What is Agency Theory?

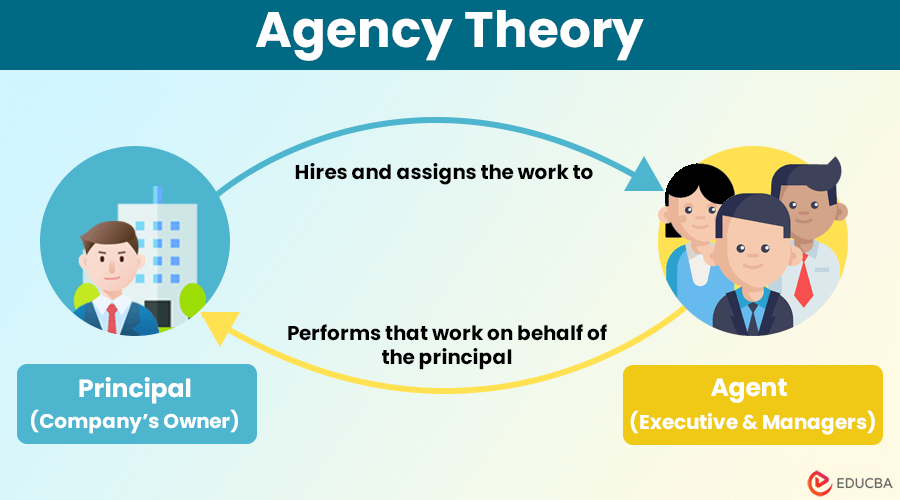

Agency theory explains how bosses (principals) assign tasks and workers (agents) execute those tasks. This concept helps us identify and fix any problems that might arise between them.

In corporate governance, the principals are the company’s shareholders (or owners), and the agents are the company executives or managers. However, this theory is not just limited to the business context; it applies broadly to any situation where one party works on another’s behalf, for example, clients and their lawyers or employees and employers.

Agency theory often addresses problems by providing solutions or resolving issues arising from the disagreement between the interests of principals and agents. Moreover, this theory’s main purpose is to make sure that agents work in the principal’s best interest, even when their personal goals differ.

Table of Contents

- What is It?

- Types

- Causes of Problems (with Examples)

- Strategies to Reduce Agency Problems

- Agency Theory Vs. Stewardship Theory

Types of Agency Theory (Relationship)

The following are the types of relationships between principal and agent.

1. Shareholders and Company Executive

| Principal: | Shareholders |

| Agent: | Company’s management (executives, managers) |

In this type, shareholders are the company’s owners and act as principals. Meanwhile, the company’s management, including executives and managers, act as agents who run the company’s operations. Here, the shareholders entrust the company’s running to the executives or managers, expecting them to make decisions that benefit the company. It is because shareholders invest their money in the company to expect better returns and maximize their shareholder value.

2. Investor and Fund Manager

| Principal: | Investors |

| Agent: | Fund managers |

In this relationship, investors are the principals, and fund managers are the agents. The investors allocate their funds to a fund manager to invest in various assets that align with their financial goals and risk preferences. If the fund manager brings huge profits, it will strengthen their bond with investors.

3. Board of Directors and CEO

| Principal: | Board of directors |

| Agent: | CEO |

The board of directors (BOD) is a principal to the CEO (Chief Executive Officer), who acts as the agent. The CEO is responsible for the business’s day-to-day operations and implementing strategic decisions. The CEO’s decision will impact its relationship with the BOD.

4. Employers and Employees

| Principal: | Employers |

| Agent: | Employees |

In an organization, employers are the principals who assign tasks and responsibilities to employees who act as agents in performing those duties. Employers expect employees to work hard and contribute to the company’s success. Meanwhile, employees expect fair compensation and treatment for their efforts.

Causes of Principal-Agent Problems (With Examples)

When both parties work together, problems can arise from conflicts of interest or disagreement, as numerous decisions may not align with the interests of both parties. This is known as the principal-agent problem in the agency theory.

The following are some primary reasons for conflicts between them.

1. Differences in Goals

A difference in goals is a major cause of issues between principals and agents. Even if they both start with similar goals, their interests may differ over time.

2. Information Asymmetry

In this relationship theory, agents know more about the company’s operations, performance, and potential risks than principals. Therefore, this information gap can lead to conflicts of interest and other situations where agents may act in their own interests rather than the principals.

3. Differences in Risk Aversion

Risk aversion arises when the willingness to take financial risks differs between the principal and the agent. This discrepancy often leads to decisions that do not profitably serve the interests of both parties.

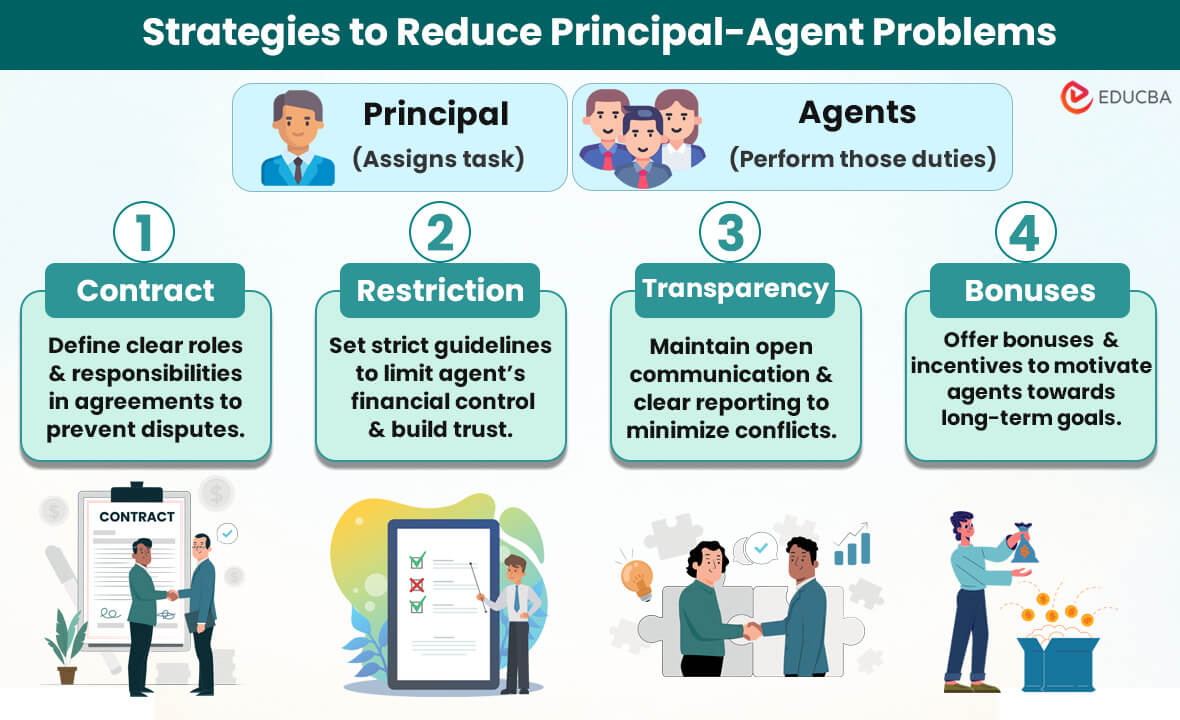

Strategies to Reduce Agency Problems

The following are some of the strategies to reduce agency problems.

1. Contract

To reduce agency problems, principals and agents must get into an agreement or contract. These contracts must mention each party’s roles and responsibilities to avoid future disputes.

2. Restriction

Principals must implement strict restrictions and guidelines for agents to limit the power of agents to control their money. For example, principals can impose limits on spending, investment choices, or other financial activities that align with the principals’ goals. In this way, principals can build trust in their agents.

3. Transparency

There should be transparency in decision-making processes and communication channels between them. Parties can use transparency to report financial performance and operational activities and make future strategic decisions. This strategy will reduce the chances of confusion and conflicts between them.

4. Bonuses

This strategy involves implementing incentives and performance-based bonuses. Thus, by tying bonuses to specific performance metrics or target goals, agents will maximize objectives and contribute to their long-term success.

Agency Theory Vs. Stewardship Theory

The following is the difference between agency theory and stewardship theory.

| Particulars | Agency Theory | Stewardship Theory |

| Basic Assumptions | Focuses on conflicts of interest (disagreement) that arise between the owner (principal) and the manager (agent). | Focuses on the alignment of interests (mutual benefits) between owners (shareholders) and managers (stewards). |

| Relationship Type | Principal-agent relationship. | Owner-manager relationship. |

| View of Manager | It assumes that managers work in their own interests, sometimes conflicting with the principal’s or company’s goals | It assumes that managers naturally work in the best interests of the principal’s or company’s goals. |

| Strategies | It involves monitoring managers’ actions and providing incentives to align their interests with the principal (owners). | It consists of strategies that build trust and transparency in the owner-manager relationship. |

Final Thoughts

To conclude, agency theory provides a framework for understanding the relationships between principals and agents and the potential conflict of interest that arises in these relationships. Moreover, this theory provides valuable insights into designing systems that promote efficient decision-making that benefits both parties.

Frequently Asked Questions (FAQs)

Q1. Who proposed the concept of agency theory?

Answer: The principal-agent theory is a mix of economics and institutional studies, and it was first proposed in the 1970s. While Stephen Ross and Barry Mitnick claim authorship for the idea, the most widely recognized description of this theory comes from Michael C. Jensen and William Meckling.

Q2. Why is agency theory important?

Answer: Agency theory is important because of the following reasons.

- It helps to understand the conflicts between principals and agents, which is crucial in understanding corporate and organizational behavior.

- It provides a corporate world in creating proper governance structures to align the interests of agents with those of principals.

- It also guides on how risks are distributed and managed between principals and agents in contractual arrangements.

Q3. What are the limitations of agency theory?

Answer: Despite its considerable benefits, this theory has some limitations.

- It often assumes that both parties work for their own benefit, sometimes missing out on being ethical.

- This theory sometimes allows managers to make complex decisions that can impact their relationship with shareholders.

- It focuses on the costs related to problems between owners and managers, which might make it undervalue some non-economic aspects that are still important for the organization’s well-being.

- This theory primarily looks from the perspective of the relationship between shareholders and managers, often neglecting other stakeholders.

Q4. What is the difference between agency theory and stakeholder theory?

Answer: Agency theory describes the conflicts between one party assigning the task and another party performing those tasks. Its focus is to align the interests of both parties.

In contrast, stakeholder theory assumes that an organization comprises several individuals or groups with varying interests. This theory focuses on the interests of all parties involved in an organization.

Recommended Articles

We hope this article on “Agency Theory” was informative and beneficial to you. To learn more, refer to the articles below.