Advantages and Disadvantages of Zero Brokerage Trading Account – Overview

When investors or traders open zero brokerage trading accounts, they do not have to pay commission fees when executing trades. This is different from traditional brokerage accounts, where traders need to pay a commission based on the value of each trade. Hence, the best accounts for intraday trading are gradually gaining traction. Yet the question remains: Are they truly beneficial for intraday traders? In this article, we will look at the advantages and disadvantages of zero brokerage trading accounts to help traders make decisions.

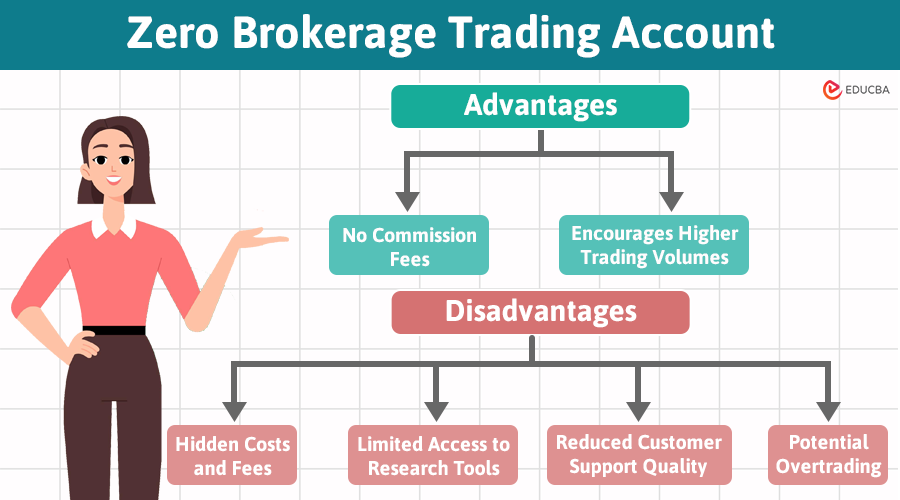

Advantages of Zero Brokerage Trading Account

Following are the advantages of zero brokerage trading account:

1. No Commission Fees

Intraday traders find zero brokerage accounts appealing because they involve a high volume of trading within a single day. Traditional traditional accounts tend to levy commissions based on a percentage of the trade value, which can pile into the thousands, especially for active traders.

In contrast, zero brokerage accounts eliminate these fees, allowing traders to pocket their profits. Thus, theoretically, with a zero brokerage account, one could execute more trades without the high costs.

2. Encourages Higher Trading Volumes

The lack of brokerage fees may encourage one to execute additional trades, which would mean exploring different strategies and opportunities. Increased freedom means greater learning and ultimately improves trading over time.

Disadvantages of Zero Brokerage Trading Account

Following are the disadvantages of zero brokerage trading account:

1. Hidden Costs and Fees

The phrase “zero brokerage” can give the impression that it is free of costs, but usually, it is too good to be true. Moreover, hidden costs (account maintenance fees, withdrawal charges) might offset the savings from not paying brokerage fees.

2. Limited Access to Research Tools

One potential downside to consider is the level of customer service provided by zero brokerage platforms. Some of these platforms may not provide the same quality of customer support or trading tools as others. For beginners or those who heavily rely on research and analysis tools, this could pose a challenge.

3. Reduced Customer Support Quality

Intraday trading demands real-time data and swift execution, and any system delays can result in missed opportunities or financial losses. Certain zero brokerage platforms might compromise on quality to offer their services for free, leading to potential issues. Therefore, it is essential to opt for a platform with a good reputation for reliability, even if it involves paying a fee.

4. Potential Overtrading

Without the barrier of costs, traders are more likely to take actions they would otherwise avoid. This makes one not stay within the discipline, chase small gains, or make riskier trades to recover the money already lost.

Overtrading not only increases the risk of losing money but can also lead to burnout. In an environment that demands intense focus and quick decision-making, excessive trading can result in fatigue-based poor decisions. Therefore, one must maintain a balanced approach even with all the freedom associated with a zero brokerage account.

Will Zero Brokerage Accounts Be the Future of Trading?

Zero brokerage trading accounts undoubtedly eliminate costs and provide the freedom to trade with ease. However, inseparable issues like hidden fees, service issues, and overtrading also come with the same. Here’s what you need to consider:

- Choose the right platform: Research and look for a platform that offers a balance of cost-saving and quality service. Keep an eye out for hidden charges and ensure that the tools and support offered by the platform provide real help in trading effectively.

- Consider your trading style: If you are an experienced trader and do not need much support, then a zero brokerage account would suffice for your endeavors. But if you are a novice or rely more on research and analysis tools, then you would need a regular account offering more comprehensive services than the zero brokerage plan.

- Stick to your plan: As much as the zero brokerage account can save you a lot of money, do not let cost savings drive your trading decisions. Stick to your trading plan and try to avoid overtrading just because it is free. Quality always beats quantity in trading.

Final Thoughts

Zero brokerage trading accounts have transformed the trading landscape by offering a new way to manage costs, allowing intraday traders to maximize profitability. But remember that the value of a zero brokerage account depends on your trading style, experience, and risk management skills.

These accounts can be ideal for some traders to save on costs and maximize capital gains, but for others, the drawbacks might outweigh the benefits. Therefore, understand the advantages and disadvantages of zero brokerage trading accounts and choose the best intraday broker.

Recommended Articles

If you found our article on the advantages and disadvantages of zero brokerage trading accounts helpful, refer to the posts below.