Updated February 10, 2023

About Sole Proprietorship

A sole proprietorship is a business entity owned and operated by one individual and, in most cases, is not registered with the state. It is the simplest form of business structure and, as such, is the most common form of business in the United States. The main advantages of a sole proprietorship are:

- Ease of formation.

- Personal responsibility for the business’s debts and liabilities.

- The ability to manage the business without requiring formal business structures or processes.

Also, the owner of a sole proprietorship has the right to keep all the money the business makes. The biggest problem with a sole proprietorship is that the owner has to pay for all of the business’s debts and liabilities.

Advantages and Disadvantages of Sole Proprietorship

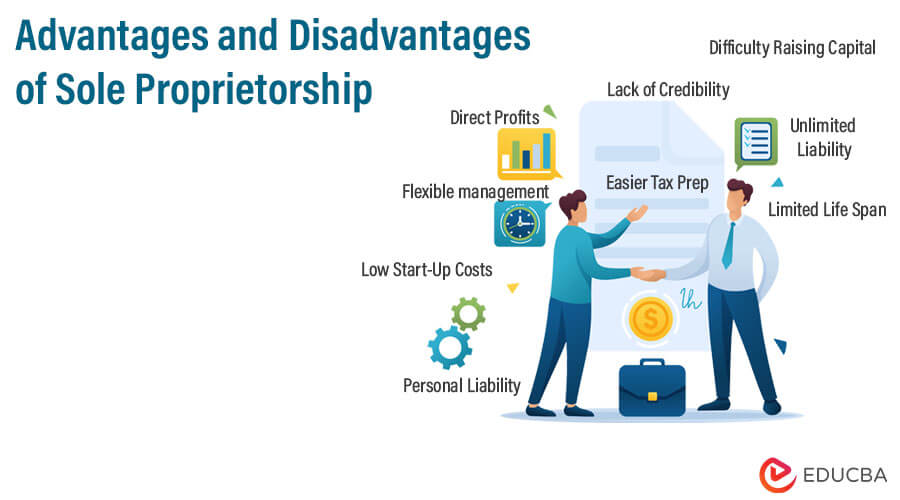

The following are some of the advantages and disadvantages of Sole Proprietorship:-

Advantages of Sole Proprietorship

The person, who is the only owner, has full control over the business and is responsible for all of its profits and losses. There are several advantages to running a sole proprietorship, including the following:

- Low Start-Up Costs: A sole proprietorship has the lowest start-up costs compared to other business structures. Most of the time, all that is needed is to get licenses and permits, register the business’s name, and maybe buy supplies and equipment.

- Easier Tax Prep: Sole proprietorships have more specific tax filing requirements. Usually, all that is needed is for the person to file a Schedule C (Form 1040) with their tax return.

- Flexible management: In a sole proprietorship, the business owner controls everything. It allows for more flexibility in decision-making and leadership.

- There are no legal requirements. A sole proprietorship does not have to follow the same legal rules as a corporation or a limited liability company (LLC).

- Direct Profits: As the sole owner, the individual receives all the profits from the business. It can be a great incentive to run a sole proprietorship.

- Personal Liability: One of the drawbacks of a sole proprietorship is that the owner is personally liable for any debts or liabilities incurred by the business. It means the individual’s assets are at risk if the company fails.

Disadvantages of Sole Proprietorship

- Unlimited Liability: As a sole proprietor, you are personally responsible for all your business debts, obligations, and liabilities. Your assets—including your assets such as your home, car, and bank accounts—can be seized to pay off any business debts.

- Difficulty Raising Capital: Raising capital for your business can be difficult as a sole proprietor. You can only get money from your resources or banks, and banks may be hesitant to give money to a single person without collateral.

- Limited Life Span: The life of a sole proprietorship is limited to the owner’s life, who may decide to retire or pass away. The business may have to be sold, closed, or transferred to another owner in death or retirement.

- Difficulty Attracting Talent: As a single owner, you may have difficulty attracting and retaining talented employees looking for more job security and benefits than a solo entrepreneur can provide.

- Lack of Credibility: As a one-person business, it cannot be easy to gain the trust and confidence of customers and suppliers, who may be more likely to work with larger, more established companies.

- Limited Growth Potential: The owner of a sole proprietorship faces limitations on how large the business can grow due to its investment limitations and its responsibility for all liabilities and debts.

Comparison of Advantages And Disadvantages of Sole Proprietorship

A sole proprietorship is a business ownership form where one individual is responsible for all assets, liabilities, and income. It’s the easiest and most common type of business, and many people choose it because it’s easy to set up and run. Advantages of a sole proprietorship include the ease of setup, the ability to maintain complete control over the business, and the potential for tax advantages. Some of the disadvantages include unlimited personal liability, difficulty in raising capital, and the challenge of long-term sustainability.

Final Thoughts

A sole proprietorship is advantageous because it offers complete control to the owner and minimal setup costs. Additionally, all profits are the owner’s property, and the owner can easily make decisions on behalf of the business. On the other hand, sole proprietorship also has its drawbacks. The owner is personally responsible for the business’s debts and obligations, and the business does not have access to the same capital resources as other business structures. Additionally, the business is not separate from the owner’s assets and taxes, making filing taxes more complicated. In conclusion, a Sole Proprietorship is a simple and low-cost business structure that offers a great deal of autonomy to the owner but also carries several potential liabilities.

Recommended Articles

We hope that this EDUCBA information on “Advantages and Disadvantages of Sole Proprietorship” was beneficial to you. You can view EDUCBA’s recommended articles for more information,