Updated November 23, 2023

Bid-Ask Spread Formula

The bid-ask spread is the difference between the bid price and asks price that dealers quote and it is the source of the dealer’s compensation.

![]()

Examples of Bid-Ask Spread Formula

Let’s take an example to find out the Bid-Ask for a company: –

Bid-Ask Spread Formula – Example #1

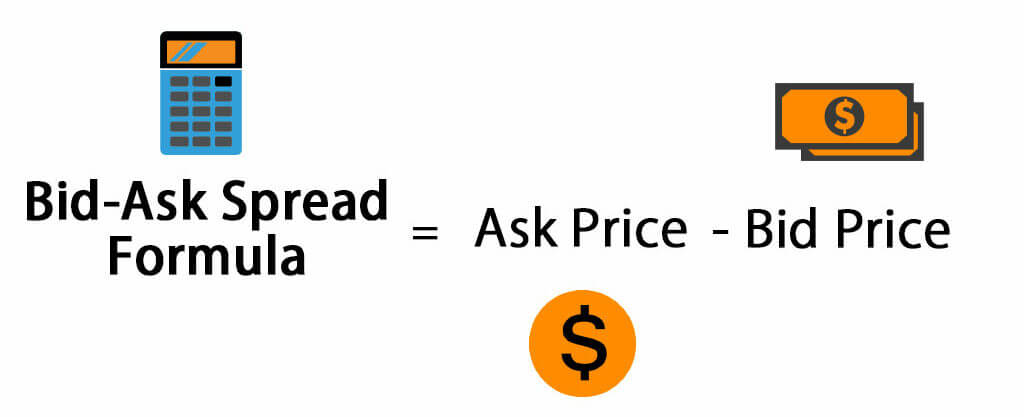

Let’s take an example of stock X being quoted in the exchange as $20/21. This indicates that the price at which the dealer is ready to purchase stock X from any investor is $20. This is the bid price for the security X. The price at which the dealer is ready to sell stock X to any investor is $21. This is the asking price for the security X.

Hence we can calculate the bid-ask spread by subtracting the bid price from the asking price.

- Bid-Ask Spread = Ask price – Bid Price

- Bid-Ask Spread = $21 – $20

- Bid-Ask Spread = $1

Hence the dealer’s compensation on a transaction of security X is $1.

Bid-Ask Spread Formula – Example #2

Currency markets are the most liquid markets across the world; hence bid-ask spreads for dealers on these transactions are very low. However the transaction size in these markets is very high, compensating dealers on any transaction.

- For example – The EUR to USD market is currently having the quote of: –

- EUR/USD = 1.1405/1.1425

- EUR to USD indicates that USD is the base currency; hence, an investor or dealer will be purchasing or selling dollars.

- Hence the dealer will buy dollars or sell euros to the investor at 1.1405, and the dealer will sell dollars or purchase euros at 1.1425.

So the bid asks spread for the dealer in this transaction: –

Now, we will find out the Bid-Ask Spread By using the Bid-Ask Spread Formula

- Bid-Ask Spread = Ask Price – Bid Price

- Bid-Ask Spread = 1.1425 – 1.1405

- Bid-Ask Spread = $0.0020

The bid asks spread for the dealer in this transaction is $0.0020

Bid-Ask Spread Formula – Example #3

Let’s say an investor wants to purchase Gold Futures in an Indian Commodity market. The best bid price, or the price at which the dealer will purchase the future contract, is Rs 26473, while the best offer price, or the price at which the dealer will sell the futures contract, is Rs 26478, then the bid-ask spread for this particular future contract is: –

Let us calculate the Bid-Ask Spread for this particular future contract

- Bid-Ask Spread = Ask price – Bid price

- Bid-Ask Spread = Rs 26478 – Rs 26473

- Bid-Ask Spread = Rs 5

Explanation of Bid-Ask Spread Formula

Securities or currency dealers provide prices at which they will buy or sell financial instruments. The bid price is the price at which the dealer will buy the security, or the investor will sell the security. The ask or offer price is the price at which the dealer will sell the security, or the investor will buy the security. The difference between the bid and ask prices is referred to as the bid-ask spread and is the source of the dealer’s compensation.

The bid and ask prices for security are quoted for specific trade sizes. The quotation in the market is the highest dealer bid, and lowest dealer ask from among all dealers in a particular security. More liquid securities have lower bid-ask spreads and therefore have lower transaction costs for investors. Traders who post bids and offers are said to make a market, while those who trade with them at posted prices are said to take the market.

Significance and Use of Bid-Ask Spread Formula

The bid-ask spread is affected by various factors. These factors determine the risk dealers take when they purchase or sell any financial instrument; hence, they are wider when riskier. One of the factors that affect bid-ask spreads is liquidity. Liquidity refers to the number of market participants or volume of that particular instrument traded. If there is a lot of demand for that particular instrument and there are a lot of market participants who want to buy or sell that instrument, then the bid asks spread will be narrower. Similarly, if the instrument does not have a lot of demand, the dealer is taking an additional risk by purchasing or selling the security as the instrument is illiquid. Hence the dealer will demand additional compensation, which results in wider bid-ask spreads.

Another major factor that impacts bid-ask spread is volatility. Volatility means that there is either huge market demand for any instrument or a total loss of demand. In these circumstances, the dealer wants to benefit as much as possible hence the spreads will be wider when volatility is high.

Bid-Ask Spread Calculator

You can use the following Bid-Ask Spread Calculator

| Ask Price | |

| Bid Price | |

| Bid Ask Spread Formula | |

| Bid Ask Spread Formula = | Ask Price – Bid Price |

| = | 0 – 0 |

| = | 0 |

Bid-Ask Spread Formula in Excel (With Excel Template)

Here we will do the same example of the Bid-Ask Spread formula in Excel. It is very easy and simple. You need to provide the two inputs i.e, Ask Price and Bid Price

You can easily calculate the Bid-Ask Spread using Formula in the template provided.

In this template, we have to solve the Bid-Ask Spread formula

Conclusion

The bid-ask spread is the difference between the asking price and the bid price quoted by the dealer for any financial instrument. If the Bid-ask spread is wider, it indicates less liquidity or more volatility for that particular financial instrument. If the bid-ask spread narrows, it indicates more liquidity and less volatility for that security.

Recommended Articles

This has been a guide to the Bid-Ask Spread formula. Here, we discuss its uses along with practical examples. We also provide a Bid-Ask Spread calculator and a downloadable Excel template.