Updated July 14, 2023

Difference Between Balance Sheet vs Consolidated Balance Sheet

The following article provides an outline for Balance Sheet vs Consolidated Balance Sheet. A balance sheet is the position of assets and liabilities as of the date of the specific organization. In contrast, the consolidated Balance sheet is the group’s combined balance sheet, which shows the combined position of assets and liabilities and is much wider than the Balance sheet.

Companies with subsidiaries or associate or joint venture entities prepare the consolidated balance sheet, while all business organizations prepare the balance sheet. The consolidated balance sheet is a much wider concept than the balance sheet. Preparing a balance sheet requires expert knowledge to prepare a consolidated balance sheet as it involves many adjustments. All organizations, including those required to prepare the balance sheet, prepare the balance sheet, but not all organizations can prepare the consolidated balance sheet. In accounting terms, the balance sheet is the standalone statement of assets and liabilities. The consolidated balance sheet can give a broader view of the company’s subsidiaries or associate companies.

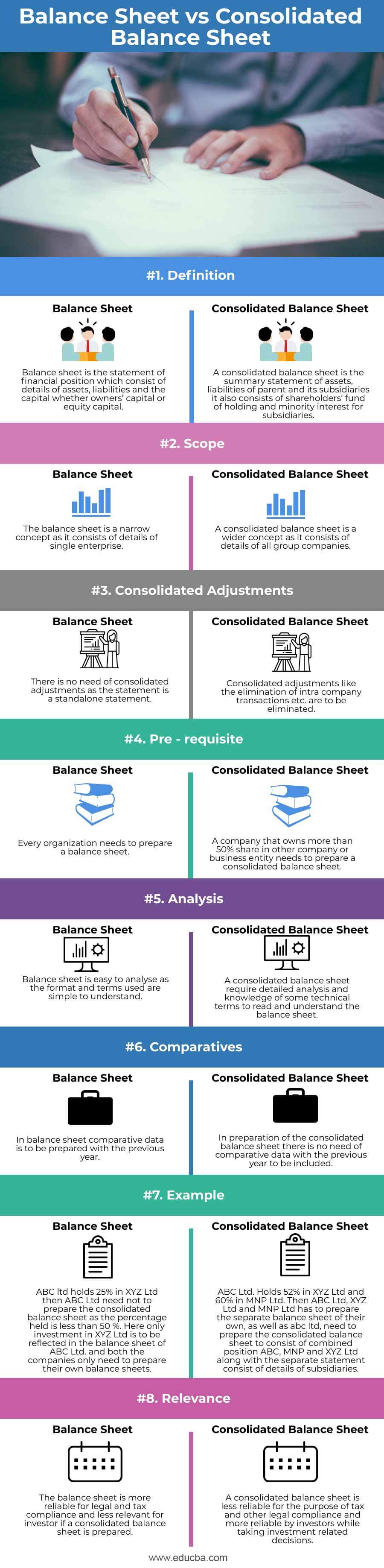

Head To Head Comparison Between Balance Sheet vs Consolidated Balance Sheet (Infographics)

Below are the top 8 differences between the balance sheet vs consolidated balance sheet

Key Differences Between Balance Sheet vs Consolidated Balance Sheet

Following are the key differences between a balance sheet and a consolidated balance sheet:

- Compulsion: Every organization, whether a business or non-profit, must prepare the balance sheet, while only organizations with subsidiary companies or associate companies are required to prepare the consolidated balance sheet.

- Audit: An audit of the balance sheet is compulsory only if the turnover exceeds the limit, whereas an audit of the consolidated balance sheet is compulsory for all organizations that prepare it.

- Classification: In the balance sheet, organizations include only the assets and liabilities that belong specifically to their entity. However, the consolidated balance sheet does not classify assets and liabilities for each subsidiary or associate.

- Preparation: Every organization must prepare the balance sheet, whether the subsidiary company, associate company, or standalone business; Each organization is responsible for preparing its balance sheet. In contrast, a consolidated balance sheet must be prepared only by the holding company.

- Involvement of experts and adjusting the intra-company holdings: While preparing the Balance sheet, a normal financially literate person can accurately prepare the balance sheet. Whereas in preparing a consolidated balance sheet, expert knowledge and involvement are required as while preparing to consolidate a balance sheet intra, company transactions are to be eliminated. Various adjustments are required at the initial level for the calculation of goodwill or capital reserve, minority interest, and thereby on every balance sheet date or on subsequent holding or disposal.

- Preparation time: An accountant can prepare a balance sheet within a limited time. It is easy to process, whereas preparing a consolidated balance sheet is time-consuming and complex.

- Preference: Consolidated balance sheet takes preference over the balance sheet if the company is required to prepare the consolidated balance sheet, as the investor will consider the consolidated balance sheet as the basis point for an investment decision.

Balance Sheet vs Consolidated Balance Sheet Comparison table

Let’s discuss the top 8 comparisons between the Balance Sheet vs Consolidated Balance Sheet:

|

Heading |

Balance Sheet |

Consolidated Balance Sheet |

| Definition | A balance sheet is a statement of financial position consisting of details of assets, liabilities, and capital, whether owners’ or equity capital. | A consolidated balance sheet is the summary statement of assets and liabilities of the parent and its subsidiaries; it also consists of shareholders’ funds of holding and minority interests for subsidiaries. |

| Scope | The balance sheet is a narrow concept as it consists of details of a single enterprise. | A consolidated balance sheet is a wider concept consisting of details of all group companies. |

| Consolidated adjustments | There is no need for consolidated adjustments as the statement is standalone. | Consolidated adjustments like eliminating intra-company transactions etc., are to be eliminated. |

| Pre – Requisite | Every organization needs to prepare a balance sheet | A company with more than 50% share in another company or business entity must prepare a consolidated balance sheet. |

| Analysis | A balance sheet is easy to analyze as the format, and terms are simple to understand. | A consolidated balance sheet requires detailed analysis and knowledge of some technical terms to read and understand the balance sheet. |

| Comparatives | The balance sheet will prepare comparative data with the previous year. | In preparation for the consolidated balance sheet, there is no need for comparative data with the previous year to be included. |

| Example | ABC Ltd holds 25% of XYZ Ltd, then ABC Ltd needs not to prepare the consolidated balance sheet as the percentage held is less than 50 %. Here only investment in XYZ Ltd is to be reflected in the balance sheet of ABC Ltd., and both companies only need to prepare their balance sheets. | ABC Ltd. Holds 52% of XYZ Ltd and 60% of MNP Ltd. Then ABC Ltd, XYZ Ltd, and MNP Ltd have to prepare separate balance sheet of their own, as well as ABC Ltd need to prepare the consolidated balance sheet to consist of combined position ABC, MNP and XYZ Ltd along with the separate statement consist of details of subsidiaries. |

| Relevance | The balance sheet is more reliable for legal and tax compliance and less relevant for the investor if a consolidated balance sheet is prepared. | A consolidated balance sheet is less reliable for tax and other legal compliance and more reliable for investors making investment-related decisions. |

Conclusion

Thus Balance sheet refers to the position of the assets and liabilities of the company on a specific date. On the other hand, a holding company that holds more than 50% of another company, known as a subsidiary company or company, is responsible for preparing the Consolidated Balance sheet. It is the statement of the financial part of the group company together. Preparing the consolidated balance sheet requires more complexity, legal compliance, and calculations than the normal balance sheet. The consolidated balance sheet is relevant for investors to make investment decisions.

Recommended Articles

This has guided the top difference between the Balance Sheet and Consolidated Balance Sheet. Here we also discuss the balance sheet vs consolidated balance sheet key differences with infographics and a comparison table. You may also have a look at the following articles to learn more-