Quickbooks Alternatives

Are you tired of using Quickbooks for your business accounting needs? Are you looking for a more innovative solution to manage your finances? Look no further as we unveil the top 10 alternatives to Quickbooks that can help you streamline your accounting process and boost your productivity.

Here, we will explore some of today’s most reliable and efficient accounting software options. From cloud-based platforms to desktop software, we’ve covered you with various options catering to different business needs and sizes. Say goodbye to the limitations of Quickbooks and embrace a new era of accounting software that can help your business thrive!

Key Highlights

- Provides insights and guidance on the features, functionalities, and benefits of different accounting software solutions.

- Assists small business owners in selecting the right accounting software that fits their needs and requirements.

- Offers practical tips, best practices, and case studies on using accounting software effectively for better financial management and decision-making.

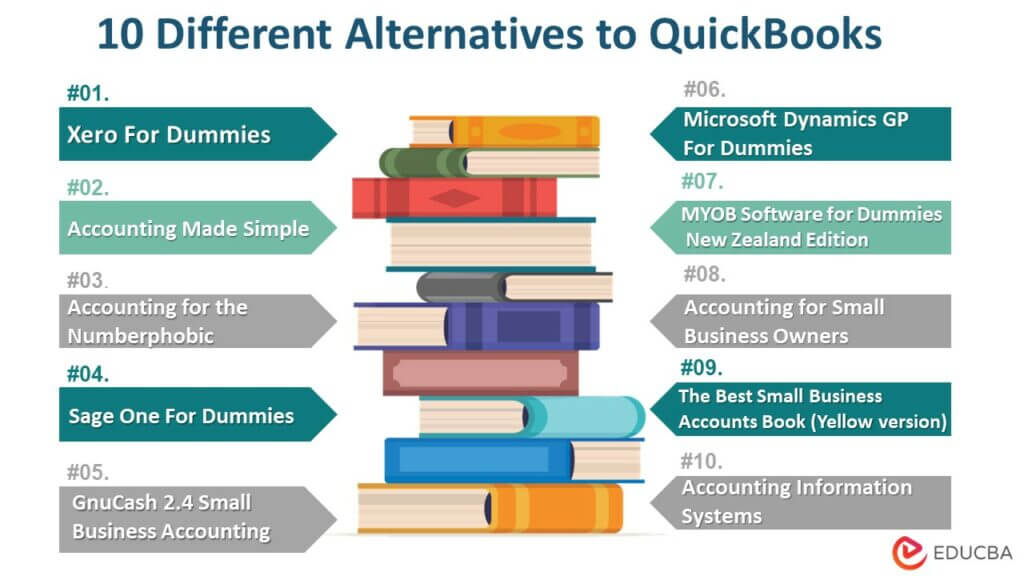

10 Different Alternatives to Quickbooks

| Sr.no | Book | Author | Publish Date |

Rating |

| 1 | Xero For Dummies | Heather Smith | 2017 | Amazon: 4.1

Goodreads: 3.65 |

| 2 | Accounting Made Simple: Accounting Explained in 100 Pages or Less | Mike Piper | 2010 | Amazon: 4.4

Goodreads: 3.93 |

| 3 | Accounting for the Numberphobic: A Survival Guide for Small Business Owners | Dawn Fotopulos | 2014 | Amazon: 4.7

Goodreads: 4.32 |

| 4 | Sage One For Dummies | Jane Kelly | 2011 | Amazon: 3.5

Goodreads: 3 |

| 5 | GnuCash 2.4 Small Business Accounting: Beginner’s Guide | Ashok Ramachandran | 2011 | Amazon: 4

Goodreads: 3.19 |

| 6 | Microsoft Dynamics GP For Dummies | Renato Bellu | 2008 | Amazon: 4.1

Goodreads: 3.30 |

| 7 | MYOB Software For Dummies | Veechi Curtis | 2015 | Amazon: –

Goodreads: 3.29 |

| 8 | Accounting for Small Business Owners | Tycho Press | 2015 | Amazon: 4.3

Goodreads: 3.79 |

| 9 | The Best Small Business Accounts Book (Yellow version): For a non-VAT Registered Small Business | Peter Hingston | 2004 | Amazon: 4.1

Goodreads: 3.38 |

| 10 | Accounting Information Systems: The Crossroads of Accounting and IT | Donna Kay, Ali Ovlia | 2013 | Amazon: 4.3

Goodreads: 4 |

Let us look at the Alternatives to Quickbooks and see which best suits your needs.

Book #1: Xero For Dummies Heather Smith

Author: Heather Smith

Review

“Xero For Dummies” by Heather Smith is a well-written, informative guide to using Xero for small businesses. The author covers everything from setting up an account to advanced features like bank reconciliation, payroll, and inventory management. The book’s step-by-step instructions, screenshots, and practical tips make it easy for readers to learn and apply the concepts. Overall, Xero For Dummies is a must-read for any small business owner looking to streamline their accounting process and use the cloud-based Xero platform.

Key Takeaways

- Xero is a cloud-based accounting software offering a range of features for small businesses.

- This book gives a step-by-step guide on how to use Xero to manage your business finances effectively.

- Readers will learn how to set up Xero, manage invoices and bills, reconcile bank transactions, and generate reports.

- The book also covers advanced features of Xero, such as inventory tracking, payroll management, and budgeting.

Book #2: Accounting Made Simple: Accounting Explained in 100 Pages or Less

Author: Mike Piper

Review

“Accounting Made Simple” is concise yet exhaustive accounting principles and practices guide. The book presents the information in a clear, easy-to-understand format suitable for beginners and non-accountants. The author uses real-life examples, diagrams, and analogies to explain accounting concepts in a relatable manner. The book covers financial statements, debits and credits, cash flow, and more. It is an excellent resource for anyone seeking a basic understanding of accounting.

Key Takeaways

- This book is a concise and easy-to-understand introduction to accounting principles and concepts.

- Readers will learn the basics of financial statements, debits and credits, journal entries, and financial ratios.

- The book also covers everyday accounting tasks such as bookkeeping, budgeting, and tax preparation.

- It is a must-have resource for small business owners and individuals who want to understand accounting without getting bogged down in technical jargon.

Book #3: Accounting for the Numberphobic: A Survival Guide for Small Business Owners

Author: Dawn Fotopulos

Review

“Accounting for the Numberphobic” by Dawn Fotopulos is a refreshing take on accounting for small business owners. The author uses storytelling to explain accounting concepts, making them relatable and engaging. The book covers financial statements, cash flow management, and pricing strategies. The author also provides practical tips and case studies illustrating how small business owners can use accounting to make better decisions. For small business owners seeking to enhance their financial management skills, “Accounting for the Numberphobic” is an indispensable read.

Key Takeaways

- This book focuses on small business owners needing help understanding financial statements and accounting concepts.

- Readers will learn how to read financial statements, create a budget, manage cash flow, and make informed financial decisions.

- The author uses simple language and real-life examples to make accounting accessible and understandable.

- It is an excellent resource for small business owners who want to lessen their financial literacy and make better business decisions.

Book #4: Sage One For Dummies

Author: Jane Kelly

Review

“Sage One For Dummies” is the ultimate guide to using Sage One accounting software. The book covers everything from setting up an account to managing invoices, expenses, and reports. The author offers the following.

- Step-by-step instructions.

- Screenshots.

- Practical tips to help readers get the most out of Sage One.

The book also includes a section on best practices and troubleshooting common issues. It is an irreplaceable resource for anyone looking to simplify their accounting process using Sage One software.

Key Takeaways

- Sage One is a cloud-based accounting software designed for small businesses.

- It provides an exhaustive guide on how to use Sage One to manage your business finances.

- Readers will learn how to set up Sage One, create and manage invoices, reconcile bank transactions, and generate reports.

- The book also covers advanced features of Sage One, such as inventory tracking, project management, and time and expense tracking.

Book #5: GnuCash 2.4 Small Business Accounting: Beginner’s Guide

Author: Ashok Ramachandran

Review

“GnuCash 2.4 Small Business Accounting: Beginner’s Guide” is an excellent resource for anyone looking to use open-source accounting software. The book provides a comprehensive overview of GnuCash’s features, including setting up accounts, creating invoices, and managing budgets. The author uses clear, concise language and provides practical examples that make understanding and applying the concepts easy. The book also includes troubleshooting tips and best practices. It is the best choice for small business owners seeking a cost-effective accounting solution.

Key Takeaways

- GnuCash is a type of accounting software that is open-source and free of charge, making it an excellent option for small businesses.

- This book provides a beginner’s guide on how to use GnuCash to manage your business finances.

- Readers will learn to set up GnuCash, create and manage accounts, record transactions, and generate reports.

- The book also covers advanced features of GnuCash, such as budgeting, invoicing, and tax preparation.

Book #6: Microsoft Dynamics GP For Dummies

Author: Renato Bellu

Review

“Microsoft Dynamics GP For Dummies,” written by Renato Bellu, is a complete guide to using Microsoft Dynamics GP accounting software. The book covers everything from setting up an account to managing financial statements, payroll, and inventory. The book also includes best practices and troubleshooting tips. Microsoft Dynamics GP For Dummies is an essential resource for any small business owner looking to streamline their accounting process.

Key Takeaways

- Microsoft Dynamics GP is an enterprise-level accounting software that offers a range of features for businesses of all sizes.

- It shows how to use Microsoft Dynamics GP to manage your business finances.

- Readers will learn how to set up Microsoft Dynamics GP, manage accounts payable and receivable, reconcile bank transactions, and generate reports.

- The book also covers advanced features of Microsoft Dynamics GP, such as payroll management, inventory tracking, and project management.

Book #7: MYOB Software For Dummies

Author: Veechi Curtis

Review

“MYOB Software For Dummies” is a guide to using MYOB accounting software. The book covers everything from setting up an account to managing inventory, payroll, and reporting. The author provides clear explanations, step-by-step instructions, and practical tips to help readers get the most out of MYOB. The book also includes a troubleshooting section and advice on best practices. It is the go-to resource for anyone looking to simplify their accounting process using MYOB software.

Key Takeaways

- MYOB is a popular accounting software that small businesses in Australia and New Zealand use.

- This book offers a step-by-step guide on how to use MYOB to manage your business finances.

- Readers will learn how to set up MYOB, manage invoices and bills, reconcile bank transactions, and generate reports.

- The book also covers advanced features of MYOB, such as payroll management, inventory tracking, and budgeting.

Book #8: Accounting for Small Business Owners

Author: Tycho Press

Review

“Accounting for Small Business Owners” is a practical guide to understanding and managing small business finances. The book covers financial statements, cash flow management, and taxes. The author provides clear explanations, real-life examples, and practical tips to help small business owners improve their financial management skills. The book also includes templates and checklists to help readers organize their finances. It is an essential resource for any small business owner looking to take control of their finances and make informed financial decisions.

Key Takeaways

- It explains how to set up and manage accounting systems for small businesses.

- Readers will learn how to create financial statements, manage cash flow, prepare for tax season, and make informed financial decisions.

- The book also covers essential bookkeeping, budgeting, and record-keeping topics.

- It is an excellent resource for small business owners who want to lessen their financial literacy and build a solid business foundation.

Book #9: The Best Small Business Accounts Book (Yellow version): For a non-VAT Registered Small Business

Author: Peter Hingston

Review

“The Best Small Business Accounts Book (Yellow version)” by Peter Hingston is a comprehensive guide to managing finances for non-VAT registered small businesses. The book covers everything from setting up an account to operating income and expenses, calculating profit, and preparing financial statements. The author provides the following.

- Clear explanations.

- Easy-to-use templates.

- Practical tips to help small business owners improve their financial management skills.

The book also includes a troubleshooting section and advice on best practices. The Best Small Business Accounts Book is a remarkable resource for anyone looking to simplify their accounting process and stay on top of their finances.

Key Takeaways

- This book is designed for non-VAT registered small businesses in the UK.

- Readers will learn how to set up and manage accounting systems for their business, including creating financial statements, managing cash flow, and preparing for tax season.

- The book also includes practical bookkeeping, record-keeping, and budgeting advice.

- It is an excellent resource for small business owners who want a simple and practical guide to managing their finances.

Book #10: Accounting Information Systems: The Crossroads of Accounting and IT

Author: Donna Kay, Ali Ovlia

Review

Donna Kay and Ali Ovlia’s “Accounting Information Systems: The Crossroads of Accounting and IT” is an extensive guide to understanding the role of technology in accounting. The book covers database management, computer security, and system design. With a focus on simplifying complex concepts, using real-world illustrations, and providing actionable advice, the authors skillfully elucidate how technology can significantly enhance accounting processes, empowering readers to streamline their financial management. The book also includes case studies and discussions on emerging trends and issues in the field. It is an excellent read for anyone who understands the intersection of accounting and technology.

Key Takeaways

- This book explores the intersection between accounting and information technology.

- Readers will learn how accounting information systems (AIS) can improve business processes, enhance decision-making, and reduce risks.

- The book covers essential topics such as database management, system development, and security controls.

- It is the go-to resource for accounting professionals and business owners who want to understand the role of technology in accounting and how to leverage it for better financial management.

Recommended Articles

Our Top 10 Alternatives to Quickbooks compilation aims to be helpful to you. For more such Alternatives to Quickbooks, EDUCBA recommends the following,