Updated November 24, 2023

Difference Between Bid Price vs Ask Price

The most widely used term while buying securities in the market is bid price vs ask price. The bid-ask spread represents the basic transaction cost that will be applied for acquiring an investment in the market. The bid-ask spread, and other fees or commissions will represent the basic transaction cost of trading that security. The bid price is the highest price that the buyers are willing to pay for them, while the asking price is the lowest price at which the sellers are willing to sell a security or other investment asset. The difference between the bid price vs ask price is called the spread. For example, if the bid price on security is $100 and the asking price is $101, then the spread will be $1

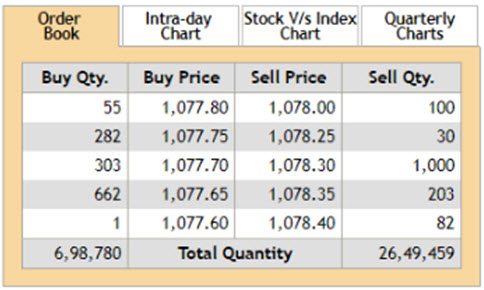

Take an example below of Reliance Industries, where we show the top 5 bid prices vs ask price.

The average investor will contend with the ask and bid spread as an implied cost of trading. For example, if the current price quotation for Reliance Industries is 1,077.65 / 1078.30, investor A, who is looking to purchase Reliance at the current market price, would pay 1078.30. In contrast, investor B, who wishes to sell Reliance at the current market price, would receive 1077.65.

Head To Head Comparison Between Bid Price vs Ask Price (Infographics)

Below is the top 7 difference between Bid Price vs Ask Price

Key Differences Between Bid Price vs Ask Price

Both Bid Price vs Ask Price are popular choices in the market; let us discuss some of the major differences between Bid Price vs Ask Price.

- In the case of security, if the stock price is expected to rise, the buyer would purchase the security at a price that he considers fair. The price at which the buyer is willing to purchase the stock is called the Bid. In the future, when the prices fall, the buyer is now a seller. He will now quote a price he considers selling to maximize his profit, known as the Ask.

- The bid price is usually quoted as low and will also be structured to achieve the desired outcome. Since the seller will never sell the security at a lower rate, the ask price must always be higher. For, if the asking price of a security is $4,000 and a buyer is willing to purchase it for $3,000, he will quote an amount of $1,000. This might appear like a compromise, and both parties will try to find a mid-path and agree on a price where they want to be.

- The Bid Price is the seller’s rate because anyone who sells the security should get the bid price. If you purchase security on the opposite side, you should get the Ask Price. The difference between these two prices will go to the specialist or the broker that handles the transaction.

- There can be a case that several buyers are bidding for a higher amount; however, the same will not likely be applicable in the case of ask.

- On the purchase side, prices will always be in descending order, and the topmost bid will be considered the best bid, on the contrary side (sell), prices are arranged in ascending order, and the topmost ask will be taken as the best ask. The average of the best ask and the best bid price will be taken as the ideal price of that security.

- The bid-ask spread can only be positive when the Bid price is smaller than the asking price. A higher spread will indicate the wide difference between the 2 prices, possibly due to a lack of liquidity. This could also make it difficult sometimes to generate a profit as the security will always be bought at a higher price and sold at a lower price.

Bid Price vs Ask Price Comparison Table

Below is the 7 topmost comparison between Bid Price vs Ask Price

| Basis Of Comparison | Bid Price | Ask Price |

| Basic Definition | The bid price is the maximum price the buyer is willing to pay for the stock or the security price. | The asking price is the minimum price for the seller to sell the stock or the security price. |

| Range-Bound | This rate will usually be higher than the market price of the stock. | The asking price will usually be below the market price of the stock. |

| Which Rate is Higher? | The bid rate is always the left one quote and is less than the ask price. | The asking price is higher than the bid price and is on the right side of the quote. |

| What does it represent? | These will be the highest bids currently, and they would be in line with lower bids. | These are the highest asks currently, and there would be higher bids in a queue as well. |

| Users | Sellers of the stock will use the bid price. | Buyers of the stock price will use the ask price. |

| Broker perspective | The bid price is their selling price; hence, they try to extract the maximum from the buyers. | The asking price is the price at which the brokers purchase the stock, so they try to lower the price from their side. |

| Convention | Say the bid price is $16 x 130; potential buyers will bid at $16 for up to 130 shares. | An asking price of $28 x 109 would mean that potential sellers are willing to sell at that price to 109 shares. |

Conclusion

Bid-ask spreads vary widely, depending on the stock, security, and market. Blue-chip companies that constitute the Dow Jones Industrial Average may have a bid-ask spread of only a few cents, while a small-cap stock may have a bid-ask spread as high as 50 cents or more.

The bid-ask spread can widen dramatically during periods of market turmoil or illiquidity since traders will not be willing to buy at a price beyond a certain threshold, and sellers will also not accept prices below a certain level.

Recommended Articles

This has been a guide to the top difference between Bid Price vs Ask Price. Here, we also discuss the Bid Price vs Ask Price key differences with infographics and a comparison table. You may also have a look at the following articles to learn more.