Updated July 24, 2023

Annualized Rate of Return Formula (Table of Contents)

What is the Annualized Rate of Return Formula?

The term “annualized rate of return” refers to an investor’s equivalent annual return over the investment holding period. In other words, the annualized rate of return is the overall return generated by the investment over a period which is then scaled down to a 12-month (or one-year) period. The overall return includes capital appreciation and other gains or losses during the investment period.

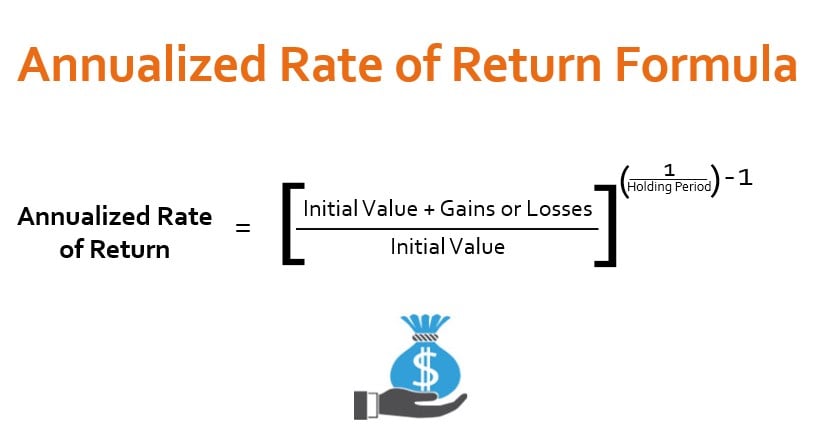

The formula for an annualized rate of return is expressed as the sum of initial investment value and gains or losses during the given period divided by its initial value, which is then raised to the reciprocal of the holding period in years and then minus one. Mathematically, it is represented as,

Example of Annualized Rate of Return Formula (With Excel Template)

Let’s take an example to understand the annualized Rate of Return calculation in a better manner.

Example #1

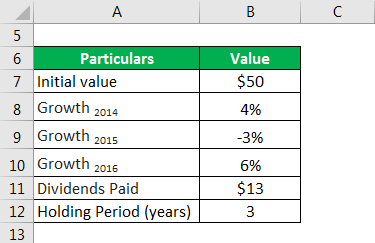

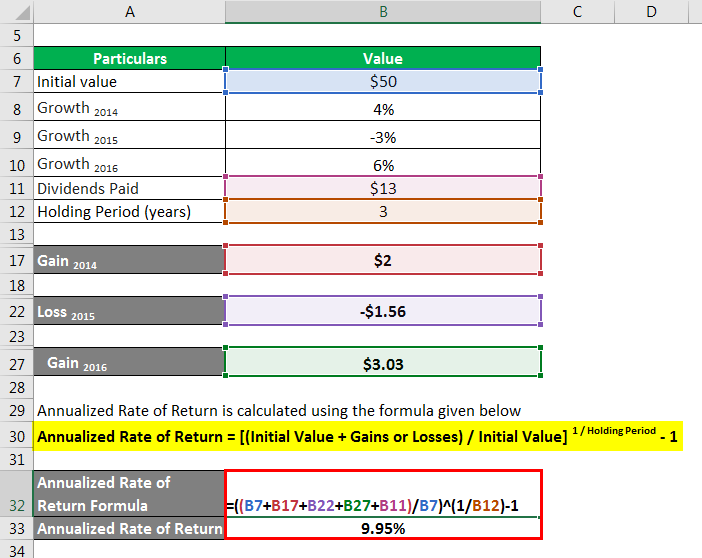

Let us take the example of John, who purchased a mutual fund worth $50 on January 1, 2014. The mutual fund grew by 4% and 6% in 2014 and 2016, respectively, while it declined by 3% in 2015. Further, the mutual fund offered dividends of $5 per stock in 2014 and $8 per stock in 2016. Calculate the annualized rate of return of the mutual fund investment during the holding period if John sold it off on December 31, 2016.

Solution:

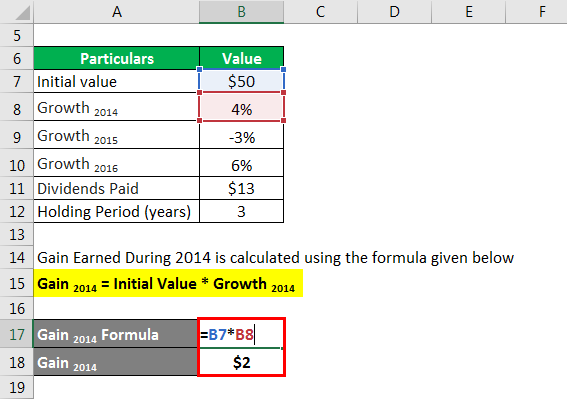

Gain Earned During 2014 is calculated using the formula given below

Gain 2014 = Initial Value * Growth 2014

- Gain 2014 = $50 * 4%

- Gain 2014 = $2

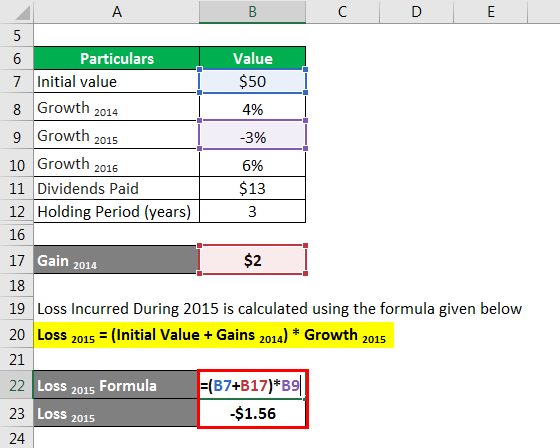

Loss Incurred During 2015 is calculated using the formula given below

Loss 2015 = (Initial Value + Gains 2014) * Growth 2015

- Loss 2015 = ($50 + $2) * (-3%)

- Loss 2015 = -$1.56

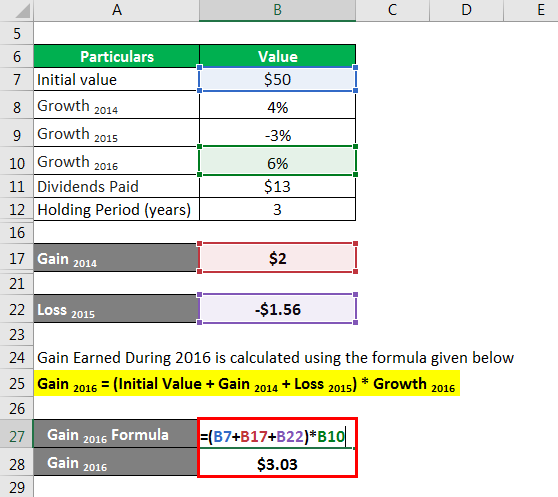

Gain Earned During 2016 calculates by using the formula given below

Gain 2016 = (Initial value + Gain 2014 + Loss 2015) * Growth 2016

- Gain 2016 = ($50 + $2 – $1.56) * 6%

- Gain 2016 = $3.03

Annualized Rate of Return calculates by using the formula given below

Annualized Rate of Return = [(Initial Value + Gains or Losses) / Initial Value] 1 / Holding Period – 1

- Annualized Rate of Return = [($50 + $2 – $1.56 + $3.03 + $13) / $50 ]1 / 3 – 1

- Annualized Rate of Return = 9.95%

Therefore, John’s mutual fund investment earned him an annualized rate of return of 9.95% during the three-year holding period.

Example #2

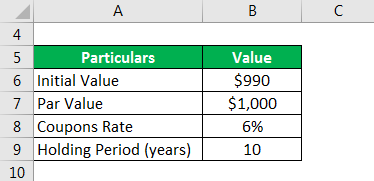

Let us take an example of an investor who purchased a coupon paying a $1,000 bond for $990 on January 1, 2005. The bond paid coupon at 6% per annum for the next 10 years until its maturity on December 31, 2014. Calculate the annualized rate of return the investor earns from the bond investment.

Solution:

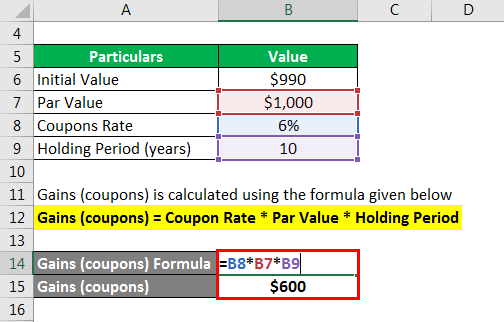

Gains (coupons) calculates by using the formula given below

Gains (coupons) = Coupon Rate * Par Value * Holding Period

- Gains (coupons) = 6% * $1,000 * 10

- Gains (coupons) = $600

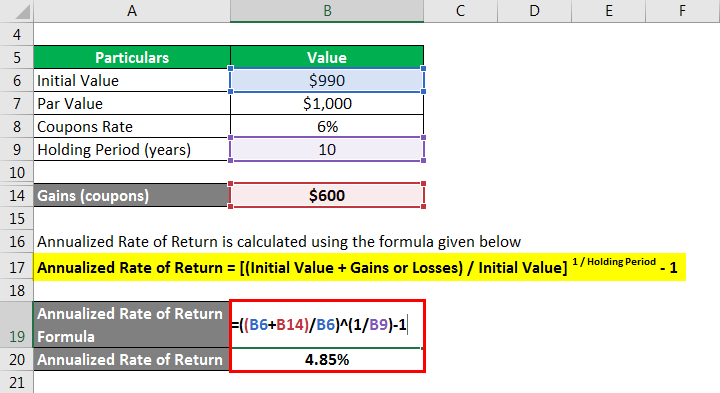

Annualized Rate of Return calculates by using the formula given below

Annualized Rate of Return = [(Initial Value + Gains or Losses) / Initial Value] 1 / Holding Period – 1

- Annualized Rate of Return = [($990 + $600) / $990 ]1 / 10 – 1

- Annualized Rate of Return = 4.85%

Therefore, the investor earned an annualized rate of return of 4.85% from the bond investment over the 10-year holding period.

Explanation

The formula for the Annualized Rate of Return can be calculated by using the following steps:

Step 1: Firstly, figure out the initial investment value, which is the investment at the beginning of the given period.

Step 2: Next, determine the value of any gains or losses recognized during the investment holding period.

Step 3: Next, figure out the holding period of the investment in terms of the number of years.

Step 4: Finally, the formula for an annualized rate of return can be derived by dividing the sum of initial investment value (step 1) and the periodic gains or losses (step 2) by its initial value, which is then raised to the reciprocal of the holding period (step 3) and then minus one as shown below.

Annualized Rate of Return = [(Initial Value + Gains or Losses) / Initial Value] 1 / Holding Period – 1

Relevance and Use of Annualized Rate of Return Formula

Understanding the concept of an annualized return rate is important because it scales down the overall return to a comparable period and averages out the gains and losses during the holding period. As such, it is useful for comparing the sustainable performance of different assets over a longer time horizon. Fund managers and portfolio analysts predominantly use this formula to objectively compare the returns of various assets, such as bonds, ETFs, stocks, mutual funds, commodities, etc.

Annualized Rate of Return Formula Calculator

You can use the following Annualized Rate of Return Formula Calculator

| Initial Value | |

| Gains or Losses | |

| Holding Period | |

| Annualized Rate of Return | |

| Annualized Rate of Return = | [(Initial Value +Gains or Losses)/Initial Value] 1/Holding Period -1 |

| = | [( 0 +0)/0] 1/0-1 = 0 |

Recommended Articles

This is a guide to the Annualized Rate of Return Formula. Here we discuss how to calculate the Annualized Rate of Return along with practical examples. We also provide an Annualized Rate of Return calculator with a downloadable excel template. You may also look at the following articles to learn more –