Is There a Right Time to Apply for a Credit Card?

For many individuals, applying for a credit card can be a wise financial choice. It provides convenience, flexibility in handling expenses, and the chance to build or enhance your credit score. However, the timing of your credit card application is crucial to maximize its benefits. When you apply at the right moment, you can increase your chances of approval, enjoy promotional offers, and manage big purchases or debt consolidation more effectively. In this article, we will explore five important factors to consider when deciding the best time for credit card application.

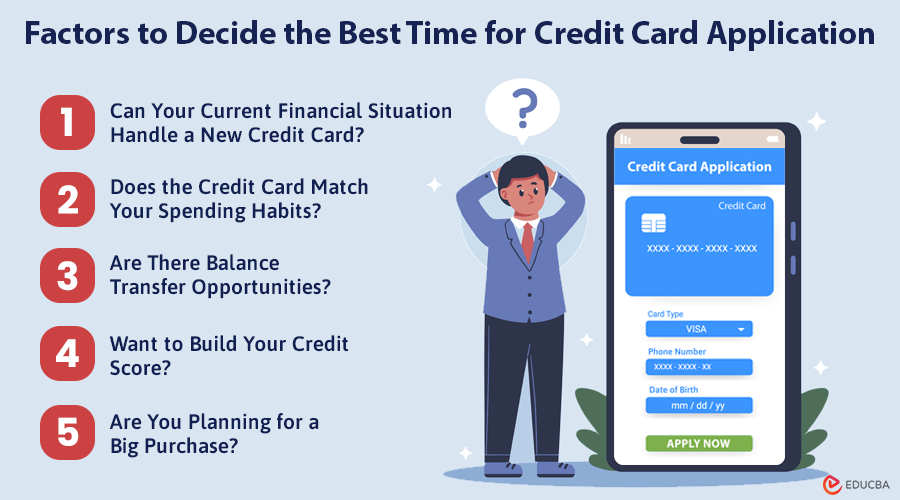

5 Factors to Decide the Best Time for Credit Card Application

Let us examine the key factors to consider when determining whether it is the right time to apply for a credit card. This will help you make an informed decision.

#1. Can Your Current Financial Situation Handle a New Credit Card?

Credit card issuers typically prefer applicants with stable incomes, which shows that you can repay your balance on time. You are more likely to be approved if you have a reliable job or income source. You may struggle to make monthly payments without a steady income, leading to late fees and debt accumulation.

Credit card issuers in the Philippines also assess an applicant’s debt-to-income ratio. This indicates how much of your monthly income goes toward paying off debts. A high debt-to-income ratio often suggests you may have already overextended your credit. Simply put, if you currently have other financial obligations, such as personal loans, car loans, or existing credit card balances, these can impact your ability to manage a new credit card. To increase your likelihood of approval, prioritize paying off existing debts before submitting a credit card application. This approach improves your financial profile and makes managing future payments easier.

#2. Does the Credit Card Match Your Spending Habits?

Another reason to apply for a credit card is to take advantage of rewards and features. However, choose a credit card with rewards that fit your lifestyle. Credit cards offer various benefits, including travel rewards, cashback, or points for spending on groceries, dining, and shopping.

For example, a card with air miles rewards would be a great option if you travel often. If you spend a lot on groceries or dining, consider a card that offers cashback on those purchases. Applying for the right card that aligns with your spending will help you maximize your credit card benefits.

#3. Are There Balance Transfer Opportunities?

If you are paying high interest rates on an existing card, applying for a new card with balance transfer offers can be a strategic move. A balance transfer lets you transfer existing debt to a new credit card with a lower interest rate, helping you reduce your interest payments over time.

Many credit card issuers in the Philippines offer promotional balance transfer deals with low or 0% interest for a limited period. Applying during such promotions can make it easier to pay off debt and save money in the long run.

#4. Want to Build Your Credit Score?

If you have a limited credit history or are new to credit, applying for a credit card at the right time can help you build your credit score. A good credit score in the Philippines is essential for securing future loans, such as personal loans or mortgages.

By applying for a credit card and managing it responsibly, you can build and maintain a positive credit history. Ensure timely bill payments and keep your balance below 30% of your credit limit. This responsible borrowing behavior will help improve your credit score over time.

#5. Are You Planning for a Big Purchase?

Another factor to consider when applying for a credit card is whether you plan to make a significant purchase soon. Many credit cards provide zero-interest installment plans, enabling you to divide large purchases into manageable monthly payments.

For instance, if you plan to buy electronics or furniture, applying for a credit card with this feature can help you spread the cost over several months without paying extra interest. This can be a smart way to manage big-ticket items while maintaining cash flow.

Final Thoughts

Understanding the best time for credit card application can help you maximize the benefits of your credit card. Whether you aim to build your credit, earn rewards, or manage debt, applying for a credit card at the right time ensures you make the most of its features. Take the time to assess your financial situation and select the card that aligns with your needs and goals. By applying at the right moment, you can set yourself up for success in managing your finances with a credit card.

Recommended Articles

We hope this guide on the best time for credit card application helps you make informed decisions about timing your credit card application for maximum benefits. Check out these recommended articles for more effective tips on managing your credit and finances.