Updated July 24, 2023

Annual Return Formula (Table of Contents)

What is the Annual Return Formula?

The term “annual return” refers to the return earned from an investment over a given period of time, and as such, it is expressed as the time-weighted annual percentage.

The returns are earned in the form of dividend pay-out, coupon payment, and capital appreciation, while the investment assets include stocks, bonds, commodities, funds, and derivatives.

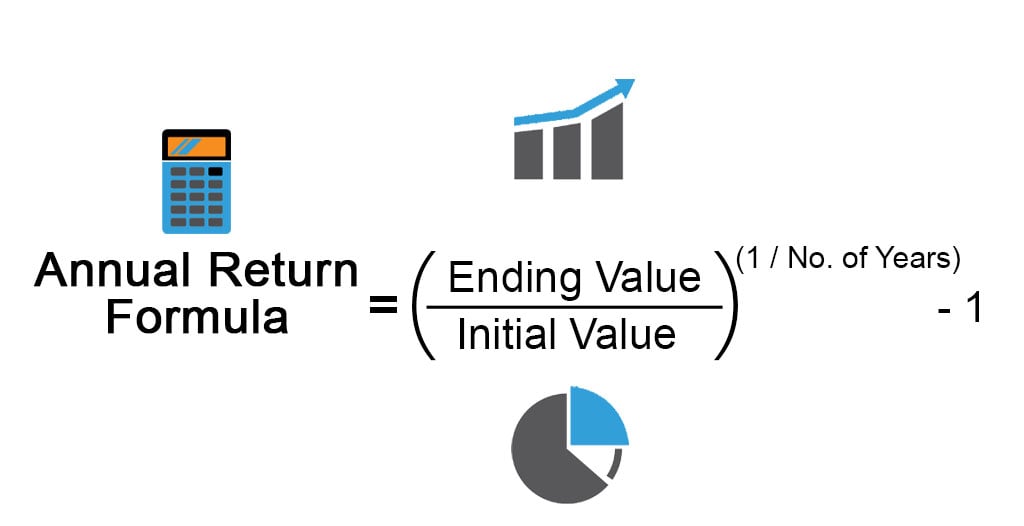

The formula for annual return is expressed as the value of the investment at the end of the given period divided by its initial value raised to the number of years’ reciprocal and then minus one. Mathematically, it is represented as,

Examples of Annual Return Formula (With Excel Template)

Let’s take an example to understand the calculation of the Annual Return in a better manner.

Annual Return Formula – Example #1

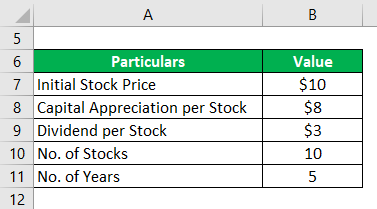

Let us take an example of an investor who purchased 10 stocks of a company worth $10 each on January 1, 2014. The investor decided to sell off all the stocks on December 31, 2018, for a capital appreciation of $8 per stock. Further, the investor also received dividends of $1 per stock in 2014 and $2 per stock in 2017, totaling dividend income of $3 per stock during the five-year holding period. Calculate the annual return earned by the investor during the period.

Solution:

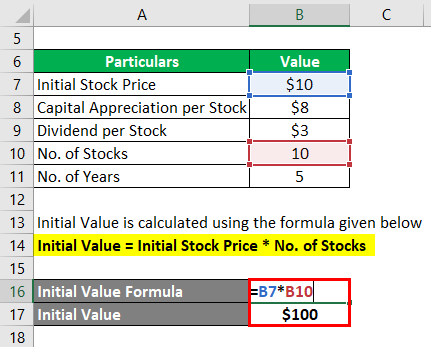

Initial Value is calculated using the formula given below

Initial Value = Initial Stock Price * No. of Stocks

- Initial Value = $10 * 10

- Initial Value = $100

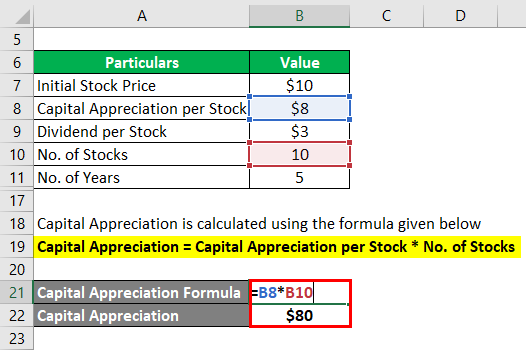

Capital Appreciation is calculated using the formula given below

Capital Appreciation = Capital Appreciation per Stock * No. of Stocks

- Capital Appreciation = $8 * 10

- Capital Appreciation = $80

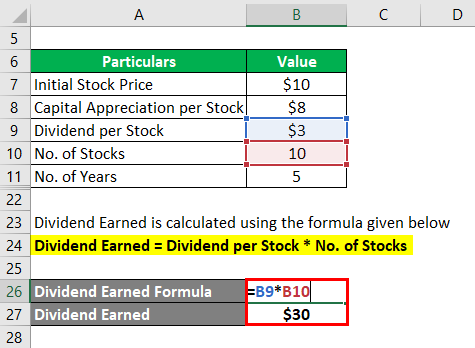

Dividend Earned is calculated using the formula given below

Dividend Earned = Dividend per Stock * No. of Stocks

- Dividend Earned = $3 * 10

- Dividend Earned = $30

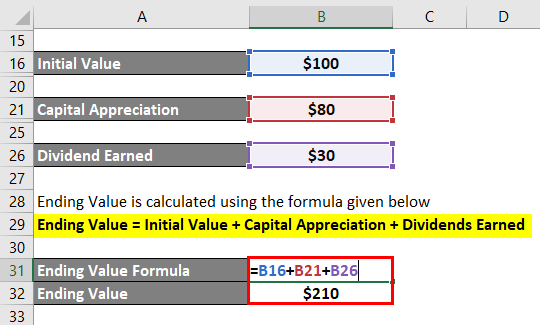

Ending Value is calculated using the formula given below

Ending Value = Initial Value + Capital Appreciation + Dividends Earned

- Ending Value = $100 + $80 + $30

- Ending Value = $210

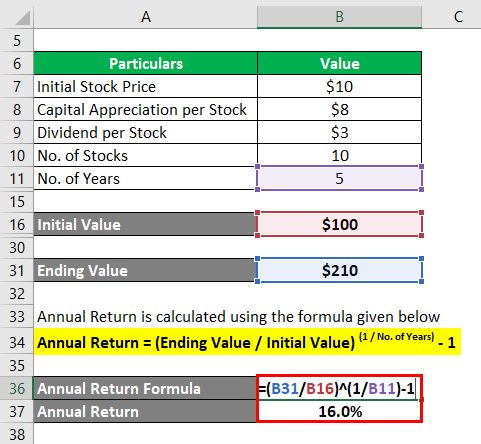

Annual Return is calculated using the formula given below

Annual Return = (Ending Value / Initial Value) (1 / No. of Years) – 1

- Annual Return = ($210 / $100) 1 / 5 – 1

- Annual Return = 16.0%

Therefore, the investor earned an annual return at the rate of 16.0% over the five-year holding period.

Annual Return Formula – Example #2

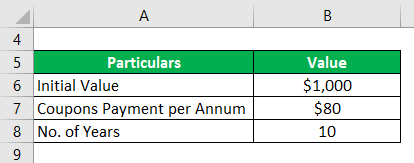

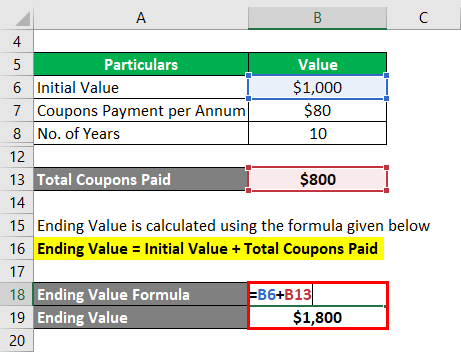

Let us take the example of Dan, who invested $1,000 to purchase a coupon paying bond on January 1, 2009. The bond paid $80 per annum as a coupon every year till its maturity on December 31, 2018. Calculate the annual return earned by Dan during the 10-year holding period.

Solution:

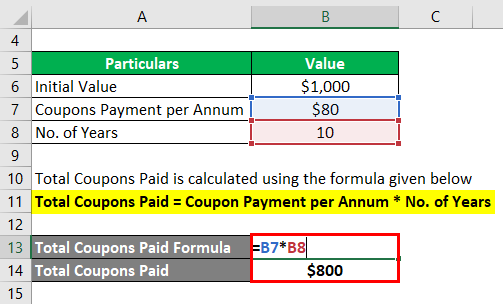

Total Coupons Paid is calculated using the formula given below

Total Coupons Paid = Coupon Payment per Annum * No. of Years

- Total Coupons Paid = $80 * 10

- Total Coupons Paid = $800

Ending Value is calculated using the formula given below

Ending Value = Initial Value + Total Coupons Paid

- Ending Value = $1,000 + $800

- Ending Value = $1,800

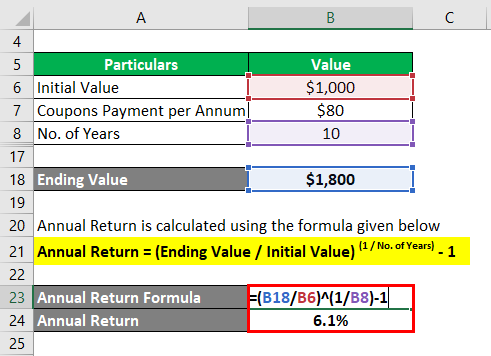

Annual Return is calculated using the formula given below

Annual Return = (Ending Value / Initial Value) (1 / No. of Years) – 1

- Annual Return = ($1,800 / $1,000) 1 / 10 – 1

- Annual Return = 6.1%

Therefore, the bond investment generated an annual return at the rate of 6.1% for Dan over the 10-year holding period.

Explanation

The formula for annual return can be derived by using the following steps:

Step 1: Firstly, determine the amount of money invested at the start of the given investment period.

Step 2: Next, determine the value of the returns earned on the investment (dividends or coupons) during the given period. Also, determine the capital appreciation of the investment. Now, add up all the returns to the investment’s initial value to compute its ending value.

Step 3: Next, determine the number of years for which the investment was made.

Step 4: Finally, the formula for annual return can be derived by dividing the ending value of the investment (step 2) by its initial value (step 1), which is then raised to the reciprocal of the number of years (step 3) and then minus one as shown below.

Annual Return = (Ending Value / Initial Value) (1 / No. of Years) – 1

Relevance and Use of Annual Return Formula

The concept of annual return is very important for an investor. It helps determine the average return generated by an asset over its entire holding period, which may include instances of extreme losses and gains. Further, it is one of the simplest forms of return assessment calculation, which is easily understandable. The annual return is basically the geometric average of the investment return over a period of time. This formula is extensively used by a fund manager and portfolio analyst who analyzes the performance of a variety of assets that include stocks, bonds, mutual funds, commodities, ETFs, etc.

Annual Return Formula Calculator

You can use the following interest Formula Calculator

| Ending Value | |

| Initial Value | |

| No. of Years | |

| Annual Return | |

| Annual Return = | (Ending Value / Initial Value)( 1 / No. of Years)- 1 |

| = | (0 / 0)(1 / 0)- 1 = 0 |

Recommended Articles

This is a guide to Annual Return Formula. Here we discuss how to calculate annual returns along with practical examples. we also provide an annual return calculator with a downloadable excel template. You may also look at the following articles to learn more –