Updated November 23, 2023

Book Value Per Share Formula (Table of Contents)

- Book Value Per Share Formula

- Book Value Per Share Formula Calculator

- Book Value Per Share Formula in Excel(With Excel Template)

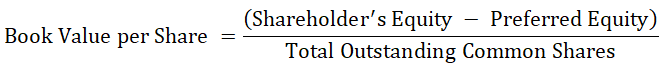

Book Value Per Share Formula

Where,

- Total liabilities

Total liabilities are the total debt and financial obligations payable by the company to organizations or individuals at any defined period of time. Total liabilities are stated on the balance sheet by the company.

- Total Assets

Total Assets are the total assets owned by an entity or an individual. Assets are items of monetary value used over time to produce a benefit for the asset’s holder. If a company owns assets, it includes them in the balance sheet to maintain accurate accounting records.

Examples of Book Value Per Share Formula

Let’s take an example to find out the Book Value Per Share for a company: –

Example #1

Let’s assume Company Anand Pvt Ltd has $25,000,000 of stockholders’ equity, $5,000,000 preferred stock, and total outstanding shares of $10,000,000 shares outstanding. We must calculate the book value per share for the Anand Group of companies.

Now, we can calculate the Book Value Per Share for Anand Pvt Ltd by using the Book Value Per Share Formula:

- Stockholder’s Equity = $25,000,000

- Preferred Equity = $5,000,000

- Total Outstanding Common Shares = $10,000,000

By using the Book Value per Share Formula

- Book Value per Share = (Shareholders’ Equity – Preferred Equity) / Total Outstanding Common Shares

- Book Value per Share = $(25,000,000- $5,000,000) / $10,000,000

- Book Value per Share = $2

This shows Anand Group has a book value per share of $2.

Example #2

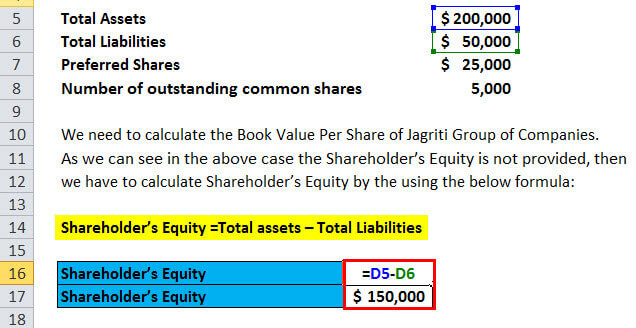

Jagriti Group of Companies has the following details as per its financials for the year ended 2017-18:

- Total assets = $200,000

- Total liabilities = $50,000

- Preferred shares = $25,000

- Number of outstanding common shares = 5000 shares

Therefore,

We must calculate the Book Value Per Share of Jagriti Group of Companies.

As we can see in the above case, the Shareholder’s Equity is not provided, then we have to calculate the Shareholder’s Equity by using the below formula:

- Total assets = $200,000

- Total liabilities = $50,000

Shareholder’s Equity Formula

- Shareholder’s Equity =Total assets – Total Liabilities

- Shareholder’s equity = $200,000 – $50,000

- Shareholder’s Equity = $1,50,000

Now, we have to calculate how much common shareholders will be getting from the shareholders’ equity. So, we must deduct the Preferred stocks from the Shareholders’ equity.

Therefore,

- Common shareholders’ equity = Shareholder’s equity – Preferred Share

- Common shareholder’s equity = $1,50,000- $25,000

- Common shareholder’s equity = $1,25,000

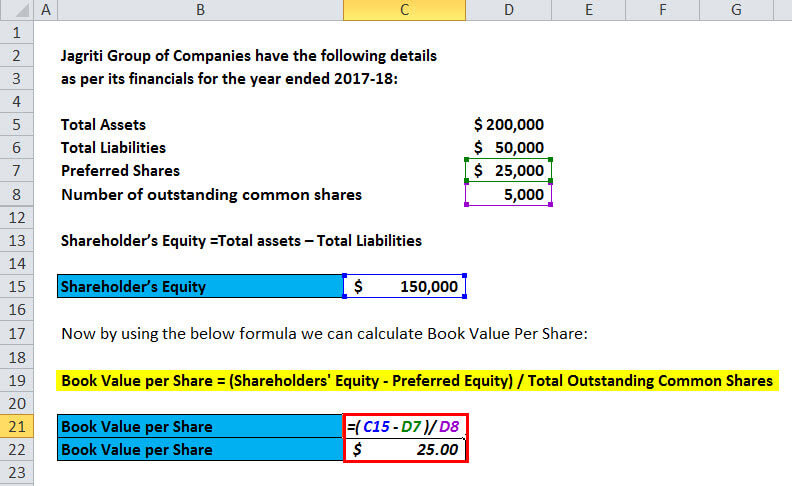

Now, by using the formula below, we can calculate Book Value Per Share:

- Book Value per Share = (Shareholders’ Equity – Preferred Equity) / Total Outstanding Common Shares

- Book Value per share = $1,50,000- $25,000/ 5,000

- Book Value per share = $1,25,000/ 5,000

- Book Value per share = $25

The book Value per share of Jagriti Group of Companies is $25

Example #3

Calculate the Book Value per share for Anand Group of Companies using the following extracts available:

- Current Assets = $70,000

- Non-current Assets = $230,000

- Current Liabilities = $60,000

- Non-Current Liabilities = $30,000

- Preferred shares = $45,000

- Number of outstanding common shares = 3500 shares

For calculating Book Value Per Share, we need Shareholders’ Equity, which can be calculated as below:

- Total assets = Current Assets + Non-current Assets

- Total Liabilities = Current Liabilities + Non-Current Liabilities

- Shareholder’s Equity = (Current Assets + Non-current Assets) – (Current Liabilities + Non-Liabilities)

- Shareholder’s Equity = ($70,000 + $230,000) – ($60,000 + $30,000)

- Shareholder’s Equity = $3,00,000 – $90,000

- Shareholder’s Equity = $2,10,000

Now, by using the formula below, we can calculate Book Value Per Share:

- Book Value per share = ($2,10,000- $45,000)/3500

- Book Value per share = $47.14

The book Value per share of Jagriti Group of Companies is $47.14.

Explanation

You can calculate the book value per share to determine the value of a company per share. The calculation is based on the equity available to common shareholders after paying off the debts and preferred shareholders for which the company is legally obliged. One must subtract preferred shares from the shareholders’ equity when calculating book value per share.

A company’s “Book Value”, also referred to as Shareholder’s Equity or Owner’s Equity, can be calculated by subtracting Total Liabilities from Total Assets.

Therefore, Shareholder’s Equity =Total assets – Total Liabilities

And, Book Value per Share = (Shareholders’ Equity – Preferred Equity) / Total Outstanding Common Shares. The data mentioned above can be found on the company’s balance sheet.

Significance and Use of Book Value Per Share

The investors can use book value per share to determine the equity in a company compared to the company’s current market value, that is, the current price of the stock. For example, Let’s assume Anand Ltd is currently trading for $30. But it has a book value of $15. This shows the stock of Anand Ltd is selling at double, I.e., two times its equity. The above example is used in valuation methodology, i.e., Multiple Valuation (price to book value or P/B) or relative valuation; in this formula, book value per share is used in the denominator.

The stock’s current market price reflects its growth potential in contrast to its Book Value. One can look at their book value per share to compare the value of different companies. The price-to-book value ratio, also known as P/B, is the value of a company’s common stock, which can be determined by using its book value per share or by Company B’s price-to-book value ratio or the industry ratio.

To compute the return on equity formula, investors can use the book value per share, abbreviated as ROE. In this scenario, one calculates ROE on a per-share basis.

Simply divide the stockholder’s equity by the net income to calculate the ROE. ROE per share = (Net Income Per share or EPS)/Book Value per share. Per per-share basis of Net income is referred to as Earnings per share or EPS. As the article demonstrates, the book value per share represents the stockholder’s equity per share.

Book Value Per Share Calculator

You can use the following Book Value per Share Calculator

| Shareholder's Equity | |

| Preferred Equity | |

| Total Outstanding Common Share's | |

| Book Value per Share Formula = | |

| Book Value per Share Formula = |

|

|

Book Value Per Share Formula in Excel (With Excel Template)

Here, we will do the same example of the Book Value per Share in Excel. It is very easy and simple. You need to provide the two inputs, i.e., Shareholders’ Equity and Preferred Equity

You can easily calculate the Book Value per Share using the formula in the template provided.

In this template, we have to solve the Book Value per Share Formula

Hence first, we are calculating the Shareholder’s Equity by using the Shareholder’s Equity Formula.

Now, we will calculate the Book Value per Share by using the formula.

Recommended Articles

This has guided the Book Value per Share Formula; here, we discuss its uses and practical examples. We also provide a Book Value per Share calculator and a downloadable Excel template.