Definition of Actuarial Science

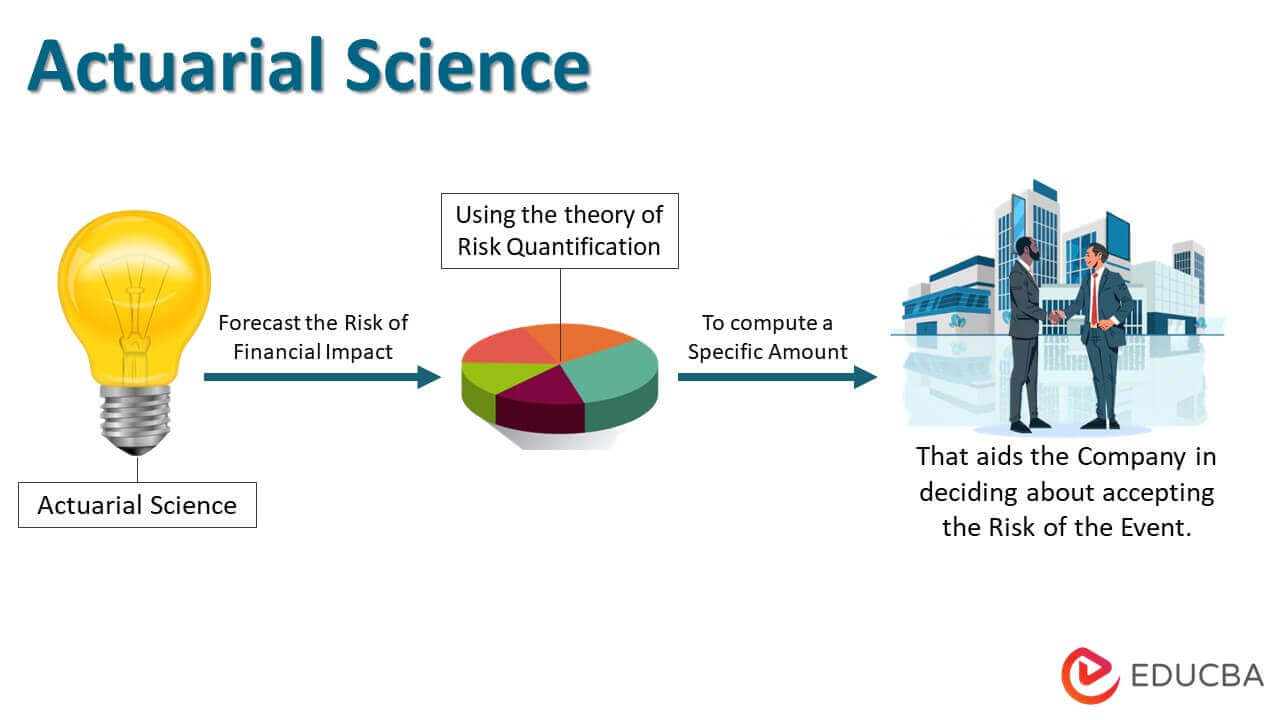

Actuarial science is based on the prediction or forecast of the reasonableness of the occurrence of an event & quantification of the risk of financial impact (i.e., the outflow of cash resources) of such prediction by using the probability theory of risk quantification so that a specific/scientific amount can be computed & which helps the company to take decisions for acceptance of the risk of the event.

Explanation

- Actuarial science is nothing but a science of probability theory. Probability means the chance of occurrence of the event in the future (near or far future).

- Actuarial science makes predictions of the event occurring in the future. The insurance computes the premium amounts based on such forecast. Such prediction helps insurance companies stay prepared for the likelihood of paying the claim amount in the future.

- The primary job of actuarial science is to quantify the risk in a probable event. Actuarial science can do the job due to its connection with probability theory, economics, the financial world, mathematical background& computer science.

- In recent decades, the world has observed various natural calamities & the risk of occurrence of such calamities. Thus, there is an increase in insurance coverage policies.

- With the up-gradation of the speed of computers & the use of modern financial theory, we have observed various scientific changes around the globe.

What’s an Actuary Doing?

- Every professional has some responsibilities towards their work & knowledge. Let us discuss the duties bestowed upon the actuary through actuarial science.

- An actuary is dependent on the historical information available as of date. Using historical data, he scientifically applies probability theory concepts to predict the company’s financial impact.

- Using the prediction, he identifies the trend of data & then provides the estimated percentage to be used for computing the final amount. The clients use such reports to set aside sufficient resources in case of probable events.

- What if there is no historical data or information available for an event? What if the historical information available is not relevant to the circumstance of the case? Here, the actuary uses the risk involved in the future regarding the said circumstance. Then the quantifies the impact based on the best estimation judgment.

- Actuaries utilize actuarial science to estimate various factors, including economic trends, policy risk, death rates, growth prospects of events, and the likelihood of an increase in global warming.

Example of Actuarial Science

You sustained severe back pain while performing your duties as a multi-chained grocery mart employee. Fortunately, after confirmation from the doctor, the Grocery Mart employee accident policy will provide compensation for one month of gross pay and medical expenses. This situation involves the application of actuarial science. How can the company quickly pay you for the unfortunate event? Well, the company has already predicted such a situation before the act. The company has already set aside sufficient resources to manage such events. In short, the company had already prepared for such an event, even if it would be expensive. This was possible only with the prediction expertise of actuarial science. If this scenario makes you want to know how the actuary did it, your aspirations are correct for actuarial science.

Requirements for Actuarial Studies

To study actuarial science, one should possess a few requirements. It depends on the university to the university.

- To attain a bachelor’s degree in actuarial science, the following are the requirements:

- Financial certification from a recognized institution

- Letter of recommendation from the relevant authority or school

- The individual should have minimum test scores in English language as “International English Language Testing (IELTS)” 6.0 or “Test of English as a Foreign Language (TOEFL)” of 80

- Records evidencing high-school transcripts

- To attain a master’s degree in actuarial science, the following are the requirements:

- The GPA should be a minimum of 3.0

- The individual should have a minimum test score in English languages as “International English Language Testing (IELTS)” 6.5 or “Test of English as a Foreign Language (TOEFL)” 80.

- GRE test scores should be appropriate

- Bachelor’s degree is essential in the field of statistics or mathematics or a type of related field.

Is It Worth an Actuarial Science Degree?

- Studying actuarial science will help a person achieve the degree of “actuary.” This study will help a person boast his dream of becoming an actuary. However, one can still pass the actuarial exams by studying related fields such as mathematics, statistics, or finance-related.

- Actuarial science is a global standard when it comes to prediction or probabilities. The study mechanics are built so that the person becomes comfortable with predictions in routine life. The reason is that the individual undergoes intention training during the entire process.

- Only due to such devotion to training & rigorous study, the actuaries around handsome bucks or even higher bucks around the globe. The market is always demanding such people.

- The insurance sector primarily utilizes actuarial science, but numerous untapped avenues for prediction worldwide remain undiscovered by anyone.

- Completing the course from “The Society of Actuaries (SOA)” or “Casualty Actuarial Society (CAS)” is suggested for attaining international recognition.

Benefits of Actuarial Science

- The 6-figure salary makes the actuary career very demanding for people who love advanced math. The starting package is around $ 50000. The median wage is estimated at $ 101000.

- Another benefit is that this career is rapidly growing & there is always a demand for the job. The primary reason is the insurance sector. The backend for the insurance sector is a growing population & complications in the world of human health.

- The work-life is balanced along with the best pay in the globe.

- The start of salary is itself high & thus there is a direct jump from no earning too high earning.

- Actuarial science helps deal with real-life issues in any industry.

- Also, actuaries are involved in high-end business decision-making.

- With the help of actuaries, the company can decide upon identifying future risks in the exposed areas.

- Actuarial science is also helpful in determining the provision for retirement benefits payable to employees. Thus, they are also involved in the preparation of the financial statements of the company.

- Risk analysis is the primary bread & butter for actuaries. Today many companies need assistance identifying various risks directly or indirectly related to businesses.

- Actuaries can provide customized solutions based on each situation for any company.

Conclusion

By this time, you may have understood the main study area of actuarial science. The main job of actuaries is to analyze the risks involved in an event & to suggest the likelihood or occurrence of the risk in the future. The client will be prepared beforehand to handle the actual situation. Due to higher global demand, many universities now offer various actuarial science courses. Due to such high-end studies, actuaries have a hold over finance, economics & mathematics (this combination is not easy to achieve). Even if there are many benefits to actuarial sciences, one must accept that the curriculum requires utter devotion & honesty.

Recommended Articles

This is a guide to Actuarial Science. Here we also discuss the definition and requirements for actuarial studies, benefits, and examples. You may also have a look at the following articles to learn more –