Updated July 24, 2023

Bond Formula (Table of Contents)

What is the Bond Formula?

The term “bond” refers to a type of debt instrument that pays periodic interest in the form of coupons and such bonds are known as coupon bonds. There are also bonds that don’t pay coupons but are issued at a lower price than their redeemable value and such bonds are known as zero-coupon or deep discount bonds.

The term “bond formula” refers to the bond price determination technique that involves computation of present value (PV) of all probable future cash flows, such as coupon payments and par or face value at maturity. The PV is calculated by discounting the cash flow using yield to maturity (YTM). Mathematically, the formula for coupon bond is represented as,

where,

- C = Annual Coupon Payment

- F = Par Value at Maturity

- r = YTM

- n = Number of Coupon Payments in A Year

- t = Number of Years until Maturity

On the other hand, the formula for zero-coupon bond (putting C = 0 in the above formula) is represented as,

Examples of Bond Formula (With Excel Template)

Let’s take an example to understand the calculation of Bond in a better manner.

Bond Formula – Example #1

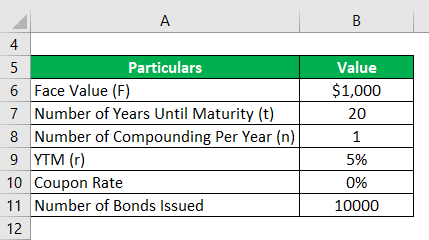

Let us take the example of deep discount bonds issued by ASD Inc. last week. The company will raise funds for its upcoming capex plans by issuing these 10,000 deep discount bonds. The face value of the bond is $1,000 and it is redeemable after 20 years. Calculate the price of each bond and the money that can be raised by ASD Inc. through these bonds if the YTM based on current market trends is 5%.

Solution:

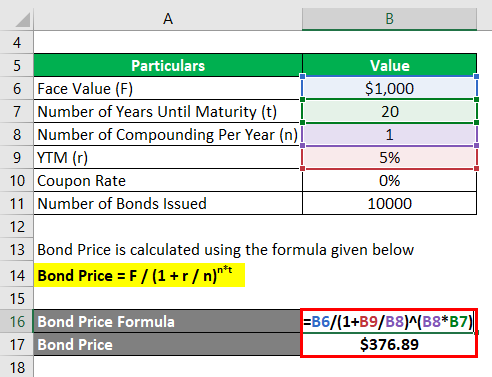

Bond Price is calculated using the formula given below

Bond Price = F / (1 +r / n) n*t

- Bond Price = $1,000 / (1 + 5% / 1) 1*20

- Bond Price = $376.89

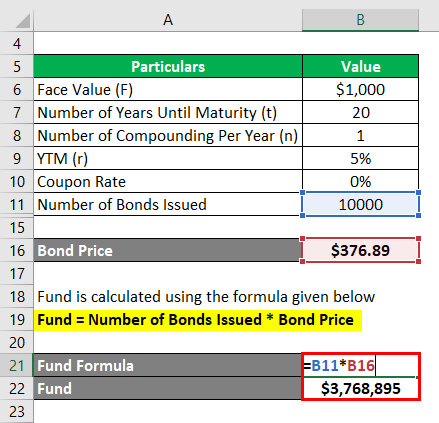

Fund is calculated using the formula given below

Fund = Number of Bonds Issued * Bond Price

- Fund = 10,000 * $376.89

- Fund = $3,768,895 or $3.77 million

Therefore, based on the given information, each bond is worth $376.89. Further, ASD Inc. will be able to raise fund worth $3.77 million.

Bond Formula – Example #2

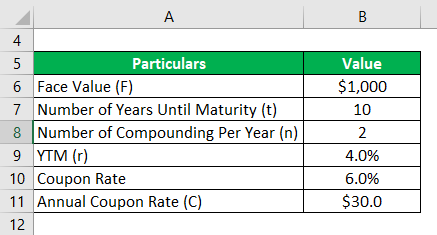

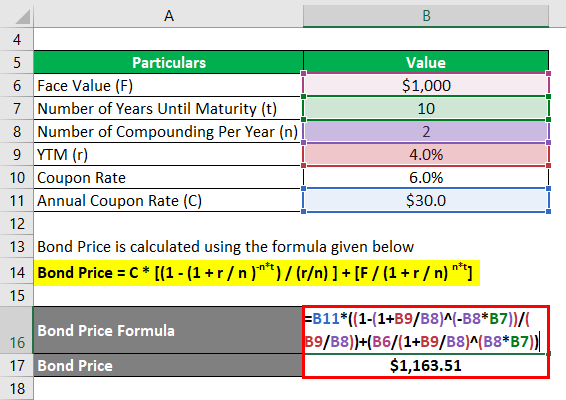

Let us take the example of another bond issue by SDF Inc. that will pay semi-annual coupons. The bonds have a face value of $1,000 and a coupon rate of 6% with maturity tenure of 10 years. Calculate the price of each coupon bond issued by SDF Inc. if the YTM based on current market trends is 4%.

Solution:

Bond Price is calculated using the formula given below

Bond Price = C * [(1 – (1 + r / n )-n*t ) / (r/n) ] + [F / (1 + r / n) n*t]

- Bond Price = $30 * [(1 – (1 + (4% / 2) )-2*10 ) / (4% / 2) ] + [$1,000 / (1 + (4% / 2) )2*10]

- Bond Price = $1,163.51

Therefore, the price of each coupon bond is expected to be $$1,163.51.

Explanation

The formula for a bond can be derived by using the following steps:

Step 1: Initially, determine the par value of the bond and it is denoted by F.

Step 2: Next, determine the rate at which coupon payments will be paid and using that calculate the periodic coupon payments. It is the product of the par value of the bond and coupon rate. It is denoted by C and mathematically represented as shown below.

C = Annual Coupon Rate * F

Step 3: Next, determine the bond’s number of years until maturity, which is denoted by t.

Step 4: Next, determine the YTM of the bond on the basis of the return currently expected from securities with similar risk profiles. The YTM is denoted by r.

Step 5: Next, determine the number of coupon payments to be paid during a year, which is denoted by n. To put it simply, it is the number of compounding per year.

Step 6: Next, determine the PV of probable future cash flows by discounting coupon payments and the face value at maturity using the YTM as shown below.

PV of kth Periodic Coupon Payment = (C / n) / (1 + r / n) k

PV of Face Value = F / (1 + r / n) n*t

Step 7: Finally, the bond formula can be derived by adding up the PV of all the coupon payments and the face value at maturity as shown below.

Bond Price = C * [(1 – (1 + r / n )-n*t ) / (r/n) ] + [F / (1 + r / n) n*t]

Relevance and Use of Bond Formula

From the perspective of an investor or an analyst, it is important to understand the concept of bond pricing as bonds are an indispensable part of the capital market. In the bond market, bonds paying higher coupons attractive for investors as a higher coupon rate means higher yields. Further, bonds that trade at a value higher than their face value are said to be trading at a premium, while bonds that trade at a value lower than their face value are said to be trading at discount. However, in the case of zero-coupon bonds, the current market trend decides it worth it. If the issue price is lower than the market rate then it is good for the investor.

Recommended Articles

This is a guide to Bond Formula. Here we discuss how to calculate Bond along with practical examples. We also provide a downloadable excel template. You may also look at the following articles to learn more –