Updated July 15, 2023

What is Bond Ladder?

The term “bond ladder” refers to the investment strategy in which an investor builds a portfolio of fixed-income securities (primarily bonds) that mature at equally spaced regular intervals.

As the bonds mature at the end of each interval, they are reinvested or rolled over for another round. In this way, the investors maintain their holding position of bonds in equally spaced intervals.

Explanation of Bond Ladder

In the bond ladder strategy, the investors place their money in multiple bonds with staggered maturity periods. As each bond matures, the investors reinvest the money in a new bond with a maturity period equivalent to the longest term of the ladder strategy. Effectively, if the interest rates go up, the investors can reinvest at higher rates. On the other hand, if the interest rates fall, the investors will have the existing bonds already invested at higher yields.

Goals of Bond Ladder

The investors who chose to follow the bond laddering strategy intend to achieve the following two goals:

- To reduce the reinvestment risk associated with the rollover of the matured bonds all at once. Investors avoid investing at any single interest rate by staggering the maturity periods.

- To manage the flow of money through a steady stream of cash flows through coupon payments spread across the year.

How Does Bond Ladder Work?

In the bond ladder strategy, the investors initially purchase short-term and long-term bonds to spread the risk along the interest rate curve. When the interest rates rise, the investors can reinvest the short-term bonds at a higher rate, while the long-term bonds will continue to generate lower returns until maturity. On the other hand, when the interest rates plummet, the investors will earn a lower yield on the reinvested short-term bonds, but the long-term bonds will generate higher returns until their maturity. In this way, the bond laddering strategy helps generate a higher average yield while reducing interest rate and liquidity risks.

Example of Bond Ladder

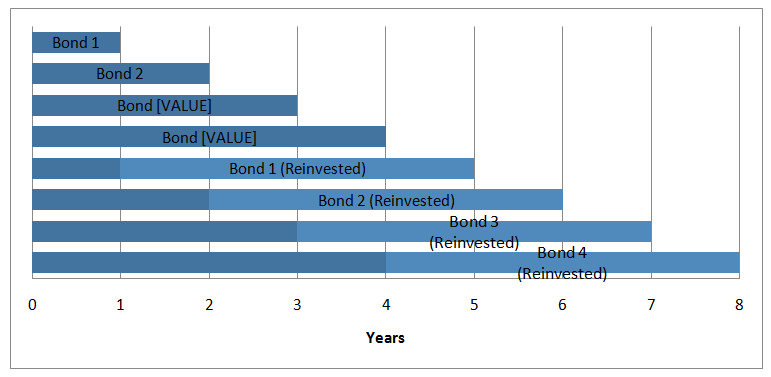

Let us look at an example to understand the strategy of the bond ladder. Let us assume that an investor has $20,000 to invest and intends to construct a bond portfolio spread across four years, with a maturity every year. So, the investor will invest $5,000 in four different bonds with maturity periods of one year, two years, three years, and four years. For convenience, let us name them Bond 1, Bond 2, Bond 3, and Bond 4, respectively.

So, at the end of one year, when Bond 1 matures, the investor will roll over it into a 4-year maturity bond. Similarly, the other three bonds will be rolled over into 4-year bonds at the end of two, three, and four years. Eventually, after a period of 4 years, the investor’s ladder position will be created. So, we can see that in the above chart, the investor will have a maturity at the end of each year.

How to Build a Bond Ladder?

A bond laddering strategy is usually constructed with a mix of different types of bonds. The following are the various components of a typical bond ladder strategy:

- Rungs: The number of bonds in the portfolio can be derived by dividing the total dollar amount by the total number of years for which the ladder strategy has to be created. This resembles the number of rungs in a ladder. The thumb rule is that the higher the number of rungs, the more diversified the portfolio, thus better protected against reinvestment risk. The number of rungs is 4 in the above example.

- Height: The distance between two consecutive rungs is the metaphorical representation of the duration between two consecutive maturities. The height of a bond ladder can vary from a few months to a few years. The thumb rule is that the lower the height, the more safeguarded the portfolio from reinvestment risk, resulting in a relatively lower average return. The height of the bond ladder is 1 year in the above example.

- Building materials: Bond ladders are also made of different materials, just like real ladders. For instance, investors may invest in different companies to reduce exposure to company-specific risks. Investors can also consider investing in other fixed securities, such as debentures, treasury bonds, municipal bonds, government bonds, and certificates of deposit.

Advantages

Some of the major advantages of the bond ladder are as follows:

- First, the investors can have the maturities at the end of a particular interval instead of getting caught in the lock-in period of a long-term fixed-income instrument. This ensures a better liquidity position.

- It significantly reduces the reinvestment risk due to changing interest rates, an issue with long-term bonds.

- The ability to incorporate different types of fixed-income securities helps in the diversification of the investment portfolio.

Disadvantages of Bond Ladder

Some of the major disadvantages of the bond ladder are as follows:

- Investors must invest in lower-yield bonds in a continuously declining interest-rate market. So, the bond laddering strategy can backfire at times.

- This strategy involves frequent buying and selling of bonds. If the investments are routed through a broker, the broker fees eat away a certain portion of the bond yield.

Conclusion

So, we can see that the bond laddering strategy has its own set of advantages and limitations. It is best for investors who are willing to take the trade-off between interest rate and reinvestment risk. The investors should be able to set aside the fund for a relatively long period for the approach to be fruitful. The strategy can lower the portfolio risk and thus can be a very good option for saving for a retirement account.

Recommended Articles

This is a guide to Bond Ladder. Here we also discuss the definition and How Does Bond Ladder Work? Along with advantages and disadvantages. You may also have a look at the following articles to learn more –