Advantages and Disadvantages of Debit Card – Introduction

Imagine being at a small cafe that only accepts card payments. Luckily, you have a debit card. You can easily swipe or tap your card to pay for your order, making the transaction quick and seamless. Debit cards are great for digital payments, which many places prefer nowadays. Even if you don’t have cash, having a debit card can be convenient in this cashless world. However, one needs to understand the advantages and disadvantages of debit card to ensure a smooth financial adventure.

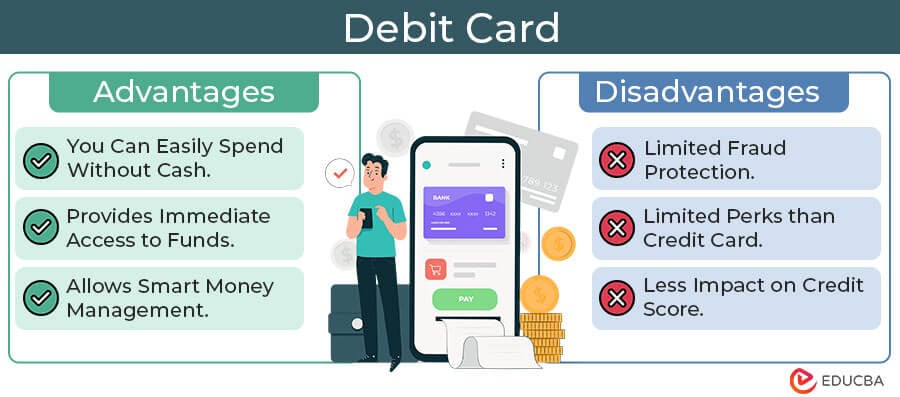

Advantages of Debit Card

Here are some of the key advantages of using a debit card:

1. You Can Easily Spend Without Cash

Debit cards allow you to make purchases and payments easily without carrying cash. You can use them at different stores and online retailers as they are accepted widely.

2. Provides Immediate Access to Funds

Debit cards are directly linked to your bank account. So, when you use a debit card for a transaction, you access funds that are already available in your account. It allows for quick and straightforward transactions without the need for credit.

3. There Are No Extra Charges

When you use a credit card, you borrow money that you will have to pay back later with interest. However, with a debit card, you spend your money already in your bank account. That means you won’t have to pay interest charges on your purchases.

4. Allows Smart Money Management

Debit cards keep your spending in check by only allowing you to spend what you have in your bank account. It helps avoid overspending and promotes responsible financial behavior.

5. Makes Online Transactions Easy

Debit cards are commonly used for online shopping and electronic transactions. They provide a secure and straightforward way to make payments in the digital space without needing physical cash.

Disadvantages of Debit Card

Debit cards also come with certain disadvantages that users should be aware of.

1. Limited Fraud Protection

When someone steals your debit card or uses it without your permission, it can be difficult to get your money back. Fraud protection for debit cards is not as strong as credit cards, which means you may be unable to recover all your lost funds.

2. Includes Overdraft Fees

If you spend more money than you have in your bank account, the bank may charge you extra fees called ‘overdraft fees’. It’s simply a penalty for spending more than what you have.

3. Limited Perks than Credit Card

Most credit cards give you rewards like cash back or points for spending, but all debit cards don’t offer extra benefits.

4. Not Ideal for Certain Transactions

Using a debit card might not be the best option for certain transactions like renting a car or booking a hotel room. This is because some service providers prefer credit cards due to safety concerns.

5. Less Impact on Credit Score

Using a debit card won’t improve your credit score because it doesn’t involve borrowing money. However, credit cards can help improve your credit score because they demonstrate your ability to repay the borrowed money responsibly.

Final Thoughts

To sum up the advantages and disadvantages of debit cards, debit cards provide a range of benefits, such as convenience, accessibility, and assistance with budgeting. However, they also have drawbacks, such as possible charges and the absence of credit-building advantages. Using a debit card ultimately depends on your financial objectives and preferences. Therefore, you must carefully evaluate the advantages and disadvantages when selecting a payment method.

Recommended Articles

We hope you found this article on the advantages and disadvantages of debit card helpful. Refer to the following recommendations to view similar articles.