Updated July 17, 2023

Definition of Audit Procedure

Audit procedure is the process of obtaining audit evidence for auditing. Audit procedure includes Inspection, Observation, External confirmation, Re performance, Re calculation, Analytical procedure and Inquiry. Due to this process sufficient and appropriate audit evidence is found out.

It is very important to be followed by the auditors because it will directly affect the auditor’s report. It is determined through the process of review and analysis by following all the procedures in the financial reporting.

Explanation

Audit Procedure is a very vast subject it includes inspection, observation, re performance, re calculation, confirmation from the external sources, analytical procedures and also includes the inquiry. It is rightly said that if the audit procedures are used effectively then the audit evidence is very easily traced during the audit. The audit procedure makes a pillar for the audit of the company in that financial year. Audit Procedures also includes some sort of risk assessment procedures and also some test of controls. The auditor should have sound knowledge and expertise to implement the audit procedure. It has been seen that different organizations require different planning and so audit procedures are always subjective in nature. For example, if the company is recording all its documents in the electronic form then if the auditor will follow the traditional method of auditing the vouchers he will not get any audit points rather at that time he should use the computer to vouch for the bills etc. Therefore it is also recommended that auditor will have to decide regarding the audit procedures and if the choices are made effectively then we can get good audit points from our audit.

Examples of Audit Procedure

Suppose a big manufacturing concern wants to get their accounts audited from a firm of Chartered Accountants. So after all the engagements procedures were done the auditors visited the site and found out that the company is not following the proper depreciation method, the suppliers of the raw materials are not clearing the payments and some false bills are made on behalf of the suppliers, in most of the cases it has been seen that the prices of the raw materials are also not recorded properly. So in these cases, if an auditor is required to make an audit report then he should follow certain audit procedures.

- Firstly, he will have to do the inspection and do an inquiry regarding the raw materials’ prevailing prices in the market.

- Then he should perform external confirmation from the suppliers regarding the delay in payment and also after vouching all the bills the auditor will have to make sure that all the bills are recoded properly and are accounted for in the year of receipt.

- Auditor will have to find out the reasons for the change in the method of depreciation and therefore they will be required to do

- Therefore an auditor will have to perform almost all the audit procedure to find out the audit points to make their reliable audit report.

Classifications of Audit Procedures

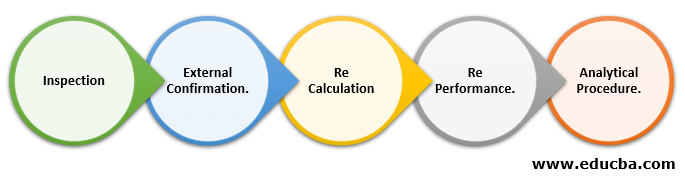

It can be classified as under:

- Inspection

- External Confirmation.

- Re Calculation

- Re Performance.

- Analytical Procedure.

An audit procedure is based upon these processes. An auditor is required to make an audit plan with the help of audit procedure prior then their teams are allocated their jobs to perform the audit in the field. Therefore, the procedure is also considered as a prerequisite to the audit.

Benefits

Some of the benefits are:

- Audit Procedure is the method of carrying out the audit smoothly.

- It can help in making the audit checklist in a better way.

- It is a tool that can be used by any auditor to find their audit evidence for the audit proceedings.

- Audit Procedure also helps to make the audit plans because the audit procedure will always be clear about the process of the audit to be taken by the auditors.

- It is through the audit procedure the fraudulent misstatements are easily located.

- In audit procedure inspection, observation, external confirmation is done in a very early stage so that the misstatements can be very easily checked.

- It is a prerequisite of any audit which is to be followed by an auditor before approving the audit plans.

- It also includes inquires to be made in case of any default is found out.

- These are well defined and are made in such a manner all the audit points can be covered while doing the audit to make a reliable audit report for the management to take it further.

Limitations of Audit Procedure

Some of the limitations are:

- It is always not possible for some auditors to follow all the assertions in the audit procedures.

- Audit procedure can be very cumbersome and time taking for the auditors to follow.

- In many organizations where there are large transactions takes place it is very difficult for the auditors to do the Re calculation or Re performing the same task to find out the mistakes or misstatements.

- Some organizations may not be willing to allow the auditors to do the external confirmation. So in that case auditor will have to report the limitations on the part of management. Therefore the auditor then will have to give qualification to the company.

- Some accountants may not be able to understand the exact logic f this audit procedure and thus they may certain things difficult for the auditors and these are some of the practical problems which is to be dealt.

Conclusions

In all walks of life, we have to follow a certain procedure to achieve the desired goals. In an audit scenario, audit procedures are being implanted so that the auditor can take maximum advantage of the same. But like everything has some limitations audit procedure also comes with some sort of limitations. It has been seen that the procedures are likely to be followed by large organizations but it would be great if all the audits are done by following the audit procedure defined.

Recommended Articles

This is a guide to Audit Procedure. Here we also discuss the definition and classifications along with benefits and limitations. You may also have a look at the following articles to learn more –