Introduction to Advantages and Disadvantages of Lease

Imagine a scenario where a company leases high-end computer equipment to another business for seven years. The agreement includes monthly fees, lease duration, and responsibilities. This is called a lease, where the lessee can use advanced technology, equipment, or land. The lessor gets regular payments and retains ownership, while the lessee benefits from using the asset without buying it. In this article, we will look into the advantages and disadvantages of lease and analyze it with the help of a case study.

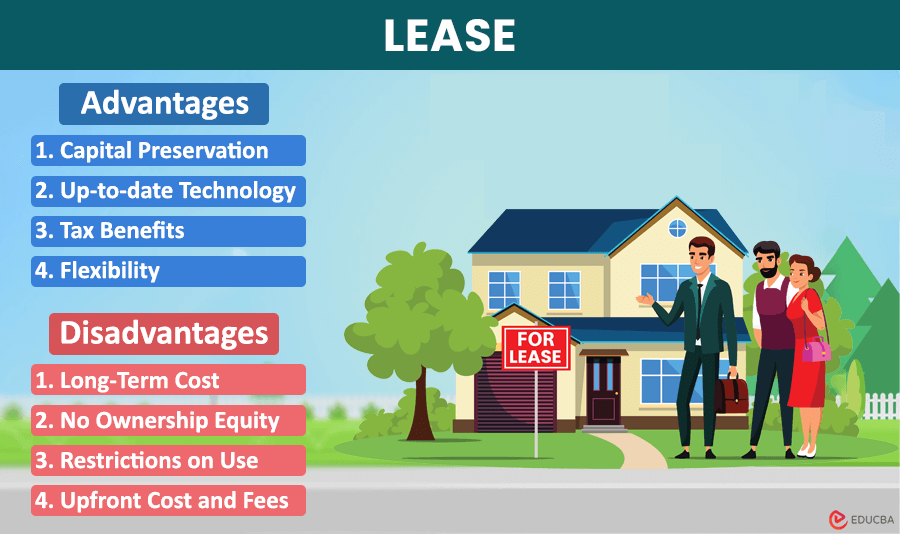

Advantages of Lease

Let us look at some of the advantages of Lease:

1. Capital Preservation

Businesses can acquire assets in a lease without making a large upfront capital investment. This allows them to preserve capital for other essential needs such as operations, marketing, or expansion.

2. Up-to-date Technology

Leasing lets organizations use advanced equipment or technology without stressing about it becoming obsolete (outdated). The flexible leasing terms make it simple for businesses to upgrade or replace equipment to help them stay competitive.

3. Tax Benefits

Leasing equipment offers tax benefits to businesses. Businesses can reduce their overall leasing costs by treating lease payments as everyday operating expenses. Additionally, these expenses might be eligible for tax deductions, providing businesses with tax advantages as they utilize the latest equipment.

4. Flexibility

Leasing provides flexibility when it comes to choosing the duration of the contract and deciding on the end-of-lease options. This means that individuals or businesses can customize their lease agreements based on their needs by adjusting the terms according to the asset’s expected lifespan or budget.

5. Improved Cash Flow Management

Leasing helps businesses manage their budget and cash flow better by allowing them to make fixed monthly payments. Fixed monthly payments provide a predictable financial structure compared to outright purchasing. This way, you will know exactly how much you must pay monthly and avoid unexpected expenses.

6. Easy Asset Disposal

When businesses lease assets, they can either return them to the leasing company at the end of the lease term or purchase them. This benefits businesses because they don’t have to worry about the difficulties and risks of selling depreciated assets.

Case Study Based on Advantages of Lease

Innotech Industries, a manufacturing company, decided to lease the following:

- Office space

- IT equipments

- Vehicles

- Manufacturing equipments

- Office furniture & fixtures

This choice had several advantages that improved the company’s finances and overall operations, as follows:

1. It saved money for future growth

Leasing allowed InnoTech to save money for essential investments like research and hiring, ensuring they could adapt to changes in their finances.

2. It helped stay technologically competitive

Leasing IT equipment ensured InnoTech always had up-to-date technology, making their business operations more efficient.

3. Allowed strategic tax planning

To save on taxes, InnoTech decided to lease their company vehicles. This smart choice gave them deductions on lease payments, which helped their overall financial performance.

4. The company could adapt to market changes

Leasing manufacturing equipment allowed easy upgrades or changes based on evolving production needs. Thus, the company could adjust its operational capacity without the burden of owning outdated assets.

5. Allowed efficient cash flow management

InnoTech maintained better control over cash flow management by leasing office furniture and fixtures. They found it easy to handle their budget because the lease payments were fixed every month. This approach helped them handle everyday expenses, respond quickly to market changes, and invest in strategies that kept their business growing steadily.

6. The company could easily dispose of outdated technology

Knowing that technology changes fast, InnoTech chose to lease computer hardware. This made removing old equipment easy when the lease ended because the leasing company took care of it. InnoTech didn’t have to worry about managing outdated technology, ensuring a smooth shift to the latest advancements.

Disadvantages of Lease

Let us look at some of the disadvantages of Lease:

1. Long-Term Cost

Over the long term, leasing can be more expensive than purchasing. Despite lower monthly lease payments, the cumulative cost over the lease term can exceed the cost of buying the asset outright.

2. No Ownership Equity

When you lease, you are not building asset ownership. In contrast to purchasing, where you eventually own the asset entirely, leasing is like renting. At the end of the lease term, you may have to return the asset without owning it.

3. Restrictions on Use

Lease agreements often come with restrictions on how you can use the asset. These limits may involve mileage restrictions for leased vehicles, restrictions on making modifications, or prohibitions on certain uses. Violating these terms may result in penalties.

4. Upfront Cost and Fees

Lease agreements may require upfront payments, such as a security deposit, acquisition fee, or the first and last month’s payment. These upfront costs can add up, making leasing less financially appealing initially.

5. Early Termination Penalties

You may face heavy penalties and fees if you need to end the lease before the agreed-upon term. These high charges may leave you with no potential savings you thought you would gain from terminating the lease early.

6. Market Value Fluctuations

Suppose you want to buy an asset. If the asset’s market value is lower than the agreed-upon residual value, you could pay more than the asset’s worth.

Case Study Based on Disadvantages of Lease

Ayka Industries, a manufacturing company, leased specialized machinery to expand production. However, this decision had multiple drawbacks that significantly impacted the company’s finances and operations.

1. Long-term costs led to financial difficulties

Ayka Industries thought leasing specialized machinery was cost-effective, but costs increased over time. Monthly payments included extra fees and hidden charges. It made leasing more expensive than buying. This financial strain messed up the company’s budget plans, diverting money from important areas. Initially, it was seen as a good idea, but leasing was a costly mistake.

2. There was no ownership equity

Instead of purchasing, Ayka Industries leased specialized machinery so they couldn’t own them over time. When you buy something, every payment helps you own it, but leasing only lets you use it. This meant Ayka Industries paid for using the machinery without getting ownership. This choice left the company without assets, even though they kept investing in machinery.

3. Restrictions on the use of machines led to a production workload

Ayka Industries had limits on how much they could use the machinery daily as the lease agreement imposed rules on usage. If they went over these limits, they had to pay penalties. These usage restrictions made it hard for the company to adjust to changes in production workload or project demands.

4. Upfront costs and fees impacted the company’s financial growth

Ayka Industries dealt with uncertainties in upfront costs—security deposits, administrative fees, and initial lease payments. This impacted the company’s immediate finances, making budgeting and resource planning challenging.

5. Early termination penalties brought challenges in adapting to changes

Ayka Industries considered ending the machinery lease early to have more flexibility. But the lease agreement had big fines for doing that. These financial penalties made it hard for the company to leave the agreement, limiting its ability to adapt to changing challenges.

6. Old machines damaged progress as the market value fluctuated

Leasing specialized machinery led to rapid obsolescence (outdated) due to technological advancements, impacting market value. The lease agreement didn’t let the company upgrade to newer models or change the lease terms. This left Ayka Industries with old machinery, damaging its competitiveness and stopping it from keeping up with industry progress.

Final Thoughts

Leasing helps businesses save money upfront and provides flexibility for easy asset upgrades. Yet, over time, leasing might cost more than owning, as payments add up beyond the asset’s value. Future market changes and interest rate fluctuations can affect leasing costs, highlighting the need for careful long-term financial planning.

Recommended Articles

If you found our article listing the advantages and disadvantages of lease helpful, please visit the following recommendations.