Save Money With the Brokerage Calculator

The financial market offers great opportunities, but high brokerage fees can reduce profits. This is where understanding the benefits of using a brokerage calculator becomes essential for investors and traders. Understanding and minimizing brokerage charges is crucial whether you are a day trader or a long-term investor. Platforms like Bajaj Broking provide a reliable brokerage calculator to help you estimate trading costs and optimize investments. You can also open a demat account with Bajaj Broking to access tools that simplify trading and help you save money with a brokerage calculator.

What is a Brokerage Calculator?

A brokerage calculator is a digital tool that computes the exact cost of brokerage fees and other trading expenses based on the details and nature of your trades. It helps you understand your transactions’ net profit or loss by factoring in charges like GST, SEBI fees, and more. This transparency is crucial in decision-making, allowing you to plan trades efficiently while keeping costs in check.

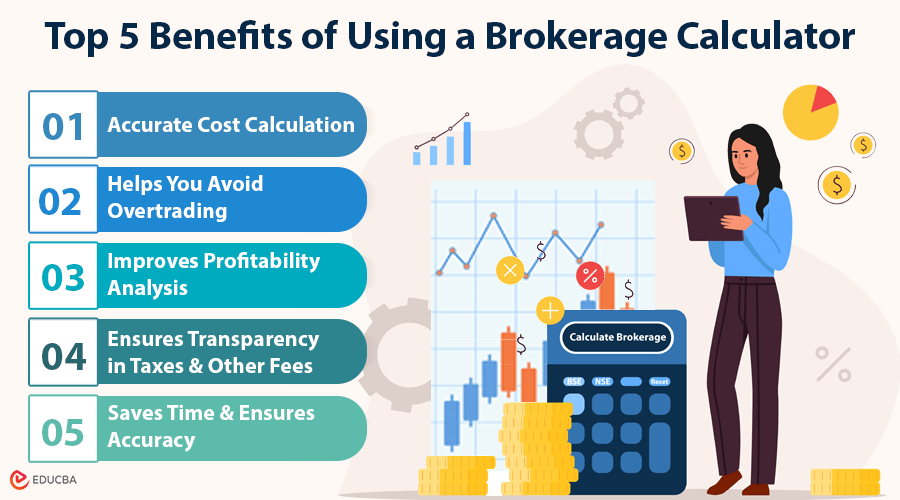

Top 5 Benefits of Using a Brokerage Calculator

Before diving into specifics, it is essential to note that a brokerage calculator does more than crunch numbers. It empowers you to strategize better. Here is how:

#1. Accurate Cost Calculation

Using a brokerage calculator gives you a clear idea of the total trading cost. This includes:

- Brokerage fees depend on the trade value.

- Regulatory charges like SEBI turnover fees and stamp duty.

- Exchange transaction charges and clearing charges.

This clarity helps you avoid hidden fees and make informed trading decisions.

#2. Helps You Avoid Overtrading

Overtrading can lead to unnecessary brokerage expenses. With a calculator, you can:

- Evaluate the cost of each trade in advance.

- Plan fewer but more strategic trades to save on fees.

For instance, by calculating the cost beforehand, you can avoid trades that yield negligible profits after deducting expenses.

#3. Improves Profitability Analysis

A brokerage calculator highlights the break-even point for your trades.

- Know the minimum price at which you need to sell to cover costs.

- Adjust your entry and exit points to ensure profitability.

By identifying high-cost trades, you can refine your trading strategy.

#4. Ensures Transparency in Taxes and Other Fees

Apart from brokerage charges, the calculator also accounts for:

- Taxes like GST.

- Exchange fees and other statutory costs.

This helps you avoid surprises during trade settlements, ensuring better financial planning.

#5. Saves Time and Ensures Accuracy

A brokerage calculator eliminates the need for manual calculations, offering:

- Instantly calculates brokerage fees, saving you effort

- Reduces errors compared to manual calculations

- Simple and accessible online tool requiring minimal inputs

You can get precise cost estimates tailored to your trading needs using a brokerage calculator.

Final Thoughts

A brokerage calculator is a must-have tool for traders looking to reduce costs and improve profitability. The benefits of using a brokerage calculator include transparency, accuracy, and strategic insights, allowing you to make smarter investment decisions. Bajaj Broking provides a reliable brokerage calculator and low-cost brokerage plans to support your trading journey. Open a demat account and take the first step towards smarter, cost-effective investing.

Investing in the securities market involves market risks. Please review all related documents carefully before making any investment decisions.

Recommended Articles

We hope this guide on the benefits of using a brokerage calculator helps you make informed investment decisions. Check out these recommended articles for more insights on optimizing your trading strategies.