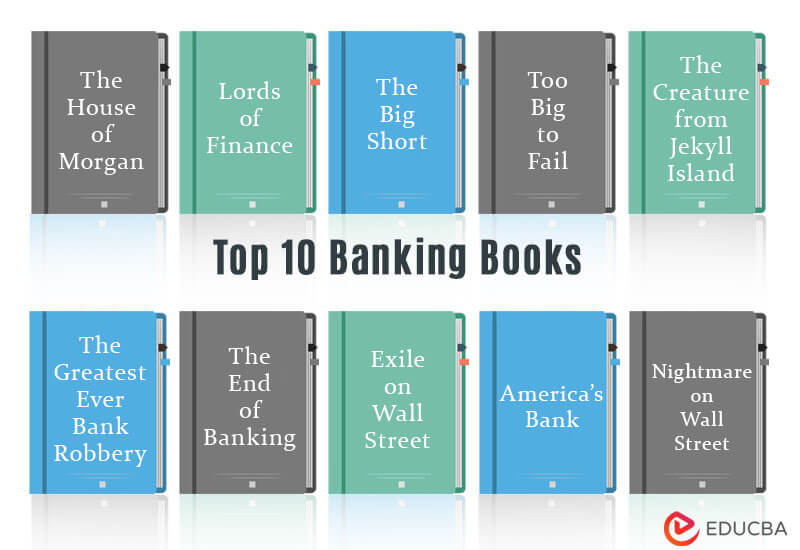

Best Books to Know about Banking

In simplest terms, banking is a business where one organization protects other people’s money. However, the subject is more nuanced than this. One needs updated knowledge regarding this field to be successful in their career.

These 10 banking books are primarily stories and historical events written with great insights and knowledge. They provide a good understanding of previous and existing banking systems and how to approach financial institutions in the future.

The list below shows the top 10 banking books to help you better grasp the subject.

|

# |

Banking Books | Author | Published |

Rating |

| 1 | The House of Morgan | Ron Chernow | 2010 | Amazon: 4.5

Goodreads: 3.93 |

| 2 | Lords of Finance | Liaquat Ahamed | 2009 | Amazon: 4.6

Goodreads: 4.01 |

| 3 | The Big Short | Michael Lewis | 2011 | Amazon: 4.6

Goodreads: 4.22 |

| 4 | Too Big to Fail | Andrew Ross Sorkin | 2010 | Amazon: 4.5

Goodreads: 4.14 |

| 5 | The Creature from Jekyll Island | G. Edward Griffin | 2018 | Amazon: 5

Goodreads: 4.27 |

| 6 | The Greatest Ever Bank Robbery | Martin Mayer | 1990 | Amazon: 5

Goodreads: 3.05 |

| 7 | The End of Banking | Jonathan McMillan | 2014 | Amazon: 4.4

Goodreads: 3.80 |

| 8 | Exile on Wall Street | Mike Mayo | 2011 | Amazon: 3.9

Goodreads: 3.71 |

| 9 | America’s Bank | Roger Lowenstein | 2016 | Amazon: 4.6

Goodreads: 3.82 |

| 10 | Nightmare on Wall Street | Martin Mayer | 1993 | Amazon: 4.6

Goodreads: 3.72 |

Let us discuss each of these banking books with their elemental reviews and key takeaways.

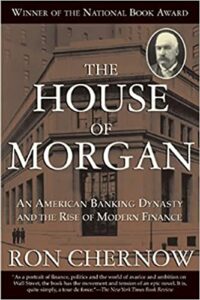

Book #1: The House of Morgan

Author: Ron Chernow

Get the book here.

Book Review

This National Award-winning book captures the transition of American finance from the old Wall Street to the hands of J.P. Morgan and Associates. This banking book is best in non-fiction as it captures the story’s tension and serves it to the readers. It also does an excellent job of capturing the lives of many influential men along the way.

Key Points

- This banking book describes the financial crisis of 1987.

- It explains the history of the Anglo-American bank and the power transfer from London to New York.

- It has lessons of experiences from the most influential men in the world.

- You can learn interesting and shocking facts about the FDR Great Depression.

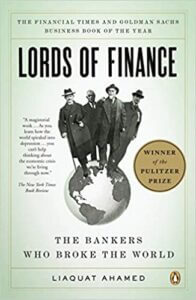

Book #2: Lords of Finance

Author: Liaquat Ahamed

Get the book here.

Book Review

The book is essentially about how not to fail in finance as four big empires of different countries fell and caused the Great Depression of 1929. To explain their failure and shed light on international finances, the book includes their decisions. This banking book is more of a biography than a self-help book. But it captures great attention in the way it is written.

Key Points

- The book includes finance topics of international lending, the gold standard, and currency devaluation.

- It also contains the central bank’s goal and to have trust in banks.

- It contains information on the free flow of global finances throughout.

- You can pick up knowledge on the working of Monetary Policy.

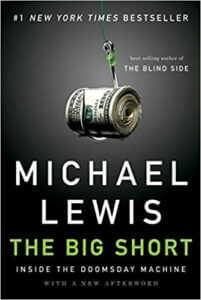

Book #3: The Big Short

Author: Michael Lewis

Get the book here.

Book Review

This book analyzes the causes of the 2007-08 financial crisis in detail. The book also includes behavioral and psychological aspects of how some financiers could predict the collapse in advance. They gained from this skill and made millions because of it. The author includes the part played by traders, salespeople, and prominent decision-makers explaining the financial history.

Key Points

- The book has the story of four investment groups who predicted the mortgage, credit, and housing bubble disaster and their success.

- The book enlists reasons for aggression and a law-bending attitude resulting in the subprime mortgage crisis.

- It sheds light on the unfair truth of monetary policies, regulations, and misguiding housing policies.

- The credit default swap concept is discussed as an alternative to what other financial institutions do.

Book #4: Too Big to Fail

Author: Andrew Ross Sorkin

Get the book here.

Book Review

It is the story of how Wall Street enabled itself to handle the crisis. The book discusses the 2007-08 subprime mortgage crisis. The book is amusing in the way that it says more prominent millionaires are not superiorly intelligent as one might assume. This book successfully provides a compelling narration of the complex situation and negotiations involved.

Key Points

- The book discusses the disaster’s origin and the banks’ deregulation.

- It explains what caused the liquidity bubble and short-term risk-taking decisions.

- The book has enough discussion on the “policy by deal” after bankruptcy.

- One can gain insights into the TARP fiscal measures and how major banks opened up lines of credit and direct investment.

Book #5: The Creature from Jekyll Island

Author: G. Edward Griffin

Get the book here.

Book Review

The book’s title encompasses the Federal Reserve’s findings as a result of a confidential meeting at Jekyll Island, Georgia, in 1910. This book is essentially a critical analysis of contemporary centralized banking. The Federal Reserve’s research work sheds light on bankers’ bad decisions causing inflation. It exposes the illicit relationship between bankers and corrupt politicians. It is easy to read despite covering hard topics.

Key Points

- The book has captivating information bits to keep the reader entertained.

- It discusses the principal problem of modern banking, the making of fiat money.

- The book has a conspiratorial analysis of history and a socialist system study.

- It covers warmongering, boom-bust cycles, and the history of central banking.

Book #6: The Greatest Ever Bank Robbery

Author: Martin Mayer

Get the book here.

Book Review

This book is an amalgamation of thoughtful frauds in which the government was liable for negligence. Hence it is essentially a critical review of the legislative actors and banks. The book analyzes taxpayer bailouts and fraud through lax regulations leading to losses.

Key Points

- The book contains information on how different chiefs of the banking system and politicians made wrong, long-impacting decisions.

- The book displays how legislation allowed the savings and loan industry to compete with banks for deposits.

- It is a collection of events that lead to savings and loan thefts.

- The book has an objective standpoint on the mechanisms of the banking system.

Book #7: The End of Banking

Author: Jonathan McMillan

Get the book here.

Book Review

The book analyzes the connection between the banking system and the government through history and the industrial age in one half. The second half is on how the digital revolution caused disruptions in the economic crisis of 2007-08. The book also includes redundancy in the current banking system. Finally, the end explains how the current banking system’s efficiency was destabilized due to the digital revolution and left redundant.

Key Points

- The book explains the concept of shadow banking here.

- It also explores how the modern financial system works.

- It also boldly states that the digital revolution can lead to the end of banking.

- The book introduces the word moral hazard, resulting from the digital revolution.

Book #8: Exile on Wall Street

Author: Mike Mayo

Get the book here.

Book Review

This book includes the causes of the financial breakdown caused by US capitalism. This book is an autobiography of my own banking choices and provides solutions. It is easy to read without much financial jargon. The book contains good advice for the general audience and banks, as there still exist loopholes left by the financial crisis.

Key Points

- The author has included the banking mistakes they did

- The book contains unassuming stories of self from the author.

- This book encompasses six financial institutions and their part in the financial degradation of the country.

- The book analyzes the connection between the banking system with capitalism.

Book #9: America’s Bank

Author: Roger Lowenstein

Get the book here.

Book Review

The book includes information on how powerful regulators must restrain from making decisions on Banks. It also contains the regulators that operate banks to ensure a good run of the global economy. The book includes a history of how banks functioned independently with no central reserve.

Key Points

- This book is the life story of America’s Central Bank and the government’s and other banks’ history.

- The book includes the economic meltdown of Europe and the efforts of Wall Street to overcome resistance to a regulator.

- The book’s story includes four main people responsible for the banking system.

- The book explains how this lack of a central power can hurt the economy.

Book #10: Nightmare on Wall Street

Author: Martin Mayer

Get the book here.

Book Review

The book covers the story of how one firm caused great destruction in the economy of a big country. This book is a light bearer for showcasing how the influence and power of big people affect a country’s economy with selfish motives.

Key Points

- The book includes the role of the Salomon Brothers in transitioning from traditional practices to corporate banking.

- It charges the brothers with a scandal of $10 billion affecting the government and many people’s careers and businesses.

- The book is a critical analysis of corporate behavior in conducting business.

- The book also suggests that traders becoming bankers lacking experience can cause disasters.

Recommended Books

Hope this article on the top 10 banking books has helped you. For other such articles, EDUCBA recommends the following,