Updated July 21, 2023

Definition of Activity Ratio

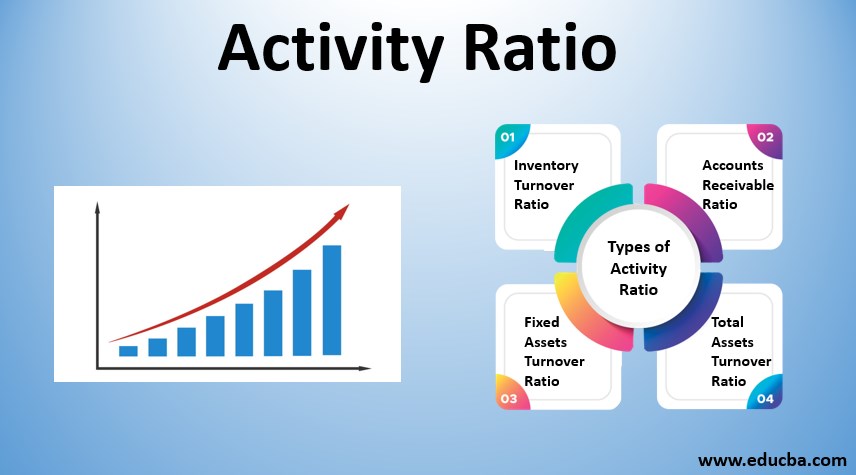

Activity Ratio also called a turnover ratio explains the level of effectiveness and efficiency with which the business is using its assets in order to generate sales, revenue, and cash. It is a measure to understand the stability and utilization capacity of the business of using the company assets, whether fixed or current.

Activity Ratio Formula,

Types of Activity Ratio

Let us discuss the Types of Activity Ratios:

- Inventory Turnover Ratio

- Accounts Receivable Ratio

- Fixed Assets Turnover Ratio

- Total Assets Turnover Ratio

Example of Activity Ratio (With Excel Template)

Let’s take an example to understand the calculation of the Activity Ratio in a better manner.

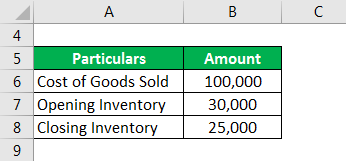

Example #1 – Inventory Turnover Ratio

This ratio gives information about how quickly or how much time it takes for the conversion of inventory into sales and thus ultimately in cash. The formula to compute inventory turnover ratio is the cost of goods sold divided by the average inventory for a specified period, usually a year.

Solution:

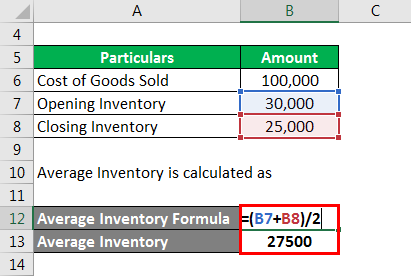

Average Inventory is calculated as

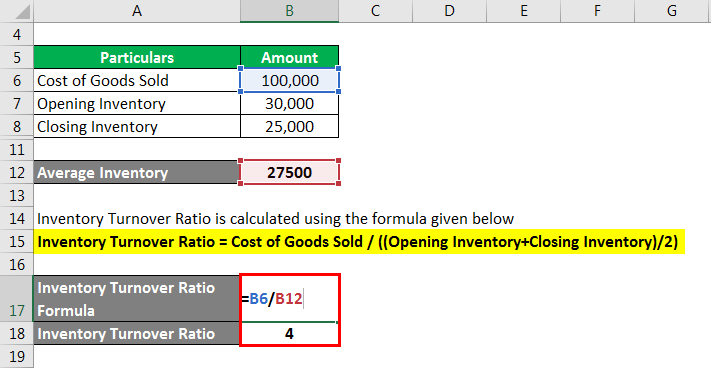

Inventory Turnover Ratio is calculated using the formula given below

Inventory Turnover Ratio = Cost of Goods Sold / ((Opening Inventory+Closing Inventory)/2)

- Inventory Turnover Ratio = 1,00,000/27,500

- Inventory Turnover Ratio = 4

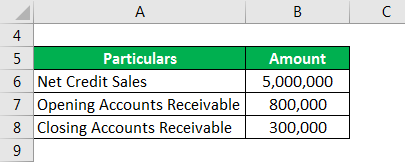

Example #2 – Accounts Receivable Ratio

Also referred to as the average collection period or debtor turnover ratio measures the company’s turnaround time for conversion of debtors into cash. In other words, this ratio gives information on time taken for the company to receive payments from its customers or clients towards sales made by the company.

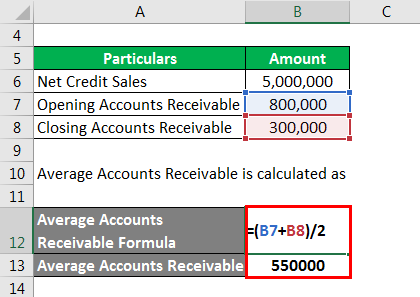

Solution:

Average Accounts Receivable is calculated as

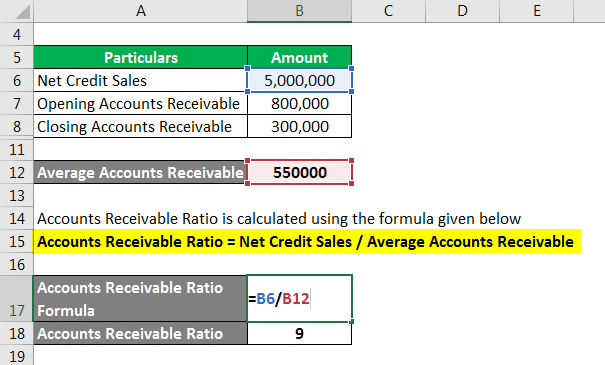

Accounts Receivable Ratio is calculated using the formula given below

Accounts Receivable Ratio = Net Credit Sales / Average Accounts Receivable

- Accounts Receivable Ratio = 5,00,000 / 5,50,000

- Accounts Receivable Ratio = 9

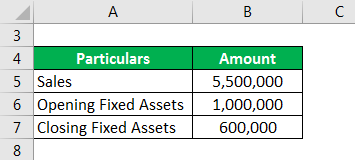

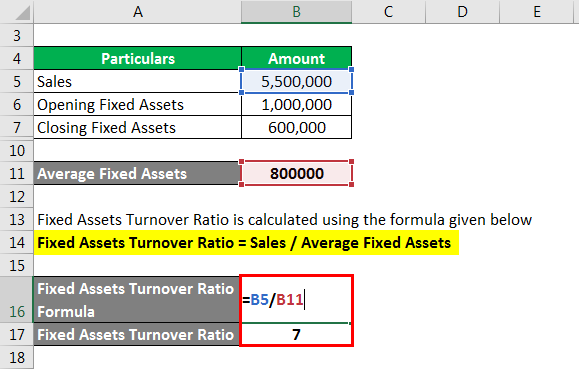

Example #3 – Fixed Assets Turnover Ratio

This ratio measures the company’s efficiency or turnaround time by utilizing its fixed assets in order to generate revenue and income. It is calculated as below:

Solution:

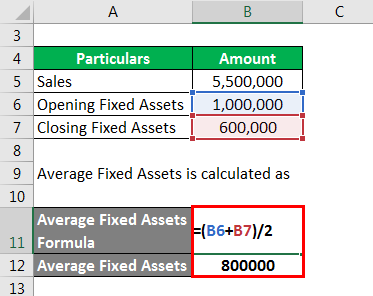

Average Fixed Assets is calculated as

Fixed Assets Turnover Ratio is calculated using the formula given below

Fixed Assets Turnover Ratio = Sales / Average Fixed Assets

- Fixed Assets Turnover Ratio = 5,500,000 / 8,00,000

- Fixed Assets Turnover Ratio = 7

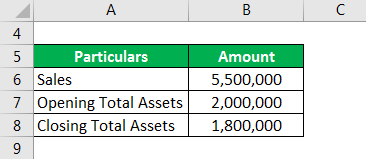

Example #4 – Total Assets Turnover Ratio

Unlike the Fixed Asset turnover ratio, which measures the efficiency only from a fixed asset utilization perspective, the Asset Turnover Ratio measures the company’s efficiency in utilizing its Total assets to generate revenue. It is calculated as below:

Solution:

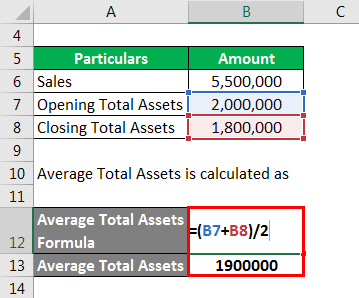

Average Total Assets is calculated as

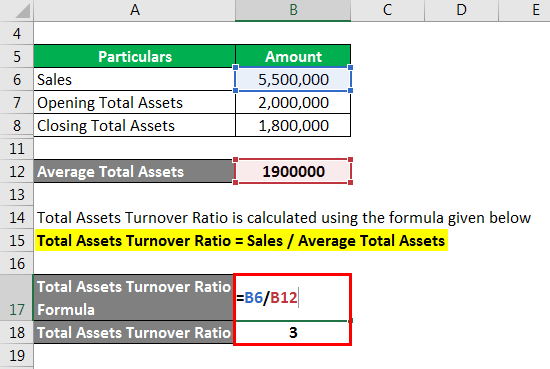

Total Assets Turnover Ratio is calculated using the formula given below

Total Assets Turnover Ratio = Sales / Average Total Assets

- Total Assets Turnover Ratio = 5,500,000 / 19,00,000

- Total Assets Turnover Ratio = 3

Explanation

The activity ratio is a ratio that is used to measure the amount of generation of sales and cash by how efficiently the company is using its assets and also managing its liabilities.

Explaining the above in financial language, it means dividing the income statement information taken as numerator and balance sheet information as the denominator. It basically combines information from both aspects of the financial statement and gives a holistic picture of the company’s performance.

Let us understand the main concept behind the formula. The essence of the activity ratio lies in the fact that it is a ratio used for comparing actual results with the average expected data.

Importance of Activity Ratio

- Activity Ratio is important from the point of view of determining the level of efficiency of a business in utilizing its assets and simultaneously managing its liabilities.

- Furthermore, this ratio also helps the management and stakeholders in making decisions by analyzing the various businesses being run by the company. The analysis assists them in arriving at a conclusion as to which business is able to generate high sales viz a viz business wherein a very low asset utilization is being made.

- Most commonly, the activity ratio is used to understand what the company has invested and what the company is reaping out of it.

Activity Ratios Vs Profitability Ratio

Though both the ratios, Activity ratio and Profitability ratio, are very important for carrying out a fundamental analysis of the company, it needs to be pointed that there are few points that distinguish these two ratios from each other. The below table gives you a fair idea of what are the core areas of difference in activity ratio and profitability ratio.

| Activity Ratio | Profitability Ratio |

| Measure of efficiency of the company for the turn over of the asset in sales or cash | Measure of the company’s ability to generate profits (by increasing sales of reducing cost) |

| Important for reviewing the company from a short term perspective | Important from long term point of view to assess company growth |

| Uses information from income statement as well as balance sheet | Mostly information available in the income statement is enough to compute profitability ratio |

| More focused towards availability of cash | More focused towards availability of profits |

| Assesses liquidity of the company | Assesses stability of the company |

| Examples: Current ratio, Quick ratio, asset turnover ratio, inventory ratio, account receivables turnover, etc | Examples: Gross profit margin, net profit margin, Operating profit margin |

Benefits of Activity Ratio

There are various benefits derived from the use of activity ration. Major benefits are listed below:

- Helps in decoding the financial position of the company

- Simplifies the accounting numbers of the company

- Acts as a measure for assessing operating efficiency

- Gives a fair idea of the business and useful while forecasting and budgeting activity

- Acts as a comparable and helps in tracking the performance of the company and its business

- Highlights the strong assets or areas of the business

- Highlights any weak spot of the business

- Useful in carrying out an analysis of the financial statement of any company

- Vital for stakeholders, as it briefly gives an idea of the working of the business and its future prospects

Conclusion

- A ratio is basically expressing one number in terms of another number, in our case, it means expressing one function of the business in monetary terms with respect to another function of the business. It shows the coordination and relationship between two aspects of a business in terms of each other.

- In the same way, activity ratio, in totally simple language, is a tool to gauge the efficiency of the business in converting its assets into sales or cash. In other words, the activity ratio can also be referred to as an efficiency ratio. The number derived as the answer to activity ratio denotes the company capable of turning around its assets (fixed or current) into the pure sale and generating cash out of it.

- Majorly used by outsiders or stakeholders to analyze the company’s fundamental strength, the activity ratio is also equally used by the management to track the business done by the company and accordingly assist in preparing a forecast for the future.

Recommended Articles

This is a guide to the Activity Ratio. Here we discuss how to calculate Activity Ratio along with practical examples. We also provide a downloadable excel template. You may also look at the following articles to learn more –