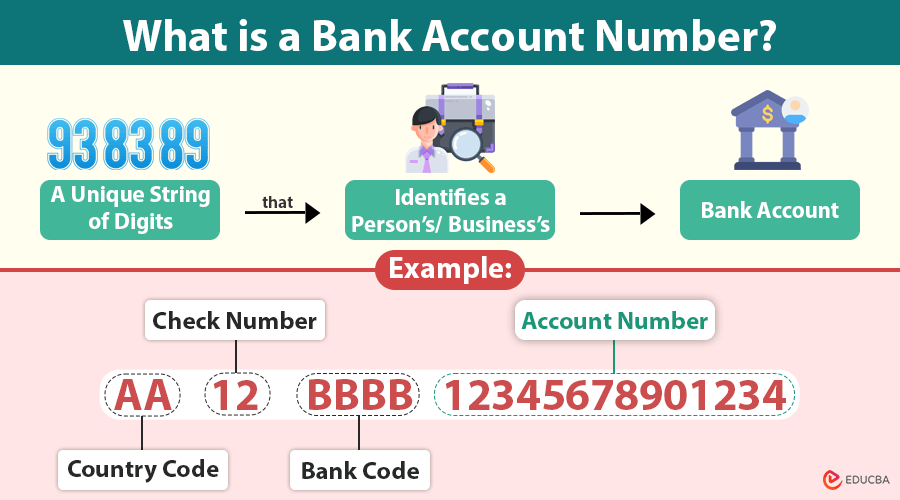

What is a Bank Account Number?

A bank account number is a unique string of digits assigned to an individual’s or business’s bank account. It identifies the account holder and helps with deposits, withdrawals, and transfers.

If your account number is 1234567890, this number uniquely identifies your account at your bank, ensuring that money sent to or from your account is processed correctly.

Importance and Uses of a Bank Account Number

An account number plays a vital role in financial transactions. Some of its key uses include the following:

- Receiving salary and payments: Employers and clients use your account number to transfer payments.

- Online transactions: When shopping online, your account number helps in fund transfers.

- Bill payments: Many services, such as utilities and subscriptions, require an account number for direct debits.

- International money transfers: The account number, along with the SWIFT code or IBAN, helps in international transactions.

Structure of a Bank Account Number

The format of bank account numbers varies across banks and countries. However, an account number typically consists of:

- Bank Code: Identifies the bank.

- Branch Code: Specifies the bank’s branch.

- Account Number: Unique identifier for the account holder.

- Check Digit: Used for verification to prevent errors.

Examples

Following are the examples:

1. India:

A typical Indian bank account number might look like 50100234567890, where:

- 50100 represents the branch code.

- 234567890 is the unique account number.

2. USA:

In the United States, account numbers range from 8 to 12 digits, often used with a routing number for transactions.

How to Find Your Bank Account Number?

Your account number can be found in several places:

- Bank Passbook: Printed on the first page.

- Bank Statement: Available in printed or digital formats.

- Online Banking: Displayed under account details.

- Cheque Book: Usually printed at the bottom.

Security Tips for Protecting Your Account Number

Since your account number is crucial for transactions, you must protect it from fraud and theft. Here are some important security measures:

- Do not share your account number publicly: Avoid posting or sharing it on social media.

- Enable multi-factor authentication: Provides additional security for online transactions.

- Regularly monitor bank statements: Helps detect unauthorized transactions.

- Use secure banking platforms: Always log in to banking websites through official links.

- Be cautious with emails and messages: Avoid phishing scams that ask for account details.

Difference Between a Bank Account Number and Other Banking Identifiers

| Identifier | Purpose | Example |

| Bank Account Number | Identifies a specific bank account | 1234567890 |

| Routing Number | Identifies the bank (used in the U.S.) | 21000021 |

| IBAN (International Bank Account Number) | Used for international transactions | GB29NWBK60161331926819 |

| SWIFT Code | Identifies a bank internationally | HDFCINBBXXX |

What to Do If You Forget or Lose Your Account Number?

If you forget or lose your account number, you can:

- Check your bank documents: Look at your passbook, checkbook, or statement.

- Log in to online banking: Your profile usually displays your account number.

- Visit the bank: Carry valid ID proof to retrieve the number.

- Contact customer support: Your bank can verify your details and provide the account number.

Final Thoughts

An account number is important for managing finances, making transactions, and ensuring secure payments. Keeping it safe and knowing how to use it properly will help you avoid fraud and financial mishaps. Always be cautious while sharing your account details and monitor your transactions regularly to ensure security.

Frequently Asked Questions (FAQs)

Q1. Can two people have the same account number?

Answer: No, account numbers are unique to each individual or business.

Q2. How many digits are in a bank account number?

Answer: It varies by country and bank but usually ranges from 8 to 16 digits.

Q3. Can I change my account number?

Answer: No, but you can open a new account with a different number.

Q4. Is it safe to share my account number?

Answer: Yes, but only with trusted entities for transactions. Never share it publicly.

Q5. What should I do if someone else knows my account number?

Answer: Monitor your transactions and contact your bank if you suspect any fraudulent activity.

Recommended Articles

We hope this guide has been helpful. Check out these recommended articles for insights on secure banking, financial transactions, and fraud prevention.