Updated July 27, 2023

Accrued Interest Formula (Table of Contents)

What is Accrued Interest Formula?

Accrued Interest is the Interest amount you earn on a debt. But it is the amount that is not yet collected or paid. These amounts come from:

- Income statement

- Balance Sheet

This gets gathered gradually from the data a loan is issued or bond coupon is made. Accrued Interest is noted as Revenue or Expense for a Bond selling or buying a loan respectively in Income Statements. Similarly, In Balance Sheet, The amount to be collected is noted as an asset and to be paid is noted as Liability. It is often called as Current Asset or Current Liability since it is expected to be paid or gathered within a year of time or 6 months. For the payment on bonds, this is called as ‘Coupon’ payments.

Formula to calculate Accrued Interest is given below:

When a seller sells a bond, the buyer of the bond will pay interest to the seller. Generally, most of the bonds follow semiannual interest payments. Generally, Accrued Interest follows Day Count Fraction. That is the number of Days considered in a month divided by Number of days in a year considered. Total days, most of the bonds consider is 30 days for a month, 360 days for a year. Hence DCF will be 30/360 in this case. But some bonds follow an actual number of days too. That is 365 days for a year. So it is necessary to know the days for a particular bond and the payments are semiannual or annual. Two Accounts are adjusted in two separate Financial Statements.

- Interest Expense Account

- Accrued Interest account

For Example, if Accrued Interest Account has Rs.1000 already, and it is to be received Rs.1000 again from Payable Account, the end amount in Accrued Interest Account will be Rs.2000.

Examples of Accrued Interest Formula (With Excel Template)

Let’s take an example to understand the calculation of the Accrued Interest in a better manner.

Accrued Interest Formula – Example #1

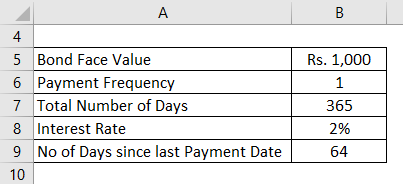

A bond is sold at a book value of Rs.1000 with annual Payment rate. The Interest is set as 2%. The Accrued period starts from Jan 1st to Dec 31st. The Bond is bought on March 5th. Here the actual number of days is considered. Calculate the accrued Interest that is yet to be received.

Solution:

Most recent payment should be on Jan 1st. so No of days from most recent payment is 31 days for Jan, 28 days for Feb, 5 days in March = 31+28+5 = 64.

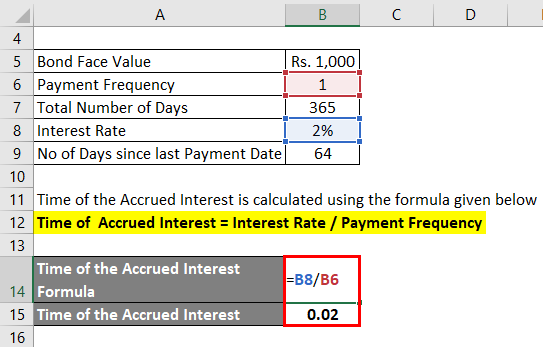

Time of the Accrued Interest is calculated using the formula given below

Time of Accrued Interest = Interest Rate / Payment Frequency

- Time of the Accrued Interest = 2% / 1

- Time of the Accrued Interest = 0.02

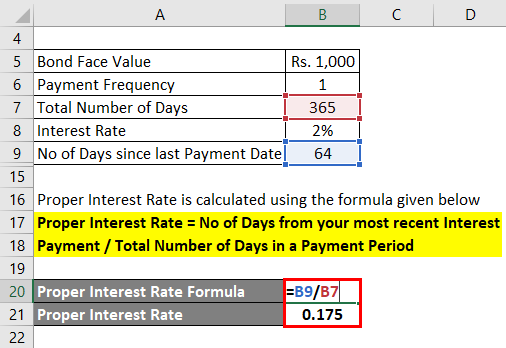

Proper Interest Rate is calculated using the formula given below

Proper Interest Rate = No of Days from your most recent Interest Payment / Total Number of Days in a Payment Period

- Proper Interest Rate = 64 / 365

- Proper Interest Rate = 0.175

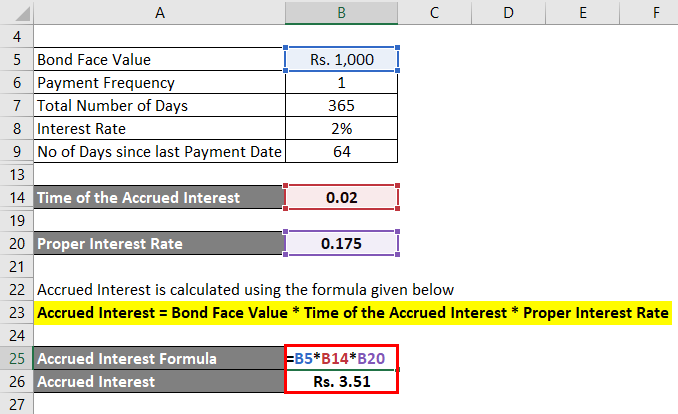

Accrued Interest is calculated using the formula given below

Accrued Interest = Bond Face Value * Time of the Accrued Interest * Proper Interest Rate

- Accrued Interest = 1000 * 0.02 * 0.175

- Accrued Interest = Rs. 3.51

Rs.3.51 is the accrued interest in the selected frame. Since Par value is very less, the interest accumulated too is very less.

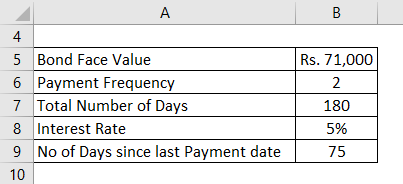

Accrued Interest Formula – Example #2

A bond is bought at the book value of Rs.71000. The interest rate is 5%. It is payable Semi-annually on February 1st and August 1st. Bond is bought on April 15th. Calculate the Accrued Interest that it is to be paid.

Solution:

Total no of days in payment = since nothing is specified it is 180 days.

No of days since last payment = 30+30+15 = 75

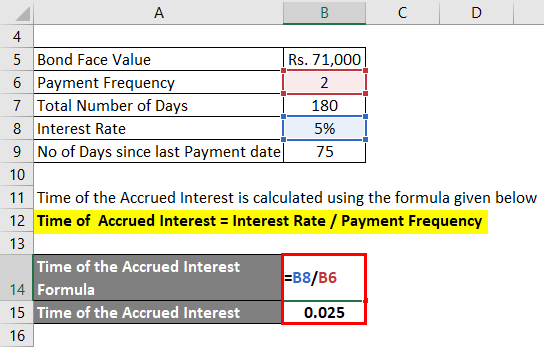

Time of the Accrued Interest is calculated using the formula given below

Time of Accrued Interest = Interest Rate / Payment Frequency

- Time of the Accrued Interest = 5% / 2

- Time of the Accrued Interest = 0.025

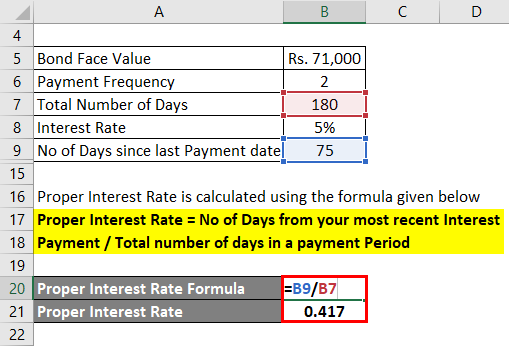

Proper Interest Rate is calculated using the formula given below

Proper Interest Rate = No of Days from your most recent Interest Payment / Total Number of Days in a Payment Period

- Proper Interest Rate = 75 / 180

- Proper Interest Rate = 0.417

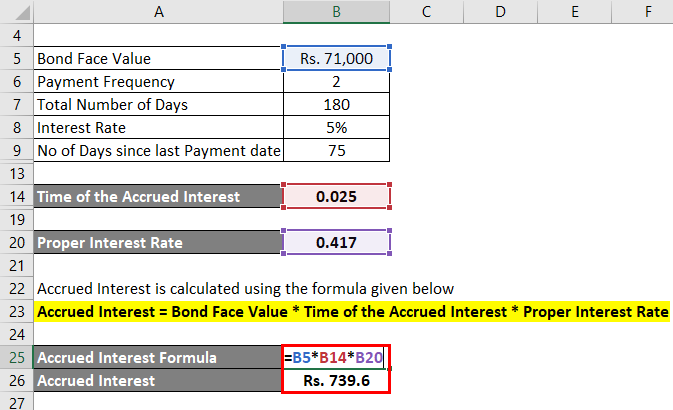

Accrued Interest is calculated using the formula given below

Accrued Interest = Bond Face Value * Time of the Accrued Interest * Proper Interest Rate

- Accrued Interest = 71000 * 0.025 * 0.417

- Accrued Interest = Rs. 739.6

Explanation

Here is the step by step approach for the calculation of Accrued Interest.

Step 1: Bond Face or PAR Value

This is the Initial Book value of a bond when it was bought or sold. This should be noted.

Step 2: Time of the Accrued Interest

This is the amount what you get by dividing the Annual Interest rate by a frequency of the payment.

Time of the Accrued Interest = Annual Interest Rate / Payment Frequency

Step 3: Proper Interest Rate

This is based on the no of days since the most recent interest payment date and the Total number of days in a payment Period. If it is semi-annual, a Total number of days in a payment period is 180 days. If it is an annual payment method, it is 360 days. As it is said earlier, for most of the bond, the total number of days is considered as 30 days for a month and 360 days for a year.

Proper Interest Rate = No of Days from your most recent Interest Payment / Total number of days in a payment Period.

Step 4: After getting all the necessary values of the variables, it is applied in the below formula to calculate the Accrued Interest.

Accrued Interest = Bond Face Value * Time of the Accrued Interest * Proper Interest Rate

Relevance and Uses of Accrued Interest Formula

The use of Accrued interest is based on Accrual Accounting. It is neither received nor paid. It is just being realized in the account statements when they occur not at the time of only receiving the payment. It keeps getting added in the Par value as an interest to the bondholder. It is being recorded in Income Statements and Balance sheets before even they received or paid. This is exactly an income like pension, leaves that are not paid immediately but once in a year.

Accrued Interest Formula Calculator

You can use the following Accrued Interest Calculator

| Bond Face Value | |

| Time of the Accrued Interest | |

| Proper Interest Rate | |

| Accrued Interest Formula | |

| Accrued Interest Formula = | Bond Face Value x Time of the Accrued Interest x Proper Interest Rate |

| = | 0 x 0 x 0 = 0 |

Recommended Articles

This is a guide to Accrued Interest Formula. Here we discuss How to Calculate Accrued Interest along with practical examples. We also provide an Accrued Interest Calculator with downloadable excel template. You may also look at the following articles to learn more –