Updated July 17, 2023

Audit Report Overviews

An audit report is an independent opinion of a person/firm (i.e., auditor) about whether the financial statements present a true & fair view of the state of affairs of the entity, profit/loss of the entity & cash flows for the year, and such opinion is given after performing reasonable audit procedures so obtain sufficient & appropriate evidence for the assurance given on the financial statements.

Explanation

- Shareholders are the owners of the entity. They do not have much time to look for each transaction and/or event occurring in the organization. They also cannot blindly rely on the management appointed by them. Hence, shareholders require third-party assurance on their financial statements.

- This is a normal requirement of global shareholders (at least for corporate entities). To avoid confusion among shareholders, auditors standardize audit reports at some level, ensuring consistency between the audit reports of different entities.

- Please note only the format is standardized & “not the opinion”. Too much subjectivity involves in drafting the opinion paragraph. That’s the beauty of an audit report since each person/firm of auditors should have a different perspective.

- The audit report is the first page of the set of annual reports of the company. After the audit report, the financial statements follow.

- In the United States of America, Certified Public Accounting firms are given the authority to audit & provide opinions on financial statements. In India, Chartered Accountants or a firm of Chartered Accountants are given the authority to audit & provide an opinion.

- The company’s financial statements provide an opinion.

- Types of audit reports mean the types of opinions. Different types of opinions are Clean/ Unmodified opinion, Qualified Opinion, Adverse opinion & Disclaimer of Opinion.

- A clean opinion means there are no fraudulent aspects of the company. The financial statements are presented fairly. The company complies with laws & regulations.

- Qualified Opinion means the company is normally compliant with laws & regulations. However, there are some areas where the auditor comments that it is not compliant with laws & regulations. Other than the said areas, the remaining financial statements are clean & can be relied upon. Auditors need to have evidence for such a qualified opinion.

- Adverse Opinion is the worst opinion. The auditor does not have confidence in the financial statements & he cannot rely on the fair presentation of the financial statements. The company may become fraudulent in the near future. Everything is grossly misstated in the financial statements & the auditor has evidence to support the opinion.

- Disclaimer of opinion means “auditor is unable to provide opinion due to many circumstances including unable to obtain the evidence”. Such an opinion reflects the weakness in the management of the company. “No opinion” things have many legal implications for the company.

Examples of Audit Reports

Let’s have the following set of examples for understanding the audit reports & their format. The first example is in a detailed manner. From the second example, we only focus on the crux part of the report.

Example #1

For example, we will take Domino’s Pizza, Inc.’s audit report for 2019. The report is signed on behalf of PricewaterCoopers LLP (PWC). The report is signed on February 20, 2020.

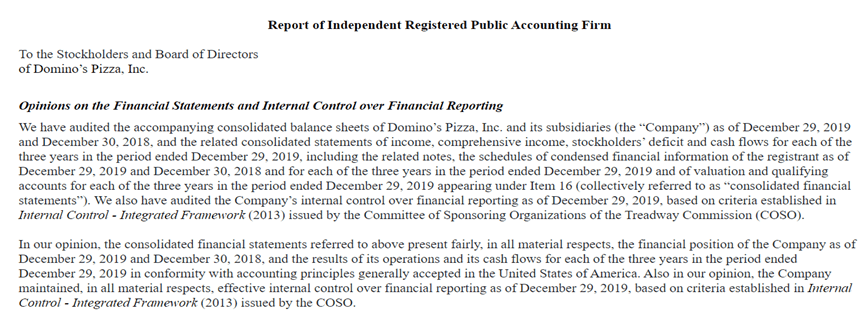

Heading & Opinion

Source: https://www.sec.gov/ix?doc=/Archives/edgar/data/1286681/000119312520042675/d796357d10k.htm

- Every audit firm should have the heading “Report of Independent Registered Public Accounting Firm”. It is addressed to “the stockholders & Board of Directors of Domino’s Pizza Inc”.

- The main opinion is as follows: (most important words are highlighted)

“In our opinion, the consolidated financial statements referred to above present fairly, in all material respects, the financial position of the company as of december 29, 2019 and december 30, 2018, and the results of its operations and its cash flows for each of the three years in the period ended december 29, 2019 in conformity with accounting principles generally accepted in the united states of america. Also in our opinion, the company maintained, in all material respects, effective internal control over financial reporting as of december 29, 2019, based on criteria established in internal control – integrated framework (2013) issued by the COSO.”

- As you can see, “present fairly” means a fair presentation of the financial statements. This means the report is “clean”. A clean report also means an unmodified report. The clean report implies the company is not fraudulent & it is lawfully compliant in all terms. Further, the internal controls of the company are “effective.”

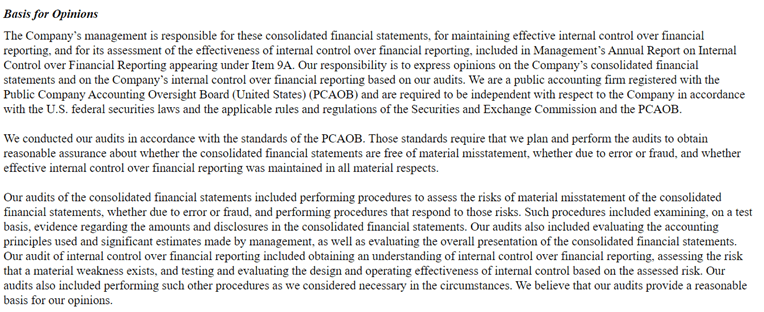

Basis for Opinion

Source: https://www.sec.gov/ix?doc=/Archives/edgar/data/1286681/000119312520042675/d796357d10k.htm

- The para provides the basis the auditor takes to provide the opinion.

- Basis para provides a glimpse of the procedures followed by the auditor in accordance with laws & regulations.

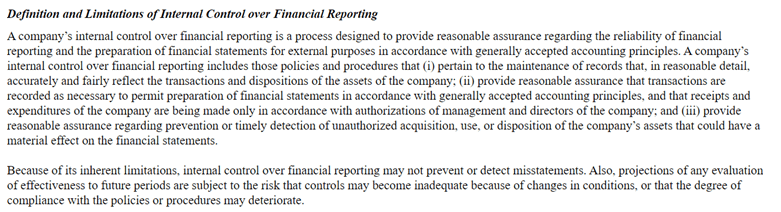

Limitations of Internal Controls over Financial Reporting

Source: https://www.sec.gov/ix?doc=/Archives/edgar/data/1286681/000119312520042675/d796357d10k.htm

- The auditor clarifies that despite the best internal controls, the company may or may not prevent or detect misstatements. Internal controls provide reasonable assurance.

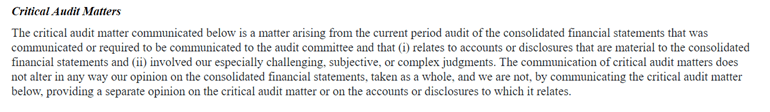

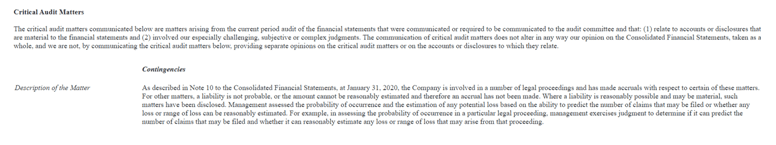

Critical Audit Matters

Source: https://www.sec.gov/ix?doc=/Archives/edgar/data/1286681/000119312520042675/d796357d10k.htm

- The auditor communicates the important areas of the evaluation to the audit committee.

- Such matters do not affect the main opinion per se. Through the audit report, the auditor specifies that he has communicated important matters.

Example #2

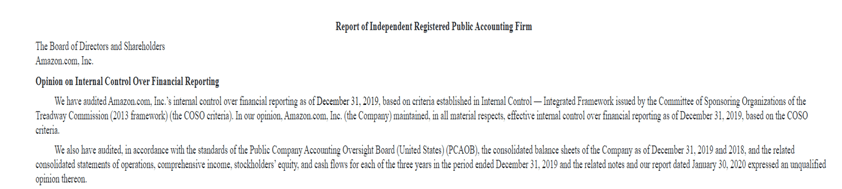

Next, we can take the example of an audit report issued to “Amazon Inc”. The report was signed by Ernst & Young LLP (also knowns as EY) on January 30, 2020, relating to the calendar year 2019. Let’s see the opinion para here:

- There is an unqualified opinion on the financial statements. Also, the auditors certify that internal controls are effective.

Example #3

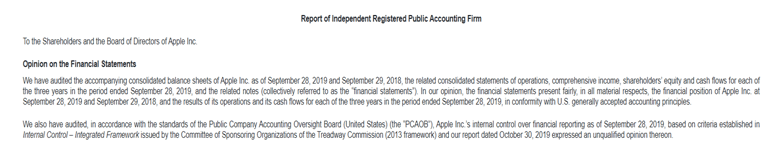

Next, we take the example of an audit report issued to Apple Inc.

Source: https://www.sec.gov/ix?doc=/Archives/edgar/data/320193/000032019319000119/a10-k20199282019.htm

- The report specifies an unqualified opinion. Further, the auditor has communicated the Critical Audit matters to the audit committee:

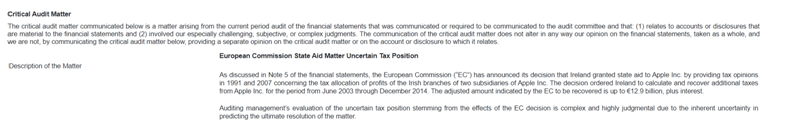

Source: https://www.sec.gov/ix?doc=/Archives/edgar/data/320193/000032019319000119/a10-k20199282019.htm

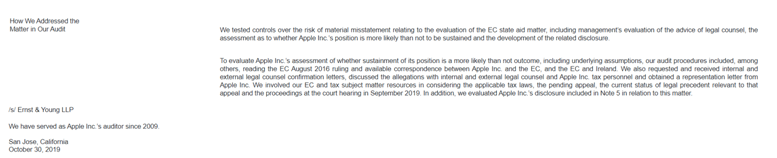

- Further, they have also stated how they have dealt with the matter in the audit report while drafting the unqualified opinion:

Source: https://www.sec.gov/ix?doc=/Archives/edgar/data/320193/000032019319000119/a10-k20199282019.htm

Example #4

Next example we take for Walmart Inc:

- The report is unqualified. However, the auditor specified two critical audit matters in the report.

First Matter

It says that the company involves in a number of legal proceedings. The company has to follow the basic accounting principles, including accruing the probable liabilities. Probable means more than a 50% chance of occurrence. The auditor says that the company has not estimated the same.

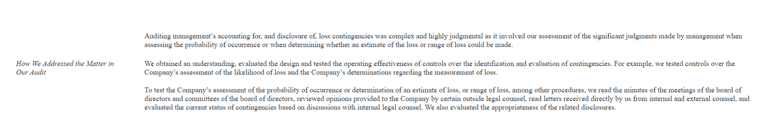

The auditor also specifies how he has dealt with an opinion & how the opinion is still unqualified. The auditor has followed the procedures & has found them to be appropriate. Thus, one can rely on an unqualified opinion.

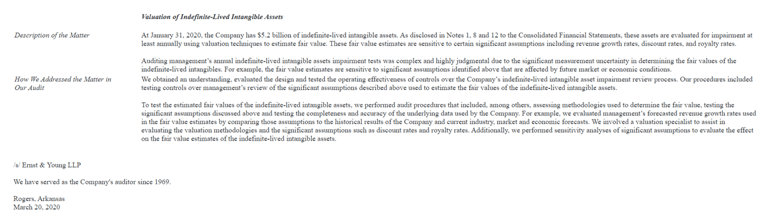

Second Matter

The second matter specifies that the company has valued the “indefinite life” of intangible assets. It has also stated how the matter is dealt with in providing the final opinion.

Conclusion

An audit report is the first thing shareholders search for after understanding the presentation of financial statements. Suppose the audit report does not give them the required confidence or assurance. In that case, it has serious implications for the company’s management and those behind it. Also, government departments take audit reports very seriously when judging the company’s status. Also, auditors must follow their ethical standards & professional parameters before providing an opinion. The subjectivity of the opinion is a matter of personal judgment, but the governing body specifies the minimum audit procedures. They are also liable for punishment by various law provisions if they fail.

Recommended Articles

This is a guide to Audit Report Examples. Here we also discuss the definition and explanation of audit reports and different examples. You may also have a look at the following articles to learn more –