What is AI in Finance?

AI in finance involves using artificial intelligence technologies (like NLP & ML) to automate or enhance financial processes and services, such as analyzing vast financial data, making predictions, creating financial models, optimizing investment strategies, personalizing customer service with chatbots, and more.

Imagine you are trying to decide whether to invest in a particular stock. AI can help by analyzing public sentiment, historical market data, and other relevant information to predict how that stock might perform. It can also spot trends and patterns that human analysts might miss, aiding investors in making more accurate and timely decisions.

Table of Contents

- What is AI in Finance?

- Impact

- Applications

- Predictive Analysis

- Financial Modeling & Forecasting

- Credit Scoring

- Algorithmic Trading

- Financial Reporting

- Tax Planning

- Automated Bookkeeping

- Expense Management

- Personal Finance Management

- Portfolio Management

- Pricing Optimization

- Wealth Management

- Liquidity Management

- Market Analysis

- Sentiment Analysis

- Investment Analysis

- Risk Management

- Loan Underwriting

- Loan Repayment Optimization

- Trading Signal Generation

- Insurance Underwriting

- Claims Processing

- Anomaly Detection

- Digital Assistants

- Financial Education

- Regulatory Compliance

- Customer Onboarding

- Examples

- Benefits

- Challenges

- Governance

How Does AI Impact the Finance Industry?

AI is transforming risk management in finance by improving security, compliance, fraud detection, AML, and KYC processes. Banks and financial firms use AI to predict performance, spot unusual activities, and ensure real-time compliance.

AI quickly processes large amounts of data, identifying risks and fraud that humans might miss. For example, AI tools analyze customer data to flag suspicious activities for KYC and AML checks, making these processes more efficient and secure. A key area where AI excels is payment transaction monitoring, where it continually scans transactions for signs of fraud or anomalies.

AI is a game-changer in regulatory compliance and financial decision-making, uncovering hidden patterns in data. In decentralized finance (DeFi), AI performs audits on smart contracts to find weaknesses and prevent fraud, helping users make smarter financial decisions.

27 Applications of AI in Finance

AI is revolutionizing the finance industry, enhancing efficiency, accuracy, and decision-making. Here’s a detailed look at how you can use AI across different financial services:

1. Predictive Analytics

AI for predictive analytics uses advanced technology to improve predictions about future trends, behaviors, and results. Before AI, predictive analytics relied on statistics and data analysis. Now, AI integrates sophisticated methods like deep learning and natural language processing to make these predictions even better.

For example, AI can predict how customers might behave in the future, like how likely they are to stay loyal, how satisfied they are, and how they perceive value. It does this by analyzing their interactions, preferences, and feedback. It helps businesses improve their marketing, sales, and customer service strategies by offering personalized recommendations and targeted offers.

2. Financial Modeling & Forecasting

AI improves financial modeling and forecasting by speeding up and adjusting the process. It finds patterns, risks, and opportunities that traditional methods might miss, reducing errors and risks in business. Unlike traditional methods that use limited data sources, AI combines multiple financial data streams for more accurate predictions.

AI helps businesses get instant predictions, which helps them identify threats, avoid mistakes, and grow faster. With advanced technology, AI speeds up decision-making and boosts overall financial results.

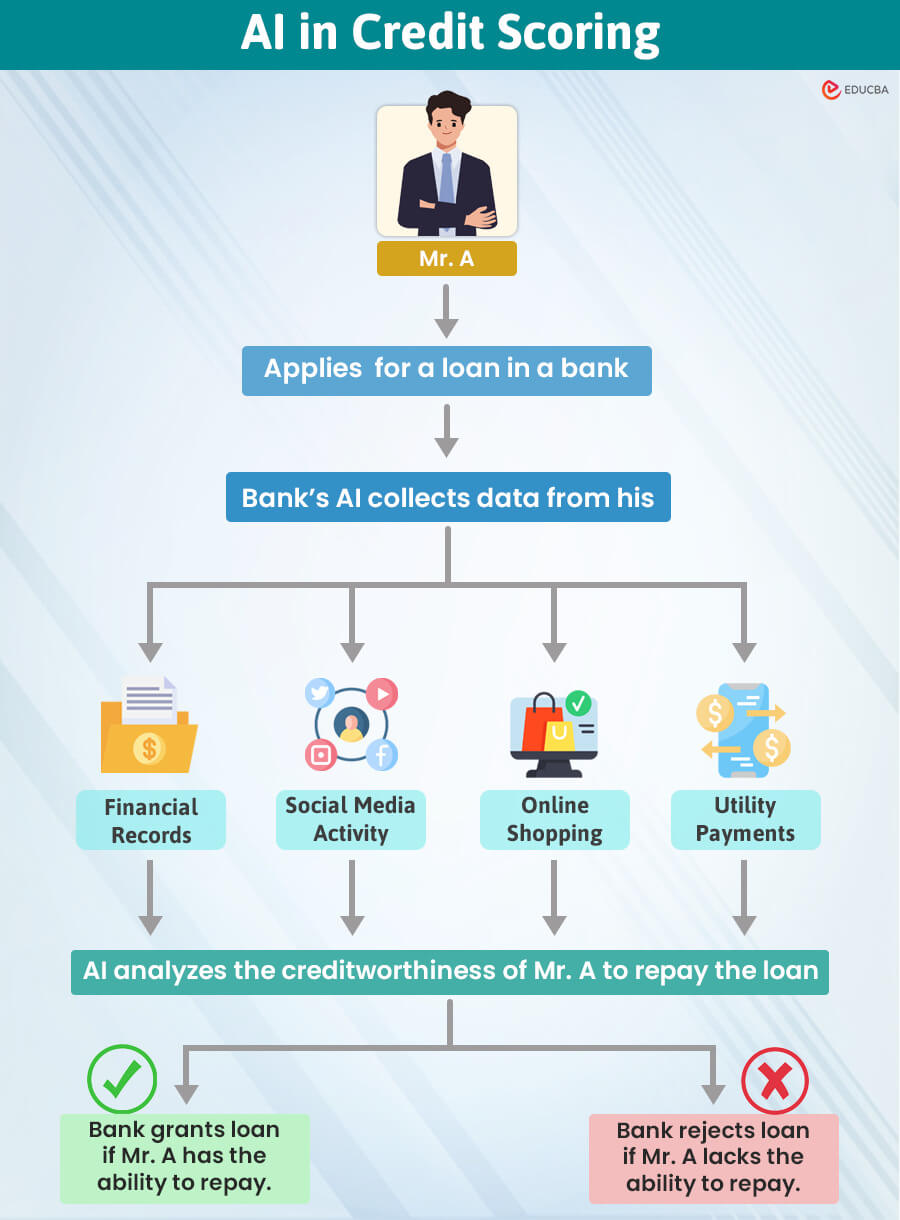

3. Credit Scoring

AI collects data from various sources, such as social media activity, online shopping habits, utility payments, and financial history. By analyzing this information, it identifies key indicators of creditworthiness, such as timely utility bill payments. Consequently, when a financial institution receives a new credit application, AI can predict the applicant’s likelihood of defaulting on a loan.

4. Algorithmic Trading

Traders who buy and sell stocks daily continuously monitor stock prices, software, and news. However, deciding and executing trades takes time, during which the market can change, causing them to miss the best prices. On the other hand, AI trading systems can quickly analyze stock prices and news and buy stocks within milliseconds when prices drop. It allows AI systems to secure the best prices before the market shifts, giving them a significant advantage over manual trading.

5. Financial Reporting

AI helps automate creating reports, making financial statements more accurate, and spotting unusual data. Predictive AI predicts future financial results using past data. Generative AI can create new insights or reports from existing financial information. Machine learning helps discover patterns in financial data, thereby enhancing the accuracy and efficiency of report generation.

6. Tax Planning

AI is transforming taxes and accounting by automating repetitive tasks. It provides more detailed information from data. Additionally, it makes communication with clients easier. It helps professionals give better advice, improving results.

AI analyzes financial data to find patterns, catch fraud, and ensure correct tax filing. It does jobs like entering data, organizing it, and checking for matches, which makes everyday work smoother. AI also helps accountants and tax experts keep up with tax laws by studying new rules and how they affect things.

7. Automated Bookkeeping

AI technology transforms financial records through automated bookkeeping. These tools speed up data entry, sorting, and checking transactions, which speeds up financial reporting. This efficiency helps businesses quickly obtain accurate financial information to make timely decisions and improve financial management.

Automated bookkeeping plays a crucial role in strategic planning by boosting accuracy, reducing mistakes, and ensuring compliance with accounting rules. Keeping financial records current simplifies financial analysis and paves the way for businesses to plan ahead strategically.

8. Expense Management

Artificial intelligence (AI) makes expense management easier by automating tasks, speeding up processing and approvals, and giving instant updates on budgets and reconciliations. It detects suspicious activities to stop fraud and ensures everyone follows financial rules. AI uses data analysis to improve how people make financial decisions. Machine learning and Optical Character Recognition (OCR) help track expenses faster and better. These changes let finance teams focus on important plans instead of boring jobs they used to do by hand.

9. Personal Finance Management

AI in Personal Finance Management (PFM) helps people manage their money more effectively. It categorizes transactions from bank statements to track expenses, making it easier to understand spending habits and plan budgets. AI also provides insights into financial behavior, suggesting ways to save money or reduce debt. Additionally, it monitors for suspicious account activity to keep your money safe. Overall, AI simplifies financial tasks, offers personalized advice, and makes managing money easier and more secure.

10. Portfolio Management

AI is transforming the management of portfolios in finance. It is shifting from traditional human methods to a data-focused approach. It helps make better decisions, works more efficiently, and improves investment strategies. By using machine learning, AI allows investors to react quickly to market changes and enhance their portfolios. Besides providing analysis and advice, AI also helps execute plans accurately and consistently.

11.Pricing Optimization

Using AI for pricing optimization helps businesses increase revenue and profit. AI algorithms analyze customer behavior, market trends, and competitors to predict future trends and set the best prices. It is especially useful for e-commerce and subscription-based companies.

12.Wealth Management

In wealth management, AI provides financial advice, predicts investment outcomes, and spots market trends. There are different types of AI: predictive AI forecasts future events based on current data, and generative AI creates new content from existing data. Machine learning helps computers learn by identifying patterns in data.

13. Liquidity Management

AI revolutionizes liquidity management by improving cash flow, predicting future needs, and aiding decision-making. By analyzing substantial financial data, AI accurately forecasts liquidity requirements. It provides real-time monitoring, allowing businesses to respond to changes quickly. AI detects risks early and suggests strategies to avoid liquidity issues. It also automates routine tasks like cash flow reconciliation and reporting, increasing efficiency and reducing errors. Additionally, AI optimizes short-term investments to ensure profitability while keeping necessary liquidity. AI makes liquidity management more accurate, strengthens risk management, and enhances decision-making.

14. Market Analysis

AI tools can quickly analyze data, giving instant insights and helping businesses respond fast to market changes. This quick data processing helps companies stay competitive.

AI also improves market analysis by monitoring data in real-time and managing risks effectively. It helps businesses react quickly to market shifts and identify risks early, suggesting ways to address them.

15. Sentiment Analysis

AI-powered sentiment analysis automatically understands and sorts emotions expressed in text. It helps businesses gain insights into customer opinions, market trends, and brand perception. It transforms how businesses engage with customers, making service and sales interactions better and more effective. This technology, driven by machine learning and natural language processing, greatly improves customer interactions.

16. Investment Analysis

AI processes vast amounts of data in investment analysis to offer insights, forecast market trends, and assess risks. It enhances investment portfolios, mitigates risks, and diversifies investments. AI also gauges market sentiment, facilitating rapid trading for potential profits.

Moreover, AI detects fraud, monitors investment performance, and provides personalized advice. It simulates how investments might perform under adverse conditions, aiding investors in anticipating challenges. Ultimately, AI simplifies decision-making for investors, enabling effective portfolio management.

17. Risk Management

AI-powered risk management systems can quickly identify threats and help make informed decisions. With predictive analytics and data-driven insights, organizations can foresee different risk scenarios, reducing unexpected issues. Automating complex risk assessments allows employees to focus on strategic decisions and innovation. By using AI, businesses manage risks more effectively. They set new standards in risk management, staying ahead in a constantly changing world.

18. Loan Underwriting

AI-powered loan underwriting revolutionizes how lenders evaluate and approve loans. It simplifies processes, manages risks effectively, and opens up new lending opportunities. Traditional underwriting is complex. This complexity arises because each applicant’s financial situation varies significantly. Consequently, predicting repayment becomes challenging. Unlike manual methods, AI can swiftly and accurately analyze vast amounts of data, enhancing decision-making accuracy.

The major difference between credit scoring and loan underwriting is that loan underwriting needs to be comprehensive and detailed. Thus, using AI for loan underwriting can save creditors a lot of time.

19. Loan Repayment Optimization

AI improves loan repayment management by analyzing borrower data like credit scores, income, and spending habits. This analysis creates detailed borrower profiles. It predicts repayment behaviors, aiding lenders in assessing default risks and intervening proactively.

AI-powered virtual assistants and chatbots enhance customer support, offering round-the-clock assistance and personalized financial education. This approach helps borrowers better understand their loan terms. It also assists them in managing finances effectively, thereby reducing defaults. Moreover, it improves borrower satisfaction by addressing their individual financial needs.

20. Trading Signal Generation

AI-enhanced trading signal generation analyzes market data and creates signals for trading. It predicts price changes, automates technical analysis, and considers social media and news sentiment. This technology includes features designed for managing risks and testing strategies. These features help traders refine their approaches and effectively manage their risk exposure.

The advantages include enhanced trading performance, time savings, lower risk, improved decision-making, and more effective strategies. AI empowers businesses to achieve a competitive edge in the financial sector.

21. Insurance Underwriting

AI is changing insurance underwriting by improving accuracy and efficiency. It swiftly analyzes extensive data from diverse sources to assist underwriters in better assessing risks and making informed decisions. Using predictive analytics, AI identifies risk factors, detects patterns in historical data, and offers real-time quotes. By integrating insurance analytics software, AI can further enhance the precision of risk assessments and streamline data processing. By identifying anomalies in claims and applications, AI improves pricing accuracy, enhances risk management, and strengthens fraud detection. AI is transforming insurance underwriting by streamlining operations, reducing fraud, and enabling more tailored and economic policies.

22. Claims Processing

AI is also revolutionizing claims processing in insurance. It accelerates the evaluation of claims by swiftly analyzing large volumes of data from various sources. It enables insurers to process claims more efficiently and accurately. AI uses advanced analytics to detect patterns and anomalies in claims data. This capability improves the accuracy of claim assessments. It also reduces the time taken to settle claims. Overall, AI is transforming claims processing by making it faster, more accurate, and better equipped to handle complex insurance claims.

23. Anomaly Detection

AI revolutionizes anomaly detection by analyzing large datasets in real-time, swiftly identifying anomalies that may indicate potential issues or threats. AI enables proactive risk management by quickly flagging deviations from normal behavior, allowing businesses to take immediate corrective actions. Additionally, AI automates anomaly detection processes, reducing manual effort and improving accuracy. By continuously learning from data, AI enhances its ability to effectively adapt and evolve to detect new types of anomalies. AI enhances anomaly detection by providing faster detection, proactive risk mitigation, and improved operational efficiency.

24. Digital Assistants

AI-powered digital assistants in finance help customers by offering 24/7 support, answering questions, giving personalized financial advice, and helping with budgeting. Banks and financial firms use AI to automate customer service, detect fraud, speed up loan approvals, and ensure they follow the rules. Investors can also benefit from AI with robo-advisors that offer investment tips and market insights, helping them make smart decisions and manage their investments better.

25. Financial Education

AI transforms financial education by offering personalized, easy-to-access, and interesting resources. Interactive AI chatbots are available 24/7 to answer financial questions, making learning immediate and interactive. AI-powered fun apps make financial education enjoyable and low-risk.

AI tracks credit scores, explains changes, and teaches investment strategies using customized content and virtual scenarios. AI platforms provide personalized financial advice that fits each person’s unique situation, helping users make smart decisions about their money.

26. Regulatory Compliance

Artificial intelligence (AI) in regulatory compliance utilizes machine learning, natural language processing (NLP), and robotics to enhance and streamline compliance processes in finance, healthcare, and manufacturing sectors. AI boosts efficiency and accuracy while lightening the workload for compliance officers. AI also helps mitigate the risk of regulatory violations. It offers the potential to transform regulatory compliance through improved efficiency, accuracy, and responsiveness to regulatory demands.

27. Customer Onboarding

AI is a potent tool for guiding customers through product onboarding. It analyzes data, identifies patterns, and predicts outcomes. Instead of merely completing tasks, AI demonstrates product functionality. It empowers customers to interact naturally with the technology. This approach enhances the customer experience and promotes self-sufficiency as users learn to utilize the product independently.

Real Examples of AI in Finance

- PayPal uses AI algorithms to analyze real-time patterns and behaviors, reduce consumer friction, lower fraud losses, and enhance customer trust.

- Lenddo uses AI to analyze non-traditional data sources like social media and smartphone usage to assess the creditworthiness of individuals who lack traditional credit histories.

- Banks like Bank of America use AI-powered virtual assistants (e.g., Erica) to handle customer inquiries, provide account information, and assist with transactions through natural language processing.

- Apps like Mint and YNAB use AI to give users insights into their spending habits, help them create budgets, and offer personalized financial advice.

- JPMorgan Chase uses AI-powered chatbots and virtual assistants to handle customer service inquiries, improving efficiency and customer satisfaction.

- Charles Schwab’s Intelligent Portfolios uses AI to build and manage personalized investment portfolios for clients, offering automated rebalancing and tax-loss harvesting.

- Thomson Reuters uses AI to analyze news articles and social media for sentiment analysis, providing insights that can influence trading decisions.

Benefits

Here are some of the key benefits of AI in finance:

- Better Customer Experience: AI tailors financial advice and product recommendations to each customer’s needs. These tools provide instant help and answer questions anytime, improving customer satisfaction.

- Improved Risk Management: AI spots unusual transaction patterns, helping catch and prevent fraud quickly. AI uses more data to accurately assess how likely someone is to repay a loan, leading to better lending decisions.

- More Efficient Operations: AI handles repetitive tasks like data entry and compliance checks, reducing mistakes and saving time. AI finds ways to make processes like loan approvals faster and more efficient.

- Advanced Data Analysis: AI analyzes market trends to help make smart investment decisions. AI forecasts market movements and customer behavior, helping businesses plan.

- Easier Regulatory Compliance: AI helps track and comply with regulations automatically. AI speeds up processes like verifying customer identity (KYC) and preventing Anti money laundering (AML).

- Enhanced Security: AI quickly detects and responds to cyber threats, protecting financial data. AI also more effectively identifies and prevents fraud through real-time monitoring.

- Innovation and Competitive Edge: AI helps create new financial products like robo-advisors. Companies using AI can offer better services and operate more efficiently, gaining an edge over competitors.

Challenges

Using artificial intelligence (AI) in finance offers many benefits but faces several big challenges. These challenges fall into four categories: technical, regulatory, ethical, and operational.

1. Technical Challenges

- AI needs a lot of good data to work well, but financial data can be messy or incomplete.

- Many AI systems are hard to understand, which is problematic because we need to know why they make certain decisions.

- Making AI systems work well with large amounts of data and across different financial services is tough.

- AI can reflect and even worsen existing biases in the data, leading to unfair outcomes.

2. Regulatory Challenges

- Financial companies must ensure their AI systems follow strict rules and regulations, which can be complicated.

- Protecting customer data and keeping AI systems secure is crucial.

- Laws and rules can be slow to catch up with new AI technologies, creating uncertainty.

3. Ethical Challenges

- A major concern is ensuring AI systems treat everyone fairly and don’t discriminate.

- It’s hard to determine who is responsible when AI systems make mistakes.

- AI can replace human jobs, so companies need to manage the impact on their workforce.

4. Operational Challenges

- Many financial companies have old systems that are hard to integrate with new AI technologies.

- Implementing AI requires changing processes and getting everyone on board, which can be difficult.

- AI systems need regular updates and monitoring to keep working correctly and securely.

Governance

Governance of AI in finance means making rules to ensure businesses use AI properly, safely, and ethically. It includes financial laws and privacy rules like the General Data Protection Regulation (GDPR).

We need guidelines to prevent biases in AI decisions and ensure they are clear. It is important to manage risks like cybersecurity issues and test AI models to ensure they work well.

To make AI governance work, financial institutions should:

- Create clear policies with help from experts.

- Have clear roles and groups to watch over AI use while also using advanced tools to keep an eye on AI in real-time.

- Maintain good data management, i.e., using good, safe, and fair data.

- Perform regular checks and audits to help keep things running smoothly.

- Employees should get ongoing training on how to use AI responsibly.

- Talk with regulators, other companies, and customers to gather feedback and maintain trust.

- Keep up with new laws and technology.

By following these steps, financial institutions can use AI well while staying safe, fair, and following the rules.

Recommended Articles

We hope you leverage AI in finance to benefit from its resourceful capabilities. Here are a few more AI-based articles you can read.