Updated July 6, 2023

What is the Boom and Bust Cycle?

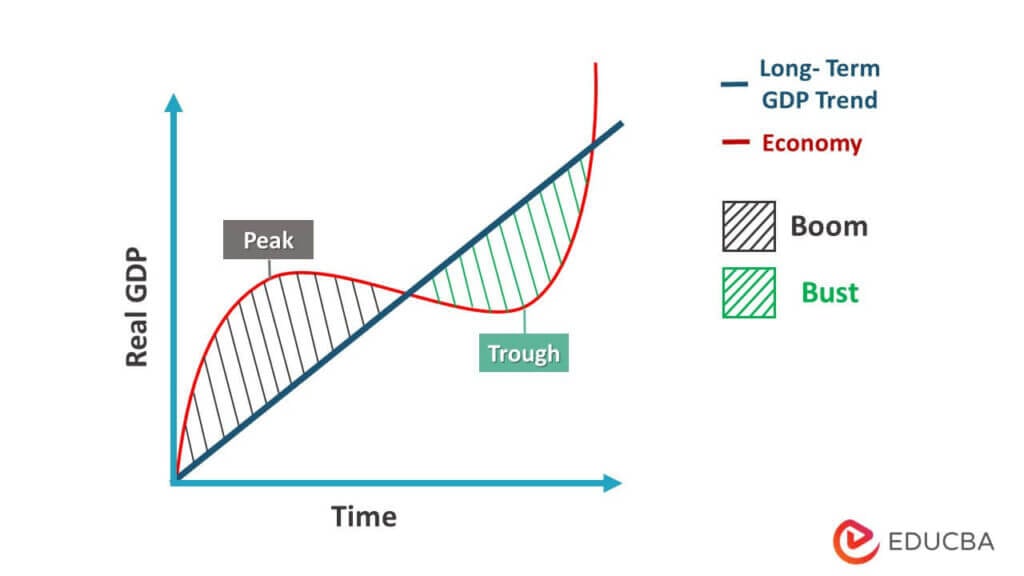

The Boom and Bust Cycle represents the economic growth and decline periods of capitalist economies, i.e., private-owned and free economies.

For example, the US housing market has been experiencing a boom since the pandemic’s beginning as people started working from home. The house prices increased, and even the purchase of housing stocks rose. However, as people began working from offices again, the housing market prices fell by 15%. Professionals say it may be the start of the bust cycle.

It is related to a business or economic cycle of the world, country, or specific geography. The cycle affects the finances of companies and different sectors. During this cyclical process, the economy undergoes four phases: boom, peak, bust, and trough. The changes by central banks or governments in interest rates directly related to the economy can affect these cycles.

Key Highlights

- The Boom and Bust Cycle is modern economies’ periodic economic growth and depression phases.

- Gross Domestic Product (GDP) and inflation are vital indicators for studying the cycle.

- In the 19th century, Karl Marx first forecasted this based on the fundamentals of the economy and consumer sentiments or psychology.

- It can last for a few months to several years. On average, these cycles last for around five years.

Stages

Boom

- During this phase, the business and economy see expansion with indicators like high employment, increase in consumer purchases, higher wages, etc.

- The excess money supply in the market makes the economy investor-friendly.

- During a boom phase, the central bank makes money lending available at low-interest rates to create liquidity in the economy, allowing borrowers or consumers to borrow more from the banks.

- It tends to increase inflation since people have more money in their pockets.

Peak

- The peak phase is the end of the boom or expansion phase, with demand reaching the topmost level.

- During the peak phase, the saturation point of the economy is gone, and the growth of expansion becomes little.

- The lower interest rates and excess liquidity in the economy results in this peak formation and can be known as the reversal of economic growth.

- The equity or stock market also becomes more volatile during this phase as investors are uncertain and not optimistic about the economy.

Bust

- The downward trend in the economy is the Bust phase, where the trend changes from spending to saving.

- It is similar to blowing a balloon, where the balloon explodes at some point of expansion. In the bust phase, there could be no additional economic development, so the economy spirals down.

- Key indicators seen during this phase are job cuts, increases in debt, higher interest rates, falling stock prices, etc. If a bust phase lasts for six months, it is also called a ‘recession.’

Trough

- The recovery in the economy refers to the ‘trough’ phase.

- The economy is neither growing nor contracting. It is the beginning or starting point of a new booming economic phase.

- The central bank pauses the interest rate increase as inflation is in control.

- It is the lowest point in any economy, and any bad news or fear about the economy fizzles out.

Causes

Psychology and Sentiment

- The investors’ and consumers’ faith and belief tend to cause these cycles.

- An optimistic behavior for the economy creates a Boom phase, whereas a pessimistic one will generate a Bust phase.

Supply and Demand

- High-interest rate lowers consumers’ demand and establishes a bust cycle.

- Lower interest rates increase consumer confidence and lead to more markets.

Policies

- Government policies can also be an essential factor in economic cycles.

- Changes in national and regional policies can lead to an increase or decrease in investment, domestic or international.

Impact

- Boom and Bust Cycles are macroeconomic events that tend to change economic parameters like GDP, consumer behavior, demand, supply, etc.

- Suppose an economy is in a Boom phase. In that case, there will be more liquidity in the economy, leading to more job creation, strong consumer sentiment, an increase in investment, high growth numbers, etc.

- In contrast, a bust cycle will see a downtrend in the economy, pay cuts or job cuts, stagflation in growth, etc.

What Should Investors Consider During the Cycle?

Diversification

- A good investment in a mixed bag of equity, debt, gold, real estate, and other financial instruments.

- It will lead to minimal loss during volatile times in the economy.

Savings

- Investors should prioritize a good amount of retirement corpus and protection for different future needs for more challenging times.

Understanding the Cycles

- Every economy undergoes Boom and Bust Cycles, and understanding the time and phases of these periods will help investors to minimize the risk of the investment portfolio.

Advantages

- The boom phase sees economic growth.

- It allows struggling businesses to survive.

- It decreases the unemployment rate.

- The boom phase attracts foreign investment leading to currency appreciation.

- The boom phase tends to generate more income for investors who invest more in bank FDs, Debt Mutual Funds, Gold, etc.

Disadvantages

- The bust phase sees economic depression and recession.

- The bust phase increases the unemployment rate.

- We can observe high inflation in the bust phase and the peak of the boom phase.

- The bust phase makes the stock or equity market more volatile.

- The bust phase considers the withdrawal of investment, especially from foreign investors leading to currency depreciation.

Final Thoughts

Boom and Bust Cycles are part of any economy. There will be phases when the economy is performing well and sometimes severely. It is natural, and no individual or economy can avoid it. They might last for a few months to a few years, but in the long term, say ten years, these cycles will only have a negligible effect on the investment portfolio. The above points are the best way to deal with these ups and downs.

Frequently Asked Questions(FAQs)

Q1. Define Boom & Bust Cycle.

Answer: The boom and bust cycle is a process that involves alternating expansion and contraction of the economies. It is the critical characteristic that is synonymous with the business cycle.

Q2. Explain the boom & bust cycle in real estate.

Answer: The boom and bust in real estate have been a recurring feature for decades in the global economy. Some instances are the Thrift crisis (1970-the 80s), the East Asian crisis (1990s), the Great Depression (1920s), etc. There is no end to the boom and bust in real estate.

Q3. When was the boom & bust cycle in the US?

Answer: The US experienced frequent boom and bust cycles in the 19th century, which continued through the Great Depression. In this cycle, the expansion period was short, and the rescission period was sharp and punctuated.

Q4. Are we in a boom or bust?

Answer: Currently, we are in the middle of the boom phase. There are efforts to reduce inflation, but it may put the economy at risk of recession.

Q5. Does the Boom & Bust cycle affect only one sector or industry?

Answer: When money flows into a sector, it is considered a boom cycle. In contrast, if cash moves out of the cycle, it comes under the bust cycle. Hence only one sector or industry can be under the cycle. One such periodic example is the commodity industries like metals, oil & gas, etc.

Q6. How can the government affect the Boom & Bust cycle?

Answer: Government policies like increases/decreases in spending on specific industries like defense, infrastructure, and agriculture can lead to ups and downs. In addition, changes in import and export policies also play a massive role in this cycle of a country’s economy. War, elections, changes in government, and political instability can affect economies too.

Recommended Articles

This article is a gist about the boom and bust cycle. Here you learned about its causes, effects, advantages, and disadvantages. To know more about the topic, you can refer to these articles,