Updated July 21, 2023

Introduction to Asset Turnover Ratio

An asset turnover ratio (ATR) measures how efficiently the assets of a company are deployed to generate revenue or sales. It is a ratio between the total amount of net sales in dollar amount to the total amount of assets which was utilized to generate the same amount of net sales mentioned above and the ratio is mostly calculated on an annual basis.

The asset turnover ratio is defined as the ratio between net sales to the total assets through which this sale was generated. Generally, a higher number of this ratio is preferred which means the company is capable enough or has enough assets to cover up its net sales or revenue.

A lower number of this ratio signifies that the assets of the company and not utilized properly or the company is going through some internal problems. Asset turnover ratios of companies operating in the same industry must be used for comparison as it differs from industry to industry.

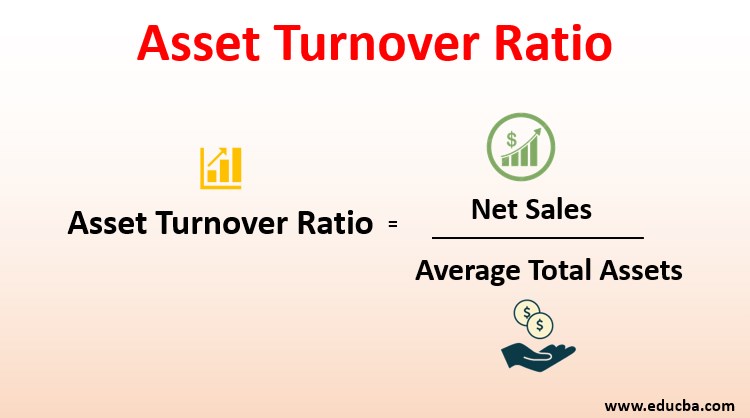

Formula to Calculate Asset Turnover Ratio

The formula to calculate the ATR is as follows:

Net sales are defined as the number of sales made by a company where we don’t include the sales return, sales discount, and the sales allowances. Average total assets are defined as the average of the total asset which we take into account generally at the end of the year or the earlier fiscal year.

Example of Asset Turnover Ratio

Let us consider a business that has initially reported to have an asset worth $200,000 at the beginning of the year. After the passage of a year, the same company reported assets worth $180,000 in the year where the assets were utilized to generate sales or revenue. During the same period, the sales of the company were estimated to be at $ 350,000 which also had a sales return of $10,000 and a sales allowance figure stood at $20,000. In this case to calculate the asset turnover ratio of the company we need to do the below calculation.

Asset Turnover Ratio = Net Sales / Average Total Assets

- ATR = [$350,000 – ($10,000 + $20,000)] / [($200,000 + $180,000)/2]

- ATR = ($350,000 – $30,000) / ($38,0000/2)

- ATR = $320,000 / $190,000

- ATR = 1.68

Thus this means for every dollar which was employed in the total asset the company current has, the company generates $1.68 in sales.

Interpretation of Asset Turnover Ratio

Asser turnover ratio varies from industry to industry. A lower ratio signifies that assets are underutilized and the business lacks efficiency and there might be some internal problems associated with the company. Investors too prefer companies with a high asset turnover ratio because this in one way proves that the company is deemed to be financially healthy and good in utilizing its assets.

Industries that are driven with a lesser margin of profit are generally the ones where the ratio is very high whereas the companies which operate in a capital intensive industry tend to have a very low number of the same ratio. A higher number of this ratio is the one that a company or industry would desire because it represents an efficient and effective use of the assets in generating sales for the company. Though it may not always be a case that a company with a low ATR will have some major issues as in some industries it is common to have a lower ratio.

Asset Turnover Ratio vs Return on Assets

The basic difference between asset turnover ratio and return on asset is that the where ATR is defined as the ratio between net sales to the total assets through which this sale was generated, on the other hand, return on asset is defined as the ratio between net income to the total assets through which this income was earned. In terms of asset turnover ratio, it shows how much sales are made utilizing per dollar amount of the asset whereas in case of return on asset ratio it shows us how much per dollar we invest in the asset to generate the amount of the net earnings. Thus on the basis of a formula, we can determine the follows:

Advantages and Disadvantages of Asset turnover Ratio

Below are the advantages and disadvantages:

Advantages

The advantages of ATR can be considered as the following:

- It takes into consideration all the assets: There are other ratios which is called fixed asset turnover ratio which only includes fixed asset but in the case of ATR we generally consider all the assets under operation i.e. both fixed and current assets.

- It balances the revenue in sales along with the proportion of assets: This ratio is very useful for companies that are in the growth stage to check if the revenue generated is proportionate to the assets deployed.

- Success/Failure rate of asset: Managers can determine how effective or efficient their asset deployment has been for the company.

Disadvantages

The disadvantages of the ATR can be considered as the following:

- It includes idle asset too: The ratio includes the entire asset even those which were not deployed in the production or not considered in the specific period where the turnover was generated. Thus this ratio can be incorrect based on the list of the actual asset used an asset which did not contribute at all.

- Individual asset performance: The ratio is the performance of all assets in general. Thus it is not possible to understand or measure how individual asset is performing.

- Profit Calculation: This ratio does not give a clear picture of how good/bad a company is earning its profit.

Conclusion

Asset turnover ratio is a key number for every business be it big or small because it helps managers to determine how effective or efficient their asset deployment has been for the company. The only thing which one must understand for the comparison of this ratio is that ratios of companies operating in the same industry must be used for comparison as it differs from industry to industry.

Recommended Articles

This is a guide to Asset Turnover Ratio. Here we discuss the introduction to Asset Turnover Ratio along with the interpretation, advantages, and disadvantages & example. You may also look at the following articles to learn more –