Updated July 15, 2023

Definition of Accrued Liabilities

Accrued liabilities are expenses incurred by the business but not yet paid. Accrued expense is a part of the accrual system of accounting, which states that an expense is recorded when it is incurred, and revenue is recorded when it is earned.

This accounting system generates more accurate results as the expenses are matched with related revenues and are reported when the expense occurs, not when cash is paid.

Explanation

Accrued liabilities are the actual liabilities, the benefit against which is received by the business, but they are not yet paid. For example, services of the employees have been received, but their salary is yet to be paid, or goods have been received, but payment is yet to be made. Here, the price has to be made in a future period. If we don’t record such expenses in our books, it will not reflect an accurate financial picture of the company’s business. Accrual liabilities only occur when the business follows the Accrual accounting system.

An Accrual accounting system is a system in which all the expenses of a particular period are recorded in the same period in which they are incurred, irrespective of whether they are paid or not. Accrued liabilities are not accounted for when the business follows the cash basis of accounting. Under the Cash basis of accounting, only those expenses accounted for are paid during that period. A company’s balance sheet shows accrued liabilities under the current liabilities head.

How Does an Accrued Liability Work?

Accrued liabilities are recorded in the books of accounts at the end of the accounting period, and they are reversed in the period when they are paid. It is like a temporary account created in the books of accounts.

Accounting entry for accrued liability

Expense A/c – Debit (Recording the actual expense)

Accrual Liability A/c – Credit (expense not paid hence liability created)

Accounting entry when paying accrued liability

Accrual Liability A/c – Debit (Reducing the liability settled)

Cash A/c – Credit (Liability settled by paying cash)

The Accrued liabilities balance in the balance sheet will be reduced after payment.

Example of Accrued Liabilities

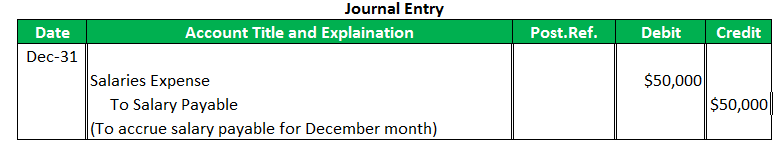

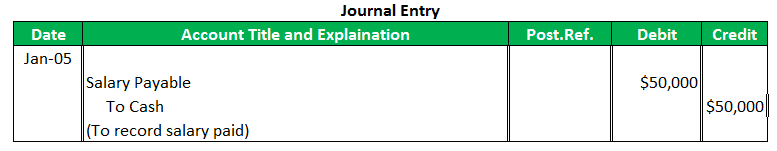

Suppose Company ABC Ltd. closes its books of accounts on the 31st of December every year. The company makes salary payments to all its employees on the 5th of next month. So, the salary for December month will be paid on the 5th of January of the next fiscal year, i.e., 2020. December month’s salary to be paid is $50,000.

In this case, the liability to pay the employees has been incurred, but the payment is not yet done. Hence, salary expenses will be recorded, and an opposite accrued liability for the same will be created in the books of accounts, and the same will be reversed next month.

Types of Accrued Liabilities

There are two types:

- Recurring accrued liabilities: These are the ones that occur in the ordinary course of business. For example, wages for the current month are paid on the 10th of next month.

- Non-recurring accrued liabilities: These are not regular accrued liabilities and do not occur in the ordinary course of business. For example, heavy machinery was purchased, but payment was not yet made.

Accrued Liabilities vs Accounts Payable

- The primary difference between accrued liabilities and accounts payable is that the accounts payable are billed to the company, but accrued liability is not yet billed.

- Another difference is that the accounts payable are a liability that will be paid soon. On the other hand, accrued liability is generally accrued and paid over some time.

- Accounts payable are recorded for any expense billed like supplier invoice, vendor payment, etc. At the same time, accrued liabilities are recorded at the end of the fiscal year.

- For example, a company purchases machinery from a supplier on the 30th of December 2019, the shipment of which will arrive in the next 15 days. If the company receives the invoice on or before the end of the accounting year, it will be booked as accounts payable. If the invoice is not received, it will be booked as an accrued liability.

Advantages

Following are the advantages of recording accrued liabilities:

- Following the accrual accounting system, it gives an accurate and fair picture of the company’s financial position. All the revenues of the current period and the expenses incurred to earn those revenues are recorded in the same accounting period. It will reflect the actual profit/loss of the company.

- The Accrual accounting system is a preferred accounting system by the Financial Accounting Standard Board (FASB).

- Financial statements prepared using the accrual accounting system are comparable to the cash accounting system.

Disadvantages

Following are the disadvantages of recording accrued liabilities:

- It is a complex accounting system and requires competent personnel who can track and report transactions promptly.

- It does not provide an accurate picture in terms of sales and cash. The company’s sales may be much higher than its actual cash position.

- It does not benefit small businesses where most transactions are done on a cash basis.

Conclusion

Accrued liabilities or accrued expenses are expenses incurred by the business in one period, but the payment will be made in another period. This way of recording the expenses gives us an accurate picture of accounting.

Recommended Articles

This is a guide to Accrued Liabilities. Here we also discuss the definition and how accrued liabilities work along with advantages and disadvantages. You may also have a look at the following articles to learn more –