What is an Audit Report?

The term “audit report” refers to the auditor’s documented opinion regarding the subject company’s financial statements. An audit report’s main objective is to communicate the overall opinion about the completeness and integrity of the subject company’s financial reporting.

Given its importance, there is a defined structure and format for presenting an audit report, which will be discussed in detail in this article.

Explanation

The audit report is published as a part of any company’s annual report, and it is considered very important as it captures the final view of the entire audit process. The primary users of the financial statements, such as shareholders, lenders, and other investors, take into account the audit report of any company while making the final decision to invest in them. As such, an audit report is considered a critical part of the annual report as it influences the perceived value of a financial statement, so the auditor must be cautious while issuing an audit report as many people rely on it and take their decisions accordingly.

Contents of Audit Report

In general, the contents of an audit report should be as follows:

- Title of the Report: This is the first and foremost part of the audit report and helps the financial statement user identify the report. This section also covers the client’s name, i.e. the subject company.

- Name of the Addressee: This section mentions the name of the person who has appointed the auditor. If the company appoints the auditor for statutory audit, then the addressee’s name refers to the company’s shareholders. In the case of a special audit, the central government is the addressee.

- Introductory paragraph: This section covers the financial reporting period along with the exact dates. It also specifies that the view on the financial statements is the auditor’s opinion.

- Scope of Audit: This section mentions the audit examination’s entire scope and process. The audit covers the subject company’s book of accounts, income statement, balance sheet, and cash flow statement. Further, the audit should be conducted in accordance with the law of the land.

- Auditor’s opinion: The report’s most important part includes the auditor’s opinion regarding the company’s financial statements. The auditor expects to examine the book of accounts based on the available information and free of bias. The auditor’s opinion will cover the following aspects of the reporting:

-

- Correctness and authenticity of the figures recorded in the financial statements.

- True and fair representation of the operating results in the financial statements in case of an unqualified opinion.

- The reasons for the mismatch between actual results and financial reporting in case of a qualified opinion.

- Emphasis of Matter: This section follows the opinion paragraph, which is the audit report’s end. It indicates the matter that has been disclosed suitably in the financial statements notes because the auditor believes it to be an important fact that should be recognized by the end users of the financial statements in their economic decision-making.

- Signature: The manual or the auditor’s digital signature can be seen in this section of the report. Usually, the name of the auditors and their signature is captured here. The signature should have the firm’s name in cases where the auditor is firm.

- Place of Signature: This section captures the auditors’ and their firms’ locations, usually the city followed by the state.

- Date of the Report: In this section of the report, the date on which the audit work has been completed should be mentioned.

Example of Audit Report Contents

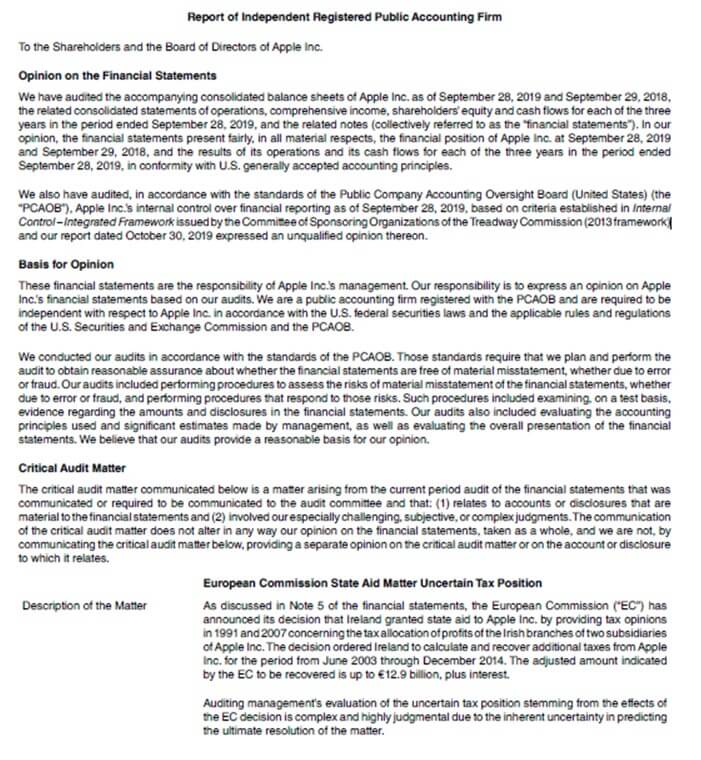

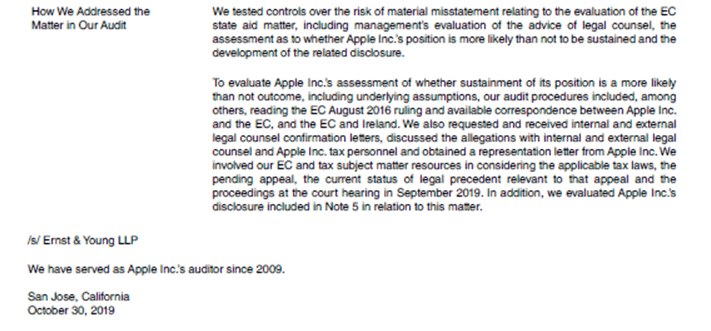

Let us take the example of Apple Inc.’s annual report for the year 2019, which has been audited by Ernst & Young LLP, and identify the contents that go into the audit report.

Let us look at the tabulated representation of the entire audit report and refer to the below screenshot for further details.

|

Sr. No. |

Particulars |

Excerpts from Annual Report |

| 1 | Title of the Report | Report of ………………. Accounting Firm |

| 2 | Addressee | To the Shareholders ……………. of Apple Inc. |

| 3 | Introductory paragraph | We have audited …………. consolidated statements of operations …………. the “financial statements”). |

| 4 | Scope of Audit | We conducted …………. the standards of the PCAOB. ………… Our audits also included ………… a reasonable basis for our opinion. |

| 5 | Auditor’s opinion | In our opinion……….. generally accepted accounting principles. |

| 6 | Emphasis of Matter | The critical audit matter ……….. Auditing management’s evaluation ………. in relation to this matter. |

| 7 | Signature | /s/ Ernst & Young LLP |

| 8 | Place of Signature | San Jose, California |

| 9 | Date of the Report | October 30, 2019 |

The screenshot of the audit report from Apple Inc.’s annual report for 2019.

Link: Apple’s Annual Report

Conclusion

So, it can be seen that an auditor issues an audit report after a thorough evaluation of the books of accounts and a company’s financial statements. The audit report contains their findings and opinion regarding the correctness and completeness of the financial reporting. Therefore, the content of an audit report provides an independent view of a company’s financial statements.

Recommended Articles

This is a guide to Audit Report Contents. Here we also discuss the introduction and contents of an audit report along with an example. You may also have a look at the following articles to learn more –