Updated July 17, 2023

Definition of At the Money

At the money, the term is used in the context of the options strategy. It refers to the strike level where the underlying security price (let’s denote it by S) is equal to the strike price (let us denote it by K). At the money, Option refers to a situation where the underlying security price and the strike price of the option on the security are both same. At the money, the option is popularly denoted as the ATM option.

Mathematically at the money can be denoted in equation form as:

S = K

An at the money option comprises of the only time value of money and has no intrinsic value unlike an in the money option (under this the strike price (K) is within the security price(S) in such a way that the security price is over and above the strike price) in which the option has both intrinsic value as well as time value of money.

Explanation

At the money, term is used in describing the moneyness of an option with respect to the underlying price of the security against which the option is to be exercised. For a better understanding of an At money option let’s understand the two components of an option which makes together with the option value.

| Intrinsic Value |

|

| Time Value |

|

There are three types of moneyness based on which option is classified namely:

- In the Money Option (Also known as ITM)

- At the Money Option (Also known as ATM)

- Out of Money Option (Also known as OTM)

Example of At the Money

Let’s understand At the money with the help of an example:

ABC Limited stock is currently trading at $30 on NASDAQ on 30th Sep 2020. On that day the price of the following strikes are as follows:

|

Strike Price( in $) |

Premium |

| 25CE | $9 |

| 30CE | $3.5 |

| 35CE | $1.5 |

All the strikes mentioned above expire at the end of october 2020. As we can see currently the stock of abc limited is trading at $30 and accordingly, the strike price of $30 is At the money and the option premium value of $3.50 comprises of the time value of money and there is no intrinsic value in it.

On the contrary, the strike price of $ 25 is In the money option, and the premium value of $9 comprises both the Intrinsic value as well as the time value of money.

Option Pricing for At the Money

There are various option pricing models used for the pricing of options among them the most famous and popularly used one is the black scholes pricing model which requires certain variables such as strike price, underlying stock price, implied volatility, time to maturity of the option as well as the interest rates.

However, the model suffers from certain limitations and over the period has been modified to make it practicable for usage in the current scenario.

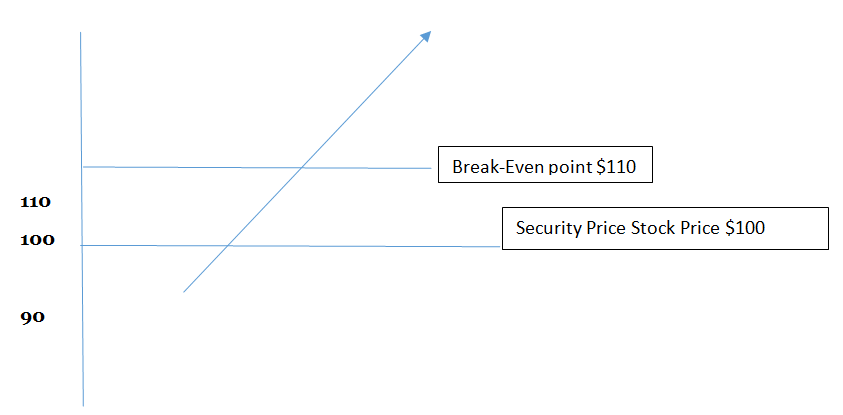

At the Money Diagram

Below is a simple payoff diagram of an At the money call option purchased by an investor with the below details:

- Current Stock Price: $100

- Strike Price: $100

- Premium paid: $10

- Break-even point: $110

Y-axis denotes the price of the underlying security And the X-axis denotes the premium as we move higher the Option value moves to the right and thereby increases.

Breakeven point happens when the price of the underlying stock is equivalent of strike price plus premium, in such case if the option expires at that level there will be no profit any loss for the option buyer as well as for the option seller ( transaction cost is assumed to be nil).

Advantages

At the money offers certain advantages which are enumerated below:

- At the money, the option is priced less expensively compared to In the money option as these options don’t have any intrinsic value.

- At the money, the option is a favorable choice in cases where big movements are expected in the underlying security.

- At the money, the option is mostly used in cases where option hedging strategies are used.

Disadvantages

Despite various advantages at the money suffers from certain disadvantages which are enumerated below:

- At the money, options cost more than out-of-money options and are impacted the most due to time decay as these options have the highest theta (a measure of time decay).

Conclusion

In the case of at the money options, three important greek tools are tracked namely delta, theta, and vega. the greek tools help in measuring the risk underlying the options. At the money options have the highest theta values compared to in the money and out of money options. Similarly at the money options have a delta of half compared to the underlying stock price which means the change in the option premium value will behalf to the change in the price of the underlying security. And finally, gamma which measures the rate of change in delta over time is highest for at money options.

At the money option are popular and the various greeks discussed above are used to track the risk sensitivity as well as the probability of profitability of such option by traders, investors as well as hedgers and accordingly modified as the underlying security price changes over time.

Reference: Options, Futures and Other derivatives by John C. Hull and sankarshanbasu.

Recommended Articles

This is a guide to At the Money. Here we also discuss the definition and option pricing for at the money along with advantages and disadvantages. You may also have a look at the following articles to learn more –