What are Altcoins?

The world of cryptocurrency (digital money) came to light with the debut of Bitcoin in 2009. Usually, Bitcoin is seen as synonymous with cryptocurrencies, but it’s not the only player in the game. There are several silent cousins known as “altcoins.”

The word “Altcoins” comes from the combination of the words “Alternative” and “Bitcoin.” It means that altcoins are the cryptocurrencies that are alternatives to Bitcoin.

They have several unique features and use cases that distinguish them from Bitcoin.

This article takes a closer look at the several types of altcoins. However, before you invest in these alternatives, for an ultimate investment education experience, click here to connect with an educational expert to make informed decisions.

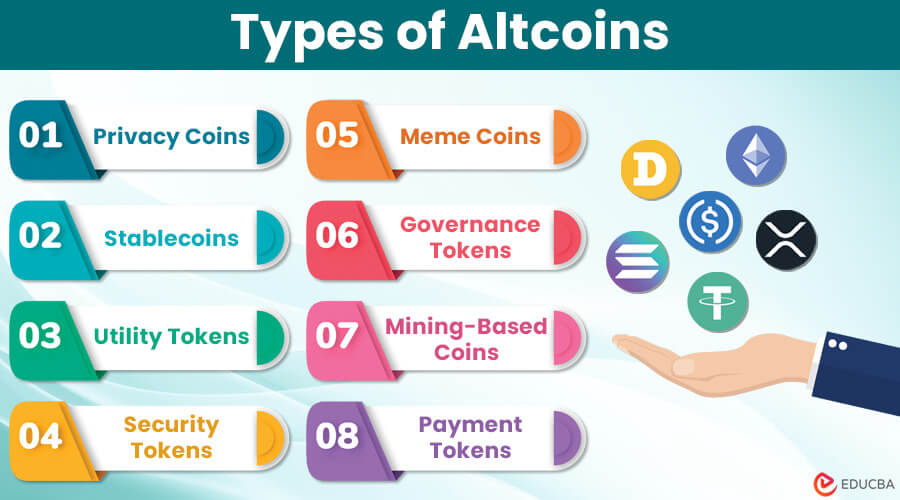

Types of Altcoins

Here are the different types of altcoins:

1. Privacy Coins

Privacy coins are altcoins that have enhanced the anonymity and privacy of cryptocurrency transactions. They utilize advanced techniques to conceal sender, receiver, and transaction amounts, ensuring confidentiality. These coins find applications beyond everyday transactions, favored by users seeking privacy and confidentiality in their financial activities.

Some privacy coins include Zcash and Monero. Monero uses features like stealth addresses to secure the identities of the parties involved. Zcash, on the other hand, uses zk-SNARKs to enable selective transparency and keep transaction details confidential.

2. Stablecoins

Stablecoins are cryptocurrencies that have their value attached to a reserve asset, like a currency (dollar) or commodity (gold). This keeps the value of these altcoins stable.

Stablecoins bridge the gap between the volatile crypto market and traditional financial systems. It facilitates lending, borrowing, and trading without the volatility associated with other cryptocurrencies. They also provide a reliable way to hold value and trade within the decentralized finance (DeFi) system.

The different types of stablecoins are as follows,

- Fiat-Collateralized Stablecoins: These are altcoins that are backed by reserves of fiat currency. It ensures that traders can exchange each coin for a specific amount of the underlying currency.

- Crypto-Collateralized Stablecoins: These stablecoins back themselves with other cryptocurrencies instead of relying on fiat currency.

- Algorithmic Stablecoins: These stablecoins rely on algorithms to study the market demand and adjust the supply accordingly. Without direct backing by physical assets, they strive on supply & demand to maintain a stable value.

3. Utility Tokens

Utility tokens are a fundamental part of the crypto ecosystem. These altcoins allow traders to obtain particular products/services in a blockchain platform. The use of utility tokens includes accessing decentralized applications (dApps), paying transaction fees, etc.

Prominent examples of utility tokens include Ethereum’s Ether (ETH), which helps fuel transactions and smart contracts on the Ethereum network. Another one is Binance Coin (BNB), which offers discounts on trading fees within the Binance exchange.

Utility tokens power the functionality and growth of blockchain projects, as the services they enable create a demand for these tokens.

4. Security Tokens

Security tokens represent ownership in real-world assets, such as stocks, bonds, real estate, or even art. These tokens, created on blockchain platforms, are subject to regulatory oversight, similar to traditional securities.

Tokenizing real assets through security tokens offers several advantages:

- Increased liquidity by enabling fractional ownership.

- Reduced administrative costs through automated compliance.

- Enhanced transparency through unchangeable ownership records.

Security tokens have the potential to change traditional financial markets, but their use depends on changing regulations, which differ from one country to another.

5. Meme Coins

Meme coins are altcoins made from social media memes or jokes. These tokens gain popularity through online communities rather than traditional factors like technological innovation or utility. While some meme coins may have legitimate projects or use cases, many are solely created for entertainment purposes. They are highly volatile as their value rises and falls based on the token’s popularity.

For example, Dogecoin, introduced in 2013, was a joke to raise awareness about the blockchain cryptocurrency capabilities. However, what started as a joke in 2013 gained immense social media popularity and high-value fundraising in 2021, at the peak of social media evolution. Another example is the Shiba Inu coin, which was created in 2020. As the next example we can use Telegram’s DOGS coin, which launched in 2024 as a meme coin on The Open Network (TON). Designed to leverage Telegram’s massive user base, DOGS quickly garnered attention through community-driven airdrops and interactive features, cementing its place in the meme coin landscape.

6. Governance Tokens

Governance tokens are those altcoins that holders can use to participate in decision-making processes within a decentralized network. You can vote on governance matters, such as proposals related to protocol upgrades or changes using these tokens.

By these voting rights, governance token holders can influence the direction and development of the project. They are often integral to decentralized autonomous organizations (DAOs) and other decentralized governance structures.

7. Mining-Based Coins

Mining-based coins are cryptocurrencies that get their value from finding solutions to puzzles. In simple terms, miners use Proof of Work (PoW) to solve (mine) complex mathematical problems, and in return, they are rewarded with newly created coins as well as transaction fees.

Mining-based altcoins often require specialized hardware and consume significant amounts of electricity. Although Bitcoin is a mining-based coin, there are several other mining-based altcoins. Some examples include Litecoin and Ethereum.

8. Payment Token

As the name suggests, payment tokens are altcoins that let token holders buy goods and services using these tokens instead of traditional currencies like the US dollar. Therefore, they are also called transactional tokens or currency tokens.

These tokens offer fast transaction times, low fees, and scalability, making them suitable for everyday transactions. The aim is to provide alternatives to traditional fiat currencies and enable decentralized, peer-to-peer transactions without going through banks or payment gateways. Examples of payment tokens are Bitcoin Cash (BCH) and Dash (DASH).

Final Thoughts

In conclusion, beyond Bitcoin’s dominance lies a rich and diverse cryptocurrency ecosystem. These altcoins enhance confidentiality, bridge crypto and traditional finance, power decentralized networks, and revolutionize real-world asset ownership. Embracing this diversity allows participants in the crypto space to navigate the ever-changing landscape with greater insight. It also offers promising opportunities and the potential for a more inclusive financial future.

Recommended Articles

If you found this article on “Altcoins” describing the various types of altcoins interesting and informative, do read the following recommendations for similar content.