Updated July 21, 2023

Benefit-Cost Ratio Formula (Table of Contents)

What is the Benefit-Cost Ratio Formula?

The term “Benefit-Cost Ratio” refers to the financial metric that helps in assessing the viability of an upcoming project based on its expected costs and benefits.

In other words, the ratio determines the relationship between the expected incremental benefit from a project and the corresponding costs that would be incurred to complete the project.

The benefit-cost ratio formula is expressed as PV of all the benefits expected from the project divided by the PV of all the costs to be incurred for the project. Mathematically, it is represented as,

Example of Benefit-Cost Ratio Formula (With Excel Template)

Let’s take an example to understand the calculation of the Benefit-Cost Ratio in a better manner.

Benefit-Cost Ratio Formula – Example #1

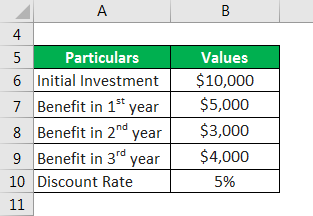

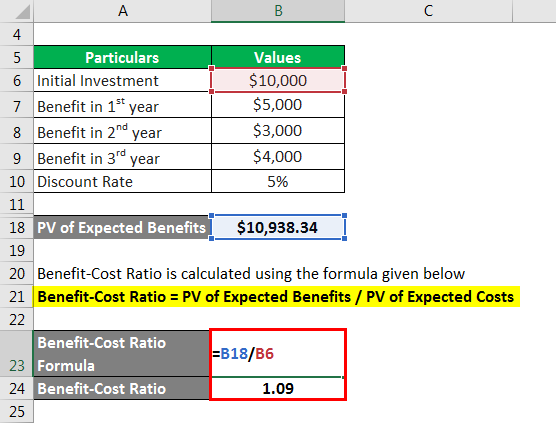

Let us take an example of a company that has recently invested $10,000 for the purpose of replacing some of its machinery components. This renovation is expected to result in incremental benefits of $5,000 in 1st year, $3,000 in 2nd year and $4,000 in 3rd year. Calculate the benefit-cost ratio of the replacement project if the applicable discounting rate is 5%.

Solution:

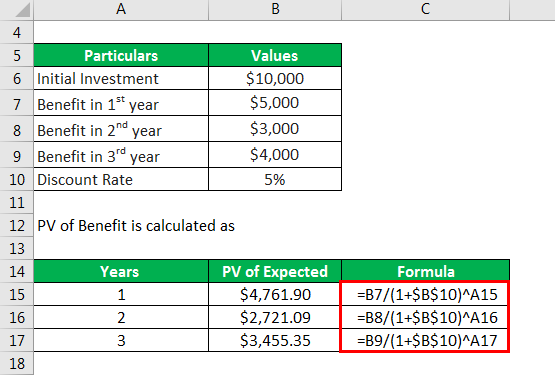

PV of benefit is calculated as,

- PV of benefit in 1st year = $5,000 / (1 + 5%)1 = $4,761.90

- PV of benefit in 2nd year = $3,000 / (1 + 5%)2 = $2,721.09

- PV of benefit in 3rd year = $4,000 / (1 + 5%)3 = $3,455.35

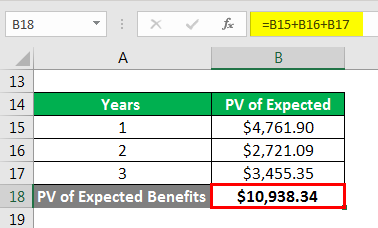

PV of Expected Benefits is calculated as,

- PV of Expected Benefits = $4,761.90 + $2,721.09 + $3,455.35

- PV of Expected Benefits = $10,938.34

Benefit-Cost Ratio is calculated using the formula given below

Benefit-Cost Ratio = PV of Expected Benefits / PV of Expected Costs

- Benefit-Cost Ratio = $10,938.34 / $10,000

- Benefit-Cost Ratio = 1.09

Therefore, the benefit-cost ratio of the project is 1.09 which indicates that it will create additional value and as such it should be considered positively.

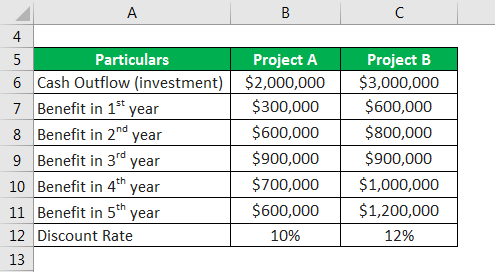

Benefit-Cost Ratio Formula – Example #2

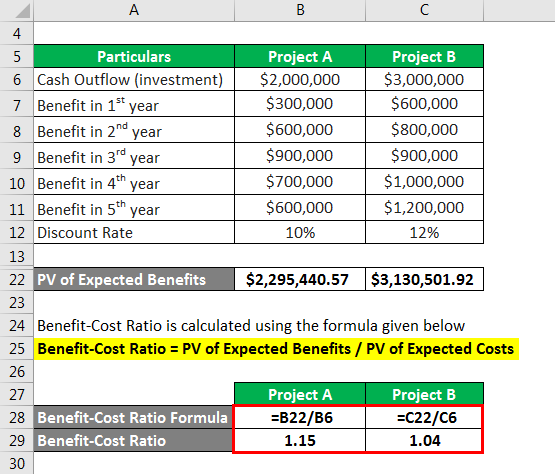

Let us take another example where two projects are being assessed by ASD Inc. The cash flow and discount rate details of the two projects (Project A and Project B) are as given below. Based on the given information, calculate out of the two projects which is a better project.

Solution:

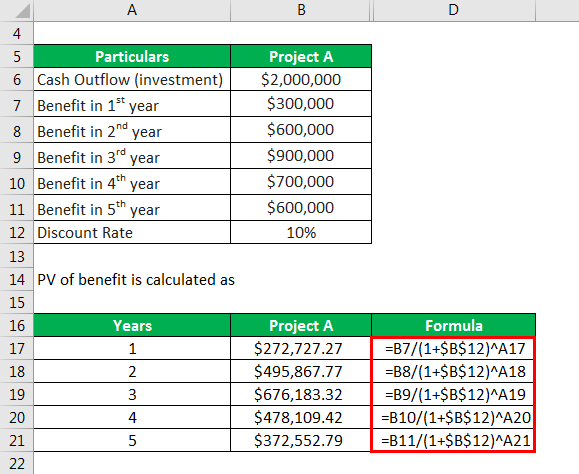

PV of Benefit is calculated as

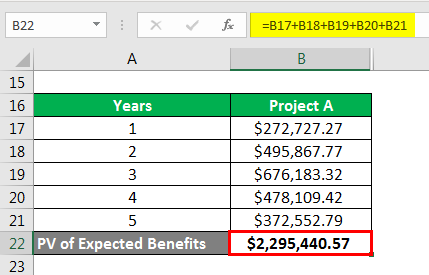

For Project A

- PV of benefit in 1st year = $300,000 / (1+10%)1 = $272,727.27

- PV of benefit in 2nd year = $600,000 / (1+10%)2 = $495,867.77

- PV of benefit in 3rd year = $900,000 / (1+10%)3 = $676,183.32

- PV of benefit in 4th year = $700,000 / (1+10%)4 = $478,109.42

- PV of benefit in 5th year = $600,000 / (1+10%)5 = $372,552.79

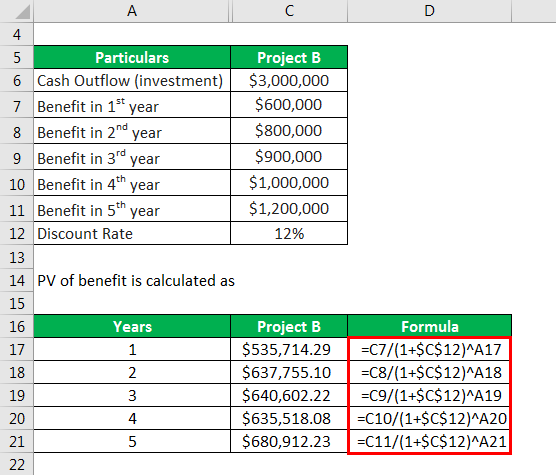

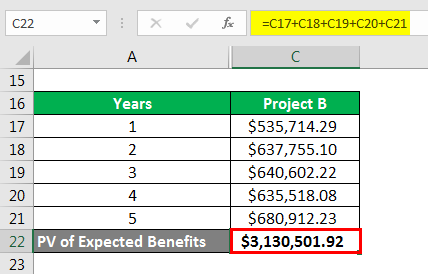

For Project B

- PV of benefit in 1st year = $600,000 / (1+12%)1 = $535,714.29

- PV of benefit in 2nd year = $800,000 / (1+12%)2 = $637,755.10

- PV of benefit in 3rd year = $900,000 / (1+12%)3 = $640,602.22

- PV of benefit in 4th year = $1,000,000 / (1+12%)4 = $635,518.08

- PV of benefit in 5th year = $1,200,000 / (1+12%)5 = $680,912.23

PV of Expected Benefits is calculated using the formula given below

For Project A

- PV of Expected Benefits = $272,727.27 + $495,867.77 + $676,183.32 + $478,109.42 + $372,552.79

- PV of Expected Benefits = $2,295,440.57

For Project B

- PV of Expected Benefits = $535,714.29 + $637,755.10 + $640,602.22 + $635,518.08 + $680,912.23

- PV of Expected Benefits = $3,130,501.92

Benefit-Cost Ratio is calculated using the formula given below

Benefit-Cost Ratio = PV of Expected Benefits / PV of Expected Costs

For Project A

- Benefit-Cost Ratio = $2,295,440.57 / $2,000,000

- Benefit-Cost Ratio = 1.15

For Project B

- Benefit-Cost Ratio = $3,130,501.92 / $3,000,000

- Benefit-Cost Ratio = 1.04

Therefore, it can be seen that Project A has a higher benefit-cost ratio as compared to Project B which indicates that out of the two Project A is the better investment option.

Explanation

The formula for Benefit-Cost Ratio can be calculated by using the following steps:

Step 1: Firstly, determine all the cash outflows which are basically the costs to be incurred in order to complete the upcoming project. One of the prime examples of such costs is the initial investment of a project.

Step 2: Next, determine all the cash inflows or benefits that are expected from the project. Incremental revenue or sales and cost savings are some of the major examples of such expected benefits.

Step 3: Next, determine the discounting rate based on available market information or opportunity cost.

Step 4: Next, compute the present value of all the expected cash outflows or costs (step 1) by using the discounting rate (step 3).

Step 5: Next, compute the present value of all the expected cash inflows or benefits (step 2) by using the discounting rate (step 3).

Step 6: Finally, the formula for a benefit-cost ratio can be derived by dividing the present value of all the expected benefits from the project (step 5) by the present value of all the expected costs of the project (step 4) as shown below.

Benefit-Cost Ratio = PV of Expected Benefits / PV of Expected Costs

Relevance and Use of Benefit-Cost Ratio Formula

It is a very concept as it is predominantly used in capital budgeting to have a fair idea about the overall value of an upcoming project. However, this technique is more useful for smaller projects compared to larger ones as the latter usually have too many assumptions and uncertainties which makes it hard to quantify the future benefits.

A value of greater than 1.0 is desirable as it indicates that the project is expected to deliver a positive NPV. On the other hand, a value of less than 1.0 means that the project’s costs is expected to outrun its benefits and as such should be rejected.

Benefit-Cost Ratio Formula Calculator

You can use the following Benefit-Cost Ratio Formula Calculator

| PV of Expected Benefits | |

| PV of Expected Costs | |

| Benefit-Cost Ratio | |

| Benefit-Cost Ratio = | PV of Expected Benefits /PV of Expected Costs |

| = | 0 /0 = 0 |

Recommended Articles

This is a guide to Benefit-Cost Ratio Formula. Here we discuss how to calculate the Benefit-Cost Ratio Formula along with practical examples. We also provide a Benefit-Cost Ratio a calculator with a downloadable excel template. You may also look at the following articles to learn more –