Updated November 30, 2023

Advantages and Disadvantages of LLC – Introduction

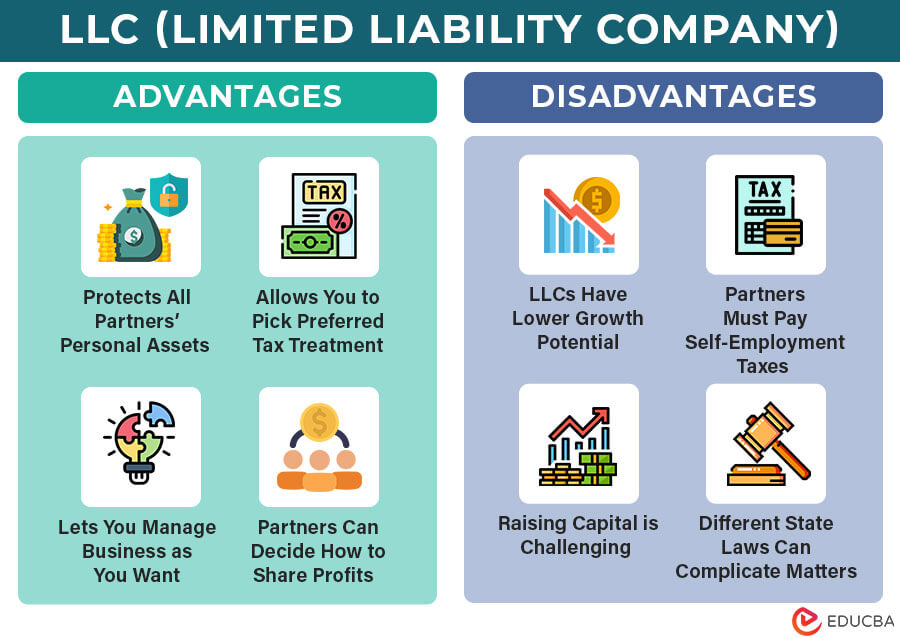

When starting a business, choosing the proper structure is crucial for success and peace of mind. Among the many options available, the Limited Liability Company (LLC) is a popular choice for entrepreneurs. Its hybrid structure combines a partnership’s flexibility with a corporation’s liability protection.

However, like any business structure, it has its pros and cons. In this article, we will explore the advantages and disadvantages of LLC to help you make an informed decision and manage your business effectively.

Advantages of an LLC

LLCs are popular in the US for a reason. It is one of the most common structures and entities for small businesses wanting to make a professional statement, build a brand, and protect their finances.

Here are a couple of reasons why LLC might be the best choice for you:

1. Protects All Partners’ Personal Assets

One of the most obvious advantages of an LLC is in its name – limited liability. It means the owners are not personally responsible for the business’s debts and liabilities. Considering today’s volatile market environment, this might be one of the most significant advantages for many business owners.

2. Lets Partners Pick Their Preferred Tax Treatment

Tax flexibility is another advantage of an LLC because the owners can choose how to be taxed, either as a sole proprietorship, partnership, or corporation. This flexibility allows owners to use the most favorable tax treatment for their company and situation.

3. Includes Less Regulations and Paperwork

If we compare the LLC to a corporation, it’s noticeable that this structure is less formal and requires fewer record-keeping requirements. This ease of operations is usually very appealing to small business owners. It is because they might not have the resources for extensive paperwork.

4. Allows Partners to Manage the Business as They Want

Running an LLC is also easier because this type of organization doesn’t require a board of directors or annual meetings. The members of an LLC have the opportunity to manage the business as they see fit. It is usually quite favorable for small and solo businesses.

5. Diverse Group of People can Become Partners in an LLC

There are no restrictions when it comes to the number or type of owners an LLC can have. It often means that a diverse range of individuals or entities can be a part of the LLC.

6. Partners Have the Freedom to Decide How to Share Profits

Unlike corporations, LLCs do not have to distribute profits equally among owners. Partners can mutually decide how to divide profits. This way, they can consider each member’s contributions and share profits accordingly.

Disadvantages of an LLC

Even though the LLC structure is flexible and easy to manage, there are a few disadvantages you need to consider before making the final decision. This way, you will have all the necessary information to make the right choice for your business.

1. LLCs Have Lower Growth Potential Compared to Others

One of the most important things to remember about LLCs is the inability to issue stock. It means you can face significant challenges if you want to raise capital and/or expand your business.

2. Partners Must Pay Self-Employment Taxes

While the taxes for LLCs might be flexible, they often lead to self-employment taxation. It means partners have to pay taxes on their share of the business profits. It can sometimes lead to higher taxes compared to a corporation.

3. Differences in State Laws Can Complicate Matters

Remember that the laws and regulations regarding LLCs can change depending on your location. Additional work and research can burden some business owners who don’t have the time and the resources to deal with the paperwork.

4. Raising Capital From Investors is Challenging

Investors usually prefer investing in businesses they are familiar with, like corporations. As they are unfamiliar with LLCs, it takes them time and higher costs to review essential documents before deciding to invest. Therefore, raising capital from new investors can take a lot of work.

5. Compliance Requirements

While less stringent than those for corporations, LLCs still have certain compliance requirements. These may include filing an annual report and paying state-specific fees.

6. Transferring Ownership in an LLC is Difficult

The last thing to consider before choosing an LLC for your business is transferring the ownership. This step can be significantly more challenging if you have an LLC instead of a corporation. Thus, it can be a disadvantage when it comes to succession planning.

Final Thoughts

Once you consider all the advantages and disadvantages of LLC and lean toward starting one, it’s time to take the next step. You can easily and quickly create the legal structure by visiting “How to Start My LLC ” for comprehensive guidance on forming an LLC. This resource can provide the specific information and support you need to set up your LLC correctly and efficiently.

An LLC offers many attractive benefits, including liability protection, tax flexibility, and operational ease. However, it has limitations like limited growth potential and varied state laws. Weighing these advantages and disadvantages of LLC against your business goals and needs is essential in choosing the proper structure for your success. With the correct information and support, you can make a decision that sets your business on the path to long-term success.

Recommended Articles

If you found our article listing the several advantages and disadvantages of LLC helpful, please consider visiting the following recommendations.