Updated July 25, 2023

Average Variable Cost Formula (Table of Contents)

What is the Average Variable Cost Formula?

The term “average variable cost” refers to the variable cost of production expressed per unit of production. The variable component of the per-unit production cost primarily comprises direct labor rate, raw material cost per unit, and variable manufacturing overhead per unit.

To derive the formula for average variable cost, one must add the raw material cost, direct labor cost, and variable manufacturing overhead and then divide the resulting sum by the number of units produced. The Mathematical representation of the formula is as below:

Examples of Average Variable Cost Formula (With Excel Template)

Let’s take an example to understand the calculation of the Average Variable Cost Formula in a better manner.

Average Variable Cost Formula – Example #1

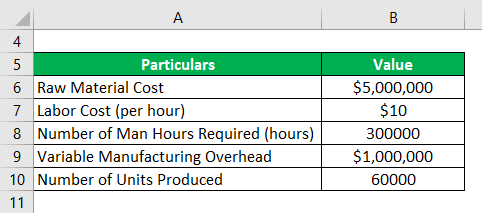

Let us take the example of XYZ Ltd. to illustrate the calculation of the average variable cost. The entity is a shoe-manufacturing company in the state of Ohio. According to the annual report published for the year 2018, the following cost information is available:

- Total raw material cost: $5 million

- Labor cost: $10 per hour

- Number of man hours required: 300,000 hours

- Total variable manufacturing overhead: $1 million

- Number of shoes manufactured: 60,000

Calculate the average variable cost of production for XYZ Ltd. based on the given information.

Solution:

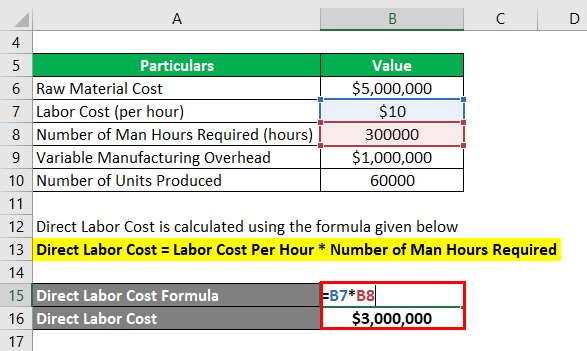

The formula to calculate Direct Labor Cost is as below:

Direct Labor Cost = Labor Cost Per Hour * Number of Man Hours Required

- Direct Labor Cost = $10 per hour * 300,000 hours

- Direct Labor Cost = $3,000,000

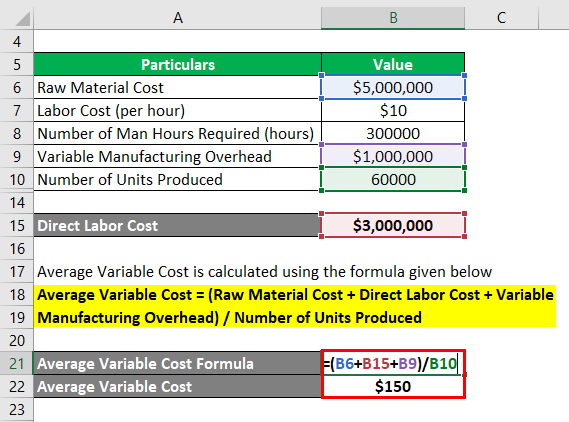

The formula to calculate Average Variable Cost is as below:

Average Variable Cost = (Raw Material Cost + Direct Labor Cost + Variable Manufacturing Overhead) / Number of Units Produced

- Average Variable Cost = ($5 million + $3 million + $1 million) / 6,0000

- Average Variable Cost = $150

Therefore, the average variable cost of XYZ Ltd. for the year 2018 is $150 per unit.

Average Variable Cost Formula – Example #2

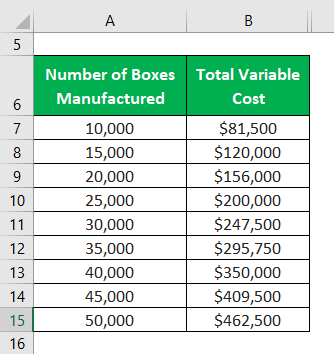

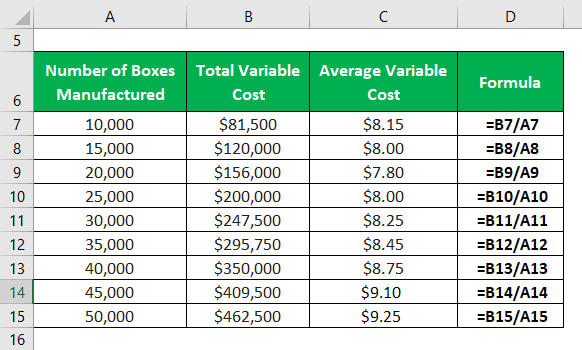

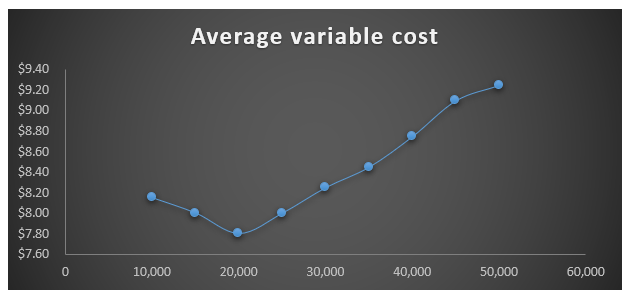

Let us take the example of ABC Ltd., which is a corrugated box manufacturer. Last year, the company gradually increased its production volume to check when the variable cost breaches the selling price. Accordingly, the following cost and production data are available. Calculate at which level of production the average variable cost breaches the selling price if the selling price is $9 per box. Also, plot the graph for average variable cost against the production volume.

Solution:

The formula to calculate Average Variable Cost is as below:

Average Variable Cost = Total Variable Cost / Number of Boxes Manufactured

For 10,000 Boxes

Average variable cost 10,000 = Total variable cost / Number of boxes manufactured

- Average variable cost 10,000 = $81,500 / 10,000

- Average variable cost 10,000 = $8.15

For 15,000 Boxes

- Average variable cost 15,000 = $120,000 / 15,000

- Average variable cost 15,000 = $8.00

For 20,000 Boxes

- Average variable cost 20,000 = $156,000 / 20,000

- Average variable cost 20,000 = $7.80

For 25,000 Boxes

- Average variable cost 25,000 = $200,000 / 25,000

- Average variable cost 25,000 = $8.00

For 30,000 Boxes

- Average variable cost 30,000 = $247,500 / 30,000

- Average variable cost 30,000 = $8.25

For 35,000 Boxes

- Average variable cost 35,000 = $295,750 / 35,000

- Average variable cost 35,000 = $8.45

For 40,000 Boxes

- Average variable cost 40,000 = $350,000 / 40,000

- Average variable cost 40,000 = $8.75

For 45,000 Boxes

- Average variable cost 45,000 = $409,500 / 45,000

- Average variable cost 45,000 = $9.10

For 50,000 Boxes

- Average variable cost 50,000 = $462,500 / 50,000

- Average variable cost 50,000 = $9.25

Therefore, from the above analysis, it can be concluded that the average variable cost breached the selling price somewhere between production levels of 40,000 boxes to 45,000 boxes. It is advisable not to increase the production beyond that level.

Explanation

The formula for average variable cost can be derived by using the following steps:

Step 1: Firstly, figure out the overall raw material cost expensed in the manufacturing process during a certain period. The raw material cost depends on the quality of the material used, the rate per unit quantity, and the amount used.

Step 2: Next, determine the cost of direct labor directly related to the manufacturing process. The direct labor cost depends on several factors, including the level of expertise, labor rate, and the number of production hours.

Step 3: Next, figure out the variable manufacturing overhead of the company, and it includes all the variable costs that are left and can be directly apportioned to the manufacturing process.

Step 4: Next, determine the number of units manufactured during the period, and it depends on the production level.

Step 5: Finally, the formula for average variable cost can be derived by adding raw material cost (step 1), direct labor cost (step 2), and variable manufacturing overhead (step 3) and then dividing the result by the number of units produced (step 4) as shown below.

Average Variable Cost = (Raw Material Cost + Direct Labor Cost + Variable Manufacturing Overhead) / Number of Units Produced

Relevance and Use of Average Variable Cost Formula

It is important to understand the concept of average variable cost as it is very pivotal to the profitability of a company. Typically, a company can drive its profit margins efficiently by effectively managing the variable cost. However, the average variable cost is indirectly governed by the law of diminishing marginal returns. As such, it decreases with the increase in production volume to a certain point, beyond which it starts to escalate with the increase in production volume. Therefore, variable cost influences the production plans because it only makes business sense to continue increasing production volume until the average variable cost is less than the average selling price.

Average Variable Cost Formula Calculator

You can use the following Average Variable Cost Formula Calculator

| Raw Material Cost | |

| Direct Labor Cost | |

| Variable Manufacturing Overhead | |

| Number of Units Produced | |

| Average Variable Cost | |

| Average Variable Cost = |

| |||||||||

|

Recommended Articles

This is a guide to the Average Variable Cost Formula. Here we discuss calculating Average Variable Cost Formula and practical examples. We also provide an Average Variable Cost calculator with a downloadable Excel template. You may also look at the following articles to learn more –