Updated July 25, 2023

Definition of Adjusted EBITDA

EBITDA and Adjusted EBITDA both are certain metrics used under business valuation concepts. Adjusted EBITDA in a sense, arriving at the actual earnings of the business based on the normal transactions and events of the business.

The method of business valuation usually avoids the transactions or events, which usually inflates the value of the business only on certain stages but not on a regular or continuous basis.

Example: Mr A is doing business on his own premises but considering higher expenses like rent for the premises to avoid the higher taxes to be paid in the future. In such situations, consideration of higher rents is removed to identify the adjusted EBITDA to arrive at the normal business value.

Difference Between EBITDA Versus Adjusted EBITDA

Both are merely the same, but the latter term gives much more importance than earlier during the time of business valuation. The main difference between EBITDA versus Adjusted EBITDA is the removal of non-recurring or Non-Operative, or unusual transactions and events from the computed Earnings before interest, tax, depreciation, and amortization. The financial analyst will take an important process during certain corporate decisions such as mergers or takeovers, valued by the Investment analyst or the investment bankers to arrive at the actual value of a business based on their regular transactions and events.

Usage of Adjusted EBITDA

Generally Adjusted EBITDA required to be identified during Amalgamation /Demerger, Mergers, Acquisition/Take Over, Raising Capital through private banks, Venture Capitals, Raising funds apart from capitals. This valuation method is necessary to arrive at the proper business value, which will avoid non-recurring, one-time, and unruly or bogus transactions to odd out the unfair elements in the valuation.

For Example, Effects for certain Non- recurring, irregular or unusual items to be given for adjusted (Earnings before interest, tax, depreciation, and amortization), few examples are as below,

- Staff Bonus/salary paid (In case of Non-recurring)

- Provision for rent on own premises

- Provision for salary on relatives

- Web Portal/Software development on phase-wise

- Loss/Gain in the Sale of Assets

- Impairment of Immovable assets

- Legal/Litigation expenses for the Business (Not regular expenses)

- Expenses paid or recorded more than the actual

- Keyman Insurance Policy paid

- Non-Competition fee paid

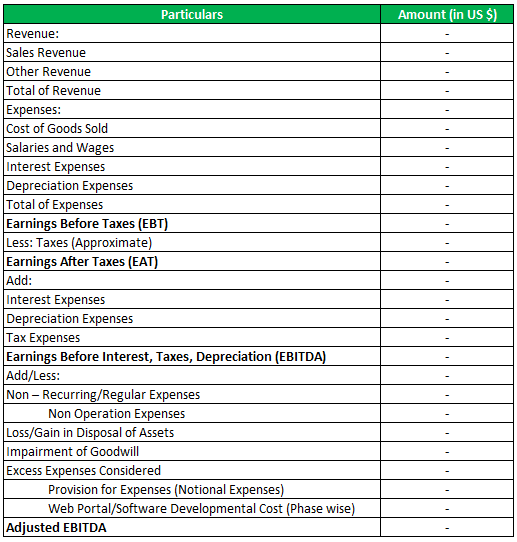

Format

Format of Adjusted EBITDA are given below:

Example of Adjusted EBITDA (With Excel Template)

Let’s take an example to understand the calculation in a better manner.

Example #1

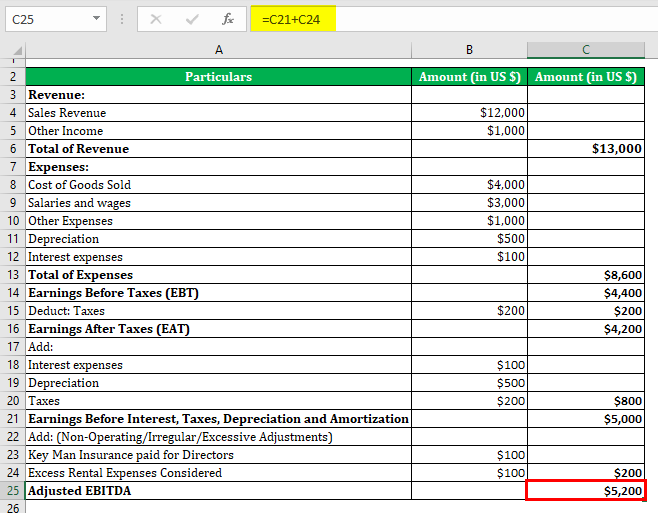

ABC LLC plans to acquire XYZ LLC; during the process of acquisition XYZ LLC provided their list of transactions that happened for the year ending December 2018 as below,

- Sales Revenue for the year – US $ 12000

- Other Income for the year – US $ 1000

- Salaries and wages for the year – US $ 3000

- Depreciation for the year – US $ 500

- Taxes for the year (Approx.) – US $ 200

- Cost of goods sold for the year – the US $ 4000

- Interest paid for the year – US $ 100

- Other Expenses – US $ 1000

Additional Info

The ABC LLC recorded excess rental expenses (beyond limits) of US $ 100 and paid Keyman Insurance for the Directors of the business concern of US $ 100 under the other expenses category.

You are required to find out the Adjusted (EBITDA) Earnings before Interest, taxes, depreciation, and amortization for the valuation of business XYZ LLC. Consider the above format for the preparation of Adjusted EBITDA.

Solution:

Advantages and Disadvantages of Adjusted EBITDA

Advantages and Disadvantage are given below:

Advantage

- A business valuation will be based on regular and actual transactions.

- An inflated valuation will be avoided with the help of adjusted EBITDA

- Business future earnings can be predictable with adjusted EBITDA

- It can be used as a better valuation tool by skilled business analyst at the time of merger and acquisition.

Disadvantage

- Identification of non-operation or non-recurring expenses during the adjusted (Earnings before interest, tax, depreciation, and amortization) process required the best skills and knowledge of the business.

- It will be varied based on the business nature and transactions.

- It’s not recognized by the GAAP (Generally Accepted Accounting Principles)

- Manipulated data for the valuation purpose cannot provide the proper value or the future estimations of the business

Conclusion

In the end, Adjusted EBITDA is one such valuation tool used by the business analyst to evaluate the business with those normal transactions and events which will avoid the unique, non-operational, irregular, overstate transactions for accurate results for the future representations. It is not prepared or regularised through GAAP but prepared with the base of the business nature and skills of the business analyst.

Recommended Articles

This is a guide to Adjusted EBITDA. Here we discuss the Advantages and Disadvantages and how to calculate along with practical examples. We also provide a downloadable excel template. You may also look at the following articles to learn more –