Avoid Overpaying on a Personal Loan in Singapore

Navigating the world of personal loans in Singapore can be tricky. With numerous lenders and varied interest rates, paying more than necessary is easy. Understanding how to spot hidden fees and choose suitable terms to avoid overpaying on personal loans is important.

Knowing the effective interest rate on a personal loan is essential, as the advertised rate might not reflect the true cost. Borrowers should also be cautious of unfamiliar charges added by lenders. Securing a loan with a clear understanding of these aspects can prevent unpleasant surprises. For those seeking a fast personal loan in Singapore, it is possible to apply for an instant personal loan with quick approval and low interest rates. Making informed choices ensures that your loan journey remains smooth and financially sound.

Understanding Personal Loans in Singapore

Personal loans in Singapore are available in several types, each offering unique features tailored to different financial needs. Factors like interest rates and fees can significantly affect the amount you pay. Borrowers often make mistakes by not comparing multiple loan options or misunderstanding the loan terms.

Types of Personal Loans Available

In Singapore, personal loans are either secured or unsecured:

- Unsecured Loans: These unsecured loans do not require collateral but typically have higher interest rates. Examples include standby credit and credit lines.

- Secured Loans: These loans are secured with assets like a fixed deposit and typically come with lower interest rates.

- Specialized Loans: Lenders design some loans for specific purposes, such as education loans or debt consolidation loans.

Knowing these loan types helps borrowers make informed choices.

Factors Affecting Personal Loan Costs

The cost of a personal loan in Singapore depends on several factors:

- Interest Rates: Whether fixed or variable, interest rates determine how much you will pay over time. Fixed interest rates remain constant, while variable rates may change.

- Fees: Lender fees can include processing fees, late payment charges, or early repayment penalties. Be sure to read the loan terms carefully to avoid surprises.

- Loan Tenure: Extending the loan tenure can lower your monthly installments, but it typically results in paying more interest over the life of the loan.

Always check the effective interest rate (EIR)—it reflects the true cost of the loan.

Common Mistakes Borrowers Make

To avoid overpaying on personal loans, borrowers should be aware of common mistakes:

- Not Comparing Loan Offers: Not comparing interest rates and terms across lenders may cause you to overlook more competitive offers and cost-saving opportunities.

- Misunderstanding Loan Terms: Understanding the full cost of borrowing, including any hidden fees or penalties.

- Borrowing for Non-Essential Items: Borrowing for unnecessary expenses can lead to a financial burden. Stick to borrowing for important needs.

Avoiding these pitfalls guarantees that the loan taken truly serves their financial goals and needs.

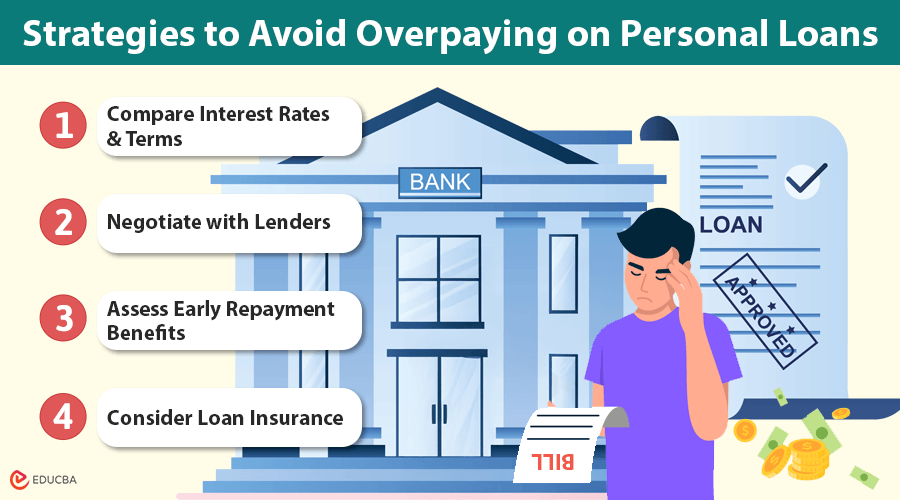

Strategies to Avoid Overpaying on Personal Loans

Certain strategies can help reduce costs when taking a personal loan in Singapore. Important steps include comparing interest rates, negotiating with lenders, understanding early repayment benefits, and considering loan insurance.

#1. Compare Interest Rates and Terms

Interest rates play a major role in determining the total cost of your loan over time. Borrowers should compare lenders to find the best rates and favorable loan terms. Some companies offer lower rates but include hidden fees, so it is important to understand the effective interest rate fully. Some websites provide insights into understanding rates and avoiding unusual charges. Calculating total repayment amounts is also suitable for seeing the full picture.

#2. Negotiate with Lenders

Lenders may be open to negotiations, especially if the borrower has a good credit score. Ask for possible fee reductions or lower interest rates. Being well-prepared with market data and offers from other lenders can strengthen the negotiating position. Some lenders might also offer flexibility in terms or waive certain charges. Borrowers should not hesitate to discuss these options to guarantee a more favorable loan agreement.

#3. Assess Early Repayment Benefits

Assessing the benefits of paying off a loan early can save money through reduced interest costs. Make sure to verify if the lender charges any penalties for early repayment. Some organizations include strict penalties, diminishing the financial advantage of settling a loan early. Borrowers should contact their lender to understand any existing penalties and weigh the costs and savings of early payment.

#4. Consider Loan Insurance

Loan insurance can provide protection but may add to the overall cost of borrowing. Evaluating whether this insurance is necessary based on individual circumstances is important. Policies usually cover events like job loss or disability, which might affect payment ability. Borrowers should thoroughly examine the terms and conditions and evaluate whether the insurance cost is worth the risk it covers. Choosing the right plan can offer peace of mind without burdening the budget excessively.

Final Thoughts

Avoiding overpaying on personal loans in Singapore requires research and planning. By evaluating different loan possibilities, comprehending interest rates, and avoiding typical problems, you can locate a loan that satisfies your financial demands without adding needless expenses. Always negotiate with your lender, assess the benefits of early repayment, and be mindful of hidden fees to ensure you do not overpay on your loan. By applying these smart tips and strategies, you can make well-informed decisions, avoid overpaying on personal loans, and secure a financially stable future.

Recommended Articles

We hope this guide helps you understand how to avoid overpaying on personal loans and secure better financial terms. Check out these recommended articles for more expert tips on managing your loans and improving your financial health.