Updated July 6, 2023

What are Administrative Expenses?

Administrative expenses are not contributing directly to revenue, such as wages, utility bills, etc., that businesses pay to run their day-to-day operations. For example, in the financial year 2022, Company ABC spent $5,000 on wages, $400 on utility bills, and $30 on office supplies. Therefore, their overall administrative expenses sum up to $5,430.

Administrative costs are an essential component of business operations. Regardless of its sales volume, it will always be present in the company. Businesses in various locations typically incur the exact administrative costs. It includes employee pay, rent, travel expenses for work, electricity and water bills, and more.

Key Highlights

- Administrative expenses are a company’s costs to maintain its day-to-day operations.

- These can include the cost of office space, utilities, insurance, and other similar items.

- The best way to lower the unavoidable costs is by outsourcing as much as possible – from payroll to accounting to IT services like data backup and disaster recovery.

- These expenses are of two categories: overhead and miscellaneous.

- Unlike selling expenses, it is not part of a company’s manufacturing, advertising, and marketing sectors.

How do Administrative Expenses Work?

Administrative expenses represent the status of a company as an indicator of how well the business is running. A company can derive its administrative expenses by summing up all the day-to-day expenses, i.e., rent, salary, utility bills, etc., throughout the year. However, it should keep these expenses low to increase its profit margin.

The business presents it in the consolidated income statement, grouping it with other operating and overhead costs. Moreover, companies cannot deduct these costs from the tax return.

List of Administrative Expenses

Employee Salary:

- It is the overall salaries the company pays its employees

- It does not include the incentives given to the sales and marketing officers.

Expenses for Correspondence:

- It includes the carbon expense of mailing and faxing.

- The company spends this amount on data exchange and gathering information.

Office Supplies:

- It is the cost of stationery like pens, paperclips, staplers, markers, etc.

- They help in keeping hard-copy records.

Business Travel Costs:

- These refer to travel expenses due to business requirements.

- If an employee has to travel a long distance for a field survey or any other purpose, his travel expenses count as administrative costs.

Utility Bills:

- It includes the bills for electricity, water, internet, etc.

- They remain the same throughout the year irrespective of the sales and profit.

Accounting Services:

- These are the expenses of income tax consultancy and financial reports.

- The company has to pay the consultant or the professional for assistance.

Human Resources:

- It consists of recruitment, orientation, and training costs.

- Accommodating a new employee in the office has a fixed procedure that includes monetary and carbon expenses.

Legal Counsel Fees:

- It is generally the cost of legal consultations for contract building, legal cases, etc.

- It also includes prosecution fees as per necessity.

Real-World Examples

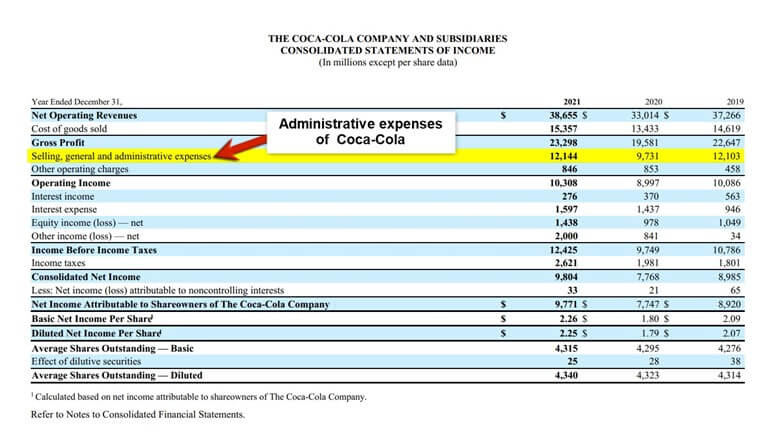

#1. Coca-Cola

The 2021 annual report shows Coca-Cola’s administrative, sales, and general expenses to be $12,144 million; in 2020, the expenditures amounted to $9,731 million. This rise results from an overall increase in annual incentives, charity, advertising campaigns, and stock-based compensation.

(Image source: Coca-Cola Annual Report 2021)

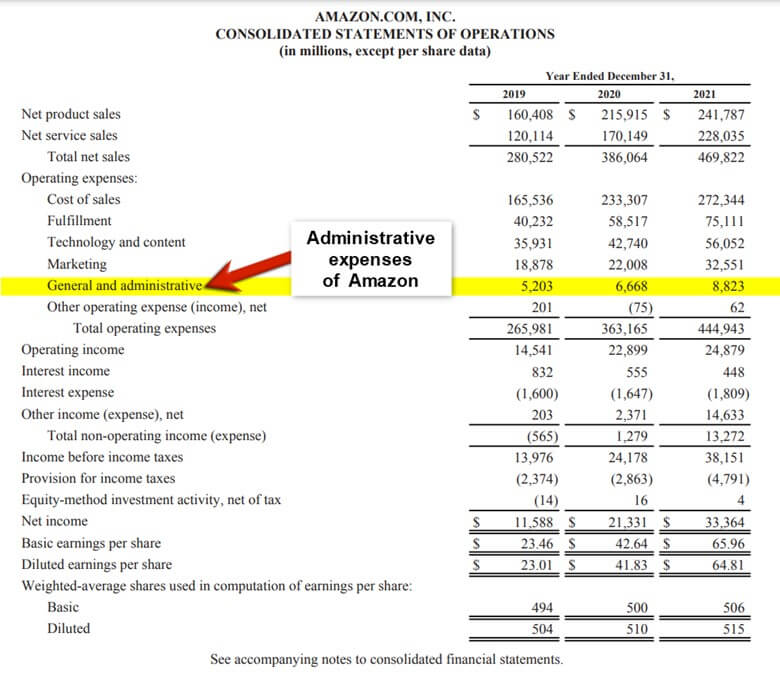

#2. Amazon

In 2021, Amazon faced a rise in its general and administrative expenses by more than $2,000 million from 2020. It happened due to the increase in payroll expenses and professional fees. According to the annual reports, the amounts are $8,823 million and $6,668 million, respectively.

(Image source: Amazon Annual Report 2021)

Examples

#1. Office Supplies

Suppose an entrepreneur spends $2,000 monthly on office supplies (including pens, paperclips, and printer ink) to run her business. The administrative expense to keep the business running daily doesn’t result in a finished product.

#2. Rent

Mike has opened his restaurant in a rented building. He has to pay a fixed monthly rent to the owner of the building, irrespective of the amount and profit of his sales.

#3. Legal Fees and Wages

If a company is sued or has a contract dispute, the owner must pay for lawyers to represent her in court. That is an administrative expense because it does not help increase sales and profit but saves the company from legal actions against it.

#4. Salaries and Business Travels

The salaries for employees in the administrative department fall under administrative costs. If someone in the finance department needs to travel for tax-related paperwork, that is also an administrative expense because it does not directly bring in more money.

Administrative Vs. Selling Expenses

| Administrative Expenses |

Selling Expenses |

| Administrative expenses are the costs of running a company. | Selling expenses are all the costs associated with sales or services to customers. |

| These include the cost of electricity and utility bills, rent, insurance premiums, and salaries of non-production employees. | These include the cost of increasing customers (via marketing), selling products to them (via salespersons), and shipping costs. |

| They are a necessary evil in any business because they keep things running smoothly. | They can be good for business if there is demand. |

| Companies should minimize these costs as they do not generate revenue. | Firms should maximize them because they generate revenue. |

Frequently Asked Questions (FAQs)

Q.1. What are administrative expenses?

Answer: Administrative expenses are those incurred during management, organization, and administrative tasks rather than during regular business operations. These expenses include rent, utility bills, legal costs, etc.

Q.2. Is salary a part of administrative costs?

Answer: Employee salaries, apart from the ones in the manufacturing, sales, and marketing department, are administrative costs—for example, wages of the management department, the canteen staff, etc.

Q.3. What are the types of administrative expenses?

Answer: Administrative expenses can be fixed or variable. The fixed costs do not change with the changes in production volume, including rent, water bills, electricity bills, etc. On the other hand, variable expenses vary according to the changes in production volume, like sales commissions, shipping expenses, office supplies, etc.

Q.4. Is administrative expense a direct expense?

Answer: Administrative expenses are indirect because they do not affect a company’s production and sales.

Q.5. What are non-administrative expenses?

Answer: Any business expense that does not affect production and profit falls under non-administrative expenses. For example, marketing expenses, production costs, the salary of the employees in the manufacturing unit, etc.

Q.6. How to calculate the administrative expense rate?

Answer: If we divide the administrative expenses of a company by its total sales, we get the administrative expense rate. The formula is,

Administrative Expense Rate = Administrative Expenses / Total Sales.

Recommended Articles

This was an EDUCBA guide to administrative expenses. To learn further details, please refer to EDUCBA’s Recommended Articles.