Definition of Balanced Fund

The term “balanced fund” refers to the hybrid financial instrument wherein the fund invests in a mix of equity and debt at certain specific ratios. This fund offers a relatively lower return, which in turn helps investors diversify their investment portfolio.

Given that a balanced fund maintains a balance between both equity and debt, they offer one of the best poise for risk-reward and generate an optimum return on investment. A balanced fund is also known as a hybrid fund.

Explanation

A balanced fund is characterized by diversification of investment among multiple asset classes. Generally, the proportion of the fund that can be invested into each asset class is governed by the limit of the minimum and maximum value set for the fund. In other words, the asset mix in a balanced fund doesn’t change materially, unlike most other asset allocation funds, wherein the asset mix changes with the changes in the investor’s risk-return appetite or overall investment market condition. A typical balanced fund has 60% of the fund allocated to stocks, while the remaining 40% is invested in bonds.

Purpose of Balanced Fund

A balanced fund has two components – equity and bond –and each component serves different purposes. First, the equity component of a balanced fund helps protect the investor’s purchasing power. On the other hand, the debt component of the fund helps generate a steady source of the secondary income stream. At the same time, it also aids in neutralizing the volatility of the investment portfolio.

Which are the Best Balanced Funds?

Now, let us have a look at some of the best-balanced funds available across the globe:

- Rowe Price Balanced (RPBAX): This fund has an above-average risk rating with an above-average return profile per Morningstar. In the last 10 years, as of August 31, 2020, the fund’s equity allocation has varied in the range of 50% to 70%, while it has generated a return of 9.80% on average with a standard deviation of 9.46. The fund’s expense ratio is 0.58%, which is below average.

- Dodge & Cox Balanced (DODBX): This fund has a high-risk rating with an above-average return profile per Morningstar. In the last 10 years, as of August 31, 2020, the fund’s equity allocation has varied in the range of 50% to 70%, while it has generated a return of 10.22% on average with a standard deviation of 11.37. The expense ratio of the fund is relatively less at 0.53%.

- American Funds American Balanced A (ABALX): This fund has a below-average risk rating with a high return profile per Morningstar. In the last 10 years, as of August 31, 2020, the fund’s equity allocation has varied in the range of 50% to 70%, while it has generated a return of 10.61% on average with a standard deviation of 8.46. The expense ratio of the fund is relatively less at 0.59%.

Who Should Invest in Balanced Funds?

Given the risk-reward profile, such investment would be ideal for investors who:

- Seeks a steady, stable return with a medium-term investment horizon (5 years).

- Is a new investor with very limited knowledge about investment and market conditions.

- Wishes to diversify their investment portfolio.

In short, if an investor wants to avoid unnecessary risks and earn above-average returns, then investment in a balanced fund is a very good option.

Importance of a Balanced Fund

A conservative fund invests far less in equities and more in bonds, resulting in low risk and low returns. In contrast, an aggressive fund goes heavy on equities, and a nominal allocation goes to bonds that result in high returns at high risk. In such a scenario, a balanced fund takes the middle way, allowing the investor to create an allocation that ensures relatively lower risk than an aggressive fund and a relatively higher return than a conservative fund. Effectively, it offers the benefit of both debt and equity accounts, but in a balanced way, as the name suggests.

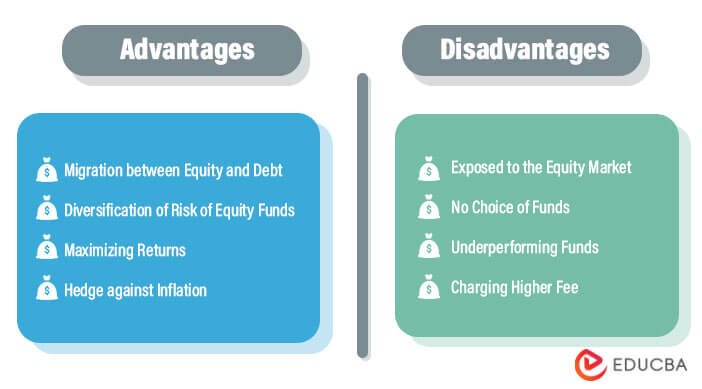

Advantages and Disadvantages

Balanced funds have a few advantages and disadvantages; let’s look at them.

Advantages

- This investment scheme allows fund managers to migrate between equity and debt without creating any tax liability for the investors. Otherwise, the investors would be liable for capital gains tax.

- Investment in such hybrid funds results in the diversification of risk of equity funds by the debt instruments. In fact, at market volatility, fund managers can easily migrate between the two asset classes.

- This type of fund aids in maximizing returns while providing a safety net against market-related risks.

- The debt component of global funds can act as a hedge against inflation, which applies to the investor’s own country.

Disadvantages

- Contrary to what most believe, balanced funds are not entirely risk-free as invariably 50% to 65% of any balanced fund is exposed to the equity market.

- The investors have no say in the choice of funds as the fund manager makes all decisions.

- In times of bull run, most funds underperform the equity mutual funds.

- A balanced fund charges a higher fee as the team of fund managers has to research and analyze debt and equity markets equally to generate optimum returns.

Conclusion

So, it can be seen that a balanced fund is a very useful financial instrument to create wealth while maintaining a low-risk level. However, the safety net of low risk comes at a cost wherein wealth accumulation must be done with mediocre returns. Thus, it is important that before investing in a balanced fund, an investor should understand the risk-reward profile of the fund and map it with their own risk appetite and investment goal.

Recommended Articles

This is a guide to Balanced Funds. Here we discuss the introduction and purpose along with its advantages and disadvantages. You may also have a look at the following articles to learn more –