Updated July 27, 2023

Annuity Formula (Table of Contents)

What is the Annuity Formula?

An annuity in very simple terms, is basically a contract between two parties wherein one party pays the lump sum amount at the start or series of payment initially and in return will get the period payment from the other party.

So it is basically a financial product in which series of payment which is made at regular intervals. This annuity contract is divided into two parts. First is the accumulation and in this phase, you invest your money in the financial the chosen financial instrument and next is annuitization, in which you will be receiving steady payments for the stipulated time period. This is a very common method which is used by many investors to secure their retirement. They save today and choose annuity so that once they become old, they will have a steady flow of income coming.

Generally, insurance companies sell these annuity contracts. Insurance companies take those deposit amount and take the risk to guarantee regular future payments to investors. The annuity also gives investors the flexibility of making payments and that can be done in lump sum amount, monthly, quarterly, etc.

Formula for Annuity is as follow:

There are many ways in which we can define the annuity formula and it depends what we want to calculate.

- If we want to see what is the lump sum amount which we have to pay today so that we can have stable cash flow in the future, we use the below formula:

Where,

- P – Present value of Annuity or the lump sum amount

- C – Future cash flow stream

- r – Interest rate

- n – Number of Periods

- Similarly, if you want to find out what will be the cash flow stream, we can use the slightly modified formula:

Examples of Annuity Formula (With Excel Template)

Let’s take an example to understand the calculation of the Annuity in a better manner.

Annuity Formula – Example #1

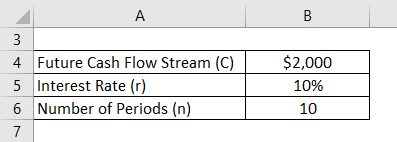

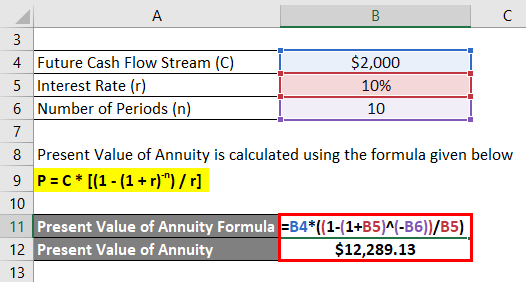

Let say you want to have $2000 payment of annuity from next year for 10 years. The current market rate is 10%. Let’s calculate how much you have to deposit today:

Solution:

Present Value of Annuity is calculated using the formula given below

P = C * [(1 – (1 + r)-n) / r]

- Present Value of Annuity = $2000 * ((1 – (1 + 10%)-10) / 10%)

- Present Value of Annuity = $12,289.13

So you have to pay $12289.13 today to receive $2000 payment from next year for 10 years.

Annuity Formula – Example #2

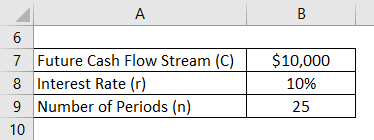

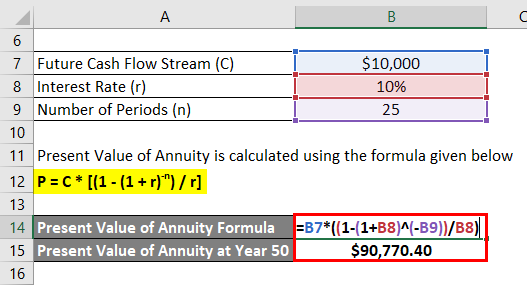

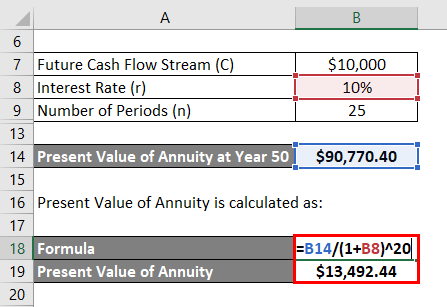

Let say your age is 30 years and you want to get retired at the age of 50 years and you expect that you will live for another 25 years. You have 20 years of service left and you want that when you retire, you will get an annual payment of $10,000 till you die (i.e. for 25 years after retirement). For that, we want to save money today. Market interest rate is 10%. You have $15000 which you can invest today. We will check that will that be enough to meet the targets.

Solution:

Now we want to get $10,000 starting from year 51 to year 75 (25 years).

Present Value of Annuity is calculated using the formula given below

P = C * [(1 – (1 + r)-n) / r]

- Present Value of Annuity at Year 50 = $10,000 * ((1 – (1 + 10%)-25) / 10%)

- Present Value of Annuity at Year 50 = $90,770.40

But that value you need at year 50 i.e. 20 years from now. You want to see the money you need today. So we need to calculate the present value of that amount today.

Present Value of Annuity is calculated as:

- Present Value of Annuity = $90,770.40 / (1 + 10%)20

- Present Value of Annuity = $13,492.44

Since you have $15,000 with you and you only need $13,492.44, you are covered and will be able to achieve your target.

Explanation

There are basically 2 types of annuities we have in the market:

- Fixed Annuity: It is the traditional financial instrument which we discussed above. You invest a specific amount and the institution will guarantees you fixed periodic payments.

- Variable Annuity: It is very different than the traditional fixed annuity. In this model, it does not guarantee you fixed payments, rather pays you based on the performance of the investments. So if an investment does well, you can have higher returns and vice versa.

Annuities, as we discussed above, provide a fixed series of payments once you pay the amount to the financial institutes. But how institutes able to pay the investor the fixed amount on a periodic basis is that they invest that amount in the financial instruments which are high in quality and provide fixed-income to the institutes. These instruments are generally high rated bonds and T-bills.

Relevance and Uses of Annuity Formula

Annuities are a great financial instrument for the investors who want to secure their future and want to have constant income coming in once they retire. Although annuity is a secure stream of payment which one gets to buy this financial instrument is not relevant for everyone. If you have enough income and not bothered that you will be short of money in the future, an annuity is not meant for you. You can choose other lucrative investments.

Also, there are some risks associated with an annuity which investors should also keep in mind. First is the opportunity cost. In an annuity, the market rates get locked and if the rate increase in the future, you will lose out those opportunities. But this can be mitigated up to an extent by not entering into long term annuity and doing gradual annuity. It will give you more room to play and make use of an increasing interest rate.

Annuity Formula Calculator

You can use the following Annuity Calculator

| C | |

| r | |

| n | |

| P | |

| P = | C X |

| ||||||||

| 0 X |

|

Recommended Articles

This is a guide to Annuity Formula. Here we discuss how to calculate Annuity along with practical examples. We also provide an Annuity calculator with a downloadable excel template. You may also look at the following articles to learn more –