Bookkeeping Definition

Bookkeeping is a record-keeping system that helps businesses track their finances, like financial records, transactions, and other important information.

Suppose a company sells $50,000 on credit. Therefore, they must record $50,000 as credit for the sales account while debiting the customers’ accounts.

For a business to function correctly, it needs a system that keeps track of its income and expenses and records accurate transactions efficiently. Suppose a company does not have the correct records. In that case, they may be paying extra tax or not eligible for certain deductions.

Key Highlights

- Bookkeeping is the process of recording financial transactions and summarizing them for a designated period

- It is essential for businesses as it provides a way to monitor the financial health of the company and identify areas that need improvement

- It is typically done either by an external or an internal bookkeeper. While external bookkeepers work on an hourly or per-project basis, internal bookkeepers can be employees or volunteers

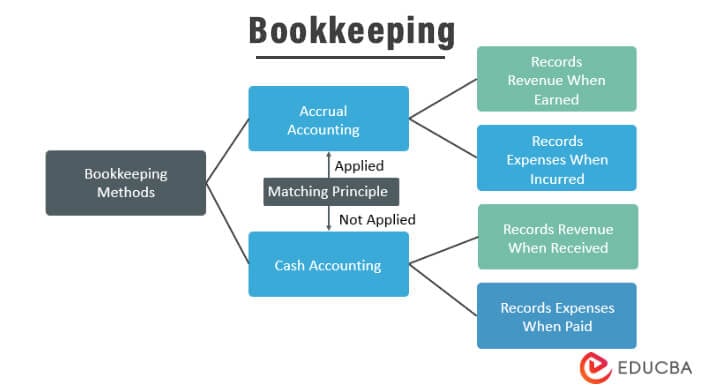

- The three bookkeeping methods are cash, accrual, or hybridization.

Importance of Bookkeeping

- Keeping financial records organized and up-to-date ensures a clear understanding of the company’s finances, which can help with decision-making, budgeting, and preparing for taxes

- It also helps if one is looking to lend or borrow money for their business. The more information a lender knows about their potential borrowers, the more likely they are willing to lend money at competitive rates

- It determines the company’s profitability which can be helpful for investors. Also, the business itself can use available data to plan its investments

- It can be valuable while projecting the growth of a company.

How to Create Records in Bookkeeping?

Here are the steps one can follow while making a bookkeeping record,

Record:

- Make a copy of the invoice, receipt, or bill

- Fill out information like date, payee’s name, payment’s purpose, account number (e.g., Account #123-456-7890), etc

- In every instance of cash inflow or outflow, make an entry.

Balance:

- Conduct trial balances to determine the company’s financial position at the moment

- Reconcile bank statements regularly so they match up with your accounting records

- In case of any discrepancies, make journal entries and adjustments to tally the credit and debit entries

- In the end, the assets and liabilities should balance, i.e., assets = liabilities.

Report:

- Summarize the financial records to form a compelling report of the business’ finances

- The prominent reports are the income statement, balance sheet, and the cash flow statement

- Use the report to gain investments or make business decisions.

Methods of Bookkeeping

1. Cash Accounting:

- In this method, the company records any transactions related to cash, property, or services in the year of actual or implied receipt.

- It is the simplest to implement and is widely used by sole proprietorships and small businesses.

- It can, however, lead to misinterpretation as it does not record payables and receivables. Therefore, it can mislead investors into believing that the company is in profit.

- It is not a GAAP-certified method of accounting.

2. Accrual Accounting:

- Records the account payables and receivables rather than the cash flow of the company.

- Predict the business’ long-term profitability more accurately but may lack short-term predictability.

- Complex accounting system as it records finances that are yet to be paid and received.

- It is a GAAP-certified method of accounting.

3. Hybridization:

- Although most businesses use cash or accrual accounting, companies with inventory may use a hybrid method

- Unless one qualifies for the small inventory business exception, tax law requires them to use accrual accounting to account for inventory and its sale

- However, many businesses with inventory use a cash basis for other income and expenses because it is simple

- A taxpayer can use different accounting methods for personal items &one business or two or more businesses. However, the businesses should be distinct, have separate books, and there are no profits or losses transactions between businesses.

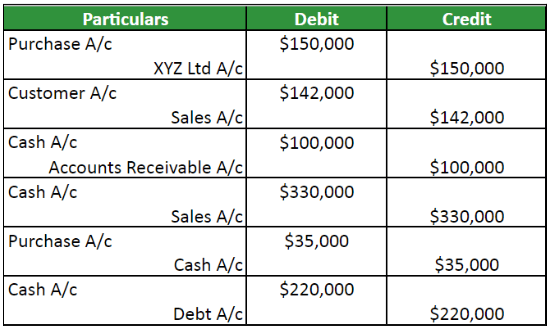

Examples of Bookkeeping

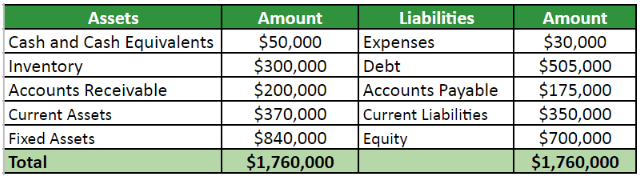

Company ABC has provided transaction information for 2022 and a balance sheet from the 2021 year-end. Let us use bookkeeping to prepare a balance sheet for 2022.

Balance Sheet 2021:

Financial records for 2021-2022 are,

- Purchase on credit from XYZ Ltd = $150,000

- Sales on credit = $142,000

- Credit sales amount received = $100,000

- Cash sales = $330,000

- Cash purchases = $35,000

- Debt repaid = $220,000

Journal Entries:

Looking at the balance sheet of 2021 as well as the journal entries for 2022, we can conclude the following,

Accounts payable = 175,000 + 150,000 = $325,000

Accounts receivable = 200,000 + 142,000 – 100,000 = $242,000

Cash = 50,000 + 100,000 + 330,000 – 35,000 + 220,000 = $665,000

Inventory = 300,000 + 150,000 – 142,000 – 330,000 + 35,000 = $13,000

Debt = 505,000 – 220,000 = $285,000

- We can observe that the company has cash in hand, which can be beneficial for short-term investments.

- It is repaying its debts as soon as it can.

- The company is making profits and has future growth potential.

Difference between Bookkeeping and Accounting

Bookkeeping:

- It summarizes financial transactions by recording them in a ledger. It involves recording receipts and payments and their posting to appropriate accounts

- Bookkeepers are responsible for maintaining records of transactions as well as preparing financial statements

- It can be manual or with the help of a computerized accounting system

- Bookkeeping is mainly concerned with historical information.

Accounting:

- It is a process of interpreting, analyzing, and reporting an organization’s finances to understand its financial situation.

- Accountants may use one or more methods to identify and record accounting information.

- Accounting can either be done manually or through computerized methods.

- Hence, it is more focused on future projections.

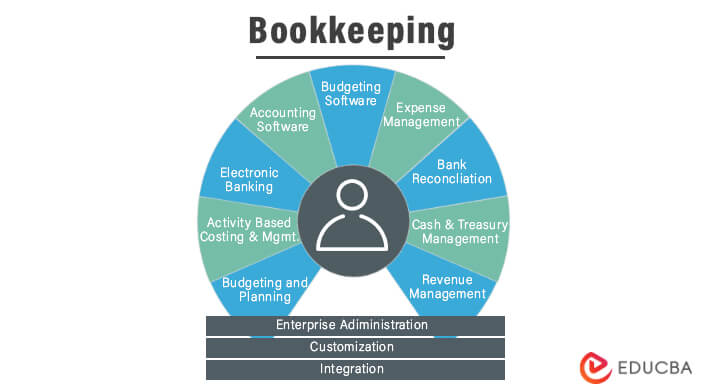

Job of a Bookkeeper

- A bookkeeper’s responsibilities vary depending on the business type. However, some everyday tasks include: reconciling bank statements & credit card receipts, entering data into the company’s accounting system, monitoring & verifying accounts balances, and managing the general ledger

- Bookkeeper work with financial records and transactions, tracking money as it flows in and out of business. They also track accounts receivable and payable, payroll expenditures, taxes, budgeting data, inventory levels, etc

- They generally are responsible for balancing out all finances and making sure that all the numbers add up at the end of each day or month

- A high school diploma or equivalent degree might be an essential requirement. Employers prefer Certified Public Accountants (CPA) or Certified Management Accountants (CMA). They should also be well-versed in excel, have math & organizational skills, and can work independently

- The average salary for bookkeeping in the United States is $45,126 annually. However, it may depend on the company and location. The top employers for bookkeepers are banks, accounting firms, and retail companies.

Benefits of Bookkeeping

- One can gradually reduce accounting expenses by using modern bookkeeping procedures.

- It offers simple file management that can save time, allowing you to increase your productivity.

- It also protects your information by uploading all books to the cloud, creating a protected backup as you have control over each document.

- Modern systems enable encryptions, ensuring that people cannot view financial reports and ledgers without authorization.

- It also allows one to plan actions, optimize processes, be aware of your current liquidity, and more.

- Bookkeeping helps with efficiency, which is the key to a growing business.

FAQs

Q1. What are the accounting books that businesses must keep?

Answer: The necessary documents a company must have are the primary financial statements, income, cash flow statements, and balance sheets. Along with those, a company should maintain journals, ledgers, and records of cash inflow & outflow. Hence, all these should be under the laws established by the regulations.

Q2. What is the primary purpose of bookkeeping?

Answer: Businesses need to record all financial transactions to simplify the accounting process. Therefore, bookkeeping helps them achieve this by systematically documenting every financial proceeding. They can further summarize the recorded data to raise funds for the company, future planning, and business decisions.

Q3. Can bookkeepers prepare financial statements?

Answer: Yes, bookkeepers are responsible for preparing financial statements. However, not all bookkeepers have training in accounting and tax laws. Therefore, finding a bookkeeper with the necessary expertise is crucial. One can also learn courses on bookkeeping.

Q4. How does a bookkeeper’s work differ from that of an accountant?

Answer: Bookkeepers are generally responsible for maintaining a company’s financial records and ensuring everything is in order. On the other hand, accountants are responsible for performing tax accounting and analyzing the financial health of an organization.

Recommended Articles

This article explains everything about Bookkeeping. To learn more about Bookkeeping, you can read the following articles,