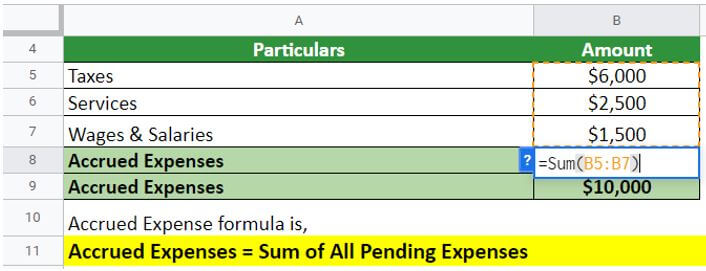

Example #2:

Following are some of the transactions in the balance sheet of ABC limited:

- Services received but not billed- $2500

- Wages and salaries incurred, but payment is still pending- $1500

- Taxes incurred- $6000

Calculate accrued expenditure for ABC Ltd.

Given,

Solution:

Let us calculate the accrued liability for ABC Ltd,

Accrued expense would be $10,000. During the financial year under consideration, the company has taken services amounting to 2500, but they are not billed. It means that the company has not paid these expenses to the service providers. This is the reason that it is recorded as an accrued liability.

Real-World Examples of Accrued Expense

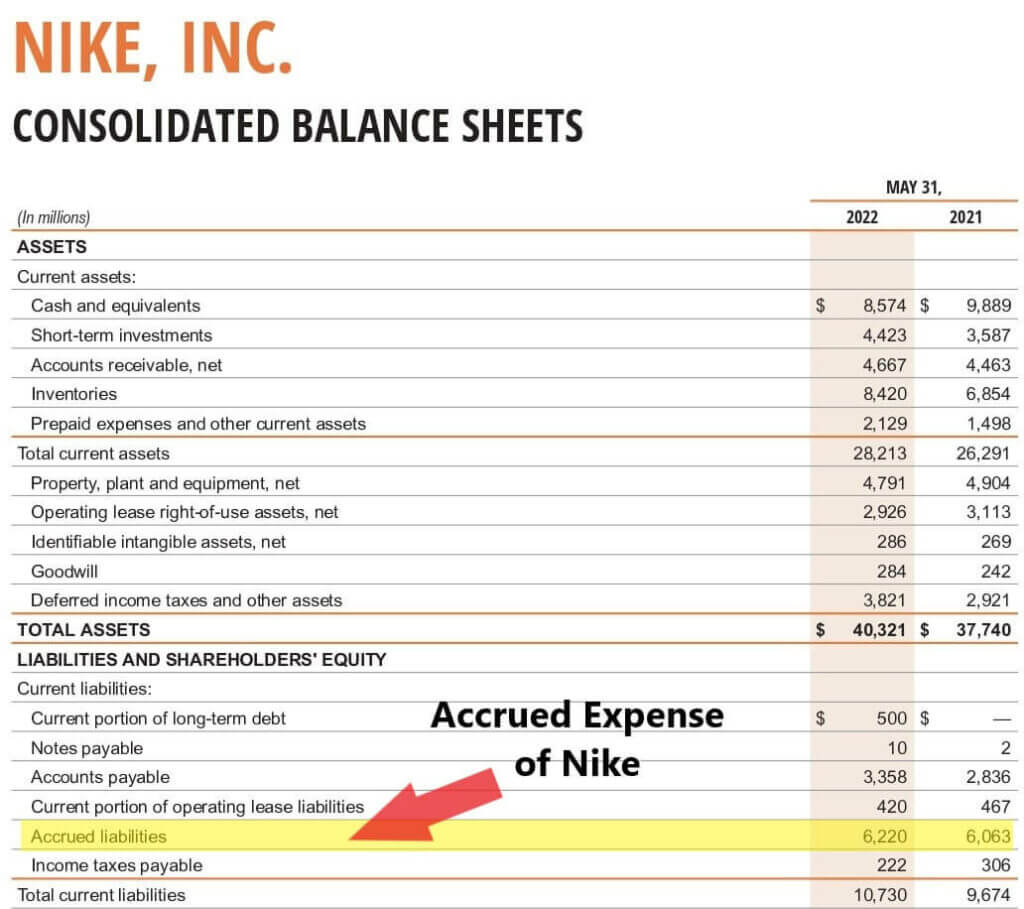

#1- Nike, Inc.

Let’s take the example of Nike, Inc. The company has provided financial information related to accrued expense in its annual report for the financial year 2022.

(Image Source: Nike Annual Report 2022)

This extract from the balance sheet shows that the company has accrued deferred tax expenses of $6,220 million for the year 2022. It means that the organization has some unpaid expenses on the balance sheet that are related to the financial year 2022.

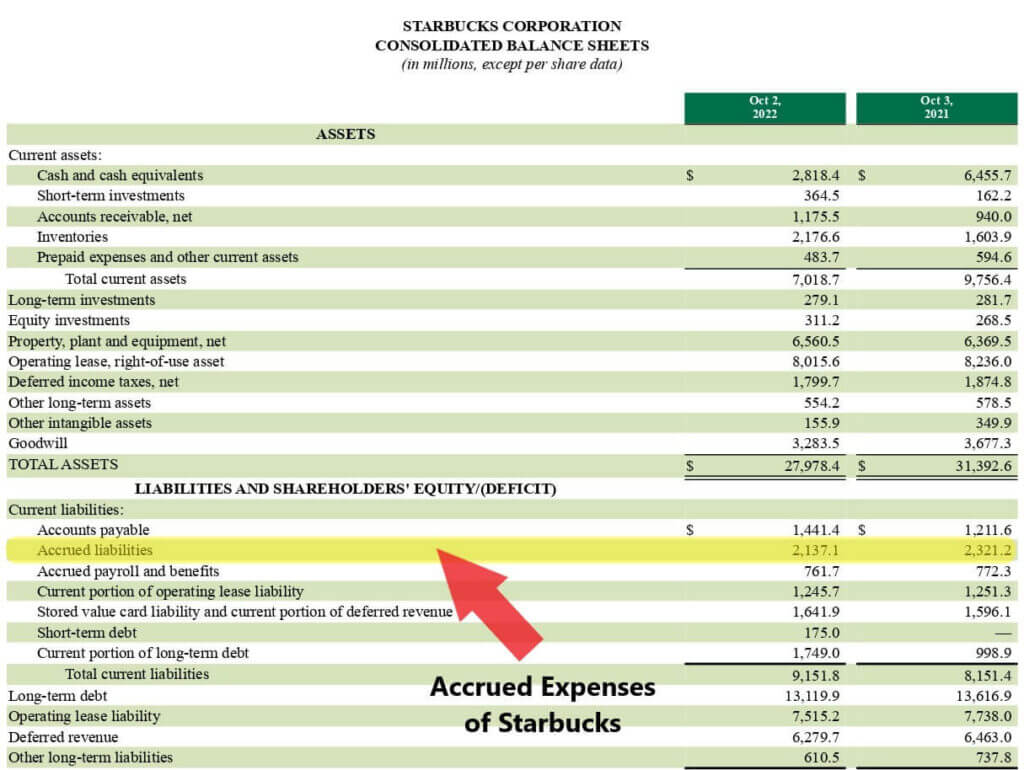

#2- Starbucks

Following are the accrued expenses shown by Starbucks in their balance sheet for the financial year 2022.

(Image Source: Starbucks Annual Report 2021)

This extract from the annual report of Starbucks shows that the total accrued liability is $2,137.1 million. This includes occupancy costs, dividends, operating expenditures, insurance, and tax expenses.

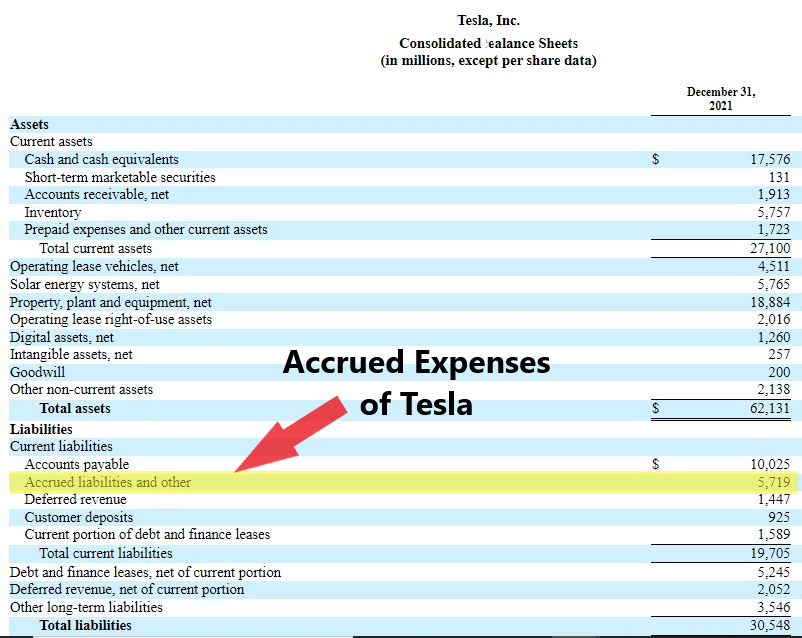

#3- Tesla Inc.

Let’s take the example of Tesla, Inc. The company has provided financial information related to accrued expenses in its annual report for the financial year 2021.

(Image Source: Tesla Annual Report 2021)

The balance sheet provided by the company indicates that it has various expenses that are categorized as accrued for the financial year 2021. According to note 9, the expenses are $2,045 for purchases, $1.122 for taxes, $703 for warranty expenses, $16 for accrued interest, $906 for payroll expenses, etc.

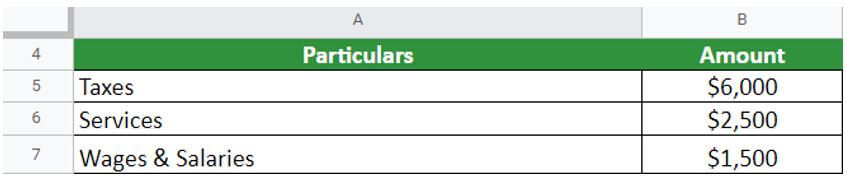

How to Record Accrued Expenses? Journal Entry

To record these expenses, companies create journal entries. In a journal entry, one debits the expense account and credits the accrual account.

For example, a business utilizes services worth $4,000 in April. However, the service was accounted as unpaid on the balance day (April 30). After this, the company gets an invoice for the service consumption on May 06 and clears the payment on May 26.

According to the accrual method of accounting, the transaction entry recorded in the month of April is given below:

| Date | Accrued Journal | Debit |

Credit |

| April 30 | Accrued Expense | $4,000 | |

| Service Payable | $4,000 |

Now, when the balance day comes, the expense is considered as a current liability (service payable), and an accrued expense (service expense) obtained by the company in April.

In the month of May (reporting period), the company must record its cash payment on May 26 related to its service bill. The entry will contain a counter account for the payable service from the previous month and a cash account.

| Date | Accrued Journal | Debit | Credit |

| May 26 | Service Payable | $4,000 | |

| Cash Amount | $4,000 |

Significance of Accrued Expense on the Financial Statements

#1 Balance Sheet:

- Accrued expense is recognized in the period of incurrence for which the invoice has not been received yet.

- When an accrual expense is recognized, it becomes an expense in the Income statement, is simultaneously unpaid, and gets recorded as a liability in the balance sheet.

- While recording an accrual expense, the expense ledger gets debited, and the accrued liability account gets credited, which appears in the balance sheet as the expense is for a limited time period and is classified as a current liability in the balance sheet.

- The components that the balance sheet reflects while finding the expenses are interest payable, salaries and wages payable, and other expenses.

#2 Income statement:

- They are recorded on the income statement as an accrued liability. These are important to include on the income statement because they represent a future obligation of the company.

- By including them on the income statement, investors and creditors can see the full extent of the company’s financial obligations.

- It can be either positive or negative. Positive expenses represent money the company owes but has not yet paid out (e.g., rent expense).

- Negative expenses represent money owed to the company but not yet received (e.g., interest income).

- If a company has significant expenses, it may be difficult to pay them off when they come due. This can put a strain on the company’s cash flow and may result in defaulting on other obligations (e.g., loan payments).

- Therefore, it is important for investors and creditors to monitor a company’s accrued expenses closely.

Accrued vs. Prepaid Expense

|

Accrued Expense |

Prepaid Expense |

| They are those that have been incurred but not yet paid for and treated as a liability. | Prepaid expenses are those incurred before receiving goods or services for a business. |

| In accounting, this is treated as an asset because it represents future benefits that have been paid for in advance. | Prepaid expenses are often paid for in cash but can also be paid for with credit. |

| When a company pays for an accrued liability with cash, it is recorded as a decrease in the expense liability account and an increase in the cash account. | When a company pays for a prepaid expense with cash, it is recorded as a decrease in the prepaid expense asset account and an increase in the cash account. |

| They are reported on the balance sheet as liabilities. | Prepaid expenses are reported on the balance sheet as assets. |

Difference Between Accrued Expense vs. Accounts Payable

|

Accrued Expense |

Accounts Payable |

| They are the expenses that a company has incurred, i.e., service is available, or goods are procured, but the supplier has not been paid. | While on the other hand, accounts payable are the debts of the company for trading goods or raw materials procured, but the payment is still due to its suppliers or creditors. |

| These are recorded by the accountant to understand the company’s liabilities better and will result in good decisions regarding available fund utilization. | Accounts payable is generally used for trading commodities. |

| Recorded in the balance sheet under the head current liabilities. | Recorded in the balance sheet under the head current liabilities. |

Advantages & Disadvantages

|

Advantages |

Disadvantages |

| It helps prepare and present true and fair financial statements. | That they can create a situation where a company appears to be more profitable than it actually is. This can lead to investors putting too much faith in the company, eventually leading to problems. |

| It helps correctly state the company’s profit in the absence of which income would have been overstated. | Accrued expenses can make it difficult to compare companies on a like-for-like basis. |

| It is recorded under the accrual basis of accounting. Therefore, the transactions are recorded immediately at the time of happening. This reduces the chances of mistakes or errors to almost zero. | It can make it hard to picture a company’s overall financial health accurately. Finally, it can also lead to cash flow problems. |

| Liabilities become more transparent and are easily accessible for the auditors and for other users of the financial statements. | This can strain a company’s cash reserves and make it difficult to meet other financial obligations. |

| Under this, all obligations of the company are clearly visible, along with the dates clearly indicating the date at which the liability will be due. | The company may have to pay for an expense that has already been incurred but hasn’t been paid for yet. |

| It helps the owners and other stakeholders better understand the business’s performance and financial position. | Some companies will include it in their financial reports, while others will not. |

Final Thoughts

Accrued expense can be simply considered as debts that have been built up over time. This can happen when suppliers give you credit, or you have unfinished work that needs to be invoiced. In either case, the money owed is an accrued expenditure.

While some businesses choose to pay their expenses as soon as possible, others wait until they receive payment from their customers. Either way, it’s important to keep track of your accrued liability to budget accordingly and avoid being caught off guard by a large bill.

Frequently Asked Questions (FAQs)

Q1. Is accrued expense an asset or liability?

Answer: An accrued expense is an expense that has been incurred but not yet paid. In accounting, it is typically treated as a liability. This is because the company has incurred a debt it will eventually have to pay. For example, if a company incurs $1,000 in expenses in January but does not pay the bill until February, the expense would be considered an accrued liability.

Q2. Are accrued expense income? Are they tax deductible?

Answer: Accrued expense are not income, and they are not tax-deductible. However, they may be used to offset income in certain circumstances. For example, if you have accrued expenditures that exceed your income for the year, you may be able to carry forward the excess to offset income in future years.

Q3. Is accrued expense a credit or debit?

Answer: The generally accepted accounting principle is that accrued expense should be recorded as debits. This is because when an expense is incurred, it represents a decrease in the company’s assets. However, some accountants argue that it should be recorded as credits. This is because when an expense is incurred, it represents an increase in the company’s liabilities. Ultimately, it is up to the accounting team to decide which method to use.

Q4. Why do we record accrued expense?

Answer: We record accrued expense to ensure that we accurately represent the company’s financial position. By recording these expenses, we are able to more accurately match revenues and expenses in the correct period. This provides a better picture of the company’s financial position and performance over time.

Q5. What type of accounts are accrued expenses?

Answer: An accrued expense is an accounting term for an expense that has been incurred but has not yet been paid. This can happen when goods or services have been received but have not yet been invoiced or when invoices have been received but have not yet been paid. Businesses need to set up an accrual journal to record these expenses properly. This is a special type of ledger where transactions are recorded as they occur rather than when they are paid. This allows businesses to track their expenses more accurately and can help them budget more effectively.

Q6. What are accrued income and accrued expense?

Answer: Income and expenses are typically accrued when earned or incurred. This means that revenue is recognized on the income statement when it is earned, regardless of when cash is received. Similarly, expenses are recognized on the income statement when they are incurred, regardless of when cash is paid out. There are a few key reasons why companies might choose to use the accrual basis of accounting rather than the cash basis.

Recommended Articles

This is a guide to Accrued Expense. Here we also discuss the definition and accrued expenses on the balance sheet, along with advantages and examples. You may also have a look at the following articles to learn more –