Why Should You Choose the Best Forex Pairs to Trade?

Currencies always trade in pairs in the forex market, and they are known as currency or forex pairs. A currency pair is like a comparison price or exchange quotation between two different types of currency (money). It simply shows how much one currency is worth compared to another. However, finding the best forex pairs to trade can be difficult.

The pair you choose can greatly impact your trading strategy and the potential profitability of your trades. Therefore, one key decision you need to make is selecting the right currency pairs in forex trading. In this article, we will explore the process of selecting currency pairs and provide valuable tips to help you make informed decisions in the world of forex trading.

Table of Contents

- Why Should You Choose the Best Forex Pairs to Trade?

- How Do Currency Pairs Work?

- Most Popular Currency Pairs

- How to Choose a Currency Pair?

- Tips for Selecting Currency Pairs

How Do Currency Pairs Work?

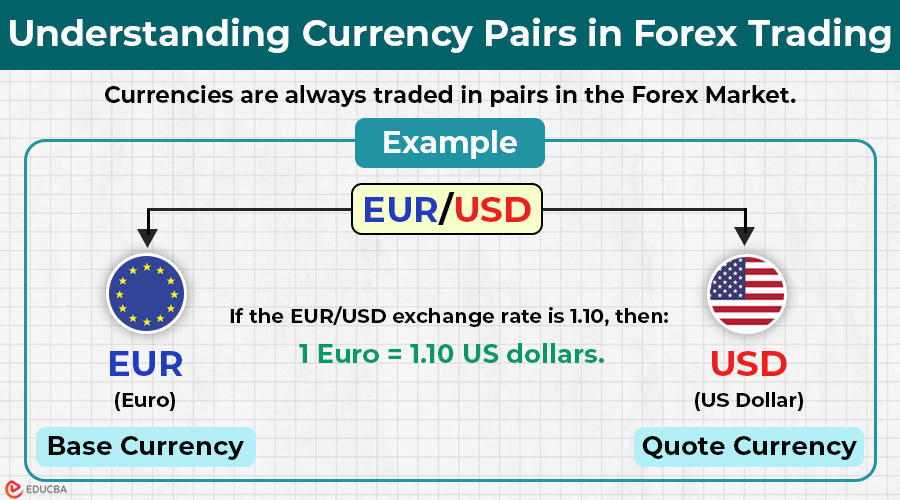

In forex trading, when you buy one currency, you are simultaneously selling another.

- Here, the first currency of the currency pair is the base currency. It is the currency you use for buying or selling.

- The second currency listed is the quote currency. It tells you the exchange rate or quoted price to buy one unit of the base currency.

Example:

In EUR/USD:

- Euro (EUR) = Base currency

- US dollar (USD) = Quote currency

If the EUR/USD exchange rate is 1.10, then to buy 1 euro, you need 1.10 US dollars.

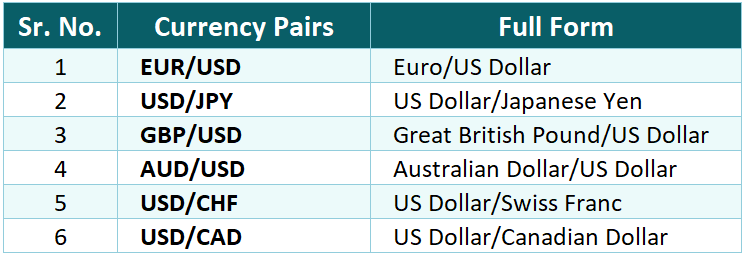

Best Forex Pairs to Trade – 6 Most Popular Currency Pairs

Some currency pairs are more popular than others in forex trading. These popular pairs are known as major currency pairs, and they include the US dollar (USD), Euro (EUR), Japanese yen (JPY), British pound (GBP), Canadian dollar (CAD), and Australian dollar (AUD). These major pairs are easy to trade because many people use them. Moreover, they usually have stable prices and do not change much.

The following are the best forex pairs to trade in the forex market:

The above pairs account for a major portion of the forex market’s total trading volume. Moreover, the EUR/USD pair is the most common trading currency pair, contributing to more than 24% of the total trading volume.

Best Forex Pairs to Trade – How to Choose a Currency Pair?

Choosing the best forex pairs to trade requires careful consideration of various factors. Here are some key factors to keep in mind:

1. Market Fluctuations or Volatility

Market volatility refers to the degree of change or fluctuation in the prices of a currency pair. If a currency pair is highly volatile, it means there are significant price movements among them.

Sometimes, this volatility means good opportunities or high risks for traders. Therefore, some trade in volatile markets, while others prefer more stable conditions. When selecting any pairs based on volatility, you must consider your risk tolerance and trading strategy.

2. Liquidity

Liquidity measures how easily you can trade or exchange ( buy or sell) a currency pair without changing prices. Highly liquid currency pairs have many buyers and sellers, ensuring you can enter and exit trades quickly.

Liquidity is important because it affects the execution speed and the cost of trading. For example, major pairs, like EUR/USD and USD/JPY, show high liquidity.

3. Economic Factors

Economic indicators or events play a crucial role in currency price movements. Therefore, you must stay updated on changes in a country’s economy, such as central bank decisions and political events that could impact the currency pairs you are interested in.

In addition, factors such as GDP growth, inflation, interest rates, and political stability can also significantly influence currency values.

4. Relationship between Pairs

These pairs can exhibit positive or negative correlations, meaning some pairs move in the same direction while others move in opposite directions. Understanding the correlations between currencies of a particular pair can help you make wise trading choices and manage risk.

For example, you can consider trading EUR/USD and GBP/USD because these pairs are positively correlated, meaning they often move in similar directions.

5. Technical Analysis

Technical analysis means using historical trading data, various analytical tools, and indicators to identify price patterns and trends of currency pairs. You can use historical charts, which show price movement, and technical indicators, such as moving averages and oscillators.

Moreover, including these technical analysis tools will help in the decision-making process and can identify potential entry and exit points for trades.

Tips for Selecting Currency Pairs

The following are some tips for selecting good forex pairs to trade.

1. Plan Your Trading Strategy

Before selecting any pairs, it is important to have a clear trading strategy in place. You should determine your goals, trading style, and the level of risk you are comfortable with.

Also, decide whether you are looking for short-term or long-term opportunities. Your trading strategy will guide you in selecting the appropriate pairs.

2. Start with Major or Commonly Used Pairs

If you are new to forex trading, we recommend that you start with the major or most common currency pairs. These pairs have higher liquidity and more stable price movements than other currency pairs.

3. Stay Informed on Economic Updates

Stay updated on economic news, market trends, and geopolitical events that could impact your chosen pairs. Economic calendars, financial news websites, and reputable forex forums are valuable sources of information.

Moreover, being aware of upcoming news releases and events can help you understand potential market volatility and adjust your trading strategy accordingly.

4. Practice With Demo Accounts

You can use demo accounts to practice trading strategies and familiarize yourself with different currency pairs. Many reputable brokers provide demo accounts where you can practice with virtual money.

You can use this opportunity to test your strategies, understand the dynamics of different pairs, and gain confidence before trading with real money.

5. Monitor Your Trading Performance and Improve

You must continuously monitor and review your trading performance. You can keep a trading journal to record your transactions, including the currency pairs, entry and exit points, and the reasons behind each trade or transaction.

Thus, by regularly reviewing your trades, you will be able to identify market patterns and your strengths and weaknesses in trading. Use this feedback to refine your strategy and improve your overall trading performance.

Final Thoughts

Selecting the best forex pairs to trade is crucial to achieving success in forex trading. Before trading, you must conduct thorough research, analysis, and risk management. Remember, forex trading is dynamic and requires continuous learning and adaptation.

Recommended Articles

We hope this article listing the best forex pairs to trade was informative and helpful to you. Refer to the suggestions below to learn more about trading and related topics.